What a time to be invested in Copper (approaching a 2-yr. high) & Gold (near an all-time high). Gold (“Au”) is now at $2,357/oz., but traded as high as $2,432/oz. on April 12th. Forget about price targets of $2,500/oz…

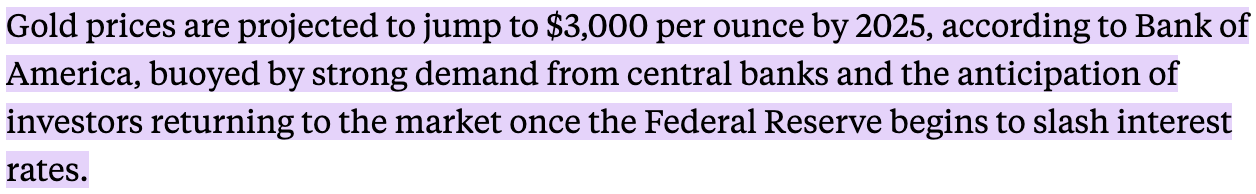

On Friday, Goldman Sachs raised its year-end target from $2,300 to $2,700/oz., and last week Bank of America said we could see $3,000/oz. next year.

Copper (“Cu”) at $4.43/lb. = $9,767/tonne is great news for existing producers, but well below the incentive price needed to bring major new projects online. Is $12,000/tonne the new $10,000/t? Several investment banks have switched gears, now talking about $12k/t Cu in 2025 instead of $10k/t in 2024.

Some, like mining legend Robert Friedland, say $15k/t is needed to get a robust supply response to increasing demand. I agree. $12k-$15k/t = $5.44-$6.80/lb.

Don’t get me started on the critical importance of security of supply. The U.S. is 100% net import reliant for 12 critical minerals and net import reliant of > 50% for 31 others. More Cu/Au & Ag from Canada & the U.S. is desperately needed!

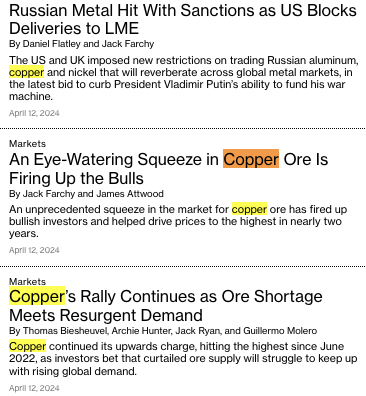

During the 2001-2006 bull market, Cu rose +500%. Citigroup said there’s potential for, “explosive price upside” in the next three years. Last Friday, the U.S. & the UK announced new trade sanctions on Russian Cu, nickel & aluminum.

Where is robust increased demand coming from? I asked Google’s Gemini AI chatbox… I agree with its response…

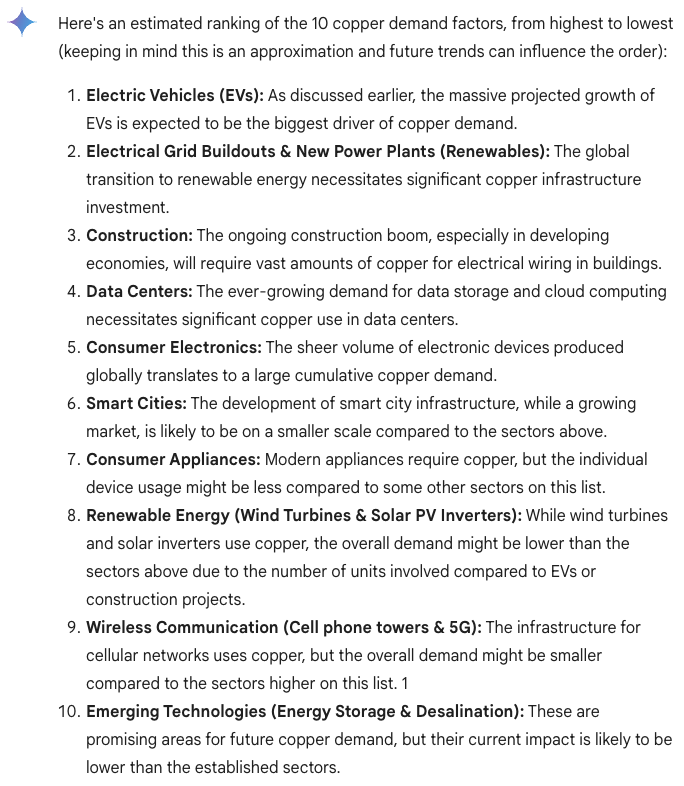

With Cu/Au/Ag prices up +17% to +24% {see chart below) in the past two months, many stocks are up +50% to > +130%, yet Aston Bay Holdings (TSX-v: BAY) / (OTCQB: ATBHF) is up just +13%.

Aston Bay has a 20% free-carried interest in the advanced-exploration Storm Copper project

Aston has two exciting high-grade, near-surface, Cu-heavy projects in Nunavut, Canada, and two promising Au & base metals projects in Virginia, USA. The Company is valued at ~C$30M.

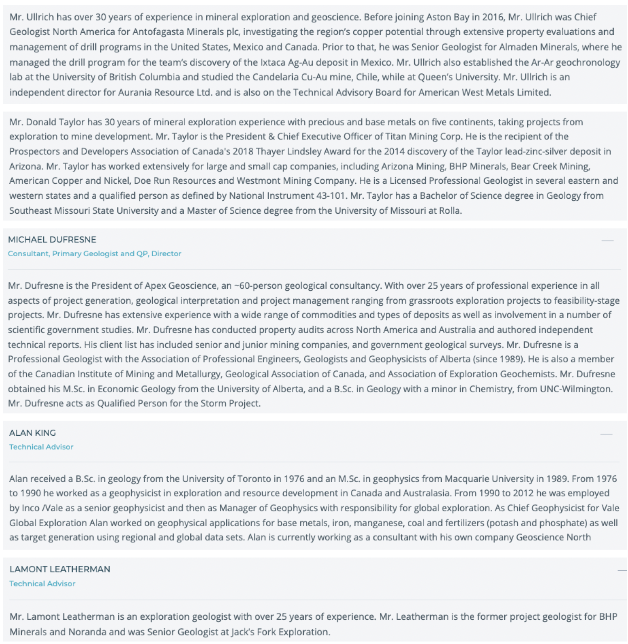

Readers should note the team member bios below. Aston is led by CEO & Dir. Thomas Ullrich, the only full-time employee, surrounded by a stellar board & slate of advisors.

Mr. Ullrich has > 30 years of experience in exploration & geoscience. Before Aston Bay, he was Chief Geologist N. America for Antofagasta Minerals plc, investigating Cu potential through extensive property evaluations & management of drill programs.

Before that he was Senior Geologist for Almaden Minerals, managing drill programs leading to the discovery of the Ixtaca Ag-Au deposit in Mexico. Thomas is an independent director for Aurania Resources and on the Advisory Board of Aston’s 80% partner on Storm Copper — American West Metals.

Donald R. Taylor has 30 years of exploration experience with precious & base metals on five continents, taking projects from exploration to mine development. He received PDAC’s 2018 Thayer Lindsley Award for the 2014 discovery of the Taylor lead-zinc-silver (“Ag”) deposit in Arizona.

He has worked extensively for large & small companies including; Arizona Mining, BHP Minerals, Bear Creek Mining, American Copper & Nickel, Doe Run Resources & Westmont Mining Co.

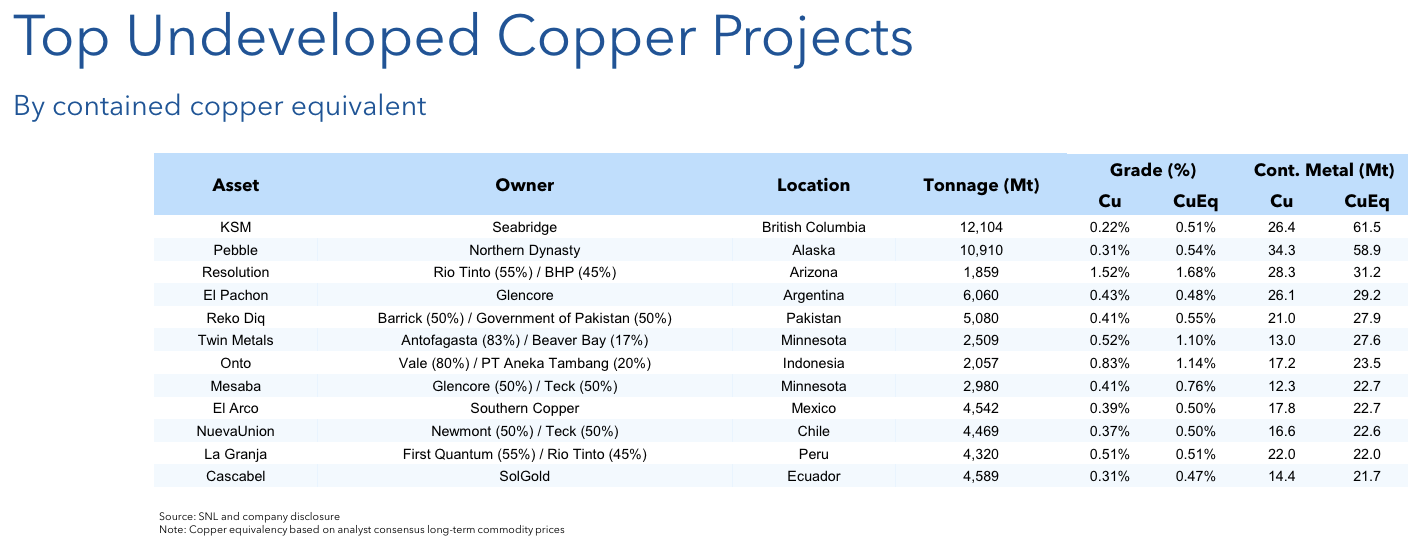

Storm Copper is in far northern Canada, in the territory of Nunavut. The Project is on Somerset Island, covering > 2,200 sq. km within the Polaris mineral district ~120 km south of the regional community & logistics hub of Resolute Bay. The seasonally ice-free deep-water Aston Bay is just ~20 km away.

Upcoming geophysical surveys & exploration programs at Storm Copper will be conducted (and 100%-funded by) partner American West Metals. Excellent facilities are in place, including a 50-person camp. Aston acquired Storm roughly 11 years ago.

Board of directors (CEO Ullrich is on the board, bio included above)…

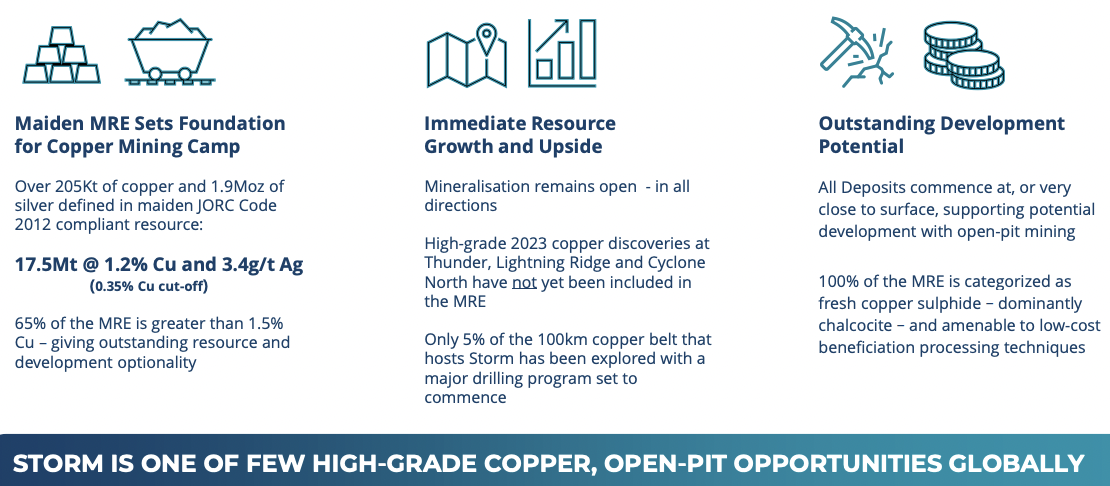

Only 5% of the ~100 km long Cu belt has been explored with focused geophysics & drilling. The high-grade, near-surface mineralization is likely amenable to simple beneficiation techniques.

A maiden mineral resource estimate (“MRE”) was delivered in January, containing 17.5Mt @ 1.2% Cu + 3.4 g/t Ag. That’s equal to 463M lbs. Cu + 1.9M troy ounces Ag.

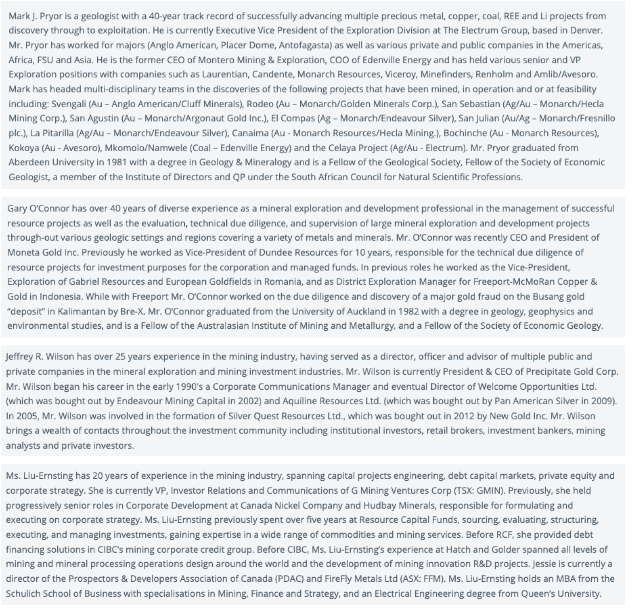

Management believes the resource has good potential to grow substantially. Compare Storm’s Cu-only grade (not its size) to the world’s Top-12 undeveloped projects…Ten of the 12 names have an average Cu-only grade of 0.38%. At spot prices, 1.2% Cu = $117/tonne rock.

High-grade, near-surface discoveries at Thunder (48.6 m @ 3% Cu), and Lightning Ridge (15.2 m / 2.3% Cu & 15.2 m / 2.1%) were not included in the MRE. Intervals that were included are; 110 m of 2.45% Cu (from the surface) & 56.3 m of 3.07% Cu (from 12.2 m).

Over the past 18 months, an interval of 110 M @ 2.45% Cu would have been a Top-6 [high-grade, > 2%] result, as measured by meters x grade, among N. American projects.

Test work using a full-scale ore sorter produced strong results, generating a > 53% Cu concentrate. There’s potential to remove the need for a floatation plant + tailings facility, greatly reducing the operating footprint, capital costs & time to commercial production.

I asked CEO Ullrich how difficult it would be to “direct ship” Storm Copper ore,

“Storm Copper is just 20 km from the coast, across a flat area. Engineering studies are underway, and we believe we could build a road to the coast without a bridge or culvert. We propose to ship upgraded mineralization in one-tonne bags, using empty sea-lift ships on their return leg south. No port facilities would be required, just barges from the shore.”

Upfront cap-ex to direct ship should be quite modest. The equipment is modular and fits into sea containers. Management sees this as a bolt-together operation using low-cost temporary structures rather than significant permanent constructions.

In my view, (not company guidance) cap-ex could be under US$50M, especially if management ramps up production in two or more phases. Aston’s share of the US$50M would be US$10M.

As exciting as Storm Copper is, on March 1st, management announced an option to acquire an 80% interest in the Epworth project, also in Nunavut. Aston must invest a total of $3M over four years. Notice that the Cu price is up +15% since March 1st! Are investors aware of how promising this project is?

Epworth is a very significant opportunity. Several polymetallic trends have been identified in rock & soil sampling. Grab samples from chalcocite boulders returned up to 61.2% Cu + 5,600 g/t Ag. Recent results delivered highs of 37.8% Cu, 27.4% Zn, 1,100 g/t Ag + 3 g/t Au.

Aston Bay is earning up to an 80% interest in a new Cu project in Nunavut

Epworth is ~70 km from tidewater. Recent staking has significantly expanded the size to 71,135 hectares, covering a trend of ~74 km by ~14 km. Mineralization at Epworth is similar to deposits in the Central African Copper Belt (“CACB”) and at Storm Copper.

The reference to the CACB is important. Ivanhoe Mines’ Kamoa-Kakula Copper complex is one of the best Cu discoveries of all time. It has ~95 billion Measured + Indicated + Inferred pounds of Cu at a weighted average grade of 2.54%.

If Aston or American Western Metals could find just 5% of the Kamoa-Kakula endowment at Storm or Epworth, it would be game-changing. Asked about the connection between the CACB and [Storm Copper + Epworth], Mr. Ullrich responded,

“Like many deposits in Central Africa, Nunavut’s Storm Copper & Epworth projects in Nunavut have significant amounts of chalcocite — a high-grade Cu mineral — at surface. This indicates a very efficient Cu mineralizing process in both jurisdictions. The next step is to determine where there could be thicker, more laterally extensive mineralization at depth. This exact game plan led to the discovery of Kamoa-Kakula, and is the plan being followed at Storm & Epworth.”

Management anticipates receiving a drill permit in June. This summer the Company will fly airborne electromagnetic (EM) geophysics and get experienced geologists on the ground.

This grab sample from Epworth is ~143.7 g/t Au Eq. Or ~116% Cu Eq.

There are a large number of outcrops, so geos in the field + geophysics should delineate strong drill targets. A modest drill program may be done this year. CEO Ullrich added,

“Epworth is an impressive 74-km trend of high-grade copper, silver & zinc with accompanying gold, cobalt & lead. We will leverage our knowledge & experience at Storm to make new discoveries at Epworth.”

Since the 1990s there has been prospecting, mapping, geophysics + sparse drilling, but no modern geophysical surveys. Therefore, Epworth has substantial blue-sky potential.

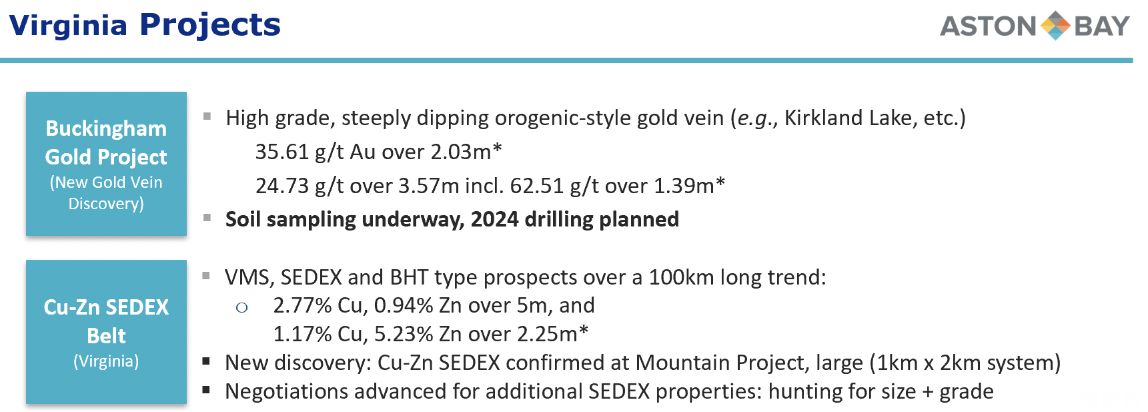

In Virginia, USA Aston has two projects that haven’t seen meaningful work since 2022. While the near-term focus is in Nunavut, these U.S. assets have considerable value given where Cu & Au prices are vs. two years ago!

Senior technical advisor Donald Taylor (mentioned above) vended these opportunities into the Compay. They are some of his favorite U.S. prospects. Aston Bay (TSX-v: BAY) / (OTC: ATBHF) is very well positioned for the ongoing bull markets in Cu, Au & Ag.

Its Storm Copper project is doing great under the direction of partner American West Metals. The Company will be free-carried there for several more years. Leveraging the great success & experience at Storm, management is earning up to 80% of another Nunavut project, Epworth.

Epworth could be as good or better than Storm. Importantly, in addition to near-surface, high-grade Cu, it also has pockets of very high-grade Ag. With Cu, Au & Ag up +20%, +19% & +25% from the lows of 2024, I believe Aston’s valuation could move meaningfully higher.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Aston Bay Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Aston Bay are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Aston Bay was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)