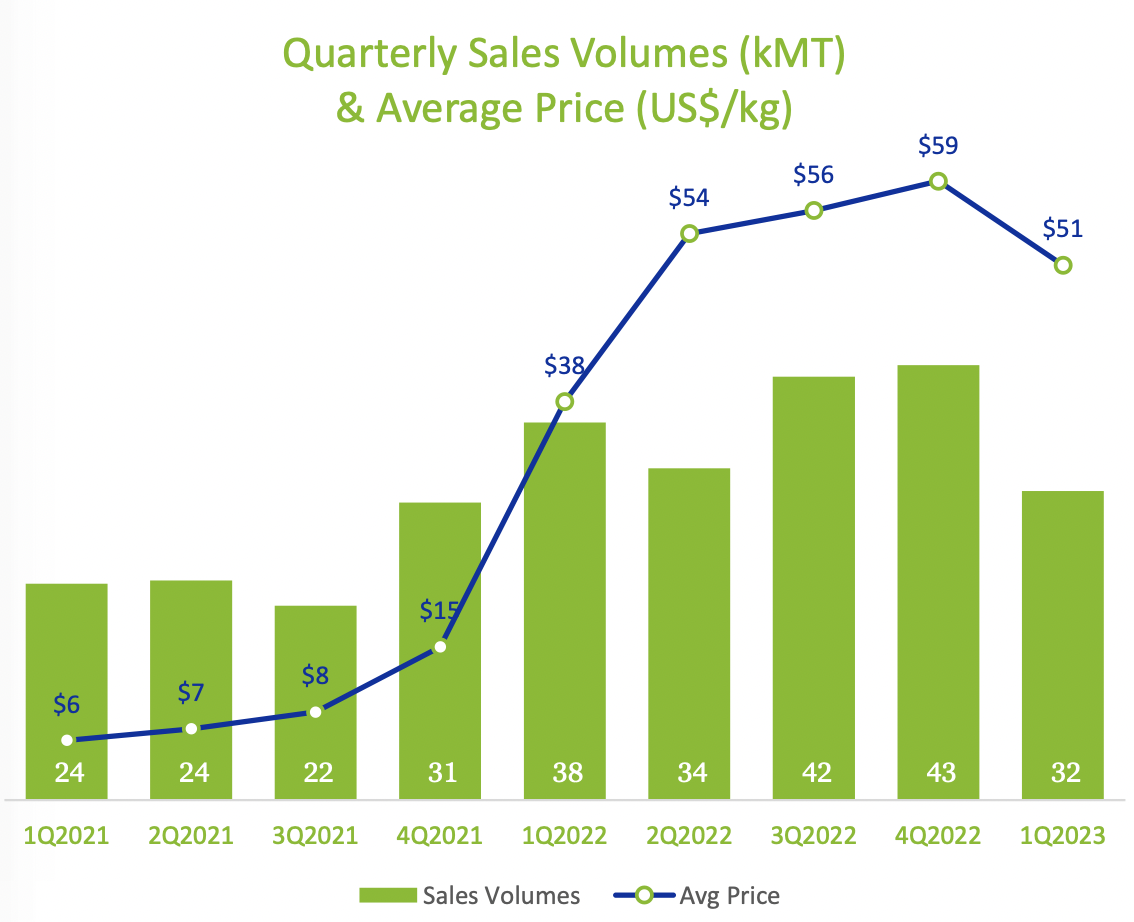

From November of last year through most of April, investors were getting nervous about the lithium (“Li“) narrative as the spot price of battery-quality Li carbonate in China fell from 597.5k to 165.5k yuan/tonne.

However, the price has rebounded to 302.5k yuan +83% (investing.com). Astute readers recognize that spot prices in China are far more volatile than quarterly contract prices announced by companies like Albemarle, Livent, Allkem & SQM.

SQM’s first quarter results showed an average contract price decline of just 14% from US$59k (~416k yuan) to US$51k (~360k yuan). As a frame of reference, the highest Chinese spot levels ever seen before 2022 were in the mid US$20k’s {see China spot price chart above}

Aside from Li prices, M&A is showing strength with ALB trying to acquire Australia’s Liontown Resources and news of a merger between Livent & Allkem. Liontown is up > 75% since ALB’s interest was revealed.

In February Tesla was rumored to be pursuing Brazil’s Sigma Lithium. Last night a C$271M takeover bid from a Spanish industrial company for Argentinian brine junior Alpha Lithium was announced and quickly rejected as “opportunistic.” Alpha is up 49% in the past month.

From April’s lows Allkem, Patriot Battery Metals, Winsome Resources, Green Technology Metals, Atlas Lithium, Li-FT Power, Latin Resources, Q2 Metals & Idaho Champion are up an average ~55%.

Other bullish fundamentals — 1) year-over-year global EV sales have reverted from sluggishness in Jan/Feb. to solid growth in March/April. 2) Stationary energy storage systems are growing faster than EVs, albeit from a much smaller base.

3) yesterday Ford announced substantial off-take agreements with SQM, ALB & Livent/Nemaska. Li produced in Chile will help Ford’s EVs qualify for a consumer tax credit under the U.S. government’s Inflation Reduction Act (“IRA“).

Tesla, Volkswagen, Ford, BYD & GM will dominate EV sales, but dozens are fighting for a top-10 spot. Very few have secured future Li supply the way Ford has.

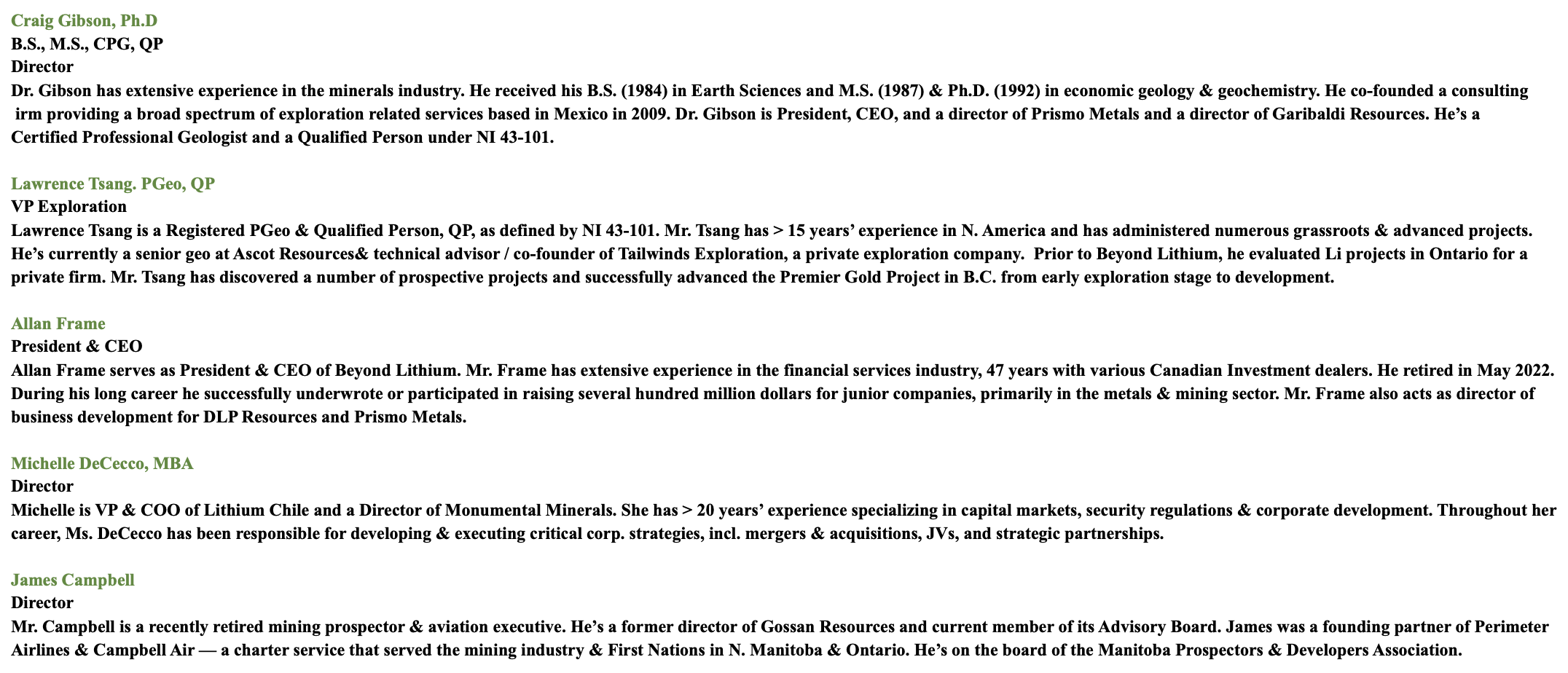

A small Li play with a giant early-stage land package in Ontario that’s so far been unable to capture the market’s attention is Beyond Lithium (fka Beyond Minerals) [CSE: BY] / [OTCQB: BYDMF].

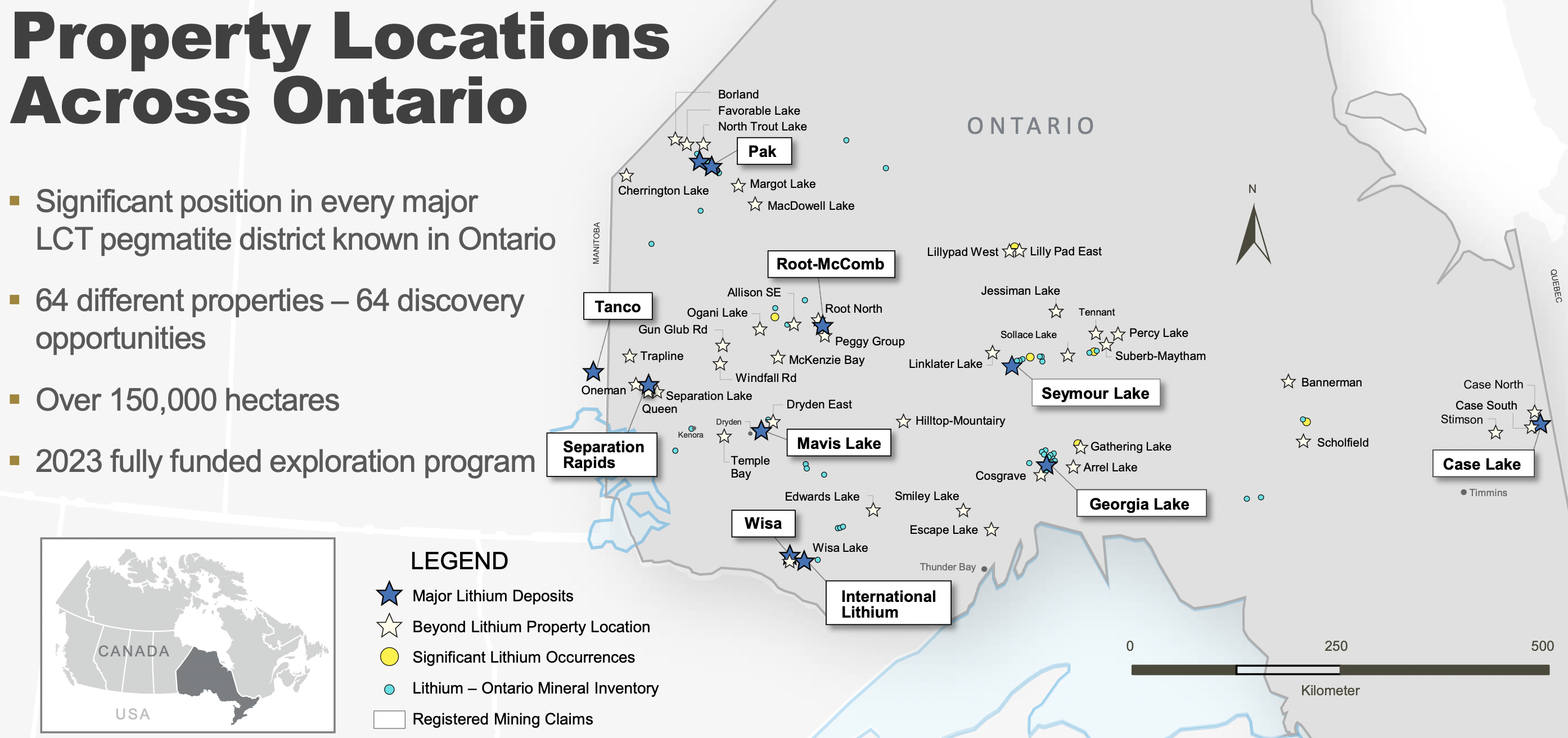

This is a company with an enterprise value {market cap + debt – cash} of C$7M [@ today’s C$0.30/shr.] that owns/controls > 150,000 Li-prospective hectares spanning 64 properties.

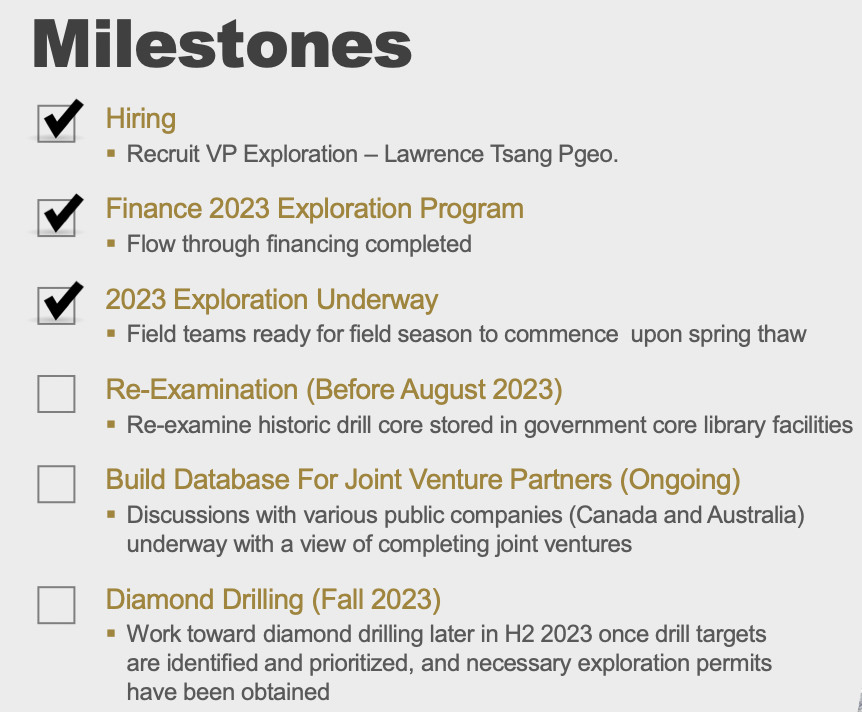

Beyond has just 28.2M shares outstanding and ~C$1.5M in cash — enough, (management says), to complete Phase 1 & 2 exploration (pre-drilling) programs across most of its prospects. Up to six experienced field teams will be actively sampling, mapping & assessing > 500 pegmatite outcrops.

Phase 1 is expected to be done by the end of August. Phase 2 will follow up on prospects showing the best potential. Management has stated in interviews that they only stake or option high-quality properties.

Importantly, historical core samples from some of the properties will be re-assayed for Li2O values this summer. Finding meaningful Li20 in this manner would represent a very low-cost “discovery” and could be a near-term catalyst.

I’ve been asking investors what they think and reading comments on CEO.ca, Linked-In & Twitter. The main concerns seem to be, 1) not enough cash to advance properties, and 2) prospects are too early stage and/or too remote.

The team cashed up at C$0.50, at an attractive premium to market with only ~180k warrants attached. Management could have spent a few more weeks rounding up the C$1.3M it closed on to C$2.0M, but they believe they have enough cash to conduct two informative exploration phases.

This company has 28.2M shares outstanding, investors should applaud management’s prudence. With China’s Li prices rebounding robustly and M&A activity looking up, raising a smaller amount now (and more later), makes sense to me.

Speaking of M&A, the combination of Allkem & Livent is a big deal. Talk about a vote of confidence, both companies have been saying on quarterly earnings calls that they see Canada as the most attractive/prospective Li market in the world. The merged company claims it will be the 3rd largest global producer by 2027.

Canada stands out for at least four main reasons 1) widespread (green/low-cost) hydroelectric power, 2) proximity to U.S. EV markets, 3) strong federal & provincial support for battery material projects, and 4) (aside from Alberta), hosts well-understood, low-risk hard rock Li deposits.

Regarding concerns about Beyond’s properties being early-stage, yes they are. This is the nature of the Company’s business model as a prospect generator. In my view, in the midst of a bull market early-stage opportunities offer tremendous upside potential (with commensurate high levels of risk).

With > 150,000 hectares and properties near most hotspots in Ontario, drilling successes at prominent projects held by Frontier Lithium, Rock Tech, Green Technology Metals, Critical Resources, Avalon Advanced Materials and others will benefit Beyond as well.

It’s increasingly clear that there will be multiple Li processing facilities built in Ontario. That suggests one or more plants will be near deposits owned or controlled by Beyond.

This is really important. Satellite deposits could be quite valuable once multiple plants are up & running and looking for incremental feed.

Already, before any facilities are operating, tonnes of Lithium Carbonate Equiv. (“LCE“) are valued at ~C$100-$400. At C$200/t, each 1M tonnes grading 1.00% Li2O is worth ~C$5M.

I strongly believe there will be dozens of satellite deposits of 2M to 10-12M tonnes worth C$200+/t, especially if spodumene concentrate continues to trade at US$4,000+/t (currently at US$4,525/t).

Beyond Lithium could be sitting on multiple deposits (or none), but at a valuation of C$7M the risk/reward is compelling.

Please take a moment to review the above property map. Readers should understand that a meaningful portion of Beyond’s land will be sold, farmed out, joint-ventured or dropped.

Zoom in on the areas around Frontier Lithium’s PAK/Spark projects that they believe host up to 100M tonnes at 1.3%+ Li20. Beyond has six (denoted by white stars) properties reasonably nearby.

Or, look at Beyond’s properties near Rock Tech’s Georgia Lake and Avalon Advanced’s Separation Rapids. Again, there will be several Li hydroxide refineries built in Ontario.

I don’t want to minimize the risk of a tiny company exploring early-stage Li properties, but I argue that a valuation of C$7M reflects these considerable early-stage challenges.

There are > 25 Canadian-focused players with market caps above C$30M, mostly in Quebec & Ontario, some Australian-listed. None have anywhere near 150,000 ha in a single province, albeit most are more advanced.

There are notable success stories at the early-stage (grassroots) Li exploration level. Brunswick Exploration has more than twice the # of hectares (spread across six provinces) as Beyond, but boasts an EV of ~C$155M.

Some of Brunswick’s properties are more advanced, but the company is still pre-maiden resource. It has not yet announced initial drill results from recently completed programs.

Another success story is Lithium Royalty Corp. with a valuation approaching a billion C$. Could Brunswick or LRC be buyers of Beyond Lithium? I have no idea, but many Li, auto, battery & commodity trading firms should be interested in Beyond Lithium’s sizable portfolio.

Li sector pundits believe that Oil & Gas majors might get involved as well. Exxon announced the acquisition of a private brine project in Arkansas last week

In terms of large Li companies, Mineral Resources, Pilbara Minerals, a combined Allkem/Livent, Wesfarmers, IGO ltd., Liontown and Sayona Mining are thought to be actively seeking assets in Canada.

As Beyond Lithium learns more about its properties, management will be able to have meaningful discussions with many interested parties; majors, mid-tiers & juniors. There are 25+ hopefuls listed in Australia who have Li investments in Canada and are looking to grow their footprints.

Australian investors love their lithium plays, which is why C$2B Patriot Battery Metals is dual-listed in Australia/Canada. Could Beyond be sitting on the next PMET-scale project? Who knows, but Beyond is valued at just 1/300th of PMET.

Beyond doesn’t need to deliver 150-200M mineralized tonnes like shareholders believe PMET has, 5-10M tonnes would be a great start.

For more information, please see Beyond’s new corporate presentation.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Beyond Lithium, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Beyond Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Beyond Lithium was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topi

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)