CoTec Holdings Corp. (TSXV: CTH) / (OTCQB: CTHCF) has reviewed over 300 cutting-edge technologies and made minority investments in those it believes are disruptive, plus an investment in a green iron project in Quebec, Canada. Unlike the vast majority of metals & mining companies, CoTec is just 24-30 months from positive cash flow.

This tech holding company is rapidly developing into an ESG-friendly resource producer. It has a very strong mgmt. team, board & advisors (see bios below). HyProMag USA proposes to use a hydrogen process to reduce end-of-life electronic scrap into an oxide powder to be used by CoTec to manufacture new recycled REE magnets.

As global timelines on new projects get stretched, and recognizing that some projects will NEVER cross the finish line, reaching positive cash flow in 2H 2026 would hugely de-risk this exciting story. From 2027 on, robust cash flow growth could be robust.

How much is high-quality, growing, diversified (across technologies, projects, jurisdictions) free cash flow worth? Perhaps the best example comes from royalty/streaming companies like Franco-Nevada, Wheaton Precious Metals, Royal Gold & Altius Resources –> valued at an average of > 26x trailing 12-month EBITDA.

Assuming CoTec doubles its share count in the next two years, (not likely if strategic partners, partially pre-funded off-take agreements, debt funding, and free-money grants play a meaningful role), the Company could be trading at < 2x CY 2027e EBITDA, making it substantially undervalued.

Disruptive means, significantly better in multiple ways; cheaper, faster, greener, simpler, scalable & long-term sustainable. CoTec is deploying technologies, mostly targeting reclamation & recycling.

On July 15th, CoTec & Mkango Resources Ltd. announced a mid-project review of the Bankable Feasibility Study (“BFS”), now 50% done, for HyProMag USA, a 50%/50% JV that’s engineering & designing a Rare Earth Element (“REE“) magnet production facility in the U.S. The BFS is proceeding on time & on budget.

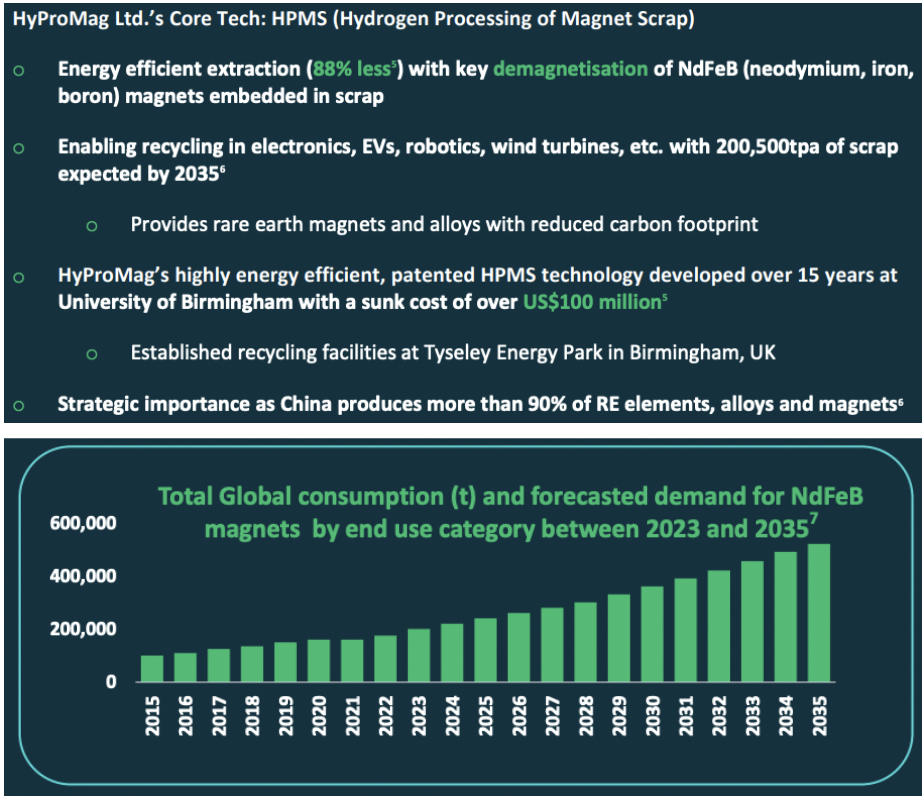

HyProMag USA is a low-cost, low-carbon, sustainable business segment underpinned by a patented Hydrogen Processing of Magnet Scrap (“HPMS“) recycling technology. A technology developed at the University of Birmingham in the UK, underpinned by ~US$100M of R&D funding to date.

Importantly, CoTec has been able to transfer key tech & design elements + associated pilot plant operating data, from HyProMag’s ongoing commissioning of the Tyseley facility in the UK, and a facility in Germany.

This disruptive technology will not only secure in-country production, it will do so with lower costs/energy consumption & emissions, enabling long-term security of supply compared to conventional mining practices. Management believes HyProMag USA could begin ramping up to US$50M in annual revenue in 2H 2026.

Four ‘hub’ site options for the Mill facility in Fort Worth are under review. Initial ‘spoke’ facilities are contemplated for sites in South Carolina & Nevada. Permitting for the hub will start in Q1 2025, allowing for the first production of REE magnets in a bit over two years.

HyProMag USA is working on securing U.S. Government funding, U.S. State financial grants & project incentives, as well as strategic partnerships with U.S. companies for feed supply + recycled NdFeB magnet and/or alloy offtake agreements. In addition to the UK, Germany & the U.S., management is evaluating other countries.

Targeted production capacity is 500 tonnes/yr. of neodymium/iron/boron, (“NdFeB”) magnets with the ability to expand to 800 tpy fairly easily. That added 60% of throughput packs a lot of economic punch as a lot more free cash would flow, with relatively minimal increases in op-ex & cap-ex.

Opportunities to produce additional NdFeB alloy products such as, “alloy powders, pellets, and strip cast flakes” are being carefully considered. Further optimization possibilities have been identified and are being pursued.

CoTec CEO Julian Treger commented,

“We are very pleased with the progress of the Bankable Feasibility Study, the learnings from HyProMag’s facilities in the UK and Germany have been invaluable… In parallel with the Feasibility Study, the Company is now focused on securing funding from the U.S. Government... We are very excited the business can be used as a platform to support the revitalizing of U.S. magnet production, metallization, and skills development, a strategic priority for the U.S. Government.”

Will Dawes, Mkango CEO added,

“The plant design has significant embedded optionality and opportunities to process & produce a wide range of feeds and NdFeB products, respectively, complementing the growing cluster of REE processing & manufacturing in Texas.”

CoTec enjoys competitive advantages vs. other REE magnet recycling technologies that have not solved the serious challenges of liberating magnets from end-of-life scrap streams.

HyProMag USA will deliver a sustainable, long-term supply of NdFeB magnets to enable the creation of, “secure, low carbon & traceable REE supply chains.”

China dominates this critically important supply chain, controlling up to 90% of the market. CoTec/Mkango are developing a closed-loop supply chain for REE magnets in key industries outside of China.

Although there are always logistical hiccups during ramp-ups, it’s important to note that HyproMag USA will benefit from the learnings from largely identical plants in the UK & Germany coming online before U.S. operations commence.

This is very exciting news as CoTec has a combined 60% economic interest in HyProMag USA. It could be worth a multiple of the Company’s enterprise value {market cap + debt – cash} of ~$31M.

The size of this opportunity is enormous. REE magnets are required for electrical motors in EVs, wind turbines, and Aerospace & Defense applications. The BFS is based on a hub-and-spoke model using three HPMS vessels (spokes) and one magnet manufacturing hub, to be based in Fort Worth, Texas.

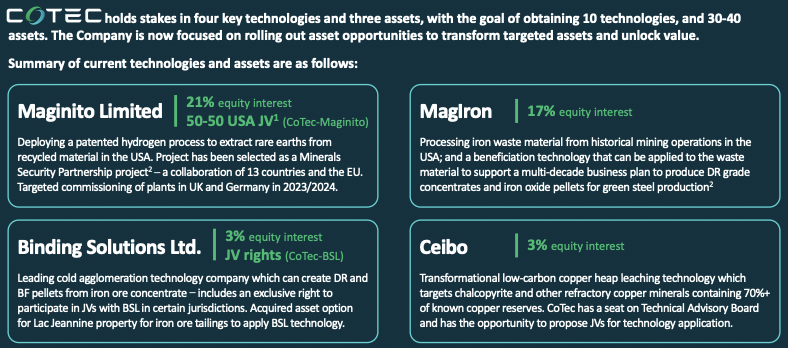

Less than 5% of REE magnets are recycled as existing methods are not that efficient, environmentally-friendly, logistically simple, or low cost. In addition to the exciting HyProMag USA opportunity, the Company is pursuing Binding Solutions (“BSL“).

In the BSL segment, fine materials from mines/waste dumps will be converted into iron pellets or briquettes for use in the production of green steel (steel with ~70% less carbon dioxide emissions).

Energy savings of up to 90% drive operating costs lower than traditional processes. It’s not just CoTec that sees BSL as disruptive, both Japan’s Mitsui and Australia’s Mineral Resources have invested in it.

Ceibo, a technology backed by BHP, features a low-carbon, high-recovery methodology applied to either primary or waste Cu via a sulfide heap-leaching process.

MagIron will help decarbonize the U.S. steel industry. It has a patented process that converts waste materials into high-grade iron ore concentrate, which can be used as feedstock in the growing fleet of steel-making electric arc furnaces.

This week’s update on the BFS for HyProMag USA comes on the heels of news last week that CEO Treger invested an additional $2.75M into CoTec at a premium to market and with no warrants, and the release of a summary of the PEA on the Lac Jeannine iron tailings project. See a recent article on Lac Jeannine here.

CoTec Holdings Corp. (TSX-v: CTH) / (OTCQB: CTHCF) has lots of irons on the fire. It should achieve meaningful cash flow in CY 2027 from two projects, on its way to multiple streams of long-term profitable operations around the world. As the market sees continued progress, I believe a re-rating of the valuation will follow.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about CoTec Holdings, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of CoTec Holdings are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, CoTec Holdings was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)