NexGen Energy’s (TSX-V: NXE) / (OTC: NXGEF) tremendous Maiden Inferred resource, both its size & grade (202 mm Inferred lbs. at 2.63% U3O8 with a 0.25% cut-off, including a higher-grade core of 120.5 million lbs. at 13.26% U3O8) caught participants off guard. The most highly anticipated, scrutinized number in the uranium space, wildly underestimated. 202 million pounds vs. a reported range of 60 to 173.5 million! In the week following the, “number,” NexGen shares soared 52% to $1.48, (March 23rd close $1.34) more than triple last March’s levels in the low-to-mid $0.40s. Why did conventional wisdom miss the mark by so much?

Did the contours of the Arrow deposit make it difficult to assess the initial number? Did the low number of drill holes (82) trigger doubts about drill hole spacing? Did some rely too heavily on computer modeling? Did analysts gravitate towards consensus estimates? Were investors content to err on the side of caution?

I believe a combination of i) group-think, ii) a failure of imagination and iii) an abundance of caution, was a key factor in the significant underestimation of the maiden resource. As a result, eminently realistic upside scenarios were relegated to outlier status. With this in mind, I believe the Company’s valuation could increase very substantially, without becoming egregious, as NexGen advances Arrow this year and next.

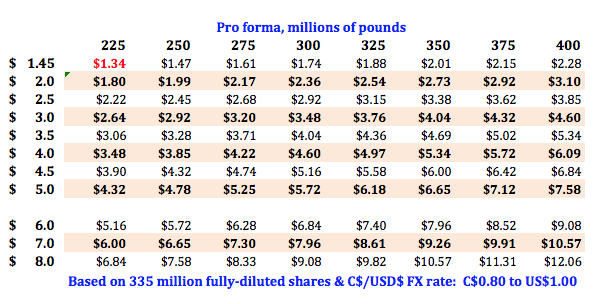

The implications of an ongoing skew in the conventional wisdom is that factors upon which the valuation hinges are unwittingly, and wittingly, too conservative. Looking at the widely cited, Enterprise Value (“EV”)/lb. ratio, NexGen is trading at US$1.45/lb. (on a pro forma 225 million lb. resource & 335 fully-diluted (“fd”) shares). I strongly believe that the Company’s true value is substantially higher.

Please consider the following,

++ With zero debt & $31 million in cash (plus $9 million in warrant proceeds), NexGen is not only funded well into 2017, covering winter & summer drilling, a first resource upgrade and other milestones, it’s funded through a potential takeout. A takeaway here is that without an equity raise, institutions have to buy shares in the open market.

++ This year’s aggressive drill programs could produce another blockbuster outcome. NexGen clearly has a world-class technical team. 82 holes got us 202 million Inferred lbs., how much might 80 more find? 25-50-75 million lbs.? Why not 100-125-150 million? Especially with winter drilling already delivering very promising results. [March 8th PR, March 15th PR]

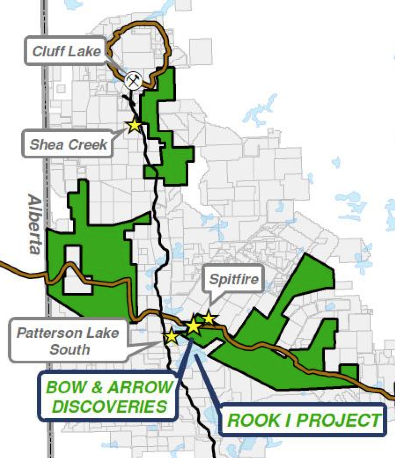

++ Key attributes that make Arrow a spectacular deposit might be obscured in the shadows of Cameco’s uranium mines. Arrow is entirely land-based (no resource under the Patterson Lake) and basement-hosted (very easy to mine). Avoidance of mineralization in the sandstone could, (if the deposit is developed), make Arrow far less technically challenging, easier to permit and less costly to build and operate than Cameco’s sandstone-hosted McArthur River & Cigar Lake, which require sophisticated and costly, ongoing ground freezing techniques.

++ The possibility of a large takeout premium may not be on investor’s radar. One need not turn to Rio Tinto’s 2011 takeout of Hathor Exploration Ltd. at a valuation of about US$11/lb. for inspiration. Why not use US$5 – US$6/lb., for one of the best NI 43-101 compliant resources on the planet?

++ The value to an acquirer of a monumental, globally significant, strategic asset, situated in the most desirable jurisdiction in the World, cannot be overstated. New entrants to the Athabasca could hardly do better than to pick off the gem of the Basin.

The usual suspects BHP, Areva, Rio Tinto & Cameco are no doubt monitoring NexGen’s progress very closely, but they are not alone. Others like China’s CGN Uranium Resources Co., Ltd. Japan’s Sumitomo Corp., South Korea’s Kansai Electric Power (“KEPCO”) and Russia’s Rosatom could be interested. In my opinion, a number of Sovereign Wealth & Private Equity funds would want to kick the tires as well. See this March 6th article about CGN Uranium Resources possible interest in NexGen.

That still leaves State owned or sponsored Chinese & Russian enterprises. Nor would approaches by companies like POSCO or Teck Resources surprise me. Teck’s market cap has more than tripled off its 52-week low. Presumably there are a number of E&P / Oil Sands giants contemplating investment alternatives.

Arrow will grow in size, and possibly in grade, with (in my opinion) new zones of mineralization identified this year or next. One of the six drills turning on site is testing regional, high-impact targets along trend from Arrow. NexGen will take full advantage of its liquidity runway to maximize shareholder value ahead of a takeout. The Company has another year+ to draw additional interested parties to the table.

The valuation per U3O8 lb. in the ground attached to NexGen should be higher, to properly reflect how unique Arrow is. One look at the new corporate presentation shows that the resource is shaping up as a deposit that could rival the deposits at McArthur River & Cigar Lake.

In many important ways, the Arrow deposit is already world-class. What EV/lb. takeout valuation is appropriate? M&A metrics change significantly over time and jurisdiction. If one agrees that (eventually) a takeout is likely, isn’t it fair to surmise that the EV/lb. ratio would be a strong one? I asked Cantor Fitzgerald’s Rob Chang that question, his response,

“I think in the current environment, a premier uranium deposit like Arrow should command an EV/lb. ratio of US$5 -US 7/lb.”

As a frame of reference, a US$3/lb. valuation on 250 million pro forma lbs. and C$1/US$0.80 exchange rate, equates to a fd share price of $2.92, +118% above the current price. A valuation of US$5/lb on 300 million pro forma lbs. is $5.72, +327% above the current price. If investors begin to focus more on the possibility, or even the perceived likelihood, of a takeout, price expectations in the $2.00s and $3.00s will be a thing of the past.

It’s at this point that readers should let their imaginations run free. If one believes as I do that the fundamental downside from a ($1.45/lb. valuation is minimal, it might be wise to embrace more exciting scenarios, unburdened by biases.

In the wide range of M&A EV/lb. values, various averages emerge. There’s the post 2011 Fukushima average, the Athabasca-only average, an average excluding the Rio/Hathor deal, an average excluding small transactions. These averages fall in the vicinity of US$5 – US$6/lb.

The year forward has a number of visible milestones that could serve as valuation catalysts. In the end, this article is not about what should or will be, but about what could be. NexGen Energy’s (TSX-V: NXE) / (OTC: NXGEF) shares could be a home run if management continues to execute well.

Disclosures: Readers fully understand and agree that nothing contained in this article authored by Peter Epstein, or on EpsteinResearch.com, including but not limited to, interviews, analysis, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered in any way whatsoever, implicit or explicit investment advice or guidance. Further, nothing contained herein is a recommendation or solicitation to buy, hold, or sell any publicly tradable security. Mr. Epstein has never been, and is not currently, a registered or licensed financial advisor. His article(s) on NexGen Energy must be considered carefully in this context.

Any comparison between or among stocks is for illustrative purposes only and should not be taken as fact or relied upon. Readers understand and agree that they must conduct their own investment due diligence. An investment in any small cap stock, including NexGen Energy, can deliver a 100% loss. While the author believes that he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein is not responsible for any perceived, or actual, errors including, but not limited to, analysis, commentary, opinions, views, assumptions, reported facts & financial calculations, or for investment actions taken.

At the time this article was posted, NexGen Energy was a sponsor of EpsteinResearch.com and the author not own shares in NexGen Energy. The shares of NexGen Energy are highly speculative, not suitable for all investors. Readers are urged to consult with their own financial advisors before making investment decisions.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)