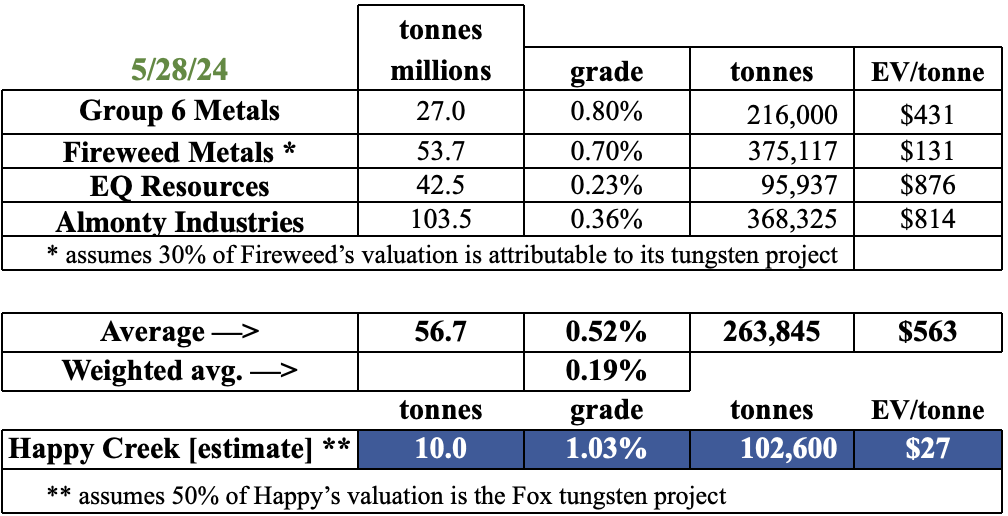

Despite the name sounding like a Netflix series, and having a tiny $5M market cap, Happy Creek (TSX-v: HPY) has four Canadian assets — any one of which could be a company-maker. For example, its sizable Fox property hosts a Top-decile grade tungsten deposit. In the chart below, notice Happy’s grade compared to its peers.

The area of prospective mineralization at Fox is 5 x 10 km, but exploration has been limited to a few small areas. Drilling has shown stacked sequences of tungsten mineralization averaging 10 meters thick from surface outcrops to ~150 m depth.

Management believes there could be 20 to 50M tonnes of tungsten-bearing mineralization. Immediate plans are to continue mapping & sampling new zones to identify drill targets.

It would not require a large deposit for Fox to become an important asset. Given its stellar grade, 10M tonnes would be significant. Happy’s 100%-owned, 200 sq. km project could potentially host multiple tungsten deposits.

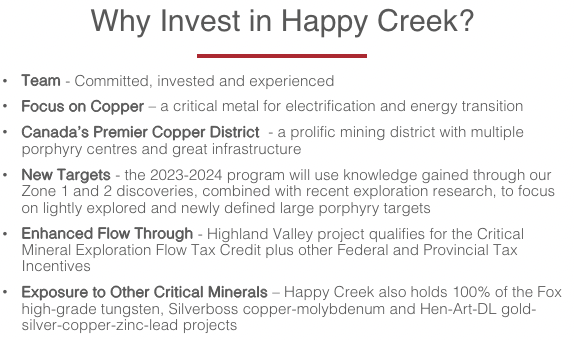

The road-accessible Fox Prospect is in the south Cariboo region of British Columbia, Canada. Due to its importance & supply risk, tungsten is deemed a strategic & critical element in Canada, the U.S., and the EU.

Preliminary metallurgical results indicate that Fox material can be recovered using gravity tables to produce a quality concentrate. There is excellent access & infrastructure; roads, power, rail & labor.

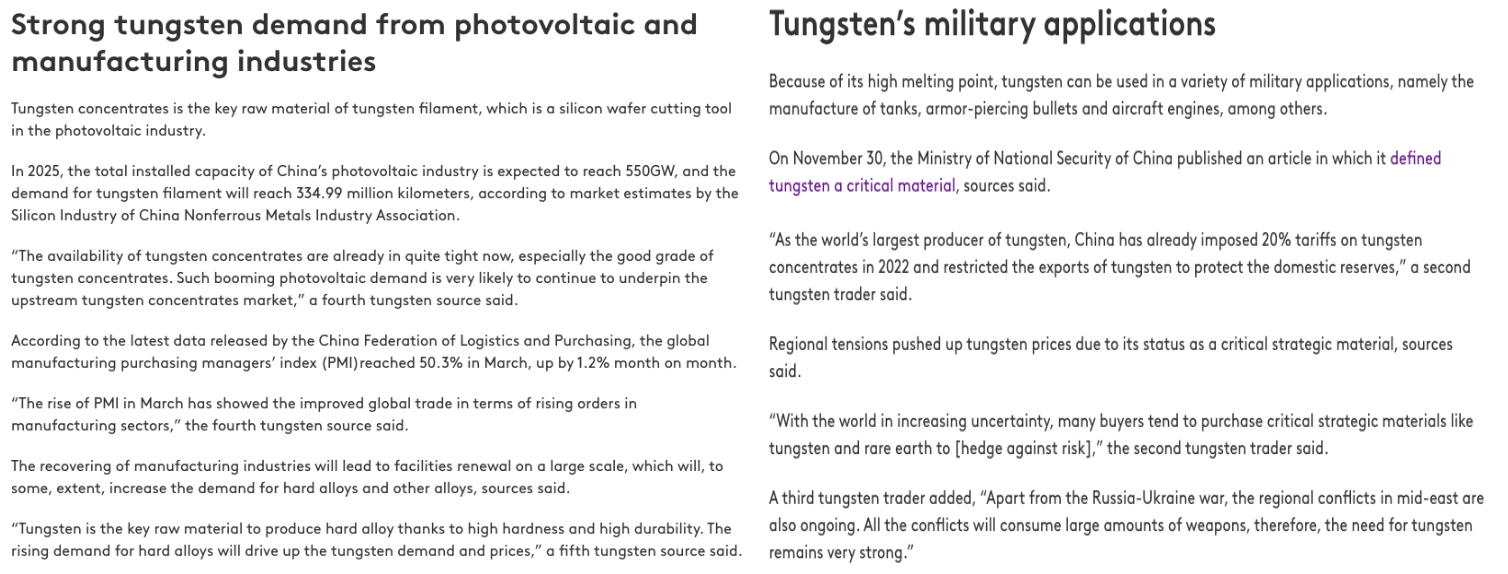

The U.S. government cares about tungsten for its uses in aerospace & defense, and tungsten is used in electrical contacts/switches, munitions, EVs, incandescent lighting, solar & wind farms & medical devices. Check out the latest on tungsten’s increasingly important role in the testing/development of nuclear fusion.

Tungsten is one of the hardest & densest industrial metals with the highest melting point. Tungsten currently trades at ~US$34,100/tonne, twice that of battery-quality lithium carbonate. Over 85% of tungsten is sourced from China & Russia, and most of it is consumed in China.

Although U.S. / Chinese geopolitical tensions are manageable at the moment, that could change if/when China invades Taiwan. Will China continue to allow critical materials like tungsten flow to support the West’s military complex?

Geopolitics & economic rivalry span far beyond military applications. Flashpoints could easily arise over semiconductors, solar panels, EVs, and/or Artificial Intelligence.

The Biden Administration recently announced a quadrupling of tariffs on Chinese EVs to 100%, a doubling on semiconductors & solar equipment to 50%, and an increase on Li-ion batteries to 25% from 7.5%. How heated might relations become? No one knows, but the situation should be taken seriously.

Fireweed Metals bills itself as having one of the highest-grade tungsten resources. I attribute 30% (C$49M) of Fireweed’s valuation to its tungsten prospects, or $131/tonne in the ground. Given Fox’s grade of 1.03%, (vs. Fireweed at 0.70%) each 10M tonnes could be worth ~C$11M = $27/tonne vs. Happy’s valuation of ~$5M.

Tungsten is great, what about Copper?

With the copper (“Cu“) price up +37% from its 52-week low, some investors are wondering if they missed the rally. No, we’re in the early innings of a stronger-for-longer period. As I write this sentence, the Cu price is $4.87/lb., vs. an all-time high of $5.20/lb. on May 19th.

Goldman Sachs believes there will be a combined Cu deficit of 921k tonnes this year & next, and is upping its 12/31/24 Cu price forecast to $12,000/t = $5.44/lb. It reiterated that Cu will average $15,000/t = $6.80/lb. in 2025. If $6.80/lb. is the average, imagine what the high tick might be…

Last month Trafigura said demand for electricity from AI will require a million tonnes of incremental Cu not baked into analyst models a year ago. That estimate would add ~0.5% to the CAGR through 2030. Consumption is now expected to grow ~3%/yr., vs. ~2%/yr. from 2000 to 2023.

Demand growth of 3% doesn’t seem that dire until one considers supply. Of the top seven Cu-producing countries, three are China, Russia & Indonesia. The West cannot rely on those countries for decades to come.

Another supply concern is climate change. PwC recently reported that 54% of the world’s Cu production faces severe-to-very-severe water challenges.

In addition to water scarcity, the two largest producers — Chile & Peru — are plagued by local opposition, old mines, declining ore grades & rising costs. Therefore, the best two (and safest) places to source Cu will be Canada & the U.S.

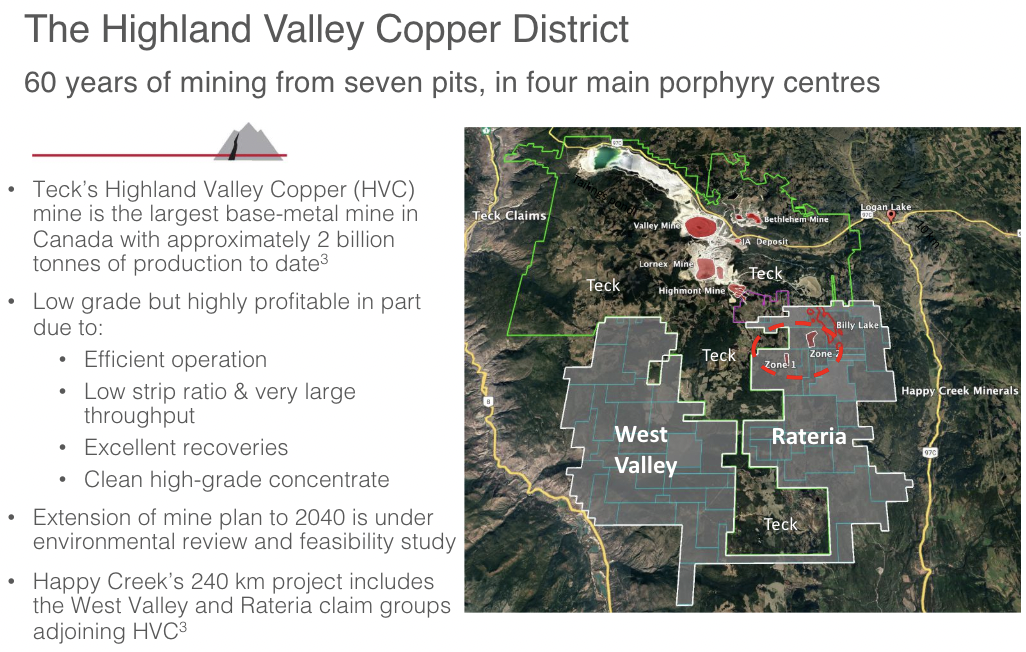

Teck Resources‘ Highland Valley Copper Mine (“HVCM“) is the largest base-metal mine in Canada with ~2 billion tonnes of production to date. It’s low-grade, but profitable due to efficient operations, low strip ratio, economies of scale, and excellent recoveries.

Teck is working on engineering studies to extend mine life to (at least) 2040. Happy Creek’s large, 100%-owned, 240 sq. km, Highland Valley Project (“HVP“) includes the West Valley & Rateria claim groups that adjoin Teck’s HVCM.

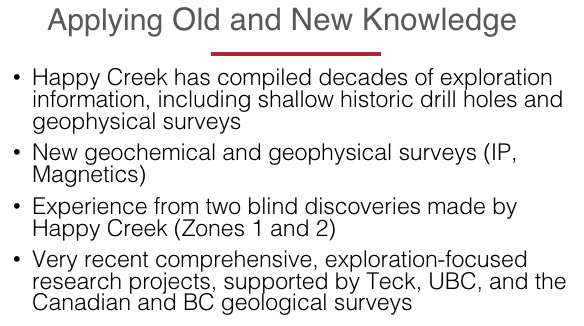

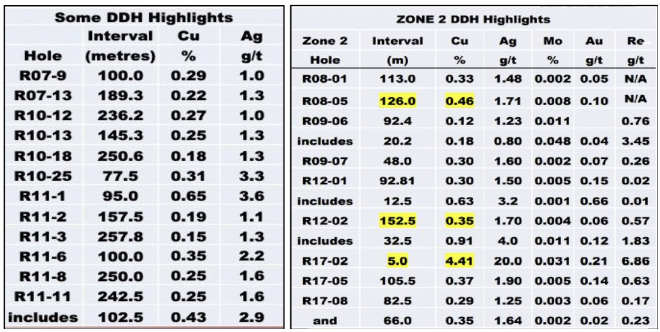

Exploration, mostly in 2006-2008, resulted in promising drill intervals {see above}. In total ~42,000 meters have been drilled, which would cost ~$11M to replicate. Historical exploration was slowed by glacial till cover and disagreements among many small claim groups.

Claim consolidation took > 18 years, but is now done. Dry, rolling upland plateau and an extensive logging road network allows for year-round exploration.

The grades from 2006-08 (shown above) were nothing to write home about. In 2008, the Cu price collapsed from $4.1 to $1.2/lb., but at today’s $4.87/lb. Cu, the situation looks a lot better.

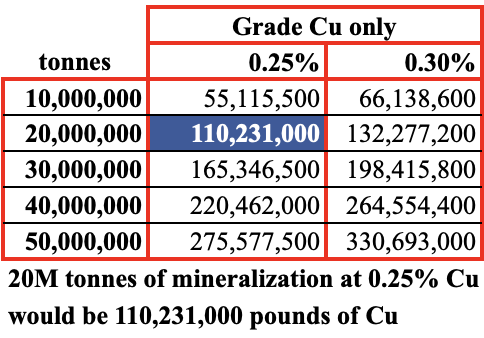

CEO Jason Bahnsen’s technical team thinks there’s a possibility of up to 50M tonnes of — 0.25 to 0.30% Cu — in Zones 1 & 2 {see map above}. However, if line-of-sight to 10s of millions of tonnes can be established, look at how much property remains to be explored/drilled.

If management could book 10s of millions of tonnes at a Cu Eq. grade equal to/better than Teck’s, Happy would have valuable satellite deposits compared to its market cap of ~$5M. Teck’s HVC has ~1.1 billion tonnes [grading 0.27% Cu].

Base metal/Cu mid-tiers & Majors could be interested in partnering with Happy Creek on its exciting Cu prospects so close to Teck’s HVC. When the Cu price was at or below $3.5-4.0/lb., there was far less urgency to partner with Happy, but that could change at any time.

As seen in the chart above, Happy’s project could potentially host 100s of millions of pounds of Cu. To be clear, under a billion pounds for a low-grade bulk-tonnage project is a small resource, but given that Happy’s entire valuation is ~$5M, HVCP could be a game-changer, especially if discoveries are made outside Zones 1 & 2.

Between high-grade tungsten & bulk tonnage Cu potential, Happy Creek’s valuation seems undervalued amid a hard asset, inflation-hedge, commodity bull market. Not to mention there are two more assets to describe…

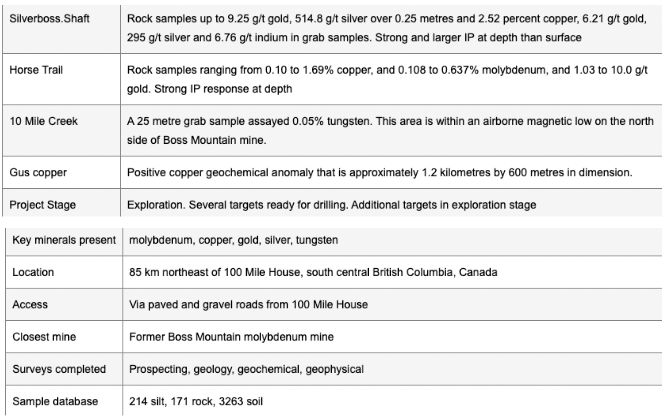

The 100%-owned, 155 sq. km, Silverboss property is ~85 km NE of 100 Mile House in S. central B.C. For the first time, a single Company has obtained this strategic land position around the former Boss Mtn. mine.

Silverboss is reasonably close to Imperial Metals‘ Mount Polly mine. 2024 guidance at Mount Polley is 30.0-33.0M lbs. Cu + 35-40,000 oz. Au. Finally, the 62 sq. km Hen & Art-DL property adjoins the Company’s Silverboss & Fox projects to the south & west, respectively.

Exploration has developed easily accessible, low-cost Cu +/- Au targets. The DL prospect is centered on an adit dating back to the 1880s. Rock samples returned up to 42.9 g/t Au over 1.0 m.

The property shares similarities to other orogenic Au analogs like the Thunder Ridge & Spanish Mountain prospects 1.5 km to the south & 100 km to the north.

Happy Creek has four promising prospects in Canada, two of which are the main focus. If one believes as I do that tungsten could be in short supply, then Happy Creek is a potential solution. Unlike Cu juniors, of which there are well over 300, fewer than a dozen juniors with tungsten projects exist.

Readers are encouraged to look at the above map of HVP’s footprint adjoining Teck. This is not merely a closeology play, it’s BOTH the largest land package, AND the closest.

If management could farm out its HVP, one of four Canadian assets, I think the retained interest would be worth more than Happy Creek’s entire valuation of ~$5M.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Happy Creek, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Happy Creek are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Happy Creek was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)