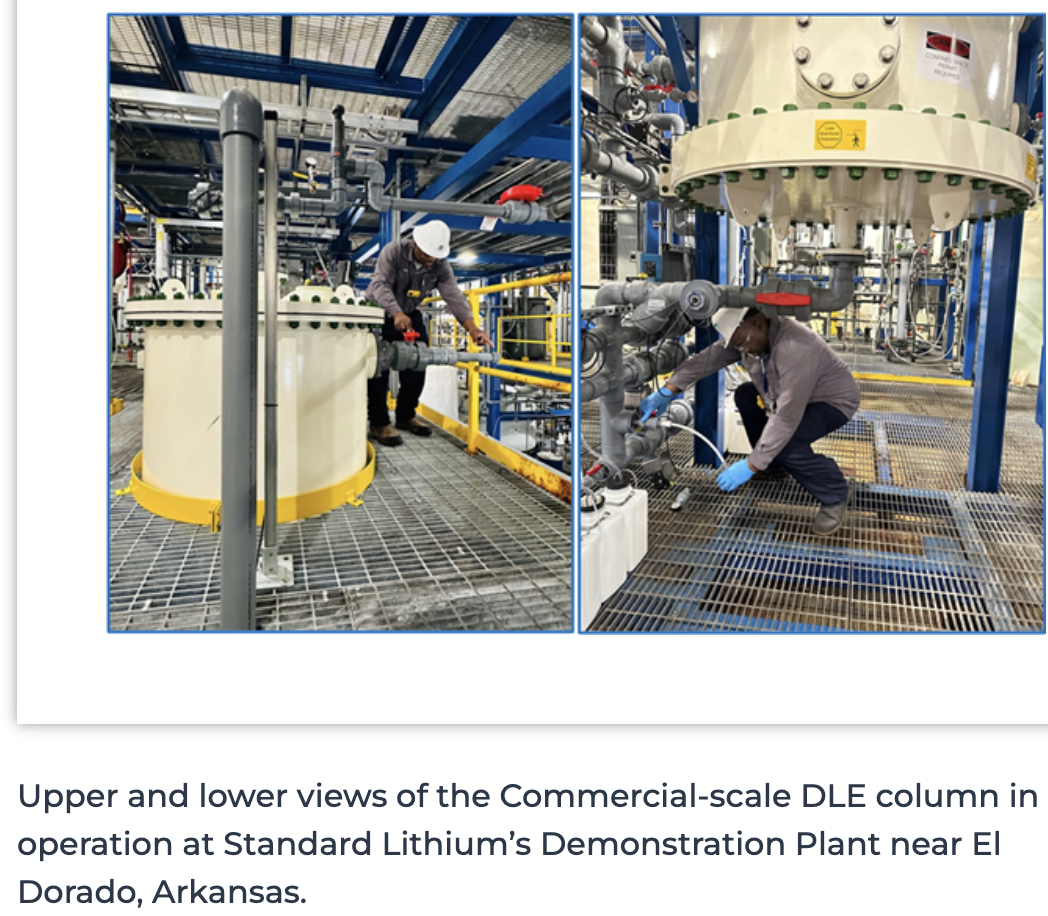

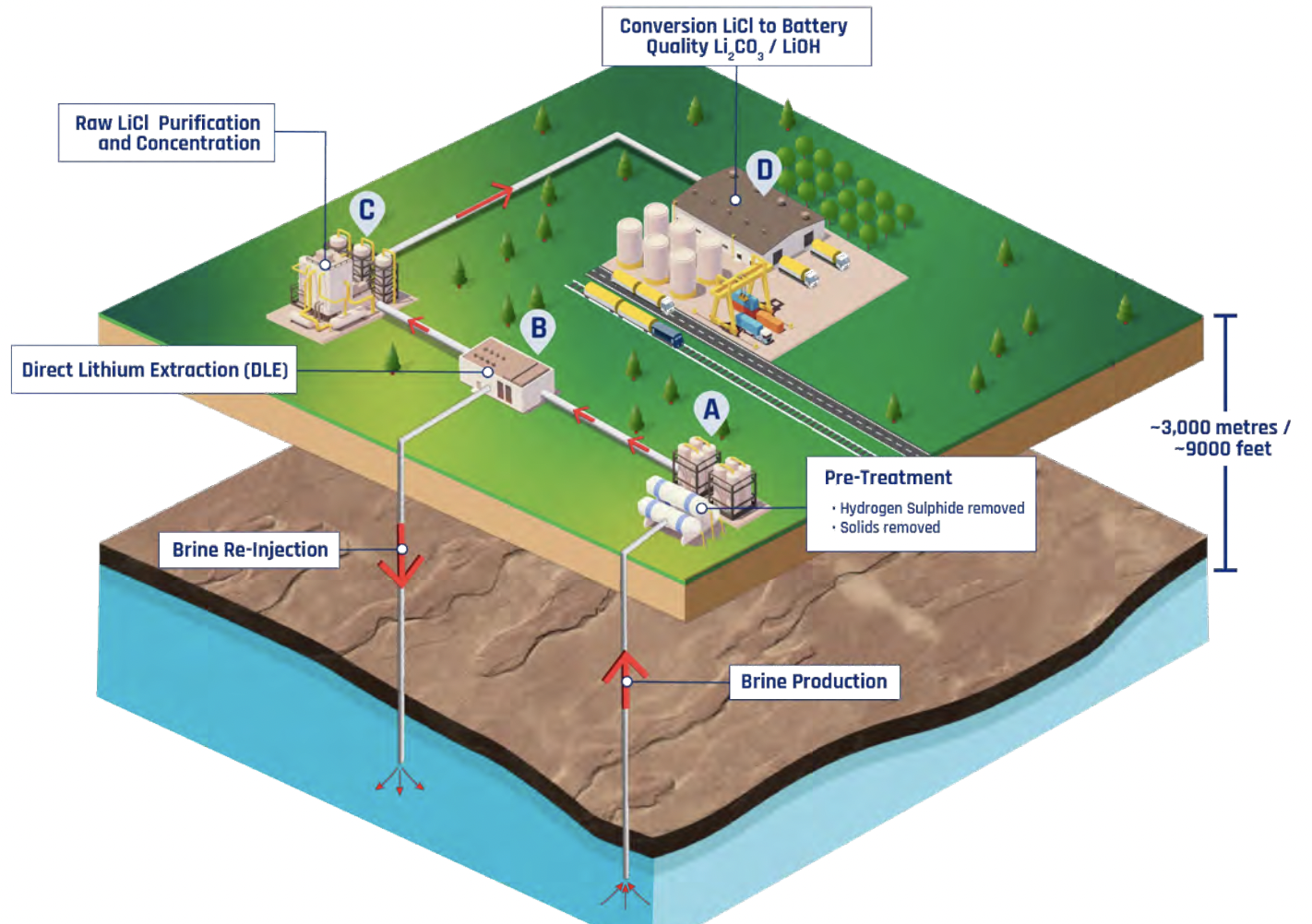

Standard Lithium (TSX-v: SLI) (NYSE American: SLI) has been at the Direct Lithium Extraction (“DLE“) game for over seven years. Progress has been slow, but steady. I strongly believe 2024 will be transformational. On April 24th, management announced the successful commissioning of a single commercial-scale DLE column.

That may not seem like a big deal given production is not until 2H 2026, but, commercial operations within ~2.5 years make Standard Lithium a leader of the pack. Yet, while some lithium (“Li“) juniors have started bouncing back, (six are up an average of +92%), Standard is up just +5% from its 52-week low.

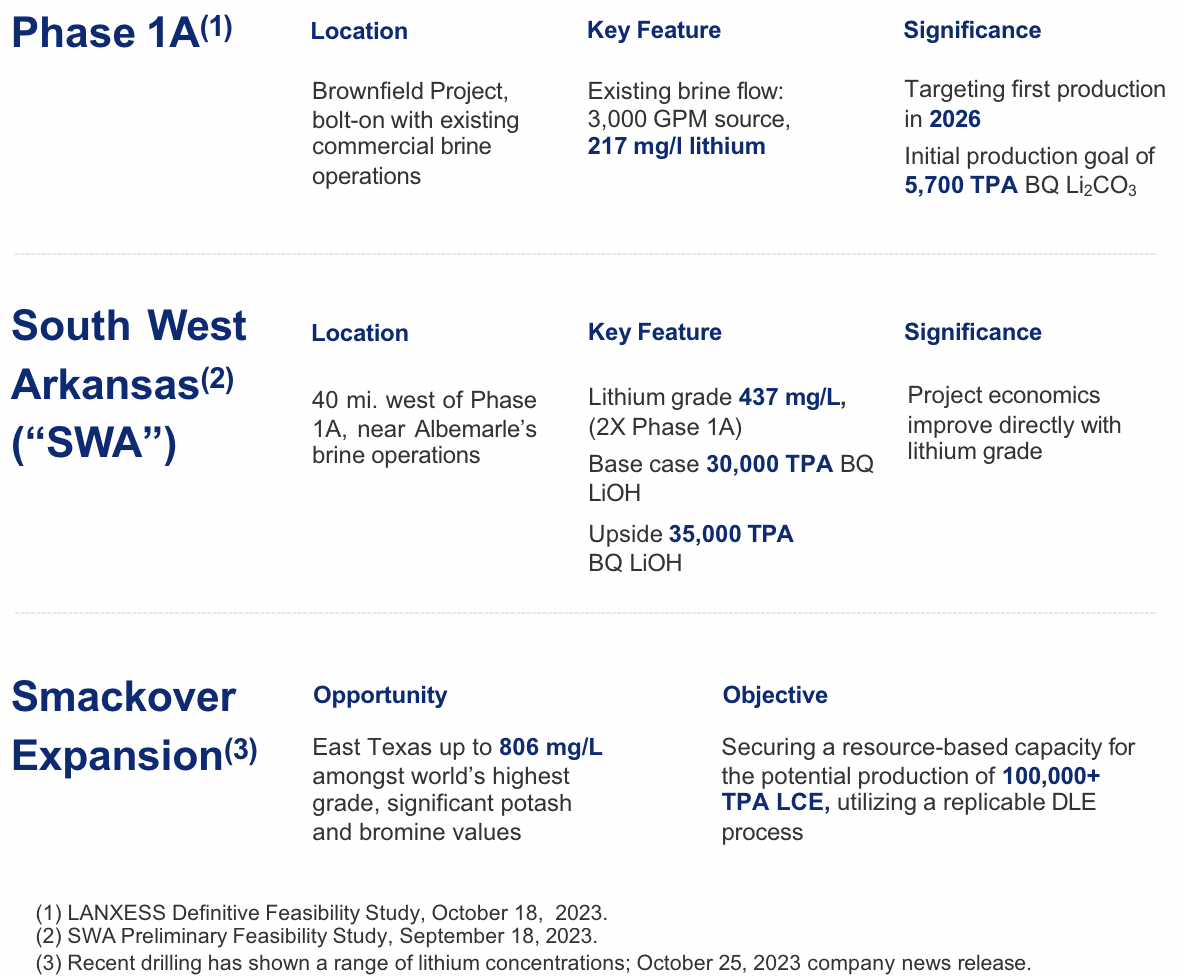

Thirty-two of those same-sized columns (processing 94 gallons per minute [“gpm“]) and the Company would be commercialized on its initial DLE project with Lanxess. Standard Lithium could be the next Li producer in the U.S., ahead of Lithium Americas, Piedmont Lithium, ioneer Ltd., Century Lithium, American Lithium & Anson Resources.

The continued de-risking of the Standard story is a noteworthy development that the market is ignoring. Perhaps investors are overly focused on the Company’s maiden project, and not its far more compelling opportunities.

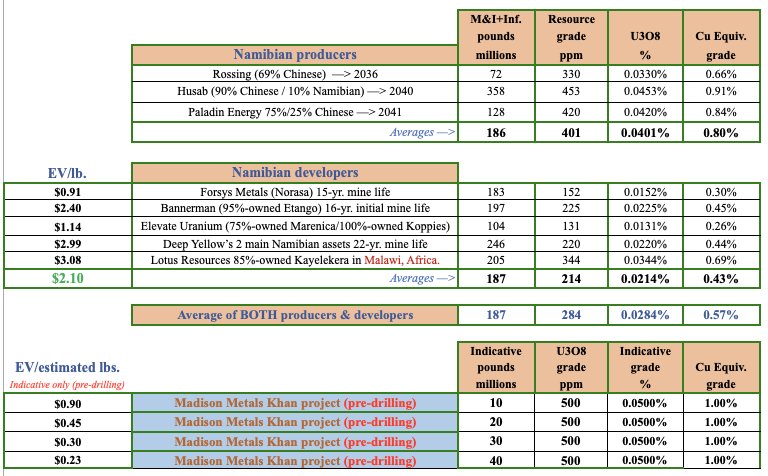

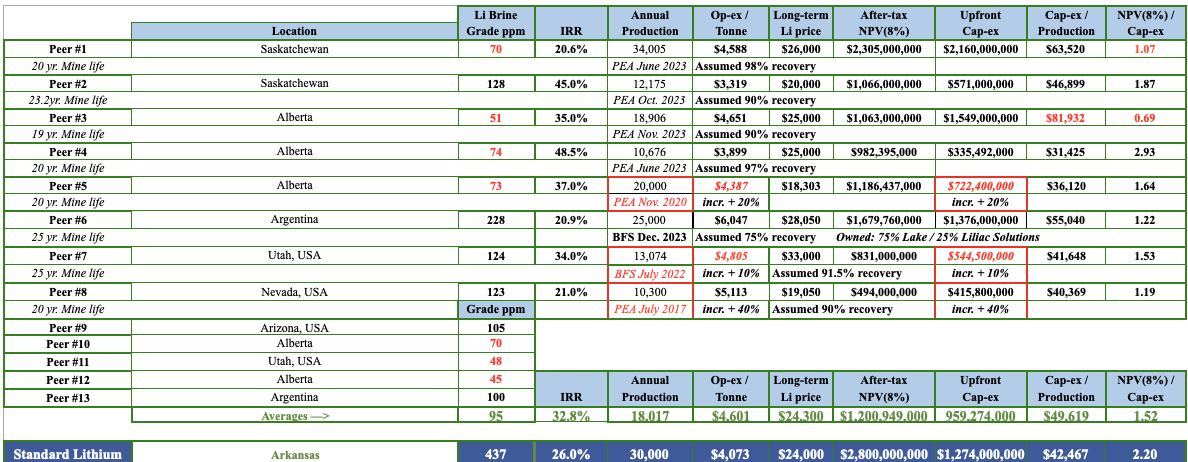

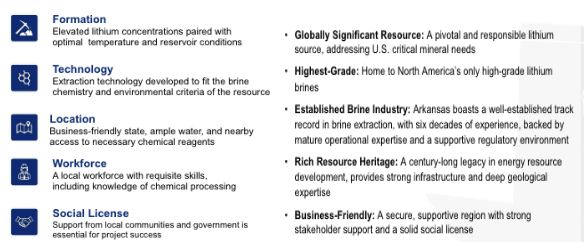

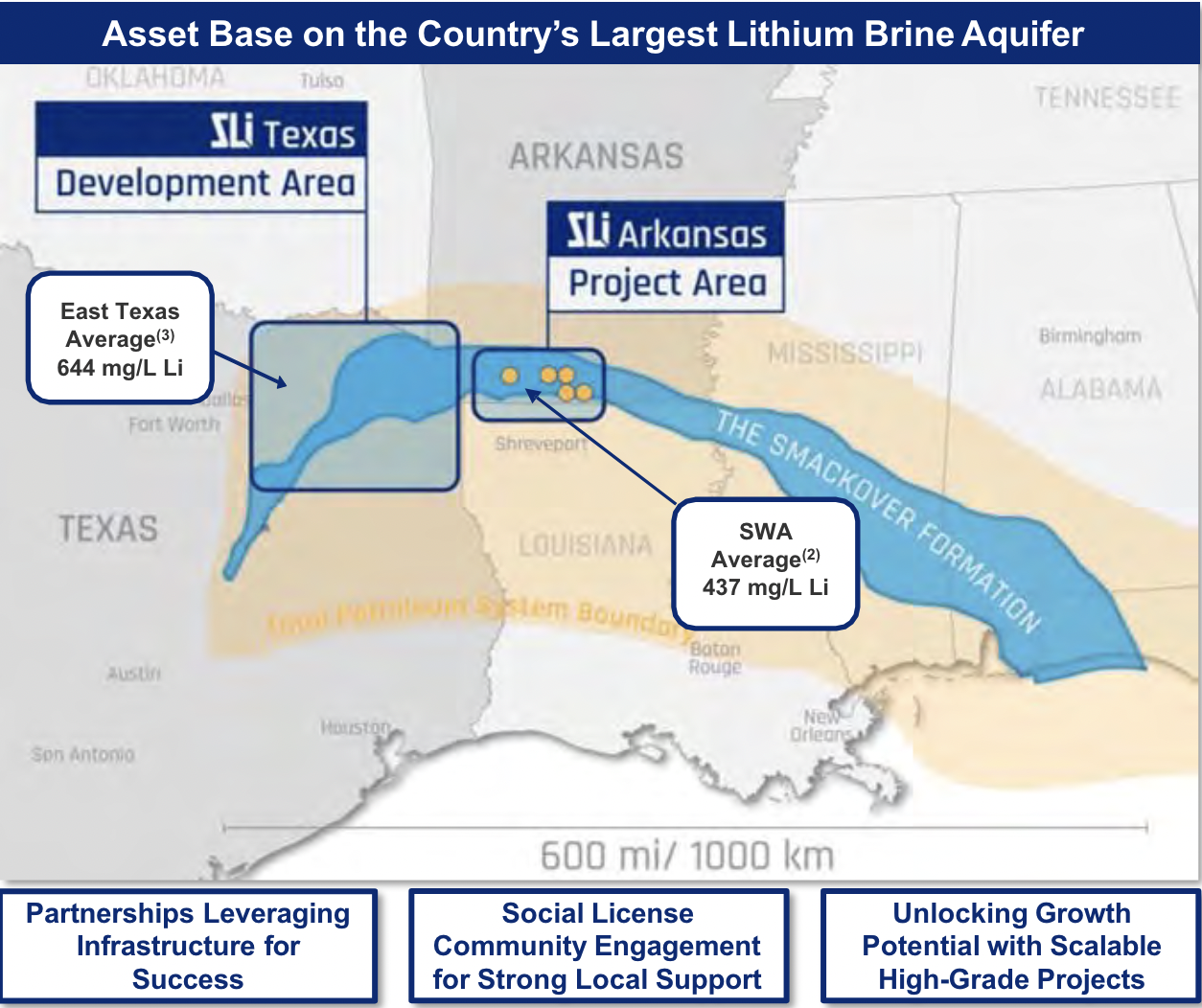

The Lanxess project is important, but it just scratches the surface of massive blue-sky potential later this decade. The Southwest Arkansas (“SWA“) project is one to watch. Many peers have projects in N. & S. America with low-to-very-low Li concentrations {see chart below}. By contrast, SWA’s grade is 437 ppm Li.

Standard’s substantially higher grade is a major differentiator. Why? The lower the grade, the more it costs in BOTH cap-ex AND op-ex to build & operate a processing facility, including transporting & re-injecting [larger] volumes of brine through a [larger] facility. Consider the margin for error in a 437 ppm Li system vs. a sub-75 ppm system.

In the chart are seven projects with an average grade of 62 ppm. Standard’s 429 ppm is nearly 7x higher! It would be nearly impossible to overstate the significance of Li concentration in DLE technologies. 437 ppm Li compares well to many brine projects in Argentina that will be using old-school evaporation ponds.

Evaporation ponds have ~45%-55% recoveries. Standard’s DLE process has a 90% recovery. Unlike the vast majority of DLE companies testing their technologies around the world, Standard’s approach is tailor-fit to SW Arkansas & east Texas brine chemistries.

Koch Industries & Lanxess + Ausenco Engineering, SGS, Optimized Process Designs, Worley Ltd., Saltworks, Zeton, Hunt, Guillot & Associates (HGA), and the Univ. of B.C., work with Standard’s technical team & independent advisors.

Readers are reminded that Koch made a US$100M equity investment into Standard in 2021 (at a much higher share price) and remains a strong DLE partner.

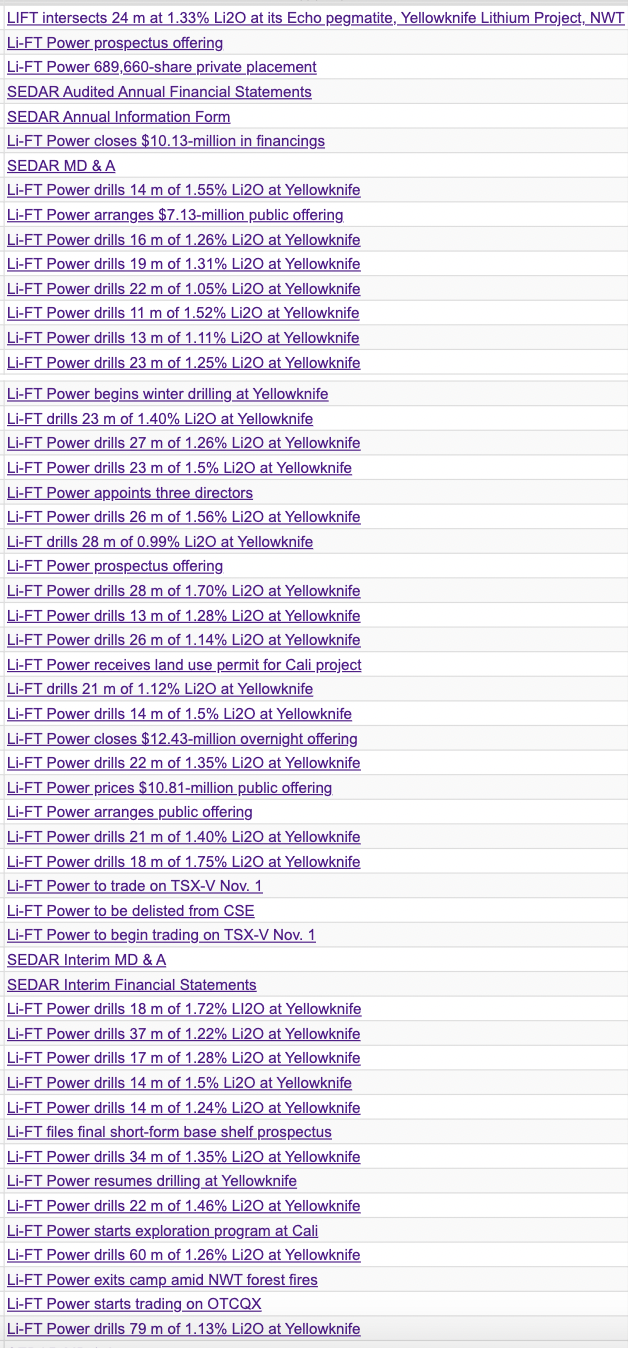

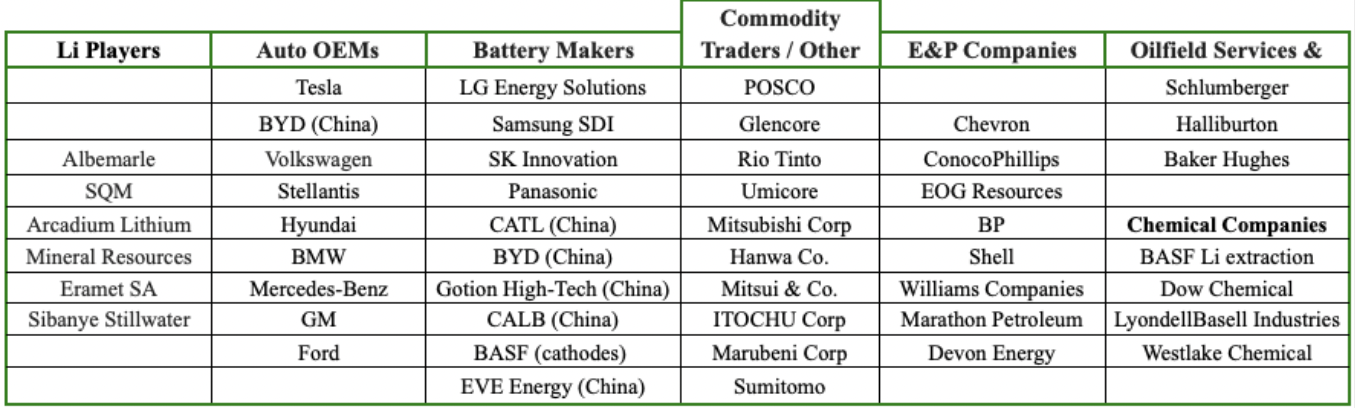

For 18 months, CEO Robert Mintak and his team have been talking to various groups about strategic investments & off-take agreements. Last year, Exxon, with its extraordinary oilfield capabilities made a big splash in the Smackover, a five-state-wide brine formation that’s been commercially exploited for bromine for 70 years.

Exxon is in the game, and Chevron, BP, Shell, Occidental Petroleum, Equinor ASA, Imperial Oil, Schlumberger & Devon Energy, are also thought to be looking into Li extraction from brines in N. America. There’s no better place to go than the Smackover Formation. The chart above shows dozens of potential strategic investors.

At this stage of (Li) development in the Smackover Formation, it’s probably better to buy into the trend than try to build out from scratch. It takes years to negotiate hundreds, even thousands of land deals to assemble a meaningful footprint.

Albemarle’s bromine operations required the signing of 9,500 lease agreements! Standard’s team has been building its land position in SW Arkansas for seven, and in east Texas, for three years, respectively. It knows the Smackover Formation extremely well and has the most data (drilling logs, pumping tests, hydrology studies, etc.).

So far, Standard has booked 4.6M tonnes, (2.8M tonnes @ 217 ppm Li at LANXESS (BFS-stage) + 1.8M tonnes @ 437 ppm Li at the SWA project (PFS-stage). There could be some upside to that 437 ppm grade as a high of 597 ppm Li has been logged.

SWA’s PFS showed an after-tax NPV of C$2.8B & IRR of 26% @ US$24,000/t Li hydroxide, or ~$1.5B & 20% at $18,000/t from 30,000 tonnes LCE/yr. Since 2019, the Top-4 M&A deals in Argentina valued Li brine projects — using solar evaporation ponds — at an average of US$811M.

Buyers Rio Tinto, Ganfeng Lithium, Zijin Mining & Tibet Summit paid between US$721M & $962M. I see no reason why Standard’s SWA project couldn’t be worth well into the US$100s of millions today, and upwards of a billion US$ next year (on a 100% basis).

In February, management explicitly stated that several sizable DoE & DoD grants are being pursued. News of loans & grants could come as soon as this 4th qtr.

Negotiations on off-take agreements are centered on upfront cash payments. For example, selling 2,500 tonnes LCE/yr. at a discounted price of US$12,500/t for five years, with the first two years totaling US$50M paid upfront. I don’t know how close we are to a deal like that, but in my view, it would be game-changing.

If Standard were to sell 70% of the SWA project in exchange for being free-carried through positive cash flow, its retained 30% interest would potentially be worth (30% of the after-tax NPV), ~C$450M @ a US$18,000/t hydroxide price, or ~C$840M @ $24,000/t, [midpoint = C$645M @ $21,000/t].

A midpoint of C$645M + the proceeds from the sale of a 70% interest, which would presumably be in the C$100s of millions. Again, I don’t know how likely a deal like that is, I’m just providing a frame of reference.

And then there’s Texas, everything’s BIGGER in Texas… As mentioned, drill results from three wells delivered Li grades up to 806 ppm, averaging 644 ppm on the east Texas Smackover properties.

In east Texas, Standard will be able to exploit both lithium & bromine resources from its growing portfolio of long-term leases. Based on Albemarle’s strong bromine margins in Arkansas, a combined Li/bromine operation in Texas could generate truly spectacular margins.

How high a grade is 806 ppm Li? It’s one of the highest brine grades reported in N. America. Those three wells alone are enough for a robust maiden resource estimate within a year. As geopolitical tensions & economic rivalry continue to increase between the West & China, made-in-America is becoming incredibly important.

Standard’s south-central U.S. locations are ideally located for security of supply, onshoring & speed to market. Getting critical materials by train/truck in a day or two, vs. several weeks by overseas container ships, makes a huge difference.

Commissioned in May-2020, the demo plant has operated nearly 24/7, processing > 17M gallons of Smackover brine, now operating at 90 gpm, via a commercial scale column. The demo plant continues to provide invaluable data that has led, and will continue to lead, to process improvements.

Scaling up from 90 gpm to 3,000 gpm for Phase 1A, a factor of 33:1, should be fairly straightforward. Some DLE technologies face scale-up factors of > 1,000:1. Standard Lithium (TSX-v: SLI) (NYSE American: SLI) offers a one-stop shop for scalable, sustainable Li/DLE extraction.

It has the right team & partners, exciting Li projects, large-scale, near-term production, incredible regional infrastructure, strong community support, and is in the heart of the Smackover Formation, the best source of Li brine in N. America.

Disclosures: Peter Epstein of Epstein Research [ER] has no existing or prior relationship with Standard Lithium. Mr. Epstein owns shares in the Company, that he purchased in the open market.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)