All dollar figures are US$

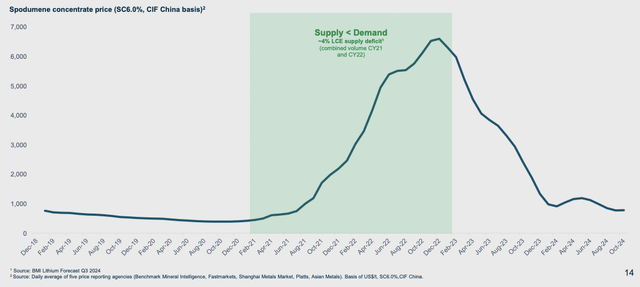

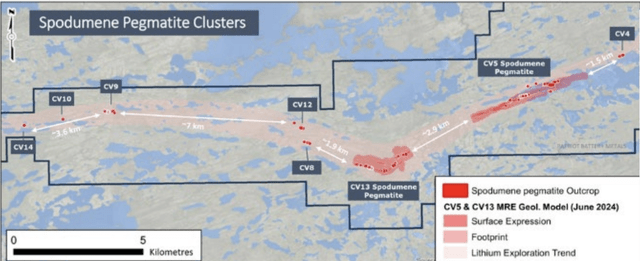

Lithium-bearing spodumene concentrate [“SC”] prices have collapsed. The chart below shows SC6.0% lithium oxide [“Li2O”]. There’s blood in the streets, is it time to buy lithium juniors? One can purchase shares in companies with world-class projects at steep discounts. For example, Patriot Battery Metals (TSX: PMET) / (OTCQX: PMETF).

In mid-2023, Albemarle Corp acquired a 5% stake in Patriot for $82.6 million, an implied valuation of $1.65 billion (after the maiden resource, but before an excellent resource update and a strong Preliminary Economic Assessment). Today Patriot is valued at ~$200 million.

I spent 45 minutes on the phone with Patriot’s CEO Ken Brinsden, followed a few days later by an investor webinar. Tax loss selling & Patriot’s removal from a stock index are factors partially responsible for the recent carnage. He’s asked if Trump is bad for EVs. Ken doesn’t think Trump will make a difference — the U.S. is under 10% of the global EV market.

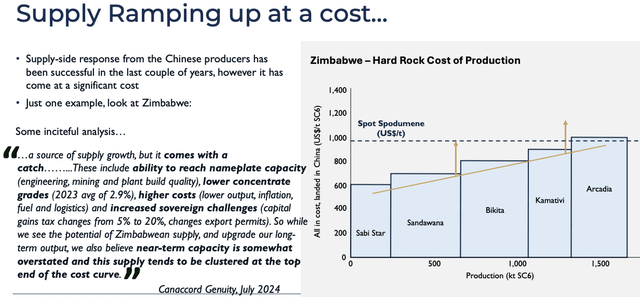

Benchmark Mineral Intelligence says Trump/Elon Musk could be very good for lithium-ion batteries! And, Trump tariffs could boost lithium prices in North America. Regarding pricing, Ken thinks Chinese & African sources of Li-bearing spodumene, lepidolite & petalite are not sustainable.

They’re dirtier, lower grade, and more costly to process than SC5.5-6.0%. He made an analogy to China in 2011 building iron ore mines due to a price spike. Three years later, those mines were shuttered.

The same dynamic is in play now. The Chinese rushed in, cut corners, did minimal mine planning, and did not properly consider local communities or the environment. Many fast-tracked lithium mines in China & Africa will close or face significantly higher costs.

Mr. Brinsden believes Western Australian producers need SC prices to nearly double and sees carbonate/hydroxide bouncing back to $25-$35,000/tonne vs. ~$11,000/t now. In 4Q/22 those chemicals breached $80,000/t. SQM’s average quarterly carbonate price over the past four years to 3Q/24 is $25,776/t.

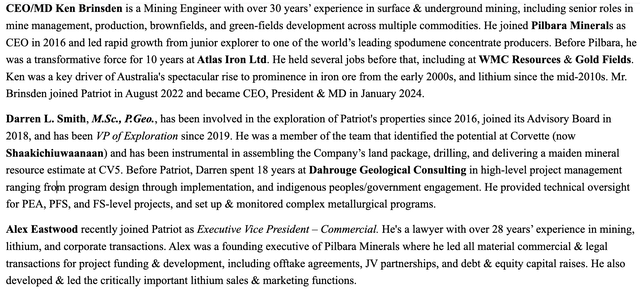

Why should readers care what Mr. Brinsden has to say? Look at the bio below, he’s one of the most experienced hard rock mining AND lithium execs in the world, having led Pilbara Minerals from early-stage to industry leader. Patriot has a stellar management team & board. In addition to the following three execs, bios of high-quality officers can be found here.

Patriot has the largest hard rock lithium project outside of Australia & Africa, a resource that could still more than double, with a top-decile grade. The Company is trading like it’s going out of business, but owns one of the sector’s best assets! On September 30th it had zero debt + $50.5 million in cash.

The flagship asset is remote (James Bay region of Québec, Canada), but it’s surrounded by meaningful lithium projects. Rio Tinto is newly active in the area by acquiring Arcadium Lithium and joining a merged Sayona Mining/Piedmont Lithium, plus Winsome Resources, Nemaska Lithium, and Critical Elements.

Investissement Quebec announced a $180M investment package for Nemaska’s Whabouchi project with a planned production start in 2.0-2.5 years. Patriot’s Shaakichiuwaanaan project has a long shipping route placing it in the top of the second quartile on the cost curve. However, road/rail spurs are being built by the Quebec & Federal governments.

The 834 km truck haul portion of the 1,532 km journey could be cut by ~30% with a new road expected in the late 2020s. In 10-15 years a planned rail spur could reduce haulage costs even more.

If Lithium Has a Future, Patriot Can’t Help But Thrive

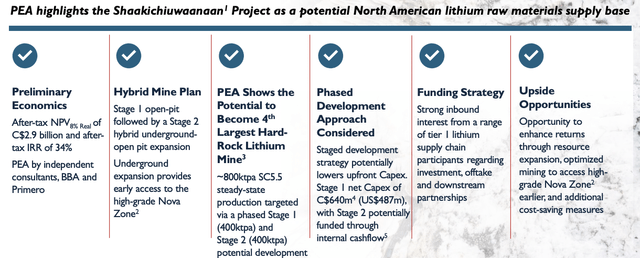

Québec will be a spodumene concentrate powerhouse, second only to Western Australia. Patriot delivered a Preliminary Economic Assessment [“PEA”] and booked 142.6 million tonnes of mineralization grading 1.38% Li2O, equal to 4.88 million tonnes of Lithium Carbonate Equivalent [“LCE”].

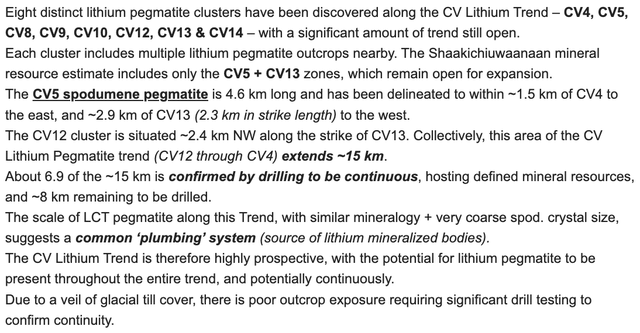

The 4.13 million tonnes of LCE at CV5 alone derives from 129,673 meters of drilling. Each meter delivered 31.85 tonnes of LCE, worth ~$350,000 at currently depressed levels! Check out the following drill intervals.

Only Frontier Lithium’s results are better. Patriot’s next resource estimate in 1Q/25 will have a higher proportion of Measured + Indicated tonnage to support a robust Feasibility Study in 3Q/25.

At $1,375/t, Patriot’s PEA used one of the industry’s lowest SC5.5% price assumptions, yet delivered a post-tax NPV(8%) of $2.1 billion and an IRR of 34%. Patriot is valued at 9% of NPV. Amazingly, the PEA included just one pegmatite cluster, (CV5).

Stage 1 production of 400,000 tonnes SC5.5% will be doubled in Stage 2. Importantly, the Company has over a decade’s worth of mining in the Nova zone grading 2.1% (diluted) Li2O.

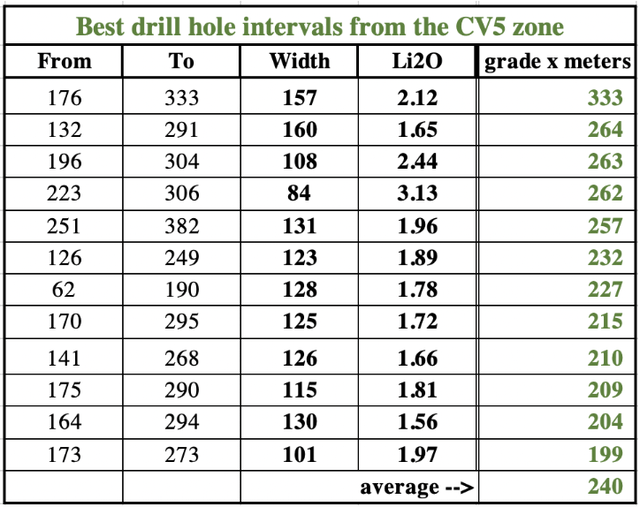

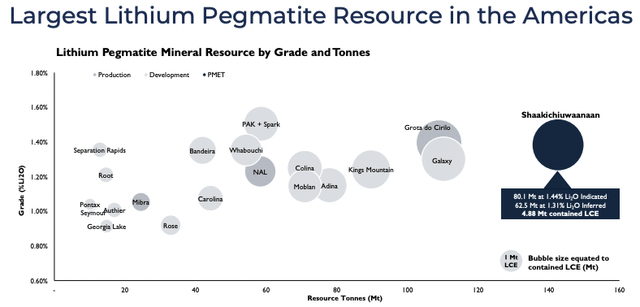

In the image below, only tonnage from CV5 & CV13 has been booked, but eight distinct clusters have been discovered, each with multiple outcrops. In an embarrassment of riches, management has a third-party derived exploration target of an incremental 146 to 231 million tonnes grading 1.00% to 1.50% Li2O.

Adding the mid-point number of tonnes at the mid-point grade would generate a 331 million tonne resource at 1.31%, or 10.7 million tonnes of LCE. Today, that would be the third-largest hard rock lithium resource (millions of tonnes more than #4).

Patriot’s pro forma Shaakichiuwaanaan [meaning, climbing a hill or hills] could approach the scale of Pilbara’s Pilgangoora mine (414 million tonnes at 1.15%). Pilbara is valued at ~$5 billion, yet Patriot’s enterprise value {market cap + debt – cash} is ~$200M.

There are several notable risk factors. The first is Li prices. I agree with Mr. Brinsden that SC will double or more in the next 12-24 months but to less than a quarter of 2022’s highs. A second risk is transportation cost/logistics. A fleet of 80 trucks will transport ~2,300 tonnes of SC daily. That’s a lot of traffic and emissions. A third is equity dilution. A fourth is permitting/environmental.

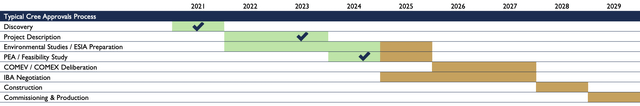

If a larger company partners with or acquires Patriot, funds cap-ex + cost overruns and can be patient developing Shaakichiuwaanaan, the above-mentioned risks would be meaningfully diminished. Rio invests in assets taking 15-20+ years to commercialize. Patriot could reach initial production in 5 or 6 years.

Others that could care include; Albemarle (already a shareholder), SQM, Fortescue Metals, Mineral Resources, Pilbara Minerals, POSCO, Glencore + Japanese trading houses –> Mitsui & Co., Sumitomo Corp, Mitsubishi Corp, ITOCHU Corp, Li-ion battery makers –> LG Energy Solution, Panasonic, BASF, and EV OEMs –> Stellantis, Tesla, GM, Ford, Volkswagen, Renault Group, and Toyota.

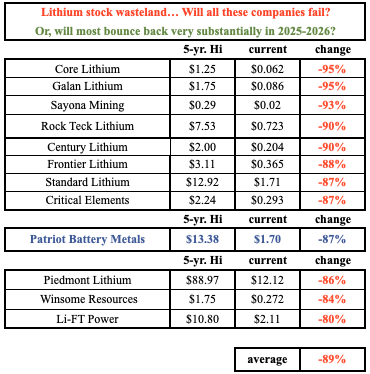

There’s a problem with a near-term takeout. Patriot’s share price is down -87% from a high of $13.38 in mid-2023 to $1.70 on November 27th. See the chart below — will all these companies fail? Or, will many bounce back hard in 2025-26?

Patriot’s decline comes despite substantial de-risking from a robust resource estimate, an impressive PEA, a $50.5M cash cushion (Sept. 30th, no debt), and Ken Brinsden + Alex Eastwood joining the Company.

With investment funds chasing fewer high-quality names, Patriot’s valuation could increase materially upon a sector rebound. Since 2021, there have been ~15 lithium company technical reports using an average SC5.5% price over $1,800/t. The world will need these projects, so the SC price has to rise to get them built.

Despite Perceptions, Global Lithium Demand is Robust

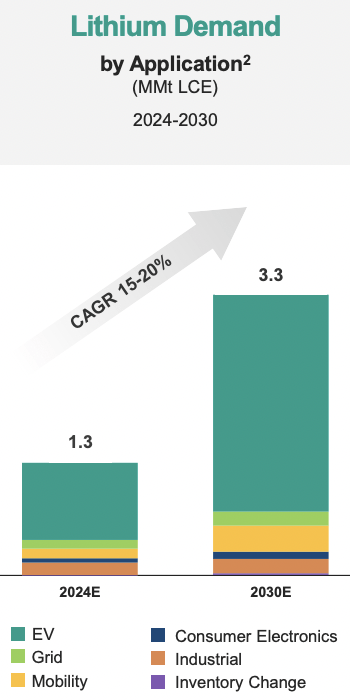

In 2023-24, African and Chinese groups flooded the market with low-grade lithium-bearing spodumene, lepidolite, and petalite. As low-cost African and Chinese material become a shrinking slice of the supply pie, the industry’s marginal cost will rise. Rho Motion reported that year-to-date global sales are up +24%.

Stationary energy storage for home, commercial, and grid-scale back-up of solar & wind farms is surging. On Albemarle’s Nov. 7th conference call the CEO said stationary storage is up +36% year-to-date. Some industry experts, including Mr. Brinsden, believe stationary storage will become bigger for lithium demand than EVs.

The following chart from Albemarle’s earnings presentation forecasts 15%-20% lithium growth through 2030. The world will urgently need Shaakichiuwaanaan!

As much lower metal prices slash battery pack costs, Li-ion battery usage is proliferating in (aviation, boats/shipping, long-haul trucking, robotics, drones, medical devices, consumer electronics, etc.). Remember when pundits said the tipping point for EVs would be battery cells under $100/kWh?

BloombergNEF reports Lithium Iron Phosphate [“LFP”] batteries are around $50/kWh! LFP is ~40% of the EV market and 50% of the stationary storage market. See slide 33 in the corporate presentation.

Supply Needed From New Entrants is Highly Uncertain

In Argentina, nine brine projects owned by; a 45%/45% JV [Lithium Americas (Argentina) Corp/Ganfeng Lithium] (Cauchari-Olaroz), POSCO (Sal de Oro), Arcadium (Sal de Vida), Rio Tinto (Rincon), EraMet (Centenario/Ratones), Ganfeng (Mariana), an 85% Lithium Americas (Argentina) Corp/15% Ganfeng JV (Pastos Grandes), Tibet Summit (Sal de los Angeles) and Zijiin Mining (Tres Quebradas) were expected to be well underway. Only the Cauchari-Olaroz JV is in production.

In Chile, SQM’s & Albemarle’s combined prodigious brine production (~275,000 tonnes of LCE in 2024, ~22% of global supply) is constrained by pumping limitations. SQM — the far larger player in Chile’s — aims to grow at ~6.5%/yr. (best case) through 2030. Yet, Albemarle is forecasting 15%-20% demand growth!

Some readers might think Direct Lithium Extraction [“DLE”] technologies on brine projects in S. America & western Canada will save the day. Not true. Each DLE project is a site-specific, specialty chemicals puzzle with complex site-specific mine engineering challenges.

DLE efforts are taking longer to build and cost more than expected. This is not speculation, DLE has been championed since around 2018. That leaves tried and true hard rock projects to pick up the brine/DLE slack. In many cases, hard rock will reach production faster, be cheaper, with low technical risk.

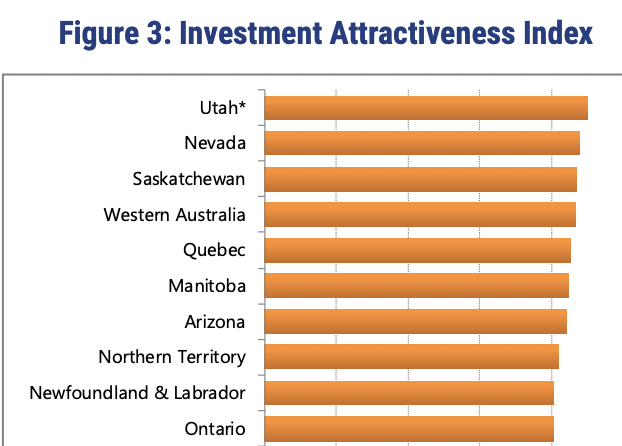

If one agrees with my commentary, one could hardly do better than Patriot Battery Metals‘ Shaakichiuwaanaan and Quebec Canada is one of the best mining jurisdictions on earth, #5 of 84 ranked by the Fraser Institute. To reiterate, Albemarle invested in Patriot at an implied valuation of $1.65 billion. Today readers can get in at an enterprise value of ~$200 million.

Please see the new November Corp. Presentation

Disclosure: PETER EPSTEIN of Epstein Research, owns shares of Patriot Battery Metals, acquired in the open market, but has no prior or existing relationship with the Company or management team. Although Mr. Epstein believes an investment in Patriot offers a compelling risk/reward proposition, this is a high-risk, speculative bet. Readers should consult with their financial advisors before investing in high-risk securities.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)