Joe Lowry’s Twitter: @globallithium joe.lowry@lithiumllc.com

After more than two decades working for one of the, “Big 3” lithium companies in senior positions in the U.S, Japan and China, Mr. Lowry formed Global Lithium LLC – an advisory firm that works with lithium producers, users, investors, hedge funds and governments on four continents. Mr. Lowry has a very extensive network of contacts, one of the best in the industry. Considered one of the world’s leading experts in lithium supply and end markets, his recent articles can be found on Linked-In: https://www.linkedin.com/in/jplowry

The following interview was conducted by phone and email in the week ended June 5, 2015. The interviewer, Peter Epstein, CFA, MBA of EpsteinResearch.com has no prior or existing relationship with any company listed herein. Peter Epstein has no prior or existing relationship with Joe Lowry or any of his business interests. I thank “Mr. Lithium,” for his time last week as he had a very busy schedule.

Please provide readers with an overview of the lithium supply side, including where we are in the cycle.

We should be in a period of significant investment, bringing large capacity additions; however, several factors have conspired to limit investment. They include: the political situation in Argentina and Chile, slower than anticipated development of the EV market, uncertainty caused by the delay in the start-up of Rockwood’s expansion in Chile, a slow start-up by Orocobre, the bankruptcy of Canada Lithium/RB Energy, etc. The lithium market is entering a shortage period that will last at least a year, possibly longer, depending on how the Rockwood expansion and Orocobre ramp-up play out.

What are your thoughts on demand?

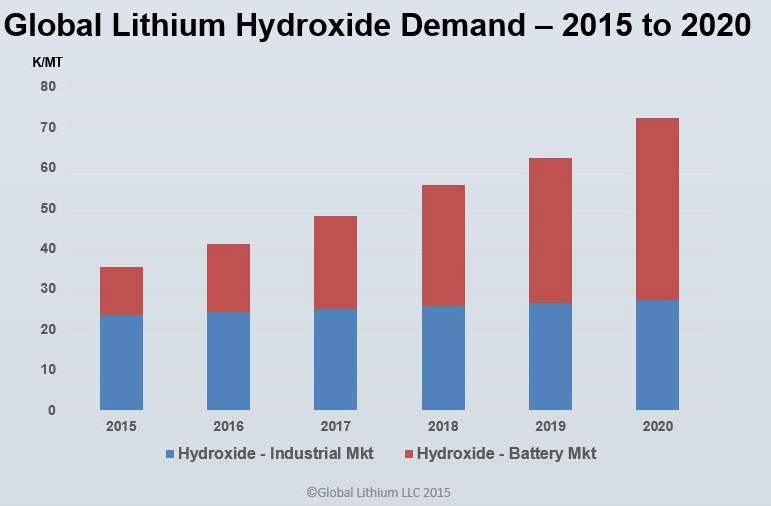

Lithium demand growth is of course led by batteries in things like cars, bikes, electronics, power tools; however base demand from grease, glass, ceramic and other industries continues to be stable, growing at GDP rates. Moving forward, strong demand is expected from home storage applications like Tesla Motor’s Powerwall offering and from the slow adoption of large grid-scale energy storage systems.

How important is the growing use of lithium for alloys such as lithium/aluminum for key components of airplanes, cars, etc?

Overall this is not significant in terms of lithium carbonate equivalent “LCE” demand; however the segment is high value so it will be more significant to a large metal producer such as China’s Ganfeng Lithium.

On a global scale, how important is lithium?

If you look at the person on your left and on your right, odds are 99% that they’re carrying a cell phone or another electronic device that contains lithium. Can the world survive without lithium? – Yes. Does it want to? – No.

Regarding the Lithium Triangle of Argentina, Chile and Bolivia is there risk of disruption of supply?

The government of Chile has made it difficult for both Rockwood and SQM to expand, going back several years now, via the permitting process required to expand capacity. Argentina is a political mess that has investors reticent to make large bets on projects like Lithium Americas Corp’s Cauchari-Olaroz project and Galaxy Resources’ Sal de Vida project. Bolivia is even worse with an unstable government and limited infrastructure to support development of lithium reserves.

What properties of lithium, the lightest metal make it important in many applications?

For batteries, the electrochemical properties of lithium give it a great power to weight ratio and a reasonable number of recharge cycles at an affordable cost. For other applications, lithium provides a wide range of benefits depending on the market – a powerful flux in glass, the enabler of grease to be used under a wide range of operating conditions, the catalyst for polymer and pharma reactions.

Has there been any changes in lithium prices over the last 6-12 months?

There’s already significant tightness in the upstream market (both carbonate & hydroxide) that will build over the next 24 months resulting in a significant price rise. In fact, prices rose substantially in the past year. Besides the delayed expansion at Rockwood and the slow start-up at Orocobre, another key factor is the limited output by SQM who seems to have production issues. They are not exporting in chemical form anywhere near the capacity they claim. They have been shorting customers in Asia on and off since 2014. The lithium chloride brine they ship to China as a raw material should not be counted in their LCE production when comparing their production vs. stated capacity. Over the past 6 months it has become clear that supply is short, causing the spot price to move up rather steeply. Suppliers are likely to go back to quarterly pricing reviews.

Has the use of lithium in batteries and large-scale energy storage become the go-to metal?

The term energy storage has many facets. Lithium will remain dominant in consumer electronics and transportation for the foreseeable future. Grid storage is still playing out – lithium certainly has a place but there are competing technologies in that area. I see no short or medium-term risk to lithium. Battery/Energy techno

How important is grade? In sectors such as graphite, grade is widely considered of paramount importance

Grade is important in certain areas but the term, “battery grade” is a marketing term over used by junior minors and analysts that don’t really understand the industry. Batteries going into Tesla’s cars are not made with, “battery grade” material as originally defined by their largest lithium supplier. There are certain specifications that lithium raw material must have, but, “battery grade” as a generic term creates more confusion than anything else. The, “premium” many analysts discuss for, “battery grade” lithium carbonate is largely a myth.

What are the differences between hard rock mining and harvesting lithium brines? Does each approach end up with roughly the same ending products?

Hard rock mining is generally more energy intensive and thus higher cost. On the other hand, the capital cost for hard rock projects is generally lower, production cycle times are faster so there are trade-offs. Both lithium sources can ultimately provide world class product although there are certain differences in impurities.

I recognize this is a complicated question, but what can you say about China’s role in the lithium market?

China is the largest lithium market and has the largest capacity for lithium chemical manufacture. While the “big 3” waffled; China added capacity despite having the highest cost structure. Chinese companies have lower ROI criteria and, generally speaking, more appetite for risk which has more than compensated for their higher cost structure.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)

Leave a Reply

You must be logged in to post a comment.