A tiny Lithium (“Li”) play with a large early-stage land package in Ontario is Beyond Lithium (fka Beyond Minerals) [CSE: BY] / [OTCQB: BYDMF].

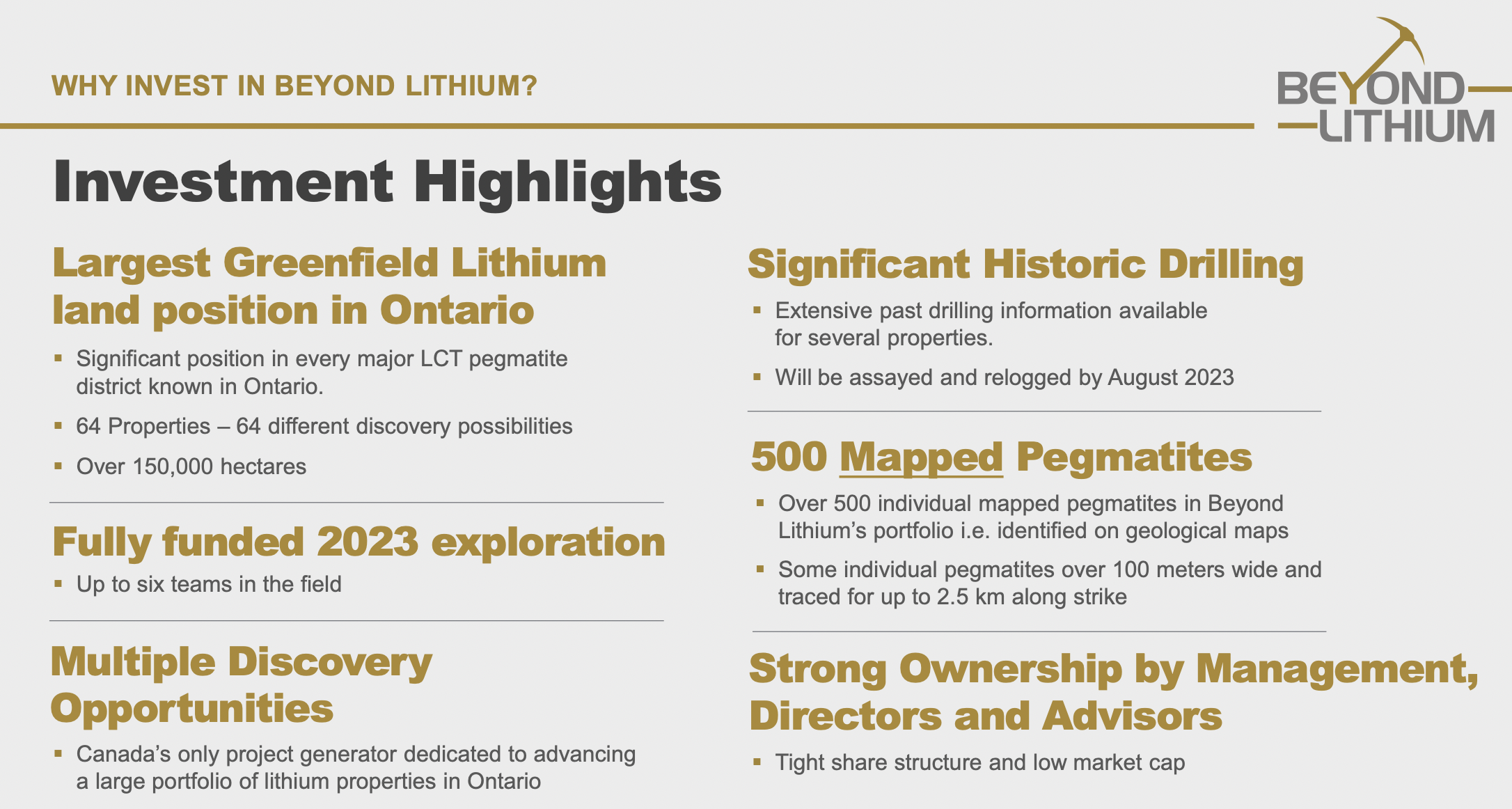

This is a company with an enterprise value {market cap + debt – cash} of $6M [@ $0.245/shr.] that owns/controls ~150,000 Li-prospective hectares spanning 64 properties.

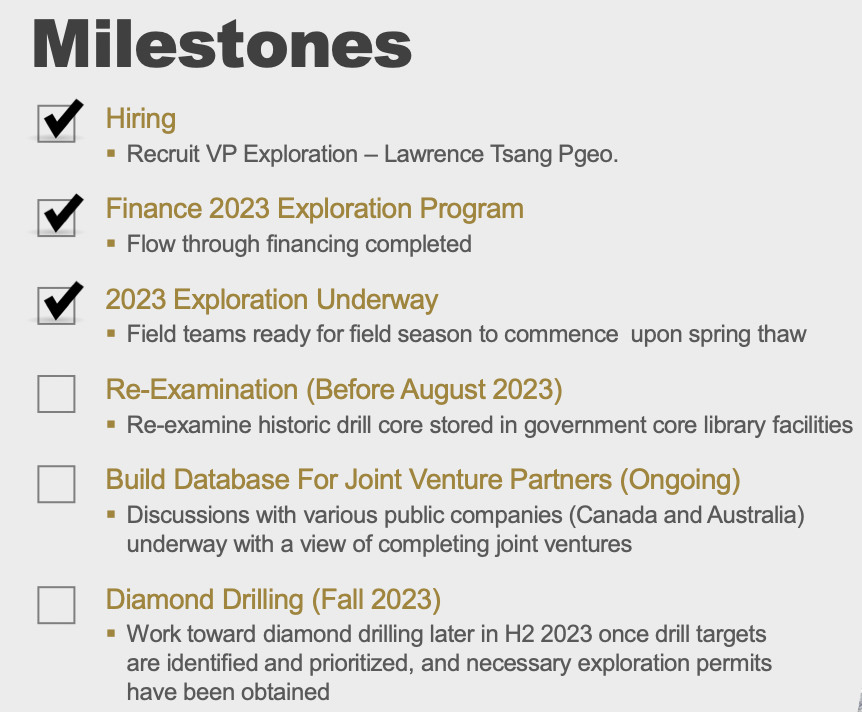

It has just 28.2M shares outstanding and nearly $1M in cash — enough to complete Phase 1 & 2 exploration (pre-drilling) programs across most or all of its prospects. Multiple experienced field teams are well into the process of surface sampling, mapping & assessing 500+ pegmatite outcrops.

Field work is progressing well, on time & on budget, with > 400 outcrop grab & channel samples sent to the lab. Initial assays are expected in a week or two. Phase 1, the first pass boots-on-the-ground program, is expected to be done by mid-August.

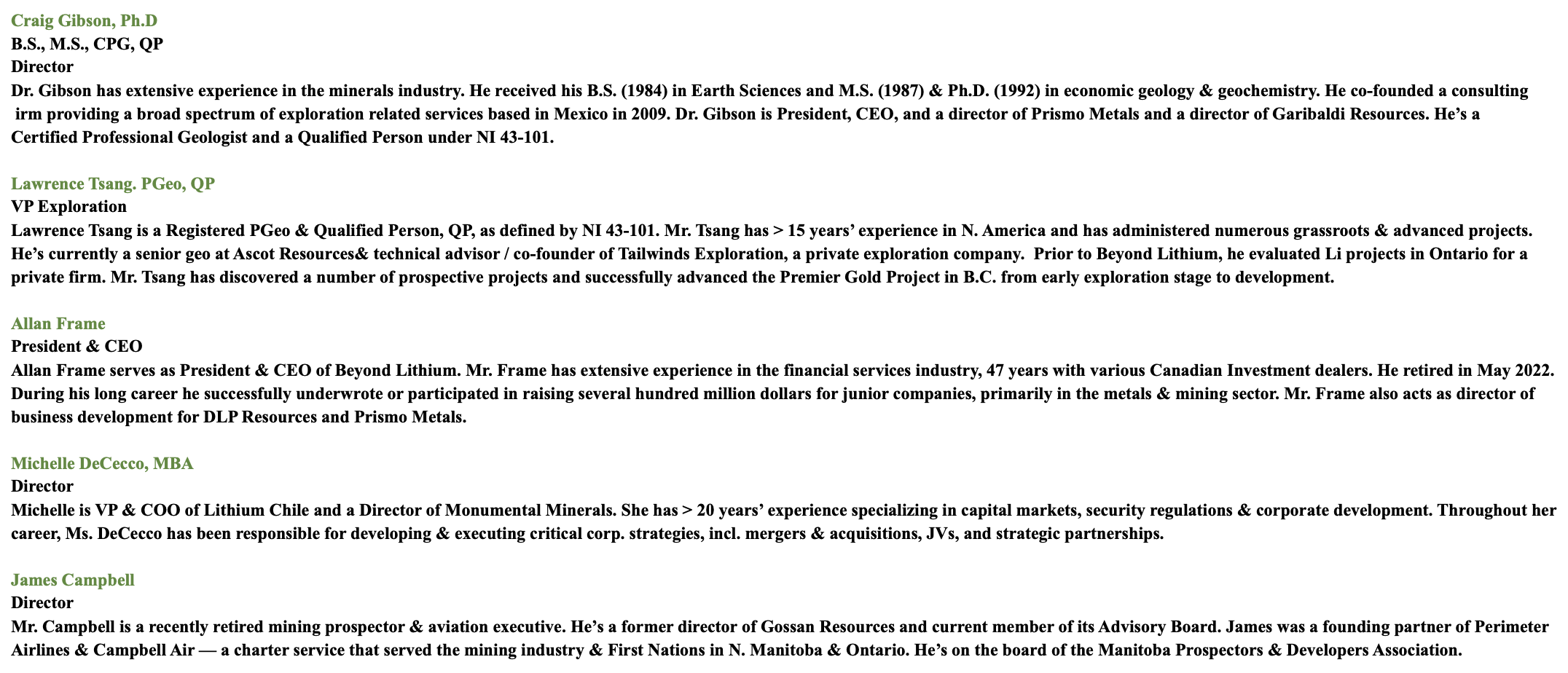

On June 26th, an update on the field visit by the management & technical teams at properties in the Dryden-Mavis Lake & McKenzie Bay districts was announced. Pres. & CEO Allan Frame, VP of Exploration Lawrence Tsang, technical advisor Graeme Evans & senior Geo Paul Baxter were among those on hand.

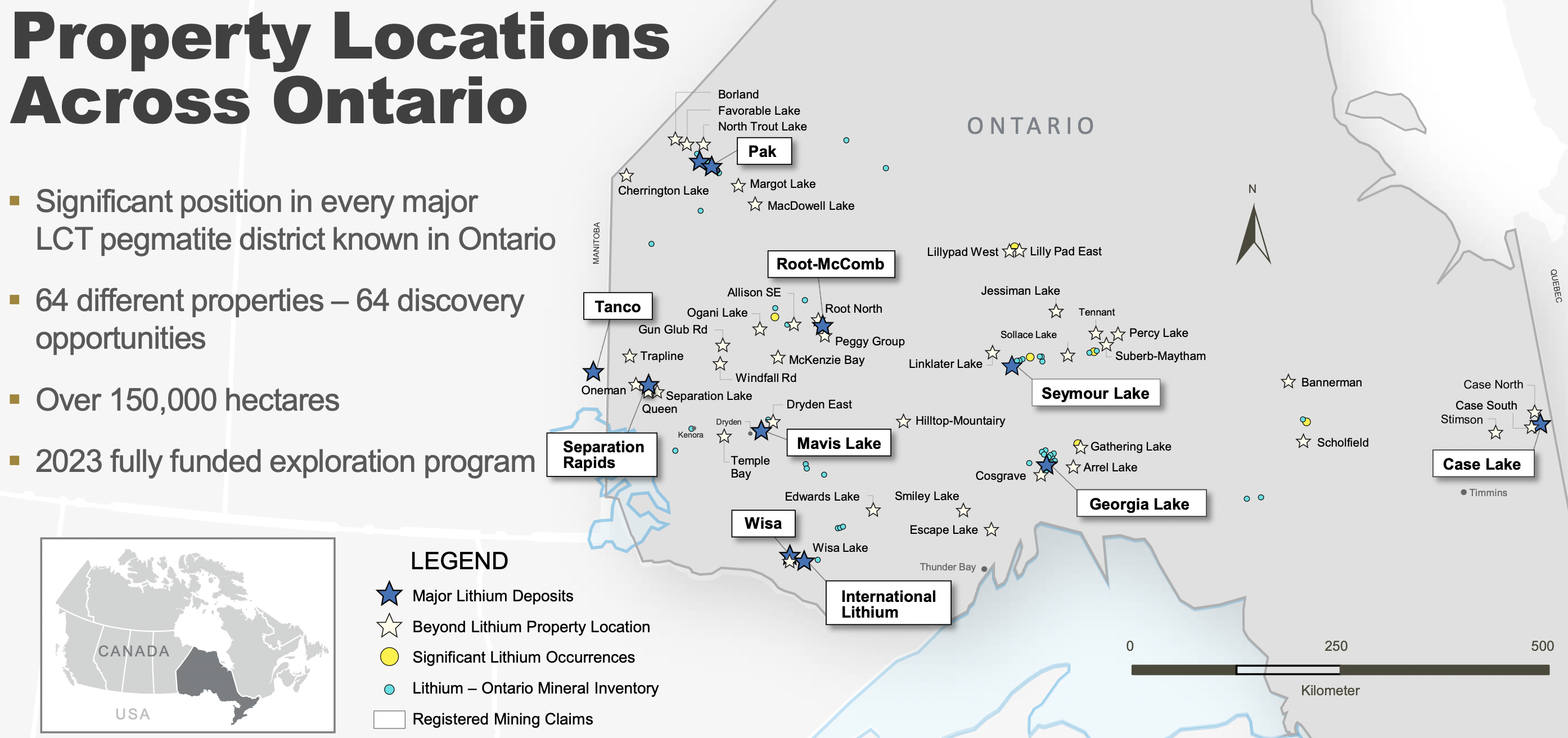

Access to the properties is described as, “excellent, with highway & well-maintained logging road infrastructure.” At Dryden-Mavis Beyond has six properties totaling 11,664 hectares next to Critical Resources’ Mavis Lake project.

At McKenzie Bay, Beyond has 12 properties totaling 24,959 hectares near Green Technology Metals‘ [GTM] McCombe project. The technical team has identified zoned beryl-bearing pegmatites around large quartz crystals.

This should help distinguish the more prospective pegmatites as beryl is easy to see and can be (but not always) an indicator of nearby Li mineralization. After careful analysis of assays from Phase , a Phase 2 program of more detailed mapping & sampling will commence on properties showing the best potential.

In addition to Li, assays will report the concentrations of several other elements, most notably cesium, tantalum & rubidium. A LiDAR survey on the Wisa Lake property has been completed with results expected in 2h July. Wisa Lake consists of 6,549 hectares next to the GTM’s Wisa project.

Importantly, historical core samples from some of the properties will be re-assayed for Li2O values this summer. Finding meaningful Li20 in this manner would represent a very low-cost “discovery” and could be an investment catalyst.

The combination of Allkem & Livent is a big deal. Talk about a vote of confidence, both companies have been saying on their earnings calls that they see Canada as the most attractive/prospective Li market in the world. The merged company claims it will be the 3rd largest global producer by 2027.

Canada stands out for at least four main reasons 1) widespread (green/low-cost) hydroelectric power, 2) proximity to U.S. EV / ESS markets, 3) strong federal & provincial support for battery material projects, and 4) hosts well-understood, low-risk hard rock Li deposits.

The combined $14B company has a strong foothold in Quebec, but nothing in Ontario. Quebec is great, but valuations there are higher and most of the best deposits are spoken for.

In Quebec, majors like Rio Tinto, Pilbara Minerals, Mineral Resources, POSCO & Wesfarmers are thought to be looking to acquire Patriot Battery Metals. Winsome Resources is following in Patriot’s footsteps, Critical Elements has an advanced, BFS-stage project, and Sayona Mining has three meaningful JVs.

With 150,000 hectares and properties near most Li hotspots in Ontario, drilling successes at prominent projects held by Frontier Lithium, Rock Tech, Green Technology Metals, Critical Resources, Power Metals and others will benefit Beyond as well.

It’s increasingly clear that there will be multiple Li spodumene conversion facilities built in Ontario. That suggests one or more will be near properties owned, controlled, or farmed-out by Beyond.

I strongly believe there will be dozens of satellite deposits worth well into the $100s/t of LCE, especially if spodumene concentrate continues to sell for around US$4,000/t., and especially after multiple facilities are up and running, competing for concentrate feedstock.

Beyond Lithium could be sitting on multiple deposits (or none), large, medium or small, high grade (> 1% Li2O) or not, but at a valuation of $6M the risk/reward is very compelling.

Zoom in on the areas around Frontier Lithium’s PAK/Spark project that is believed to host up to 100M tonnes at 1.30%+ Li20. Beyond has six (denoted by white stars) properties nearby.

Check out Beyond’s properties near Rock Tech’s Georgia Lake and Avalon Advanced Materials’ Separation Rapids. Or, look at the 12 properties I mentioned earlier near Green Technology Metals.

Winsome’s only move outside of Quebec is an investment in Power Metals — they must really like that project. PWM.v shares have doubled in the past month. Beyond has properties around Power Metals that Winsome could be interested in.

I don’t want to minimize the risks of a tiny company exploring early-stage Li properties, but the current valuation reflects these considerable early-stage challenges. In my view, it would be impossible to replicate this scale & geographic spread of this portfolio in Ontario or Quebec at a price anywhere near $6M.

More than 25 Canadian-focused players have market caps above $25M, nearly all in Quebec & Ontario, some Australian-listed. None have nearly as many as 150,000 ha in a single province.

There are notable success stories at the early-stage level. Brunswick Exploration has more than twice the # of hectares (spread across six provinces), and boasts an EV of ~$130M.

Some of Brunswick’s properties are more advanced, but the company is still pre-maiden resource. Only last month did it announce its first Li drill results.

With Chinese investment unwelcome in Canada, Korean & Japanese firms have a big opening. Battery makers LG Energy Solution, Sk On, Panasonic & Samsung SDI are jockeying for position. LG Energy has been especially active.

Japan is famous for its giant commodity trading firms, several of which are now investing in Li projects. The most notable are Mitsui & Hanwa Co. Mitsubishi Corp. is rumored to be looking to invest.

As Beyond Lithium (CSE: BY) / (OTCQB: BYDMF) learns more about its properties, management will be able to have meaningful discussions with interested parties later this year.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Beyond Lithium, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Beyond Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Beyond Lithium was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topi

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)