Is the U.S. Presidential race overshadowing an epic move higher in the gold price? Earlier this week the spot price hit US$2,484/oz., +37% above its 52-week low. Today it sits at ~$2,406/oz. Silver had been outperforming gold, causing the gold (“Au“): silver (“Ag“) ratio to fall into the low 70s to 1 from the low 90s to 1, but it has retraced to ~82.5 to 1.

This bodes well for the Ag price. At a ratio of 70 to 1, Ag would be ~US$34.4/oz. The longer-term Au: Ag ratio is ~60 to 1, placing Ag at ~$40.1/oz. As bullish as that price is, it pales compared to the all-time (inflation-adj.) high of ~$200/oz. back in Jan. 1980.

Gold’s inflation-adj. high is also from Jan. 1980 –> ~$3,400/oz. Notice that at those ATHs, the Au: Ag ratio was [$3,400/$200] = 17 to 1! In prior articles, I’ve sung the praises of solar panels driving industrial usage of Ag through the roof. China continues to dominate the buildout of new solar farms and is having another strong year.

The Pilar Au/Ag project –> surrounded by Alamos Gold, Pan American, Agnico Eagle, Newmont…

China just switched on a 5.2M panel solar farm that required ~120 tonnes of Ag = ~3.9M troy ounces. That’s nearly 4% of annual Ag demand from a single solar farm! Suffice it to say that the outlook for Ag is very strong. Switching back to Au, the price is rallying with no fundamental reason for it to stop.

Several investment banks, not just random guys on Twitter/X/Linked-in, are expecting $2,600-$3,000/oz. Support for a stronger-for-longer narrative can be found in moribund junior miners who, despite ATH Au prices, are having trouble raising exploration/development capital. New mine supply can’t keep up with growing demand.

This move higher is quite remarkable given that it has come before U.S. interest rate cuts have started. Given the Election, the U.S. Fed will likely cut in September or October to put a floor in the stock market.

I believe 2Q to 4Q earnings from the Majors will be an eye-opener, setting off a tsunami of M&A. Sonora has > 70 Au mines, many of which are low-risk, low cap-ex heap leach operations. Besides Nevada, there’s no better place on earth to develop a heap leach project.

The Majors don’t make discoveries, they rely on juniors. Therefore, all roads lead to M&A, but M&A doesn’t boost global supply, it just rearranges the deck chairs.

A company I continue to like a lot is Tocvan Ventures (CSE: TOC) / (OTC: TCVNF) with two post-discovery, Au/Ag projects in Sonora Mexico. Tocvan has consolidated a highly prospective land position at its 100%-owned, 2,278-hectare, Pilar Au-Ag project covering 21 sq. km of prospective area + 51% of a 1 sq. km parcel.

It also holds a 100% interest in the Picacho Au-Ag project in the Caborca Trend of northern Sonora, a trend that hosts some major Au deposits. The clear focus is Pilar, 130 km SE of Hermosillo, the capital of Sonora. The Project is fully road-accessible via a 2-hour drive from Hermosillo to Suaqui Grande on a paved highway, then ~30 minutes on a gravel road.

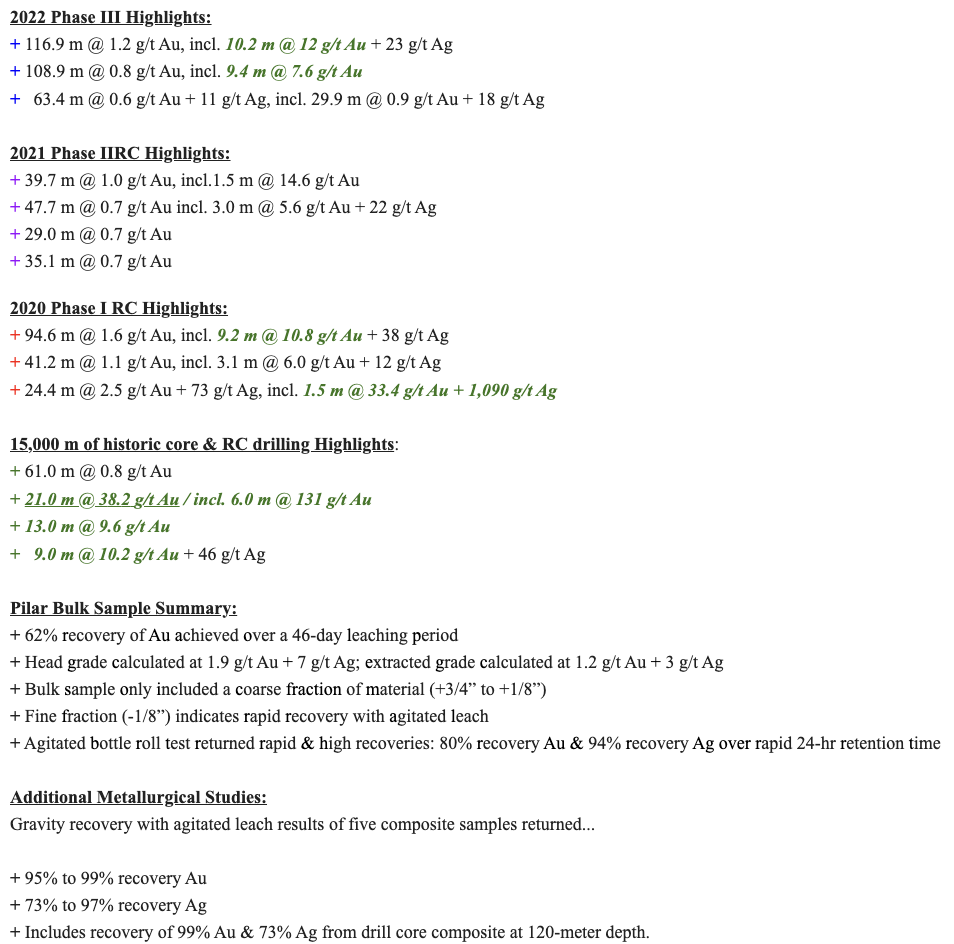

Pilar has been the subject of two significant exploration programs. The first in 1996-97, and the second from 2008 to 2018. Both included significant surface exploration + RC drilling. Sonora is a mining-friendly State with excellent infrastructure (roads, power, water, skilled workforce, mining services & equipment).

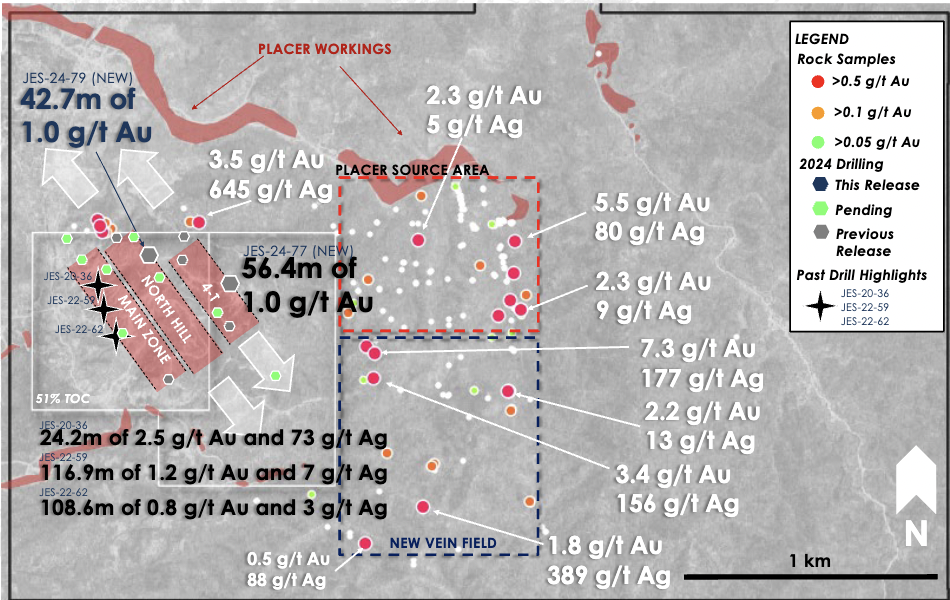

In the map above, look at the red dots that show surface rock samples, like [5.5 g/t Au + 80 g/t Ag]. A 56.4 m interval of 1.0 g/t Au is 400 m east of the 1.2 x 1.0 km Main Zone (“MZ“), and that 5.5 g/t Au sample is another ~1,000 m east. Roughly 1,200 m SW are more red dots incl. 1.8 g/t Au + 389 g/t Ag.

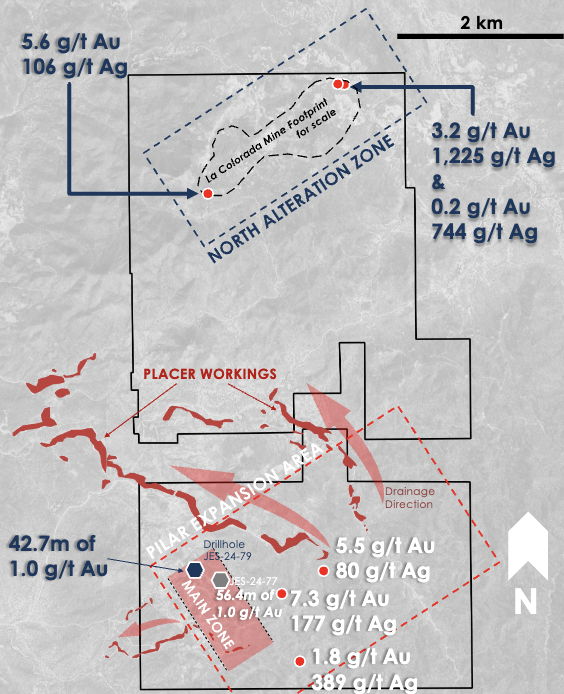

If the technical team can establish continuity across the entire MZ area, it could be transformative. As exciting as that map is, look at the next map depicting what’s north of the MZ. The North Alteration Zone (“NAZ“) is 4x bigger at 3.3 x 1.5 km, but far less explored.

It has a nice 3.2 g/t Au + 1,225 g/t Ag sample, equal to ~18.5 g/t Au Eq., and a 5.6 g/t Au + 106 g/t Ag sample a few km to the SW. In between the NAZ and the MZ are placer workings (“Placer“) that point to yet more evidence of feeder zones. The area around Placer at 3 x 2 km is 5x the size of the MZ.

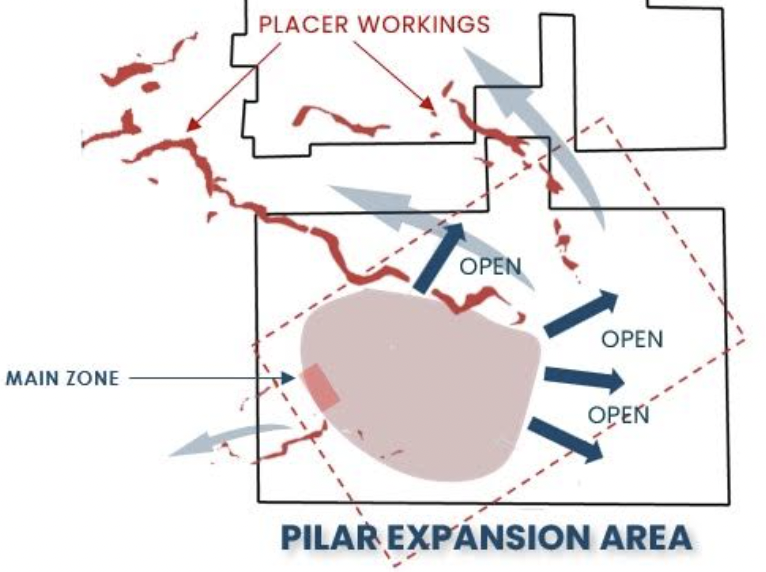

The next image shows the relative size of where all the drilling has been done in the MZ compared to the total land package. The small pink rectangle in the bottom box –> labeled MAIN ZONE –> represents just 2% of the 22 sq. km. that hosts MZ, NAZ & Placer. Of that 2%, half has tight [25-50 m] drill spacing.

What does all of this mean? Simply put, the BLUE-SKY potential at Pilar is quite spectacular. As drill results are released, there are both strong hits and lower-grade material finds. However, every single delivers critical info to build out the resource model. Even though low-grade at times, virtually every hole has hit something.

In a bulk tonnage scenario, areas of mineralization including zones as low as 0.1 to 0.4 g/t Au, combined with higher grades of 1.0+ g/t, add up to multi-million-ounce potential at a weighted-average grade of say 0.50 to 0.80 g/t Au Eq.

At spot prices, the mid-point –> 0.65 g/t Au Eq. = ~US$50/t rock, equivalent to ~0.50% Cu., a strong bulk tonnage Cu grade. Tocvan recently announced additional drill results at Pilar. To date, 3,268 m have been completed across 26 holes. Results from three holes are pending. CEO Brodie Sutherland commented,

“Drill results continue to show the broad scale of mineralization at Pilar as we push out the edges of the known deposit. Infill drilling looks to connect each of the three known trends, and results tell us that mineralization does connect. Most of the area has never seen detailed drilling, so to see mineralization & alteration in all holes showcases the robust system we have.

We are also seeing areas with elevated base metals, indicating multiple phases of Au & Ag deposition, an excellent advantage when expanding & exploring across the greater Pilar area. We have drilled just 2% of the total property, and surface sampling shows much bigger targets. A major producer continues to show a keen interest in the area. Results support the case that we’re just scratching the surface at Pilar.“

Around year-end, management hopes to release a maiden resource estimate (“MRE“) at Pilar. While this will generate an interesting technical report providing important data, it will be the tip of the iceberg. The MRE will be on just 2%-3% of the land package!

Although CEO Sutherland won’t reveal who the large company is that’s been active around Pilar, it’s probably; Industrias Peñoles, Grupo México, Newmont, Agnico Eagle, Fresnilo, Pan American Silver, or Alamos Gold (who recently acquired Argonaut). Coeur Mining, Torex Gold, First Majestic & Sivercrest Metals are four smaller companies operating in Mexico.

I believe that Tocvan’s management team is currently, or has been, in touch with many (if not most) of those companies. The longer Tocvan can hold out before striking a deal with a strategic partner, the better the transaction terms will be.

This is why the Company plans to deliver a MRE around year-end, so that prospective suitors can better evaluate the substantial potential at Pilar. The fact that Majors & mid-tier producers are interested in relatively small heap leach projects is telling. Low-cost, low-risk heap leach is quite attractive at $2,400/oz. gold!

I would not be surprised to see one or two of the big companies consolidate the small companies in Sonora. That makes Tocvan Ventures (CSE: TOC) / (TCVNF) a prime takeout candidate. Readers are encouraged to check out the Company’s latest corporate presentation to learn more.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Tocvan Ventures, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Tocvan Ventures are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Tocvan Ventures was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)