What a time to be invested in Gold (“Au“) at ~$2,375/oz. On April 12th it traded as high as $2,432/oz. (an all-time high). Yet, even at $2,000+/oz., new projects are not only viable, they would thrive. Especially low-cost, low technical risk, heap leach assets in well-established, prolific jurisdictions.

According to the website TheDiggings, Sonora, Mexico has > 70 Au mines. This is a mining-friendly State with excellent infrastructure (roads, power, water, skilled workforce, mining services & equipment).

Tocvan Ventures (CSE: TOC) / (OTC: TCVNF) recently arranged a non-brokered private placement (still open) with a lead order from an institution. The Company plans a concurrent placement of $750k, for total issuance of 6,428,571 units at C$0.35, (each unit includes a full warrant at C$0.50). Gross proceeds will be $2.25M.

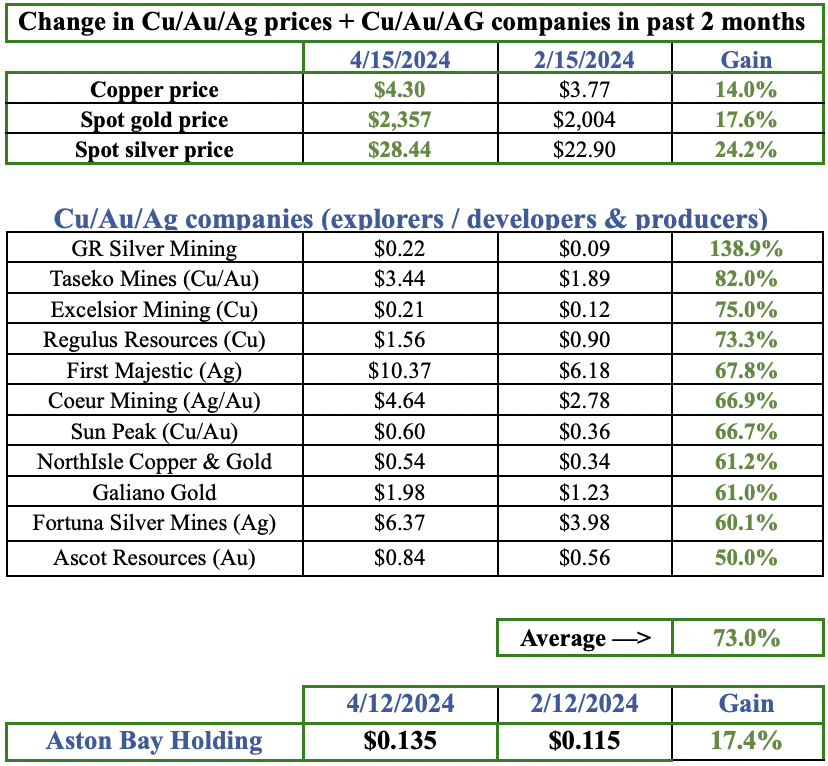

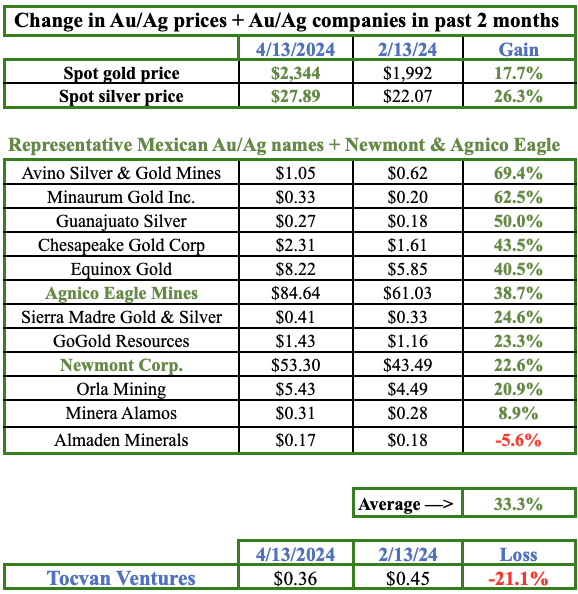

In the two months leading up to this routine equity raise, the share price did not participate in a significant movement in Au & silver (“Ag“) prices, up a whopping +18% & +26%, respectively. While peer Mexican-focused Au/Ag companies (and Newmont + Agnico Eagle) were up an average of +33%, Tocvan was down -21%.

This suggests Tocvan could be poised to catch up to peers. Before diving deeper into the Company’s exciting assets, a quick word on Au & Ag fundamentals. It’s amazing the runs that precious metals are having, even before the U.S. FED has cut rates, signaling a flight to safety on both geopolitical & inflationary/monetary grounds.

A month ago, no one was talking about $2,500 Au or $30 Ag, but prices are nearly there! Last week, Bank of America specifically mentioned $3,000/oz. for 2025. Robust Central Bank buying is reportedly behind the spike in Au as China & Russia lead BRICS away from US$ assets.

As a minority of Central Banks buy aggressively, others are increasingly likely to follow due to the fear of missing out (“FOMO“). Some currencies, like Venezuela’s, are being tied to Au, will others link to Au?

Regarding Ag, physical use is increasing robustly, most notably in solar panels, EVs, and energy storage for renewable power. China’s deployment of solar was up +148% in 2023. It’s on track to use one-seventh of the world’s mined Ag this year.

We’re in year #4 of a mined Ag deficit. This setup is reminiscent of the chronic undersupply in #uranium, resulting in the uranium price doubling in the past year. Readers are reminded that Ag averaged ~$85/oz. (in today’s dollars, adjusted for inflation) for the entire year of 1980!

Returning to Tocvan, if one could choose the attributes of a mine development scenario, what would they be? Spead to market, high-grade, community support, access to capital, a strong mgmt. team, low upfront cap-ex & best quartile op-ex, ample infrastructure, low technical & permitting risks & multi-million oz. potential.

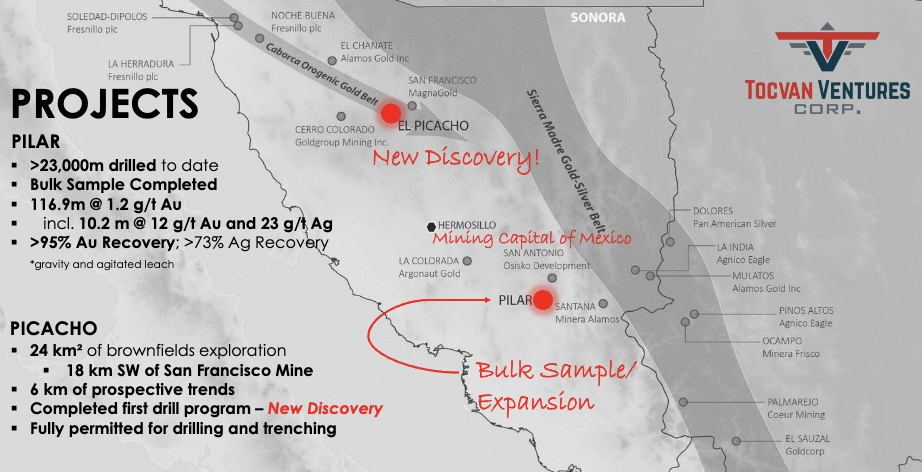

Tocvan enjoys nearly all of those attributes at its Pilar Au/Ag project. I mentioned that Sonora, Mexico has > 70 Au mines, many are heap leach operations. There are few better places on earth for heap leach mining. Low-risk, low-cost operations should be highly sought after at today’s $2,344/oz. Au.

The Company has ~50M shares outstanding (pro forma for an announced private placement) and owns or controls two exciting opportunities in Sonora. The Company has consolidated an attractive land position at its Pilar project, a 100% interest in ~22 sq. km of prospective area, + 51% in a one sq. km area shared with Colibri Resources.

Before Tocvan arrived on the scene, two historical exploration efforts were done. The first in 1996-97, and the second from 2008-2018. Both included significant surface exploration & some RC drilling. Pilar is fully road-accessible, 130 km (a 2-hr. drive) SE of the capital of Sonora, Hermosillo.

Drilling has re-started at road-accessible Pilar. The fully-permitted program will include at least 4,000 meters of infill drilling + 3,000 m of step-out drilling, possibly up to a combined 10,000 m. Results, expected in May/June, will go into a maiden resource estimate for Pilar Main Zone. Before this campaign, ~23,000 meters were done.

Drilling is going well, the rig is on hole #8, with each ~150-200 m deep. Cores from the initial three are already in the lab. The first hole followed up on JES-22-62, which returned 108.6 m of 0.8 g/t Au + 3 g/t Ag. At spot prices, JES-22-62 is $63/t rock — attractive in a bulk tonnage scenario. Even better is the 94.6 m of 1.6 g/t Au, from a 2023 interval, which equates to $121/t rock.

“…with the previous drill program identifying new areas of mineralization to the east & SE of Pilar’s Main Zone, we look to expand the overall footprint while building towards a maiden resource estimate at Pilar.”

Management points out that the Pilar project has returned some of the region’s best drill results, and it has encouraging Au/Ag recoveries from preliminary metallurgical test work. Pilar is interpreted as a “structurally controlled, low-sulphidation, epithermal system.”

Initially, three primary zones of mineralization were identified from historic surface work & drilling, they are referred to as the Main Zone, North Hill, and 4-T.

Each trend remains open to the SE to the north. New parallel zones have also been discovered. Mineralization extends along a 1.2 km trend, but only half of that has been drill-tested. About 150 representative, (not grab), surface samples are in the lab, results are expected this month.

These samples were taken immediately east of the current drilling. The objective of those samples was to outline the source of recent placer mining activity and substantially expand the overall known mineralized footprint at Pilar.

The Company has now expanded its interest in the area by consolidating ~22 sq. km of prospective ground around where it has already made significant surface discoveries. Majors & mid-tiers are said to be interested in what Tocvan is up to, and management is already talking with royalty & streaming companies.

As an aside, last week Franco-Nevada invested C$8.1M for a 2% royalty on a pre-maiden resource property package in B.C., Canada thought to contain ~2M ounces Au (so far).

Management is studying the potential, subject to more work, of a heap leach mine — ramping up over time to 50,000 ounces/yr. A great thing about small heap leach operations is that upfront cap-ex can be less than US$20M. With Au > $2,300/oz., an efficient, well-planned & operated heap leach mine should deliver profits above US$1,000/oz.

Assuming a US$1,000/oz. profit margin on 50,000 ounces, that’s ~C$68M/yr. in cash flow vs. Tocvan’s enterprise value of ~C$16M. On paper, very few companies look this compelling. Of course, there’s plenty of risk between now and 50,000 oz./yr. How much equity dilution will there be? Is first production expected in 2026? 2027? 2028?

How long might it take to ramp up to 50,000 oz.? How long & how expensive to work through inevitable start-up problems common in heap leach mines? Will Au recoveries achieve stated goals? Will All-in-Sustaining-Costs (“AISC“) come in reasonably as planned?

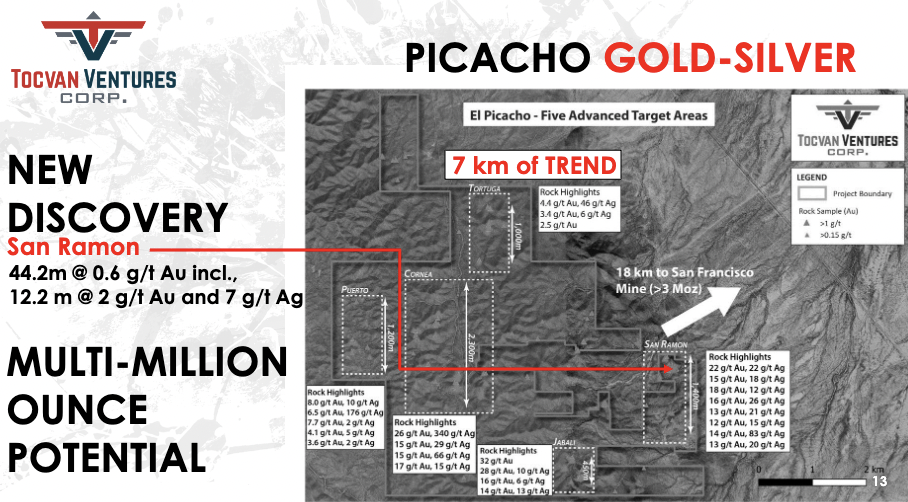

Tocvan has a second Au/Ag project in Sonora, but the overwhelming focus is on Pilar. The El Picacho project is interpreted as an orogenic Au system within the region known for mines like La Herradura (> 10M oz.) & San Francisco (> 3M oz.). The project is ~140 km north of Hermosillo and totals 24 sq. km.

Five primary zones of mineralization have been identified to date, there are over six km of prospective trends. Surface sampling & historic workings identified high-grade Au & Ag values. Management sees the potential for the discovery of a multi-million-ounce district.

It would be hard to overstate how advantageous it is for Tocvan to be developing bulk tonnage gold projects in such a highly prolific jurisdiction, surrounded by successful & very profitable heap leach mines, owned by companies that could easily afford to acquire Tocvan for a multiple of its current valuation.

Despite the Au price being up +18% since February 12th, the Company’s share price is down -21%. Yet, we are in the midst of an EPIC precious metals bull market. A small group of juniors will enjoy very spectacular outcomes, and many, many more will see 2x-5x returns.

Tocvan traded as high as $0.77 in April 2023 when the gold price was $1,995/oz. The gold price is up +17% since then, yet the share price is down -54%. I could be wrong, this is a high-risk / high-return situation, but in my view, Tocvan Ventures (CSE: TOC) / (OTCQB: TCVNF) offers a very compelling risk/reward proposition.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Tocvan Ventures, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Tocvan Ventures are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Tocvan Ventures was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)