Magma Silver (MGMA.V): Old Core, New Blood, Big Gold Upside in Peru’s Silver Heartland

This is a guest post of a recent article by Chris Parry over at equity.guru. Epstein Research [ER] has no prior or existing relationship with Magma Silver or its predecessor company. Peter Epstein of [ER] remains bullish on gold & … Continued

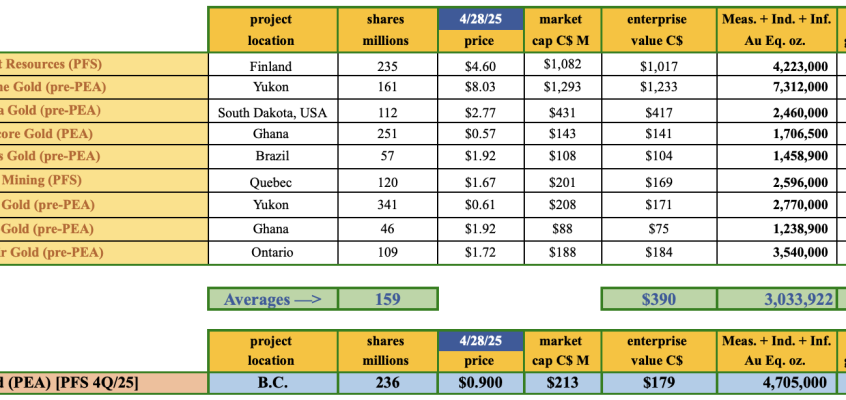

Troilus Gold, the next 12 months should be EPIC

A lot has to go right in the world for the conditions that have propelled gold higher to change. Gold (“Au“) is a safe-haven, one of the few asset classes large enough to absorb $100s of billions of inflows if/when … Continued

Thesis Gold gets 9.9% strategic investment from Centerra Gold

Game on! Centerra Gold Inc. was always a likely candidate to want a piece (or all) of Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF). On April 22nd, Thesis announced that Centerra will acquire a 9.9% equity stake at a 10% … Continued

Is Aston Bay’s 20% stake in Storm Copper undervalued?

If one’s bullish on copper (“Cu”) demand and therefore prices, one should be excited about low-valued Cu explorers/developers who can be in production within 3-5 years. But not juniors with projects in difficult jurisdictions. High-risk jurisdictions like Zambia, the DRC, Mongolia, and Indonesia are … Continued

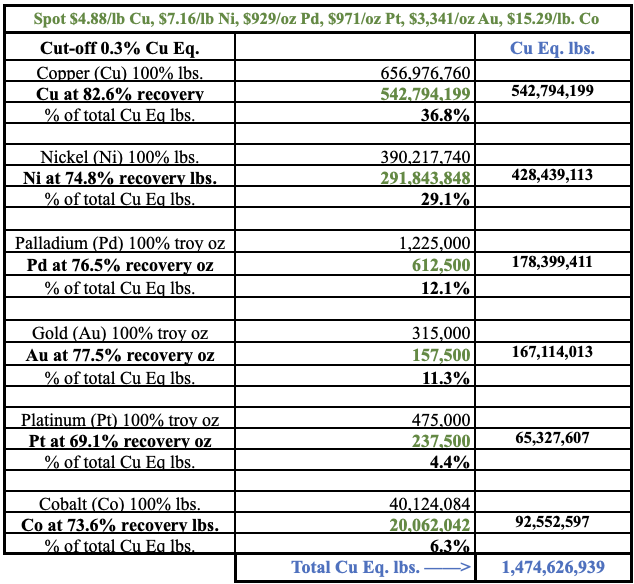

PTX Metals, strong asset value, hugely undervalued?

Canada is a mining-friendly country sharing a border (the longest between any two countries on earth) with the U.S. Exports are accessible to Europe from the east coast, Asia from the west, and easily trucked/railed south. Canada enjoys widespread, green … Continued

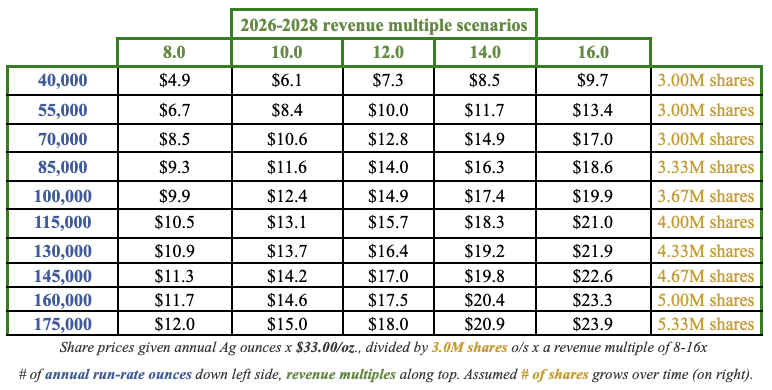

Silver Crown Royalties, 100% exposure to Ag –> all the time!

All $ figures are C$ unless stated otherwise. All metal prices are US$ Silver Crown Royalties [“SCRi“] (CBOE: SCRI) / (OTCQX: SLCRF) is a high-risk / high-reward proposition in a precious metals bull market with no end in sight. The Company has … Continued

Ucore Rare Metals, near-term #REE production in the USA

For over a decade, investors have been told that Rare Earth Elements (“REEs“), very heavily controlled by China, could be weaponized against the West in a Trade War. After numerous escalations, things took a terrible turn for the worse this … Continued

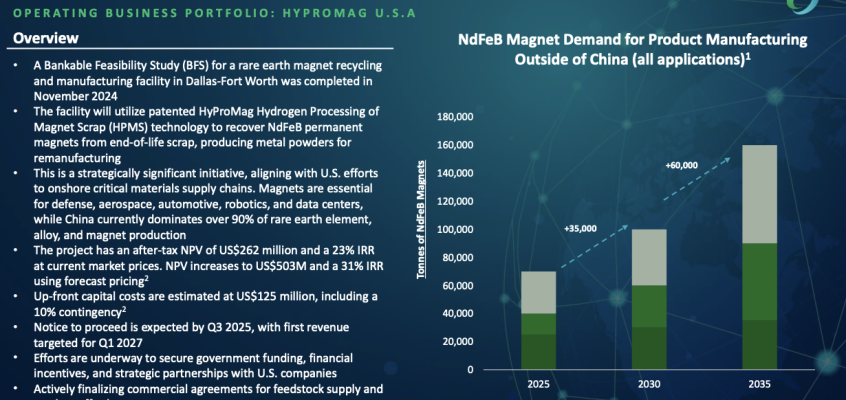

Is CoTec Holdings’ REE magnet recyling segment undervalued in a Major U.S./China trade war?

Tariffs, trade wars, and the negative impact on global stock markets, U.S. bonds & the US$ is BIG news in April. However, investors might not have noticed that gold (“Au“) fell just -7% at its worst last week, then rallied … Continued

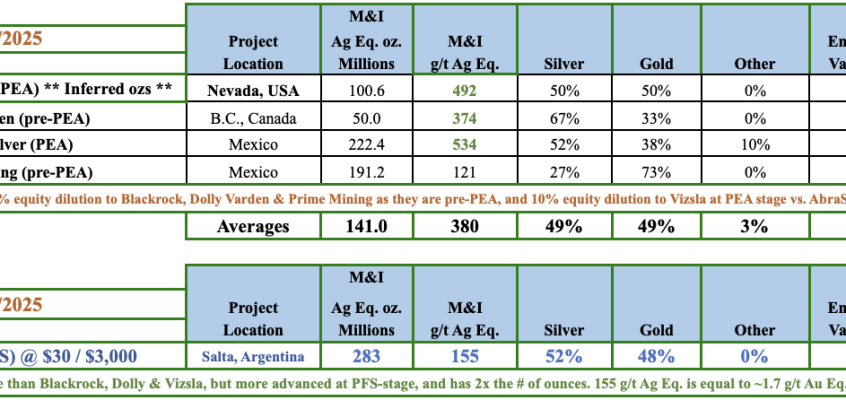

AbraSilver, fully-funded through 2026 in Gold/Silver bull market

I firmly believe that now could be a good opportunity to invest in high-quality precious metal juniors, especially those that are 100% silver (“Ag“) + gold (“Au“). The past week has been awful, but the outlook for Ag/Au remains bright. … Continued

Seabridge Gold, over a Trillion C$ of in-situ value!

all $ figures are US$ unless indicated C$ Trump has been President for 66 days. He & sidekick Elon Musk are taking a wrecking ball to U.S. government institutions, foreign alliances & global trading regimes. A focus has been on … Continued

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)