Is Standard Lithium the next U.S. producer?

In about a decade, the U.S. will be consuming 20-25% of global lithium (“Li“) supply, roughly a million (+/-100k) tonnes of Lithium Carbonate Equiv. (“LCE“)/yr. Currently, it produces ~5k tonnes. Scaling up from 5k to 1M tonnes/yr. (a +70% CAGR) … Continued

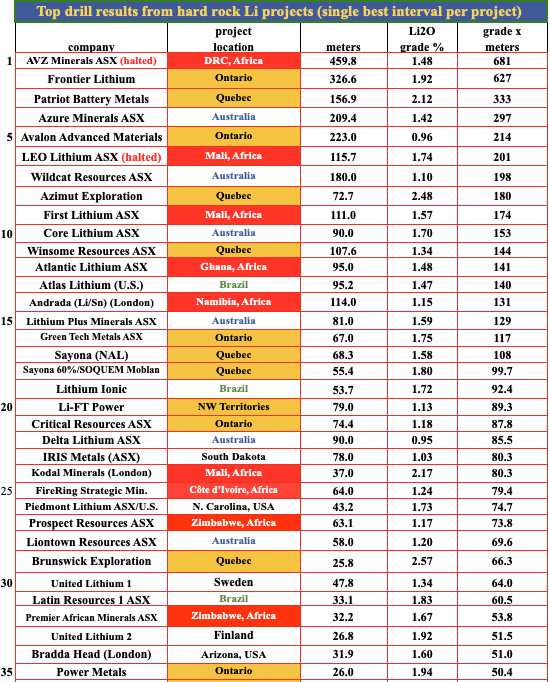

Li-FT Power; world-class #lithium project in #Canada

I’m tracking ~240 junior miners with at least one lithium (“Li“)-prospective property in Canada. The vast majority are early-stage Canadian & Australian-listed plays in Quebec & Ontario. Of those, ~100 are trading at $0.05 or less. Many will disappear… or … Continued

Beyond Lithium, a formidable #Ontario play with a tiny market cap

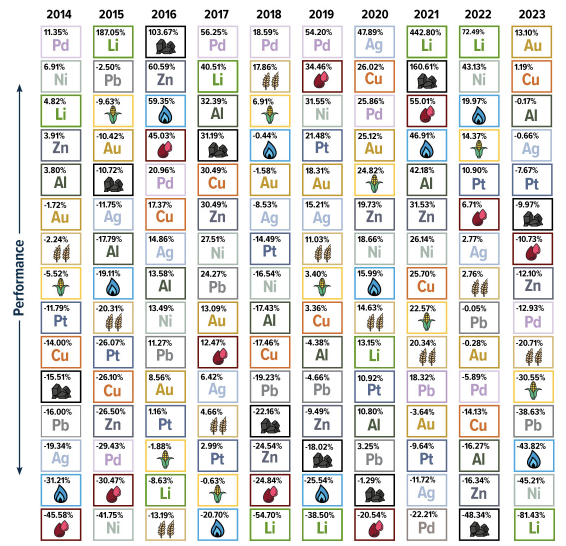

To say the lithium (“Li“) market is volatile would be a gross understatement. Over the past 10 years, the Li price ranked #1 or #2 (among 15 commodities; source Visual Capitalist) four times! However, Li was #14 or #15 in … Continued

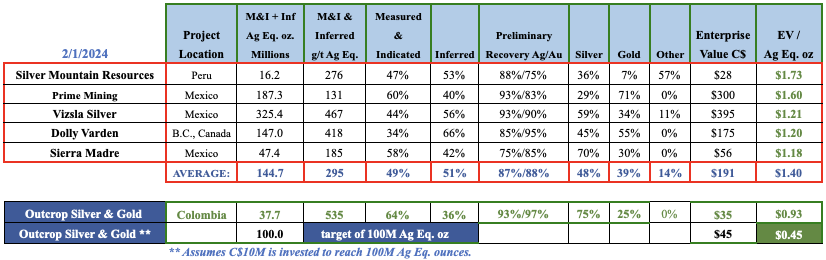

Outcrop Silver & Gold, primed for a silver surge

Will 2024 be a good, very good or great year for precious metals? Of course, it could go badly, but with interest rate cuts coming it seems unlikely gold (“Au”) & silver (“Ag”) will have a down year. The Au:Ag … Continued

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)