The gold price has had quite a run to an all-time (nominal) high of ~$2,266/oz., now at $2,258/oz., yet still well below the inflation-adjusted high in Jan-1980 of ~$3,390/oz. Gold (“Au“) averaged roughly ~$2,452/oz. in today’s dollars for the entire year of 1980. Will gold continue to rally, or give back its gains?

Some pundits believe Central Bank (“CB“) buying is behind this big move. CBs purchased an average of ~35M ounces/yr. of Au in 2022 & 2023, compared to ~16M ounces/yr. from 2012 to 2021. The real story could be that China & Russia are leading BRICS countries away from US$ assets.

If heavy CB buying continues from a minority of countries, others might feel compelled to buy before the price goes a lot higher, i.e. FOMO… Which, of course, could send the price a lot higher!

According to recent commentary from Citibank, (shortly before the explosive move to $2,266/oz.),

“The most likely wildcard path to $3,000/oz. gold is a rapid acceleration of an existing but slow-moving trend: de-dollarization across Emerging Markets central banks that in turn leads to a crisis of confidence in the USD”

Does $3,000/oz. seem crazy? That would be +33% from here, yet Bitcoin is up +70% in the past 2-3 months. Giant tech stock Nvidia is +35% since mid-February. JPMorgan & Bank of America are now saying the price could touch $2,500/oz.

Investors have not adjusted to this new reality. Rather than busting through all-time highs, Newmont & Barrick Gold are (on average) 25% below their highs. Producers will be printing money in 2024-25, so much so that we could be on the verge of a tsunami in M&A.

Pure-play, high-grade Au juniors like Scottie Resources (TSX-V: SCOT) / (OTC: SCTSF) are in a great position. On April 2nd, Scottie made one of the most important announcements in its history. Franco-Nevada is buying a 2.0% Gross Production Royalty for C$8.1M. Franco is also investing C$1.5M at C$0.275/shr. via a Charity Flow-Through transaction.

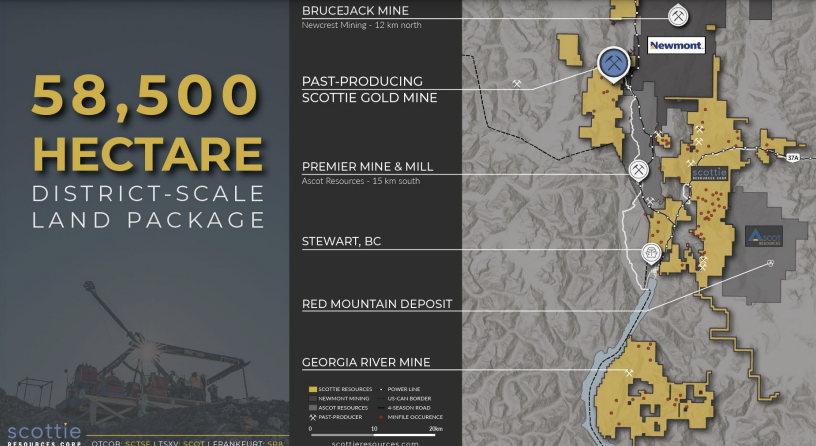

Although the cash injection is great, it’s not the critical part. More important is the strong vote of confidence in Scottie’s 58,500 hectares. In my view, for Franco to invest at the pre-maiden resource stage, it must see at least 2M high-grade ounces.

However, think about how royalty & streaming companies operate — they focus on assets that can grow larger than existing evidence supports, to obtain cash flows for decades. In other words, Franco likely would not have invested if it thought there were ONLY 2M ounces.

CEO Brad Rourke & VP of Exploration Thomas Mumford are rock stars. They deserve tremendous accolades for years & years of hard work. This validation of Scottie’s exploration methodology is incredibly important. Scottie is a serious company in the Golden Triangle, and now everyone knows it. Once M&A resumes, Scottie could be high on suitors’ wish lists.

Besides Newmont, who acquired Newcrest, making it a major player in B.C., Teck Resources has JVs on two world-class projects, Galore Creek (50%) & Shaft Creek (75%), and has invested in American Eagle Gold. Freeport McMoRan & Boliden AB have invested in Amarc Resources.

Kinross, Centerra Gold, Seabridge, Hecla Metals & Coeur Mining are also invested in B.C., and BHP acquired a 19.9% stake in Brixton Metals. Scottie’s 100%-owned, high-grade, road-assessable, Blueberry Contact Zone (“BCZ“), is a tiny portion of Scottie’s 58,500-hectare land portfolio.

The BCZ is ~20 km NW of Ascot’s Premier project coming online this month, ~25 km south of Newmont’s Brucejack mine, and two km N-NE of the past-producing Scottie Gold Mine (“SGM“).

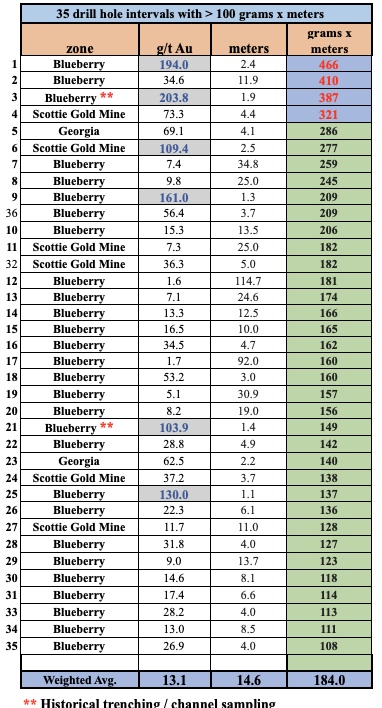

Please see the latest corporate presentation. Scottie has delivered excellent drill results, see below. Scottie has thirty-five 100+ gram-meter intercepts (incl. two historical trenching/channel samples) with lengths averaging 14.6 m at a (weighted-avg.) grade of 13.1 g/t gold.

The SGM project that also hosts the BCZ has an active mine permit allowing for the mining of up to 75,000 tonnes/yr., ~200 tonnes/day. This is interesting given that Newmont & Ascot both have mills within ~25 km.

Continued strong intervals from the BCZ are even more exciting given the preliminary metallurgical testing recently announced. Using multiple methods & parameters, gold recoveries of 87.2% to 97.6% were achieved.

CEO Rourke and his team are excited by this preliminary met work because they were not sure how recoverable BCZ mineralization would be. While they already understand recoveries at the past-producing SGM, nothing had been done at the BCZ, until now. This news further de-risks the BCZ as the [potential] ounce count approaches 2M (my guess, not Company guidance).

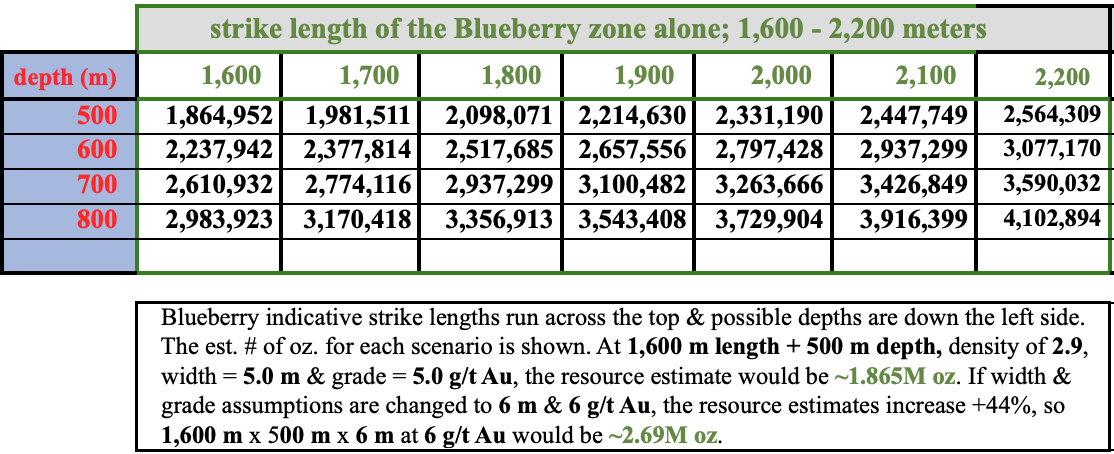

The BCZ likely has 2M and possibly 3M ounces of gold, see chart above. Not just any ounces, but high-grade within just 25 km of two significant third-party mills. Scottie is sandwiched between Newmont & Ascot.

A potential lateral extension ends at 2,200 m. How much deeper than 500 m could it run? Brucejack & Red Chris are mineralized to at least 1,800 m. Please note that this doesn’t mean Scottie’s BCZ will be as deep.

Combining Ascot/Scottie with Brucejack would generate considerable cost-saving opportunities, valuable operating flexibility & economies of scale. Newmont would have two mills and benefit from the addition of several high-grade deposits within 50 km of both.

While Newmont is best positioned to take out Ascot/Scottie, Teck should not be ignored. As mentioned, it’s selling its coking coal assets (for > $12B) and could redeploy some of the proceeds into Au/copper assets in B.C.

Teck could temper Newmont’s dominance in B.C. by acquiring Ascot/Scottie — which combined likely hosts 5M+ high-grade ounces — enough to produce 250k oz./yr for 20+ years. However, assuming aggressive drilling across Ascot’s & Scottie’s land packages, Newmont, Teck, or Freeport could potentially book millions more ounces.

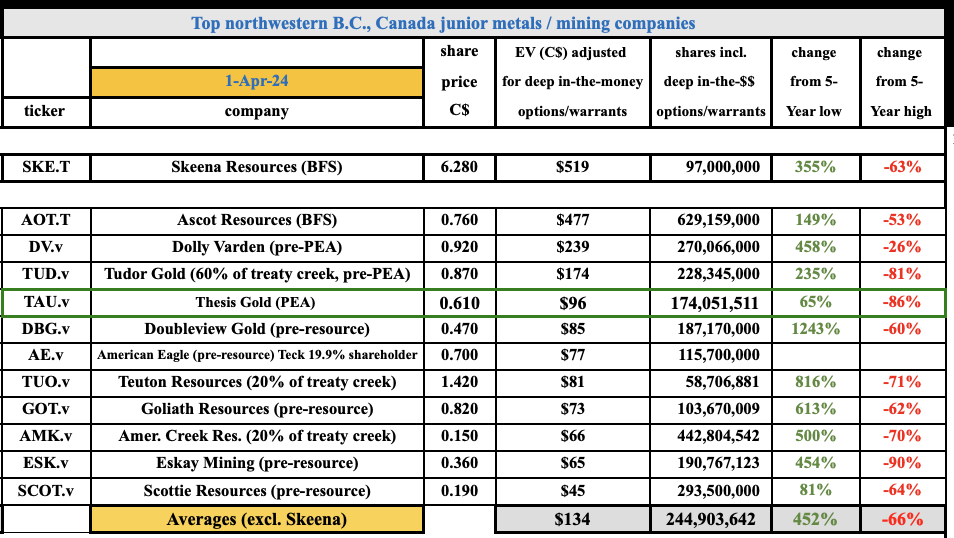

In the chart above, notice that Scottie’s pro forma valuation is the lowest. It’s valued at a 43% discount to the average of Doubleview Gold, American Eagle & Goliath Resources. Also notice that Scottie’s share price is -64% below its all-time high!, despite the Franco-Nevada news and the Au price near an all-time high.

Another scenario to consider, although not a primary focus, is Scottie farming out or forming JVs on the 31,736-hectare Cambria and/or 17,625-hectare Georgia projects. These two blocks are formidable & geologically promising, but Scottie hasn’t had the funds to advance them.

Given their sizes/locations, they would be worth millions of dollars as part of separate entities but are currently ascribed minimal values as all eyes are on the BCZ & the SGM.

Readers are encouraged to take a closer look at Scottie Resources (TSX-V: SCOT) / (OTC: SCTSF). A quick review of the maps in the corporate presentation provides a clear indication of why Scottie is a prime takeout candidate. The Franco-Nevada news is the icing on the cake.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Scottie Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Scottie Resources are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Scottie Resources was an advertiser on [ER] and Peter Epstein owned shares in the company

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)