The spot uranium price is quoted around ~$53.7/lb., up ~$3/lb. in April. A handful of uranium juniors are up 15%+, companies like Energy Fuels, Boss Energy, Atha Energy, Anfield Energy, F3 Uranium & IsoEnergy.

One of my favorites, Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) has gained > 25%, but is up just 41% from its 52-week low. {Skyharbour Ltd.’s latest {presentation}

By contrast, the top-6 performing uranium players (gains off of 52-wk lows) are up an average of +266%. I believe that the Company is well positioned to benefit in the coming uranium bull market.

A year ago when the uranium price rallied into the mid-$60’s/lb., Skyharbour’s share price soared into the $0.80’s vs. $0.40 today.

Sentiment in the uranium space continues to improve. Cameco’s earnings conference call on Friday was as upbeat as any I’ve listened to in years. Here’s an indicative quote from CEO Tim Gitzel;

“I have to tell you about an event I recently attended, the Trudeau/Biden dinner in Ottawa. The related meetings & public statements that followed exemplify the scale & scope of the uranium opportunity… The two leaders talked about the critical role of nuclear energy and the importance of collaboration between Canada and the U.S.

It was hard to believe, like a dream come true. Nuclear Energy would never have made top billing at a meeting like this, even a few years ago. It gives you a sense of just how important nuclear power, and the fuel cycle to support it, have become…”

In addition, at a recent G7 meeting Canada, the U.S. the UK, Japan & France created an alliance to leverage their respective nuclear sectors by supporting the stable supply of nuclear fuels.

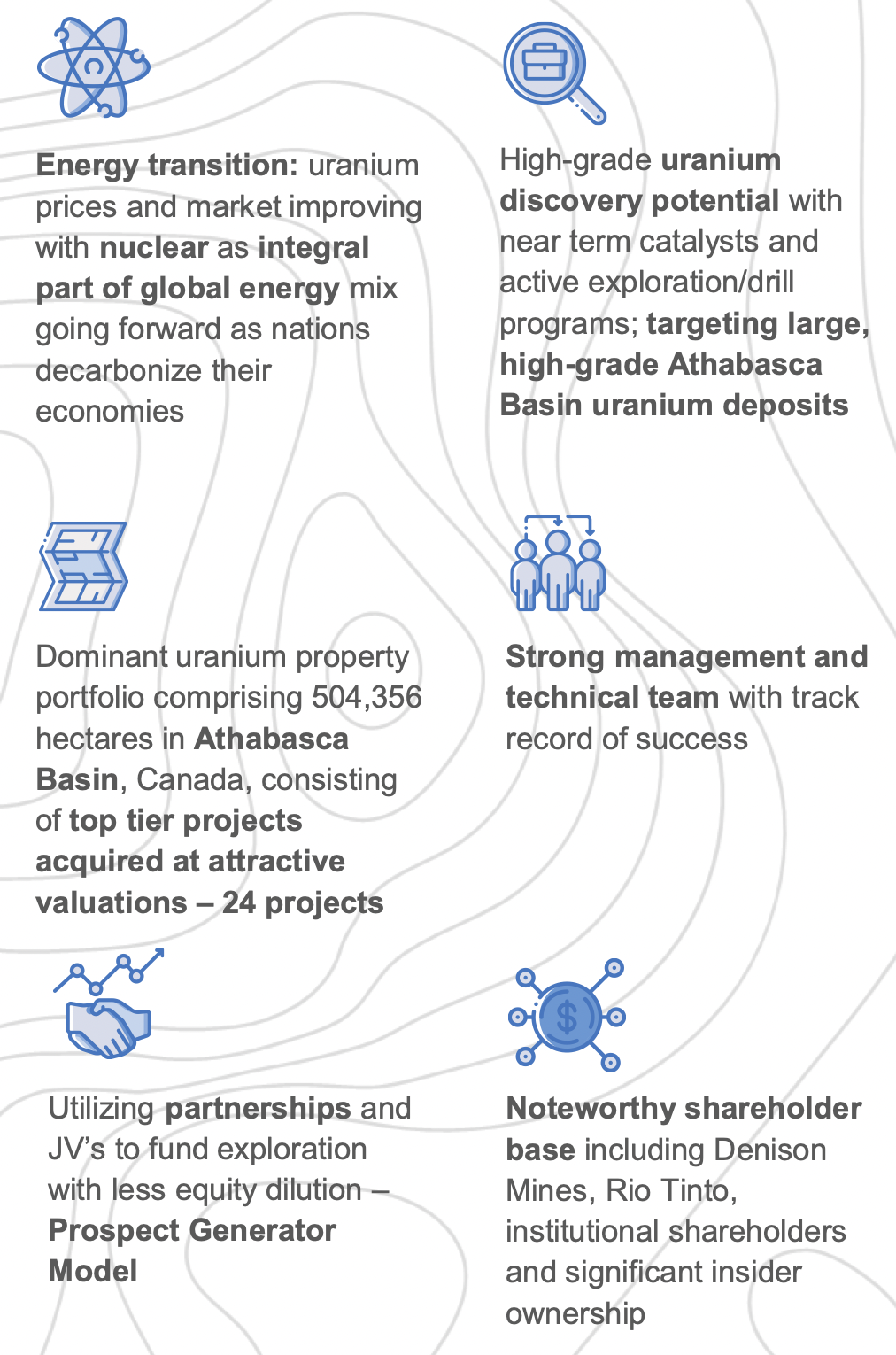

Skyharbour has a hybrid business plan with a focus on advancing two co-flagship assets, Moore Lake & Russell Lake, and also executing on a prospect generator model. This is a company with 24 properties/projects covering 504k acres in the heart of the eastern side of the Athabasca Basin.

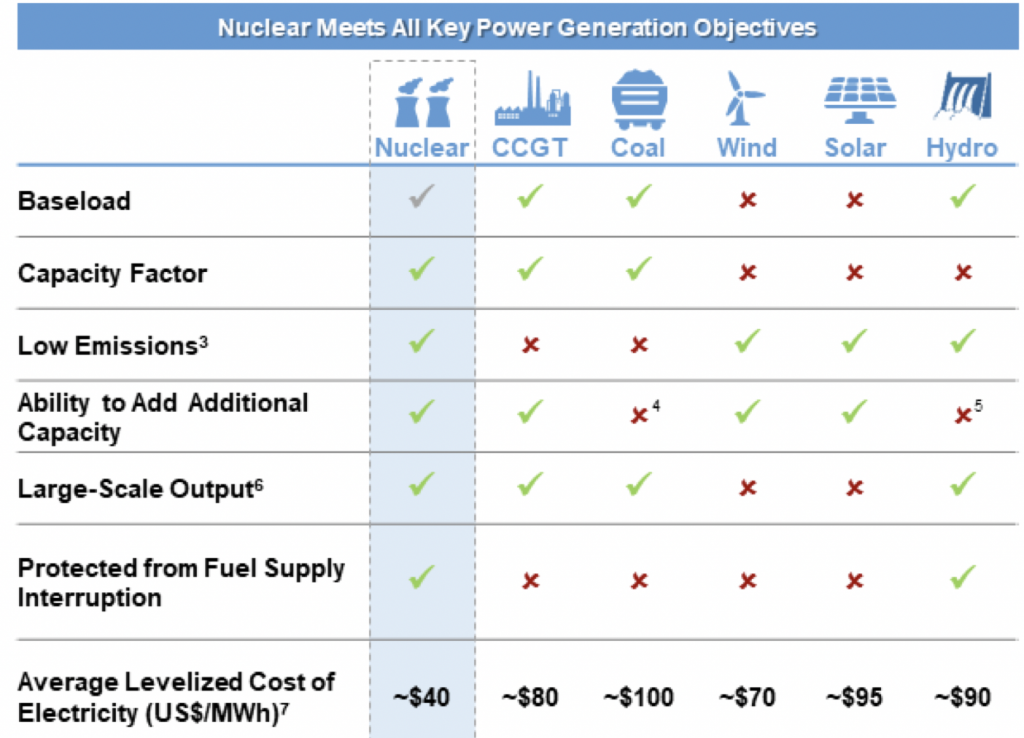

In my last article on Skyharbour I discussed the open-ended opportunity for Small Modular Reactors (“SMRs”) at length. SMRs will be mass-produced in modules at giant purpose-built facilities, slashing labor/materials costs via economies of scale, materials handling efficiencies & automation.

Instead of 10-15 years & billions of dollars, a SMR could be up & running in a year or two at a small fraction of the cost. The reason I mention this is because SMRs are not yet fully captured in long-term uranium demand projections, yet hundreds could be delivered by the 2040s.

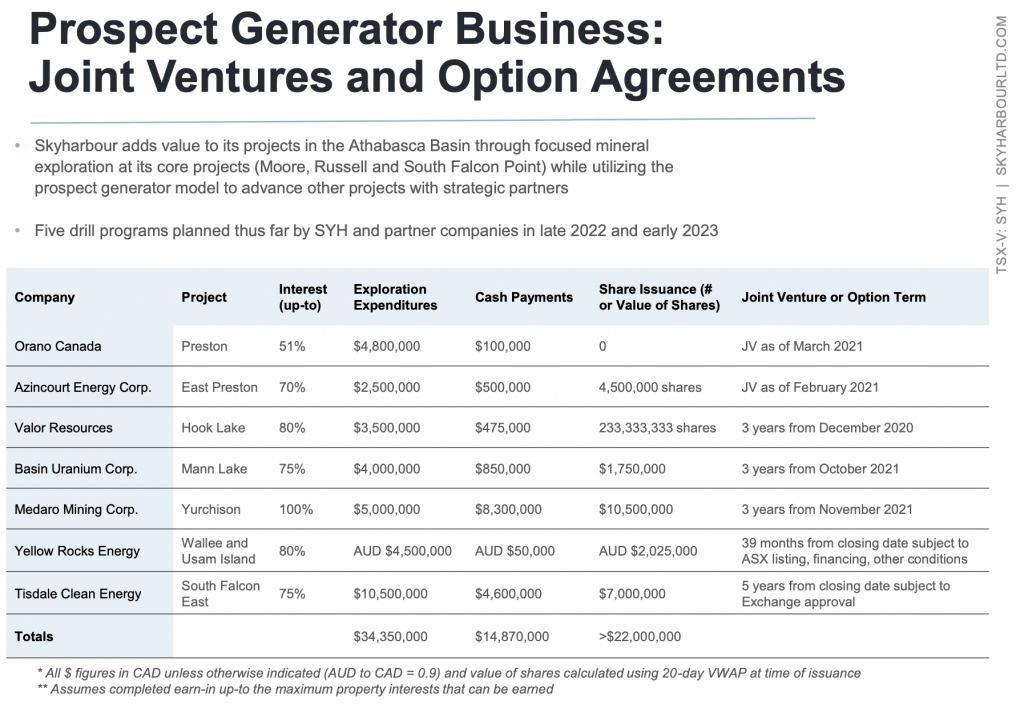

Returning to Skyharbour, management has secured two JV & five earn-in option partners who are drilling & exploring at no cost to the Company. Additional option/JV transactions are in the works.

Last week the Company acquired another meaningful property (the 12,282 hectare South Dufferin Project) from Denison Mines. David Cates, President & CEO of Denison Mines and a Director of Skyharbour said,

“Skyharbour has a large exploration project portfolio, with a unique mix of partner-optioned & funded projects as well as the dual-flagship and Skyharbour-operated Russell Lake & Moore Lake properties. We are pleased to increase our shareholding in Skyharbour and look forward to the continued collaboration between our companies.”

CEO Jordan Trimble added,

South Dufferin complements our more advanced-stage exploration assets and provides additional ground to option or joint-venture out to new partner companies as a part of our prospect generator business. Furthermore, Denison Mines has been a valuable strategic partner for a number of years and we welcome them as an even larger shareholder now.

South Dufferin is surrounded by Cameco, Orano & Nexgen Energy.

For seven years management has been working hard on the 100%-owned, 35,705 hectare Moore Lake (“ML“) project. ML has had ~$50M invested in it over the last 25 years, incl. ~140,000 meters of drilling.

Importantly, very high-grade hits extend into the basement rocks. The best results; 6% U3O8 over 6 m, incl. 20.8% U3O8 over 1.5 m, 9.1% U3O8 over 1.4 m and 5.3% U3O8 over 2.5 m.

Complimenting & expanding ML is an earn-in agreement to initially acquire 51% of Rio Tinto’s 73,294 ha Russell Lake (“RL“) project. Like ML, RL has seen significant exploration, incl. > 95,000 meters of drilling.

Adjusted for inflation, as much as C$100M has been spent on the ML & RL projects. It would take years to replicate that work. Skyharbour isn’t searching for high-grade uranium, it’s already found it.

ML & RL could host satellite deposits for nearby mills, or be combined into a standalone operation upon further exploration successes. Satellite deposits avoid very substantial costs & years of permitting, development & construction.

Companies in production, or expected to be in production in a few years, trade at very robust forward EV/EBITDA multiples. Cameco, UEC, Boss Energy & Paladin trade at an average ~19x 2024e EBITDA. Compare that figure to companies like Teck Resources, Rio Tinto, BHP, Albemarle & Vale at ~5x-6x 2024e EBITDA.

While Skyharbour won’t reach production anytime soon, select projects could be fast-tracked this decade (my opinion, not company guidance). How is that possible?

Management is studying the potential of borehole mining methods to access shallow high-grade uranium deposits like the approaches Denison & Orano are pursuing. Skyharbour could be a prime benefactor of the many years and $10s of millions spent on testing bore hole mining for uranium in the Athabasca basin.

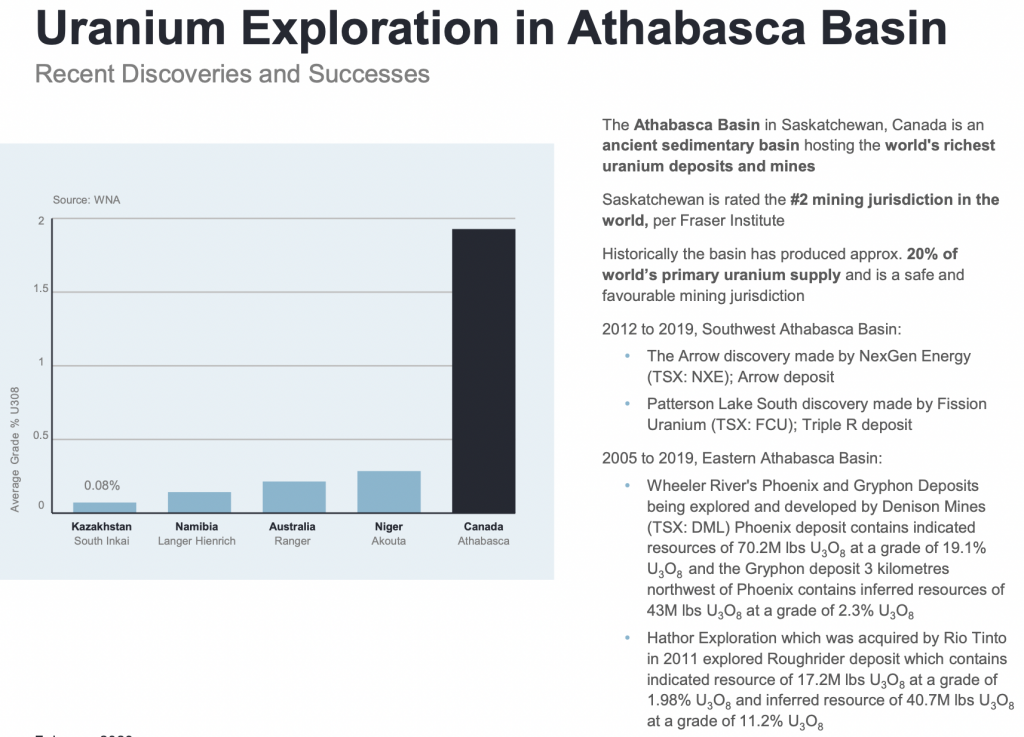

Canada is the place to be for uranium sourcing by Western countries, most notably the U.S. Among the top-5 uranium producing countries, three; Kazakhstan, Russia, China, produced > 50% of global output in 2021. Can the U.S. continue to rely heavily on Kazakhstan, Russia & China? No!

The U.S., by far the #1 consumer of uranium, produced < 1% of what it used each year from 2019-2022.

Canada is the closest source and home to the planet’s highest uranium grades. These two factors make investments in uranium juniors with projects in Canada’s Athabasca basin quite compelling.

In prior articles I always mention inflation-adjusted pricing. In the May 2007 to Feb. 2008 period the contract uranium price was pinned at $95/lb. = ~$137/lb. in today’s dollars.

If one believes 2007’s multi-month, inflation-adj. $137/lb. price was an outlier, consider the inflation-adj. level of ~$98/lb. in 1Q 2011, a price only taken down by Japan’s Mar-2011 Fukushima accident.

If one believes as I do that the uranium price will rise above $80/lb. this year or next, Skyharbour will be a highly attractive takeover target. If $64.5/lb. drove the share price into the $0.80s, what might $80/lb. do? An acquirer could take out both ML & RL, leaving shareholders with 22 prospects.

Readers are reminded that two of the most successful juniors in Canada — IsoEnergy & F3 Uranium — are spinouts.

The combined footprint of ML & RL is ~8x Denison’s world-class Wheeler River project (~12,000 ha). Wheeler has booked 135M Indicated + Inferred pounds (so far), ~11,250 pounds/ha. If ML/RL could deliver just 5% of that lbs./ha figure, it would amount to 54M pounds.

Skyharbour owns/controls 22 other prospects in its prospect generator portfolio, some moderately advanced. In the image below, notice that seven juniors need to invest $70M (over several years) in exploration, cash payments + share issuances.

Compare that $70M, plus roughly $100M (in today’s dollars) invested into ML/RL to Skyharbour’s $58M valuation.

Skyharbour shares touched $0.84 on 3/9/22, (up 91% from 1/24/22), as uranium was close to topping out at $64.5/lb. last April. Readers are reminded that back then management hadn’t executed the transformative earn-in deal with Rio Tinto or the latest one with Denison.

I believe this company’s valuation is in the sweet spot for potential capital gains. Many of the top performing uranium plays have market caps in the billion(s) / hundreds of millions.

If Cameco were to rally 30%, companies like Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) could be poised for gains of a multiple of that.

{Skyharbour Ltd.’s latest {presentation}

Disclosures/Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Skyharbour Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)