All dollar figures C$. New Age’s Li assets in Manitoba have the potential to also host tantalum, cesium & REEs. Only the Li prospects are discussed.

The first article I wrote about New Age Metals (TSX-v: NAM) / (OTCQB: NMTLF) in late November can be summarized as follows; Canada is a great mining jurisdiction for critical/battery metals, especially Lithium (“Li“).

Quebec & Ontario are becoming world-class battery material hubs with high-flying Li juniors valued at up to $1.8B, and nine others > $150M. The top-10 performing Li juniors with assets in Quebec and/or Ontario were up an average of 145% in January, New Age was up 33%.

Flying under the radar is the province of Manitoba. Top-5 global Li producer Mineral Resources Ltd., (“MinRes“) based in Australia, is interested in Manitoba, it has partnered with New Age.

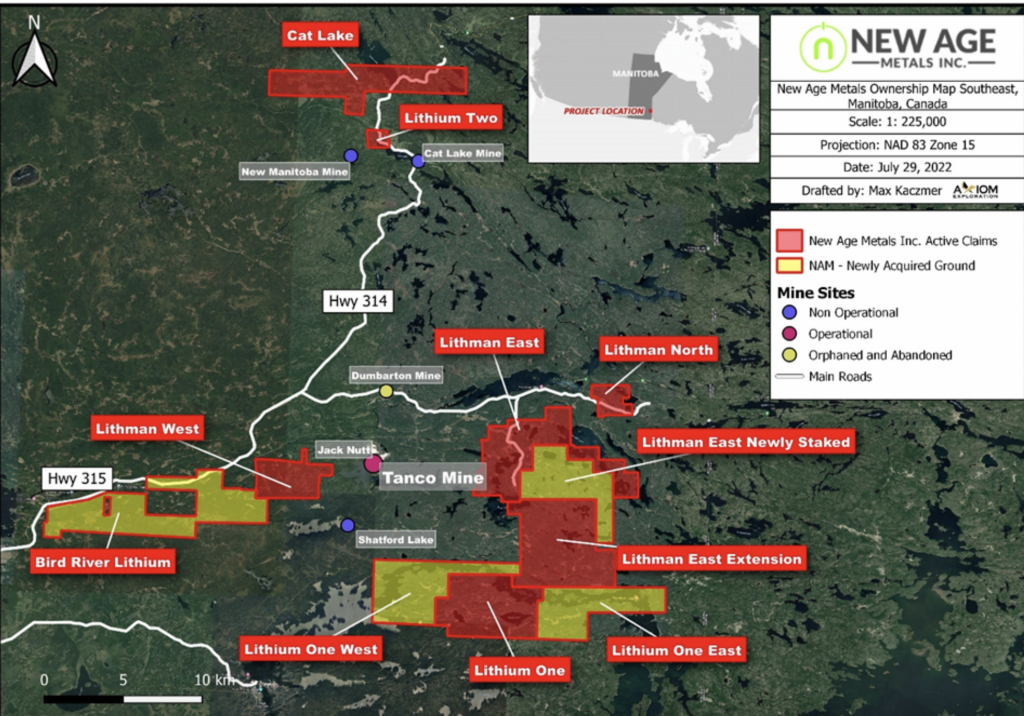

Why might MinRes do that? Look at this picture of a giant Li/cesium/tantalum mine/mill complex. It’s not in Quebec or Ontario, the only Li operations in Canada are at Tanco in Manitoba.

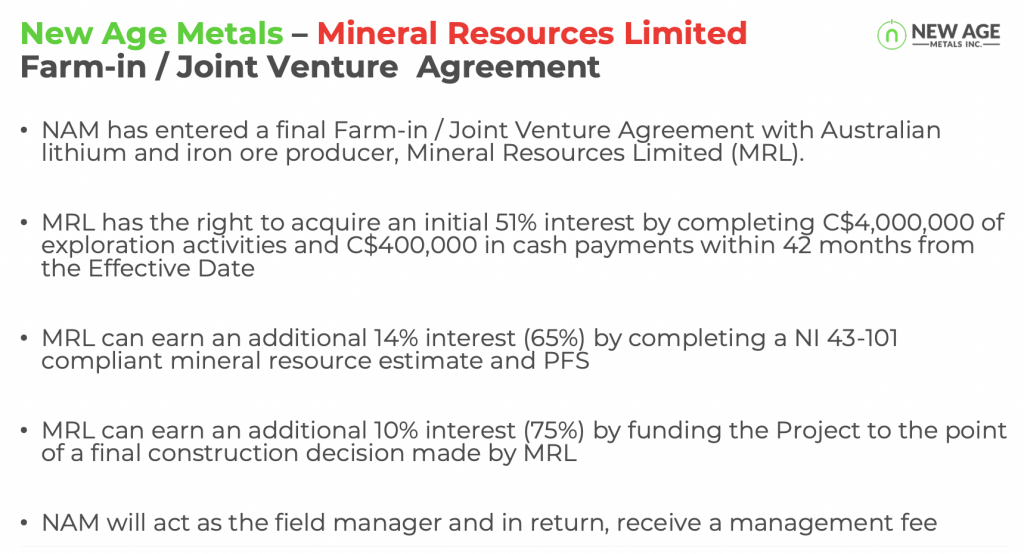

To earn an initial 51% interest in New Age’s 11 properties, MinRes must invest $4M and pay $400k cash over a 42-month period. To earn a 75% interest, MinRes would need to continue covering 100% of exploration/development costs including a PEA, PFS, BFS/DFS & other studies/reports.

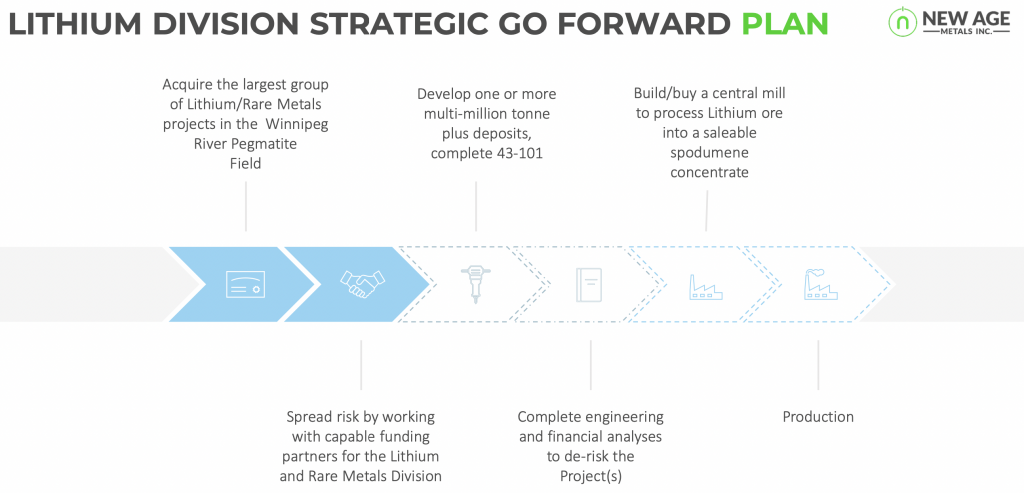

The partners would prepare & submit permit applications to various agencies and continue to consult with local communities & First Nations. Over the next several years, that could amount to $10’s of millions of value to New Age.

Consider the size of the prize. MinRes’ 75% stake in a long-lived Li (and possibly tantalum/cesium) mine could be worth $1 billion or more. Pre-maiden resource junior Patriot Battery Metals has a fully-diluted valuation of $1.8B.

In order to move the needle for giant MinRes, the scale in Manitoba has to be large. Imagine what that could mean for tiny New Age Metals.

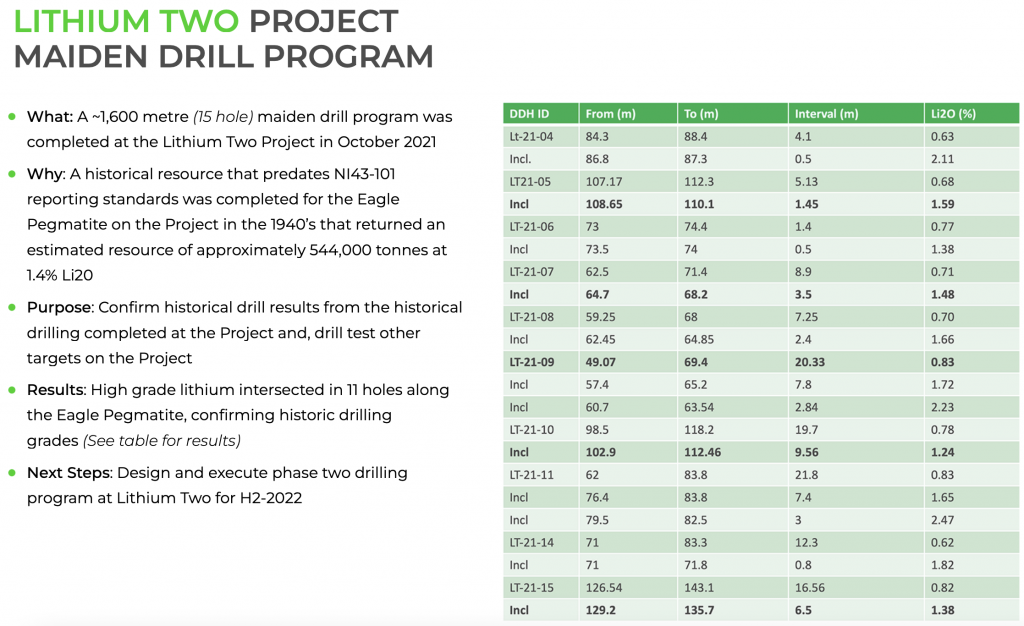

Readers might be wondering, is this just a lottery ticket? No, the chances are far, far better for a big payday. While the partners don’t have any booked tonnage, there’s a small historical (non NI 43-101 compliant) resource on one of New Age’s properties.

The partners will need to do a lot of drilling to (possibly) confirm & expand upon historical work, but the Li oxide (“Li2O“) grade was a strong 1.42%. Anything > 1.00% is considered good. Even 10-20M tonnes of mineralization would be noteworthy.

Rock Tech & Critical Elements have PFS & BFS-stage projects, respectively, each grading 0.93% Li2O, with their primary projects valued at an average of $323M.

The average pre-PEA resource is valued in the market at ~$280/t of Lithium Carbonate Equivalent (“LCE”).. Therefore, 10M tonnes grading 1.00% Li2O could be worth ~$68M. That’s $68M of potential value in 2-3 years, with minimal equity dilution as the Company is being free-carried.

Li players are flocking to Canada. Australian-listed Sayona Mining can’t get enough, neither can U.S. based Livent. Sayona announced a significant bolt-on acquisition in Canada, and Livent recently said Canadian could eventually surpass its prominent Li brine position in Argentina.

Mineral Resources, Allkem, Lithium Americas & Piedmont Lithium also have footprints in Canada. New entrants might want a piece of the action, companies like Albemarle, SQM, Sigma Lithium & Australian-listed giant Pilbara Minerals.

MinRes, valued at $16 billion, recently teamed up with New Age by agreeing to earn up to 75% of New Age’s SE Manitoba Li portfolio.

New Age owns valuable claims surrounding Canada’s only active Li mine, Tanco. Importantly, the claims are along strike of Tanco’s prodigious pegmatites. Yet, the Company’s Enterprise Value {market cap + debt – cash} is just $13M {$0.08/shr. on 1/31/23}.

Besides Patriot, other pre-maiden resource juniors in Ontario include Critical Resources & Green Technology Metals. In Quebec; Li-FT Power, Winsome Resources, Tearlach Resources, Arbor Metals, Benz Mining & Brunswick Exploration.

The average market caps of those companies is ~$118M.

New Age’s assets include 11 properties covering 21,611 hectares — with surface grab samples as high as 4.1% Li2O. One of the properties has a small, historic (non NI 43-101 complaint) resource grading 1.42% Li2O. The Company’s upcoming Jan./Feb. drill program will be near the historic resource.

As far as I know, New Age is MinRes’ only Li investment in Canada. And CEO Harry Barr prudently negotiated a 100 km area of interest around New Age’s SE Manitoba Li assets.

The Company’s holdings are likely to grow via additional staking/acquisitions. In addition, management is pursuing new opportunities farther north in Manitoba, near Snow Lake Resources.

How much is a 25% free-carried interest in New Age’s Li portfolio worth? Green Technology Metals has an EV of $208M based not on its JORC-compliant resource estimate of 9.9M tonnes at 1.04%, but on a conceptual exploration target of “50-60M tonnes” with an estimated grade of “0.80 to 1.50% Li2O.”

Likewise, Winsome is valued at $320M off of a conceptual exploration target of “15-25M tonnes at 1.0-2.0% Li2O.” At the mid-point of 20M tonnes at 1.5%, Winsome would be trading at $431/tonne in the ground.

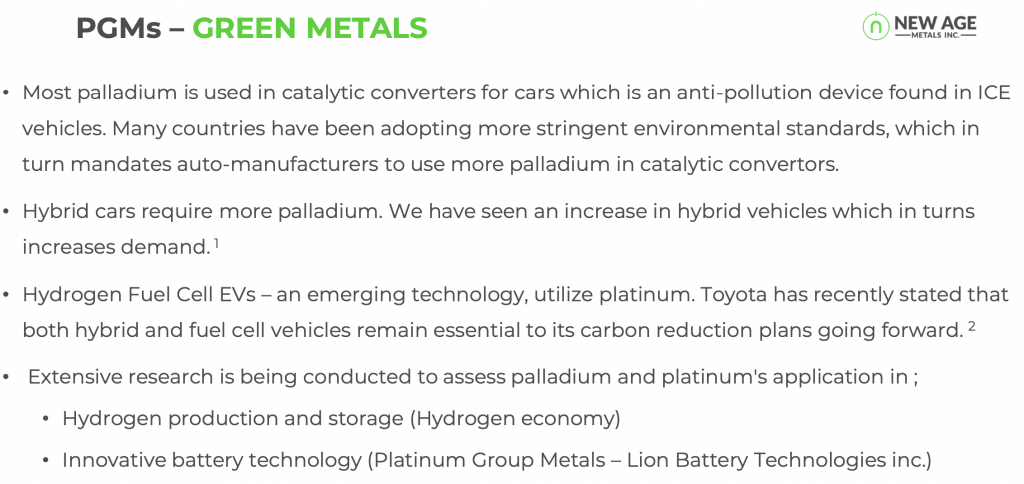

Before I dive deeper into New Age’s Li prospects, I will briefly describe two other 100%-owned assets; the 3.9M oz., PEA-stage River Valley Palladium (“RVP“) (+ platinum, gold, rhodium) project.

The after-tax NPV in the RVP project’s 2019 PEA came in at $187M with an assumed Pd price of $1,200/oz. {based on the prevailing 2-yr. trailing avg.}.

Today the Pd price is US$1,684/oz., a level that would enhance the economics in the upcoming 1Q 2023 PFS. However, op-ex & cap-ex will also be higher. If New Age can deliver an IRR in the mid-to-upper teens %, that would attract more attention.

Since the PEA, metallurgical work is ongoing to improve recoveries & concentrate grades, extend mine life, lower the strip ratio & increase production/recovery of high-priced rhodium. The resource remains open at depth.

I ascribe a $20M value to this currently out-of-favor project, ~10.7% of the PEA-derived NPV. An increase in the Pd price, a robust PFS, and/or securing a strategic partner could meaningfully boost that $20M figure.

Turning back to lithium, six pre-PEA companies with hard rock projects in Canada [Patriot, Green Technology Metals, Winsome, Li-FT Power, Snow Lake Resources & Imagine Lithium] have an average ratio of EV/mt LCE in the ground of ~$280/t.

If MinRes/New Age could book 10M / 20M / 40M tonnes at 1.00% Li2O, and assuming $280/t, that would be worth $69M / $138M / $276M, making New Age’s 25% free-carried stake worth $17M / $35M / $70M.

Moreover, for MinRes to consolidate from 75% to 100% ownership, it would have to pay a premium. Fast forward to 2025-26, New Age’s share of a prospective 20M tonnes at 1.00% Li2O might be worth [$35M x a 40% premium = $49M].

However, that indicative $49M figure could still be conservative, at an assumed 1.2% Li2O grade, the # would be ~$59M. Compare this range of Li valuations, well into the $10’s of millions + $20M for the flagship RVP project to New Age’s current valuation of just $13M.

Extensive drilling lies ahead, but MinRes is a Major Li producer and experienced hard rock miner. Presumably it wouldn’t waste time on a tiny footprint without completing significant due diligence on the mining claims & expansion possibilities.

Might management spin-off its Li assets into a new company? I believe that move alone could unlock tremendous value.

Sayona, Livent, Allkem, Patriot, Critical Elements, Rock Tech & Frontier Lithium will be standalone Li producers in Quebec/Ontario. MinRes is poised to (potentially) become an important player in SE Manitoba.

With Canada a Li hotspot, New Age’s land package is getting additional valuable by the day. Management has $5M in cash, a low cash burn, and is looking for more Li properties across Manitoba.

All eyes are on New Age’s Li properties, potentially worth well into the $10’s of millions. Since my prior article, the share price is up from $0.05 to $0.08. Readers should consider taking a closer look at New Age Metals (TSX-v: NAM) / (OTCQB: NMTLF).

Link to my first article on New Age Metals.

Disclosures/disclaimers: Peter Epstein of Epstein Research [ER] has no prior or current business relationship with any mgmt. team, board member of New Age Metals or to the Company or to any predecessor companies. Mr. Epstein owns shares of New Age purchased in the open market. Mr. Epstein is encouraging the Company to become an advertiser starting in 1Q 2023. Therefore, Mr. Epstein’s views on New Age might reasonably be considered biased.

New Age Metals is a highly speculative, small cap, low-priced security. The above article attaches a lot of weight to the fact that $16B Australian-listed Mineral Resources chose New Age’s SE Manitoba properties to explore for lithium. I consider this a strong vote of confidence. Although there has been some drilling success, a lot more drilling is needed to prove out a meaningful mineral resource. There are no assurances that the [grade x volume] of Li mineralization across New Age’s 21,611 hectares will result in an economic resource, or that the resource will be large enough to move the needle for MinRes.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)