Gold’s & sliver’s inflation-adj. ATHs in Jan. 1980 were about $3,430/oz. & $202/oz. (in today’s dollars). Notice that the gold (“Au“): silver (“Ag“) ratio was [$3,430 / $202] = 17 to 1! Today that ratio is 84:1 and it has averaged ~60:1 over the past 50 years. All else equal, a return to 60:1 would propel Ag to nearly $42/oz.

In prior articles, I’ve sung the praises of solar panels driving industrial usage of Ag through the roof, pun intended. We’re currently in year #4 of a mined Ag deficit. The setup in Ag is reminiscent of chronic undersupply in #uranium causing that price to nearly double last year.

Readers are reminded that Ag averaged ~$86/oz. (in today’s dollars) for the entire year of 1980. China continues to dominate in solar power. Globally, solar is consuming ~15% of global Ag. That figure is expected to grow to ~30% by 2027 or 2028, upwards of 500M ounces/yr.

Chinese oversupply in panels is driving panel prices down, boosting demand for Ag even more. China is boldly moving into the Middle East to move (excess) solar panels. The ME is an excellent, sun-filled solar market — still in its infancy. From there, firms can make inroads into Africa.

There’s a new narrative forming around solid-state batteries. On Twitter/X, Kevin Bambrough points out that by 2027 Samsung SDI will be selling a solid-state EV battery that lasts 20 years, charges in just nine minutes, and has a 966 km range. Toyota, BYD & CATL are also developing solid-state batteries with reported ranges of up to 1,200 km.

This battery type will very likely proliferate and could lead to incremental Ag consumption of 100’s of millions of ounces/yr. in what will be a two billion oz./yr. market in the early 2030s.

I believe 2H earnings from precious metal producers will be an eye-opener, which is why we’re seeing a tsunami of M&A. Sonora has > 70 Au mines, many of which are low-risk, low-cap-ex, heap leach operations. Besides Nevada, there’s no better place on earth to develop a heap leach project.

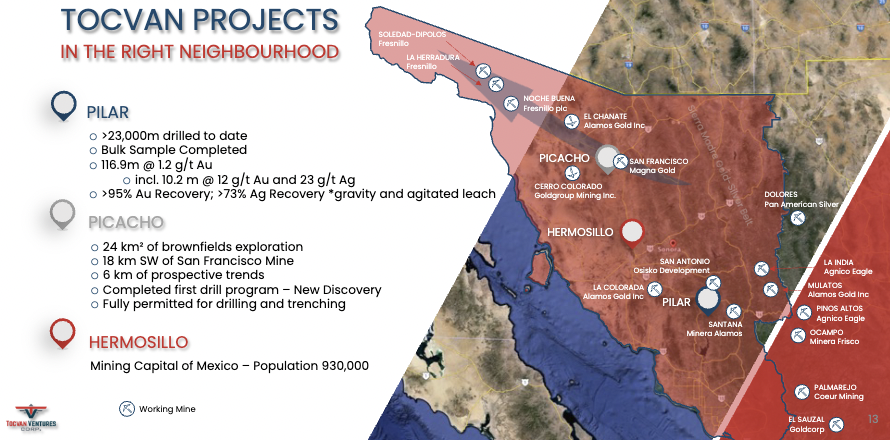

UBS, BofA, Citi & GS forecast Au prices hitting US$2,700 to $3,000/oz. next year. The mid-point of $2,850 is just +13% away! A company that’s well positioned to thrive in this precious metal bull market is Tocvan Ventures (CSE: TOC) / (OTC: TCVNF) with two post-discovery, Au/Ag projects in Sonora, Mexico.

There has been increased talk of a ban on open-pit mining in Mexico. The new Morena administration secured a two-thirds majority in the lower chamber of Congress but was two seats short of a supermajority in the Senate.

According to S&P Global Market Intelligence, Morena should be able to push through a ban, but probably only on a, “case-by-case basis.” In other words, Morena can appear tough, while at the same time allowing open-pit projects and existing mines to move forward, albeit with increased scrutiny.

As mentioned, Sonora hosts > 70 mines, many of them open-pit. A substantial proportion of Sonora’s tax & royalty income comes directly & indirectly from open-pit activities. Low-cost, low-risk heap leach mining is very profitable at $2,525/oz. Au!

Producers including; Grupo Mexico, Newmont, Industrias Penoles, BHP, Agnico Eagle, Wheaton Precious Metals, Fresnillo plc, Franco-Nevada, Pan American Silver, Alamos Gold, Hecla Mining, Coeur Mining, Torex Gold, First Majestic, Equinox Gold, Fortuna Mining, Orla Mining, Silvercrest Metals, Endeavour Silver & Minera Frisco have assets in Sonora or elsewhere in Mexico.

These companies have a lot to say about a ban on open-pit mining. Tocvan shares are down -27% in the past month vs. Ag up +7%, and a basket of Ag companies with projects outside of Mexico, up an average of +11%. In my view, the underperformance of juniors like Tocvan represents a buying opportunity.

Tocvan has consolidated a highly prospective land position at its 100%-owned, 2,278-hectare, Pilar Au-Ag project covering 21 sq. km of prospective area + 51% of a 1 sq. km parcel. It also holds a 100% interest in the Picacho Au-Ag project in the Caborca Trend of northern Sonora, a trend that hosts numerous major Au deposits.

Going forward, management will refer to the consolidated area that includes the Pilar Main zone + the adjacent 22 sq. km as Gran Pilar, signifying the broader scale project, as it advances to a maiden resource estimate.

Of the two projects, the clear focus is Gran Pilar, 130 km SE of Hermosillo, the capital of Sonora, fully road-accessible via a 2-hour drive from Hermosillo to Suaqui Grande on a paved highway, followed by ~30 minutes on a gravel road.

Pilar has been the subject of two significant exploration programs. The first in 1996-97, and the second from 2008 to 2018. Both included significant surface exploration + RC drilling. Management is studying the potential of a heap leach mine — ramping up to 50k ounces/yr.

Sonora has excellent infrastructure (roads, power, water, skilled workforce, mining services & equipment). In the next 4-5 months the Company will deliver a mineral resource estimate (“MRE“) so that prospective suitors can better evaluate the substantial potential at Pilar.

While the MRE will be an interesting technical report providing important data, it will be only the tip of the iceberg, less than 3% of the land package. According to management, a“major regional producer” recently completed a detailed, district-scale review of Gran Pilar spanning over six weeks of onsite due diligence.

A great thing about heap leach operations is that upfront cap-ex can be < US$25M. With Au around $2,525/oz., an efficient, low-cost heap leach mine should be capable of delivering profits of > US$1,200/oz.

Assuming a $1,200/oz. profit margin on 50k ounces/yr. later this decade, that would be C$81M/yr. in cash flow vs. Tocvan’s enterprise value of ~$21M at $0.41/shr. With a strategic investor, Gran Pilar could be in production in 2026 or 2027.

I think there’s a good chance that the unnamed interested party is among the names listed above. For a much larger company to be interested in Gran Pilar, it must have multi-million-ounce potential.

In other news, Tocvan was invited to present at Mexico’s largest mining conference in October. By then it might be able to share the results of the substantial due diligence done by the large regional producer.

Management is outlining a permitting & operations strategy for a pilot plant facility at Pilar underpinning a robust test mine scenario processing up to 50,000 mineralized tonnes. Timelines & budgets are being prepared with the aim of moving forward with the pilot plant early next year.

Tocvan Ventures (CSE: TOC) / (OTC: TCVNF) traded as high as C$0.77 per share in April, 2023 when Au was at ~$1,995/oz. Since then, Au is up a very strong +26%, yet the Company’s share price is down -47%. This makes no sense, especially as Tocvan continues to make good progress and attract meaningful strategic interest at Gran Pilar.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Tocvan Ventures, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Tocvan Ventures are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Tocvan Ventures was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)