New Age Metals expands Lithium portfolio in Manitoba

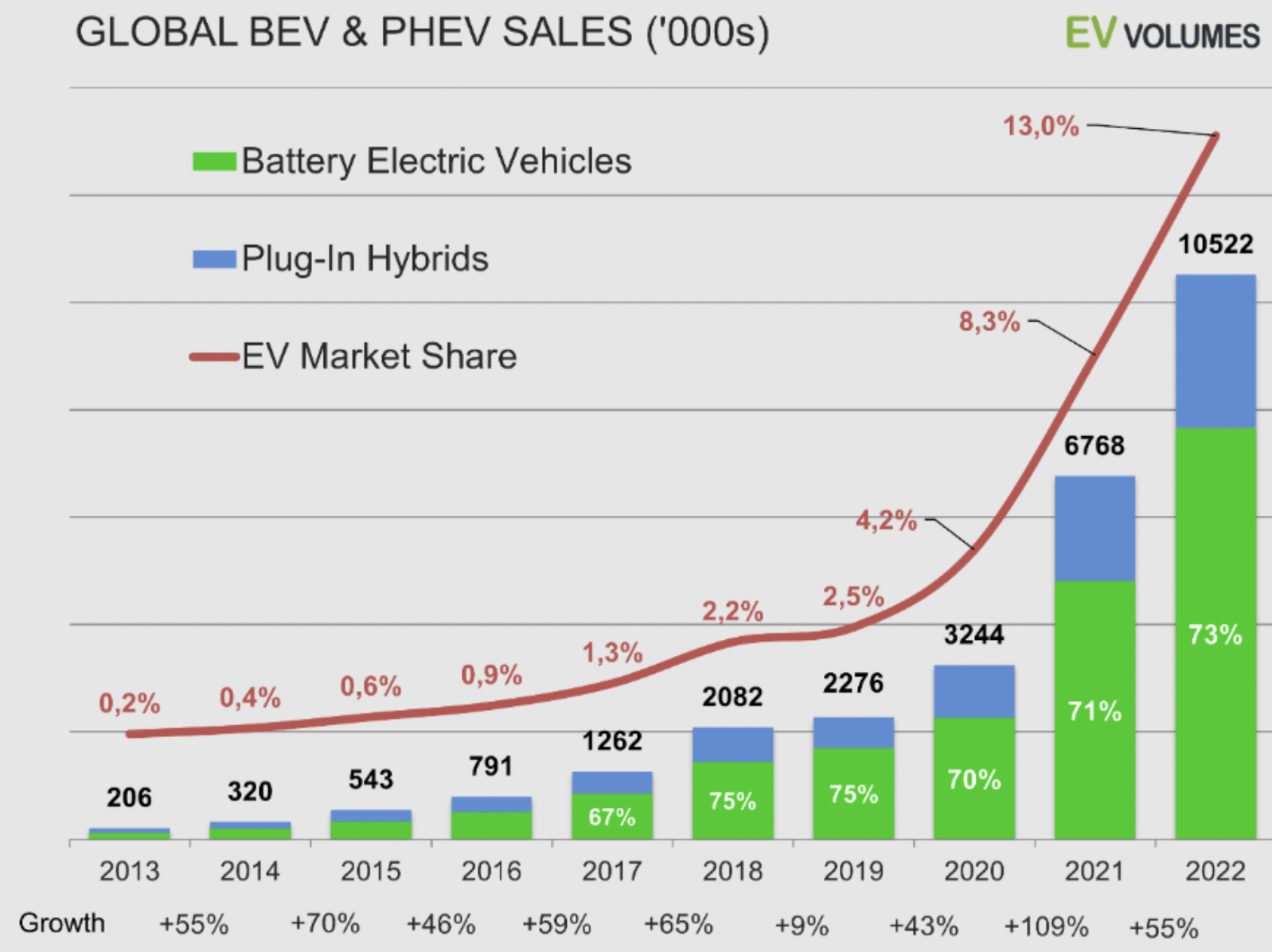

It took six months, but I can now say with confidence that (spot) battery-quality Lithium (“Li“) prices in China have bottomed. Investing.com shows the price bouncing +43.5% from 165,500 yuan/tonne on April 25th to 237,500 yuan/t on May 17th. The … Continued

Is the #uranium price about to move meaningfully higher?

The spot uranium price is quoted around ~$53.7/lb., up ~$3/lb. in April. A handful of uranium juniors are up 15%+, companies like Energy Fuels, Boss Energy, Atha Energy, Anfield Energy, F3 Uranium & IsoEnergy. One of my favorites, Skyharbour Resources … Continued

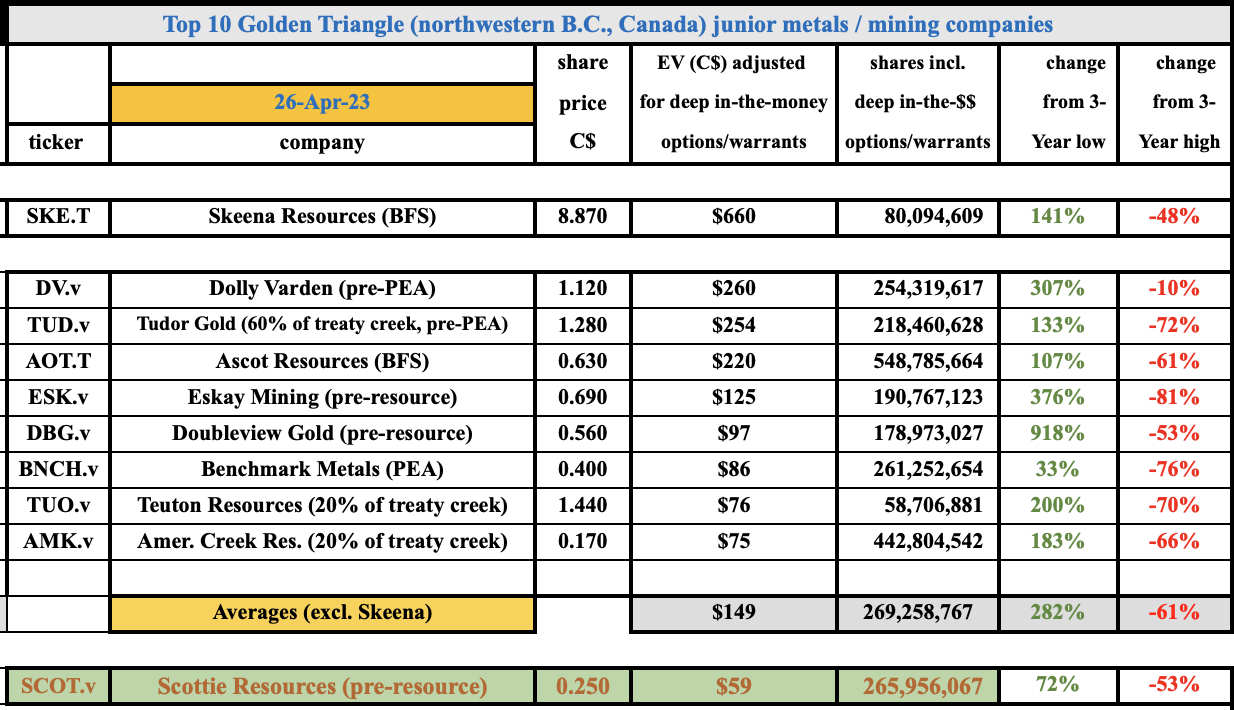

Is Golden Triangle Rock Star Scottie Resources poised to soar?

Precious metal prices have had a nice run lately. Gold topped out at just shy of $2,050/oz., but has pulled back to $1,990/oz. as I write this sentence. Importantly, the factors that launched it above US$2,000/oz. remain firmly in place. … Continued

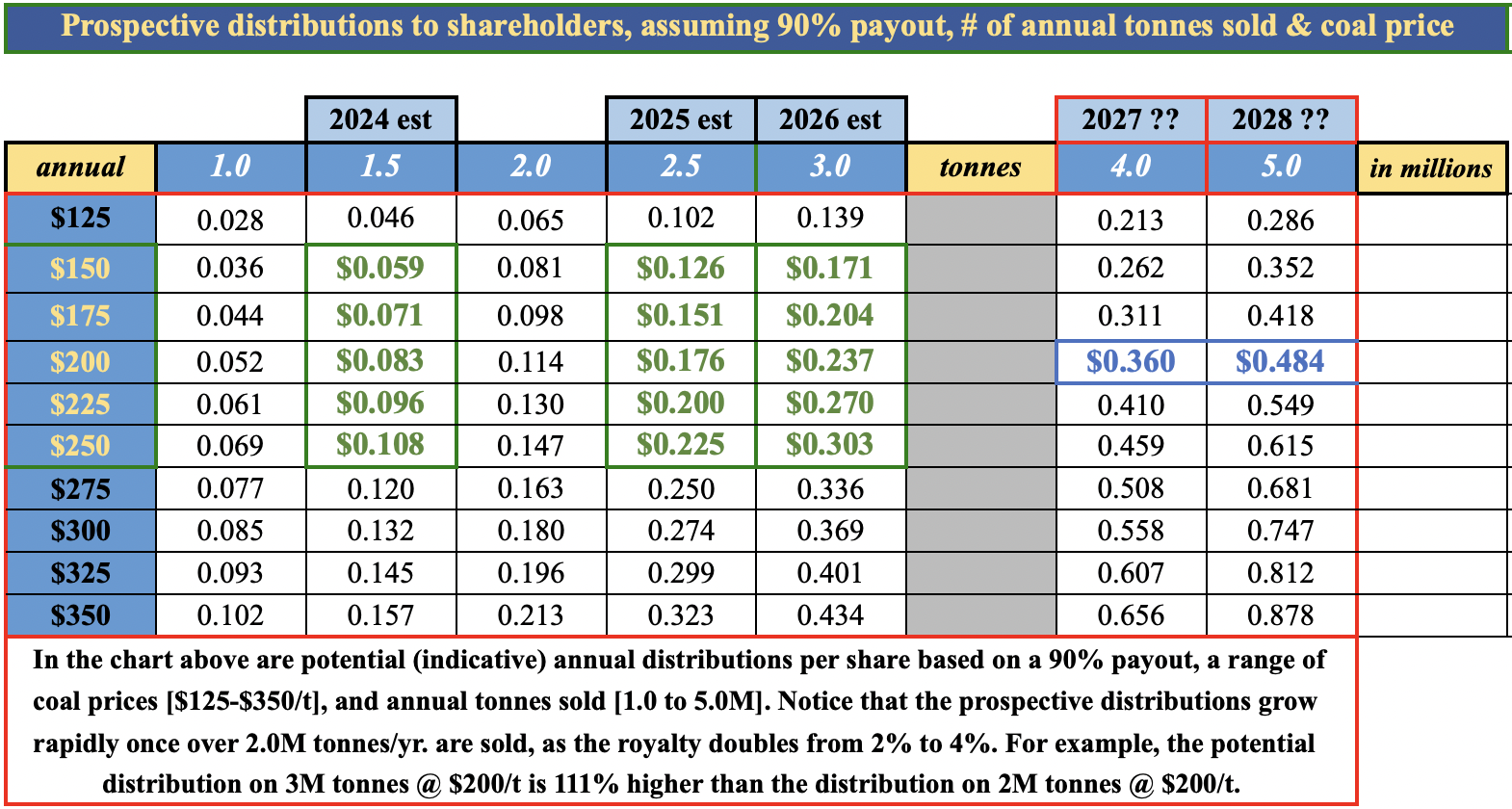

Morien Resources; 2% to 4% royalty on 25+ yr. coking coal mine in Canada

First it was COVID-19 supply disruptions expected to last months but stretching out years, then labor availability / retention issues. Next, Russia invaded Ukraine — another significant, long-term impact on the quantity & security of supply of several key commodities. … Continued

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)