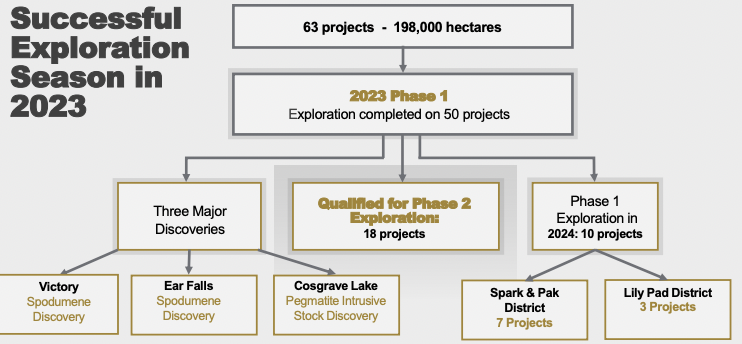

Beyond Lithium has just 34M shares outstanding, an C$11M market cap, and has been operating on a shoestring budget since day 1. Yet, its technical team has made truly remarkable progress this year.

First, a meaningful discovery at its Cosgrave Lake project (more on that later). Cosgrave has been eclipsed by two other exciting projects.

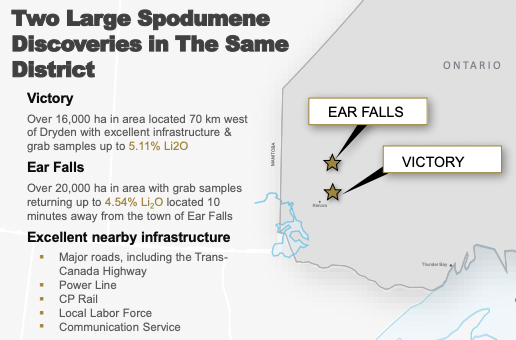

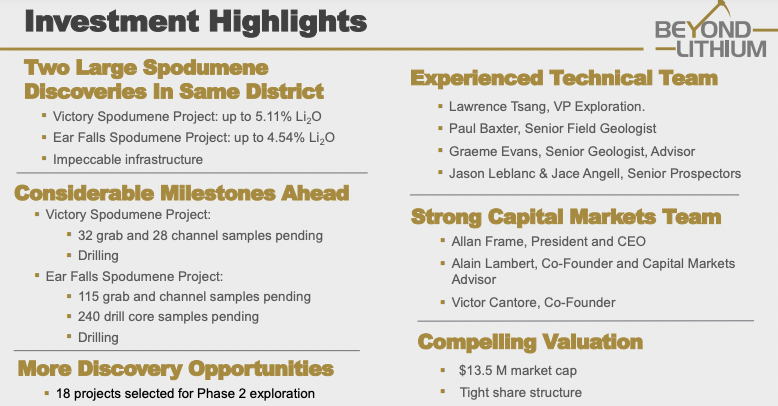

The Victory and Ear Falls projects have greater sex appeal as they host high-grade grab samples including four of 4.12% – 5.11% Li2O (at the Last Resort pegmatite on the western side of Victory) and up to 3.48% Li2O (at the Bounty Gold pegmatite on the eastern side). A rail line, two highways and a power line run east/west along the southern border of Victory.

The spodumene-bearing pegmatites at Victory are five km apart along a 6 km exploration corridor and are 30-40 m wide by 250-300 m long (on surface). Victory totals 16,682 hectares. In certain areas, spodumene mineralization has been observed to cover up to 50% of the pegmatites.

As promising as Victory is, it should be noted that district-scale synergies exist among Beyond’s Victory, Ear Falls project — and eight Mavis Lake properties — all within a 100-km radius.

This Dryden-Ear Falls region is emerging as a lithium (“Li”) hub with a favorable geological setting for Li, Cesium, Tantalum (“LCT”) pegmatites. For more on Victory, please see Beyond’s website description of it, and this November 30th press release.

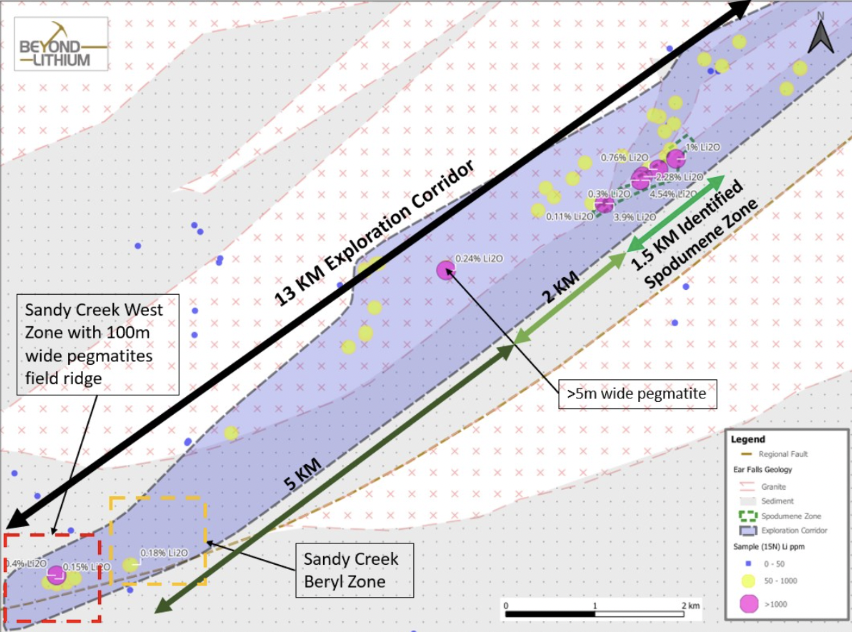

In yet another positive update, this time on the Ear Falls project, channel sample results were announced. The four best returned between 1 to 2 meters of 1.03% to 1.88% Li2O. Regarding the market’s reaction to this news, Beyond is a victim of its own success…

Shareholders have become accustomed to excellent news releases. So, this perfectly good, (but not overly exciting) update caused some profit taking.

Sixty-four channel samples were taken from 15 locations. Samples were collected from three sites; EF-1, EF-2 & EF-3, along the Wenasaga North Zone (“WNZ”). What are the chances that this 1% portion of the entire Ear Falls project will be the best mineralization found?

Readers are reminded that a stellar grab sample of 4.54% Li2O was found at the WNZ just three months ago. So, these channel results are a piece of the puzzle, but this remains an early stage prospect. A 13 km exploration corridor has been identified.

Still, in three months, a prospecting program, stripping & channel sampling, and a 330-meter drill program were completed. In addition to yesterday’s results, there are many grab + over 240 drill core samples pending from Ear Falls & Victory.

An important takeaways is that the length of the the WNZ has increased by 50% to 1.5 km. This means that the team can continue to; map, prospect, surface sample, strip, channel sample, and drill across a significant area.

Ear Falls hosts some stacked & zoned pegmatite systems, providing for the potential of discovering additional subparallel dykes by drilling deeper holes. Seven drill holes were done, but the average depth was only ~47 m. Limited drilling is allowed without obtaining permits.

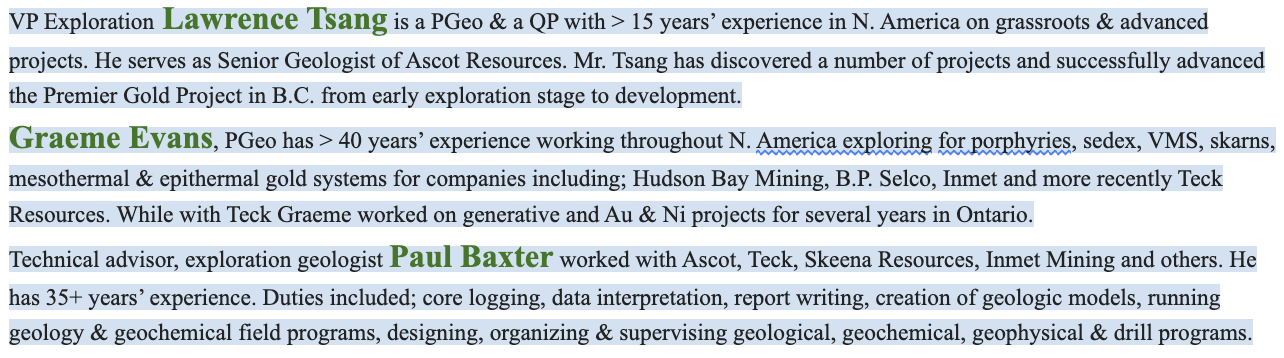

Applications for drill permits will be submitted this week. Serious drilling could start as soon as March. Let me reiterate that although it’s early days, the technical team led by VP Exploration Lawrence Tsang has accomplished a tremendous amount in well under a year.

Importantly, insights about the controls & structures at Victory & Ear Falls have already been gained. This will lead to better targeting, more efficient drilling & lower costs per meter drilled.

Five of the seven short drill holes intersected spodumene — including a dyke not exposed at surface — confirming the team’s model of stacked systems of multiple subparallel spodumene-bearing pegmatites.

This is exciting as the depth of the stacked pegmatites could potentially extend hundreds of meters below surface.

The greater the stacking and the deeper the mineralization, the less strike length required to host a meaningful deposit. In a new video interview by Ravi thejuniorexplorer, CEO Allan Frame & Mr. Tsang point out that it took Quebec’s Patriot Battery Metals a year to expand their giant Corvette project from 800 to 2,200 meters.

Patriot has grown to 4,350 meters and has identified 109.2 million tonnes of 1.42% Li20. Likewise, Winsome Resources just delivered a 58.5M tonne maiden resource based on 1,340 of 3,100 meters of mineralized strike.

This doesn’t mean that Beyond hosts deposits as good as Patriot’s or Winsome’s, but even 5M tonnes at 1.00%+ Li2O would be a tremendous start at Victory and/or Ear Falls.

Readers are reminded that only about a dozen of the 230 juniors I’m tracking that have at least one Li prospect in Canada have delivered a maiden resource estimate.

Map, prospect, surface sample, strip, channel sample, and drill… most juniors talk about the drilling. By learning about all the hard work required to find potentially viable deposits, investors in Beyond Lithium can have confidence that today’s valuation of C$11M is truly a steal.

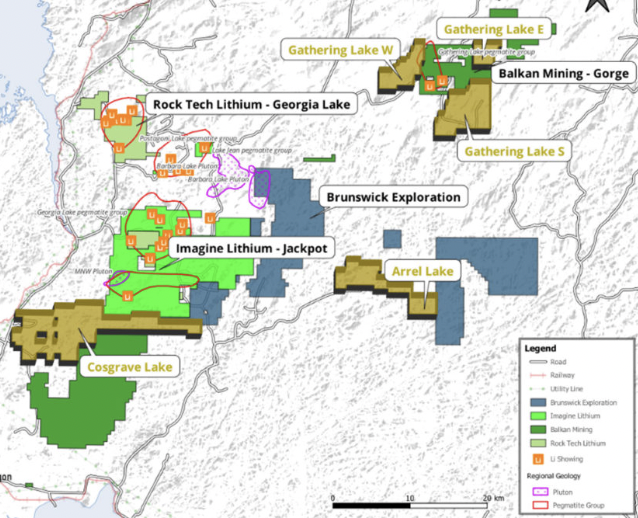

Turning to Cosgrave Lake, the Company has three prospects in the Georgia Lake District; Cosgrave (8,993 ha), Gathering Lake (6,948 ha), and Arrel Lake (3,585 ha).

Several groups of pegmatite outcrops were outlined at Cosgrave over 11 km of prospective strike length. Management discovered a fertile LCT pluton similar in size to others in the region.

Cosgrave has a comparable chemical/geological background to the pluton that hosts the Tanco LCT mine in Manitoba, a globally significant source of cesium. Grab samples returned up to 0.39% Li2O & 2.77% Manganese, suggesting the pegmatites are highly fractionated.

These conditions are amenable to the potential discovery of a higher-grade Li-bearing zone. Cosgrave is accessed via the Trans-Canada Highway and a network of well-maintained logging roads.

This is an active Li exploration area including Imagine Lithium’s Jackpot project, with intervals incl.; 5.0 m @ 3.0%, 7.2 m / 2.5% & 2.0 m / 4.5% Li2O and Rock Tech’s more advanced Georgia Lake [PFS done].

Although there’s been little said about other projects besides Victory, Ear Falls & Cosgrave Lake, readers are reminded that Beyond has > 195,000 ha spread across Ontario. Another prospect cluster worth keeping an eye on is Stimson, Case Lake North & Case Lake South.

The Stimson prospect is ~50 km west of Power Metals’ LCT pegmatites, and thought to be associated with the same intrusive body. Historical drill core from 1994 indicate that possible spodumene was encountered over a considerable interval from 60.0 to 99.8 meters downhole.

Winsome owns ~20% of Power Metals. Power’s Case Lake has delivered strong drill intervals including; 26 m of 1.94% Li2O & 18 m of 2.07% Li20, as well as pockets of high cesium concentrations.

In 1h 2024, management will begin farming out projects. It would not take more than a few deals to meaningfully slash company-wide cash burn. The team will continue to actively advance key projects internally, without blowing up the pristine 34M share capital structure.

With a valuation of C$11M, a meaningful drill result on any owned or farmed out project could launch Beyond Lithium into the next tier of Li juniors. Companies like; Arbor Metals, Brunswick Exploration, Green Technology Metals, Benz Mining & Power Metals, with market caps ranging from C$37M to $159M.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Beyond Lithium, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Beyond Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Beyond Lithium was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)