{Please see disclosures at bottom of page}

The following interview is of the CEO of Piedmont Lithium (NASDAQ: PLLL) / (ASX: PLL), Keith Phillips. Piedmont is an up-and-coming junior miner (at exploration-stage) with its main project, a hard rock lithium deposit, in the U.S.

I, Peter Epstein, CFA, of Epstein Research, have no prior or existing business relationship with Mr. Phillips, Piedmont Lithium or any predecessor companies. I chose to interview Keith because of his very extensive experience in junior mining companies and expert knowledge of valuing early-stage companies.

Appointed on July 6, 2017, Mr. Phillips has a career on Wall Street spanning 30 years during which he has worked on strategic & financing transactions representing over $100 billion in aggregate value. Mr. Phillips was most recently a Senior Advisor with merchant banker Maxit Capital, after leading the mining investment banking teams for Merrill Lynch, Bear Stearns, JPMorgan & Dahlman Rose.

Mr. Phillips has worked with numerous mining companies, including established global leaders, and has dedicated most of the past decade to advising exploration & development-stage companies in achieving their strategic objectives, with a particular focus on obtaining relevance in the U.S. capital markets. He received his MBA from The University of Chicago and a Bachelor of Commerce from Laurentian University in Canada.

Your Company is fairly well known in Australia, please give readers in North America the highlights of Piedmont Lithium.

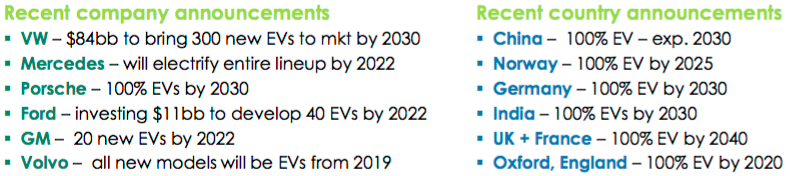

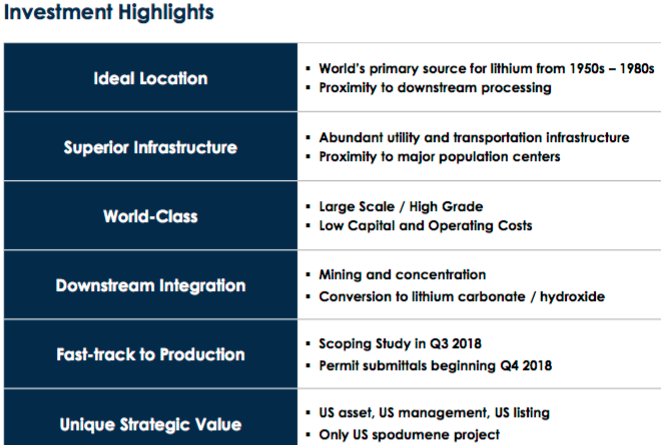

Piedmont Lithium (NASDAQ: PLLL) / (ASX: PLL) is participating in the exciting, fast-growing lithium business. We have the only independent U.S. spodumene project, and we believe our project combines large-scale, high-grade & clean metallurgy, all in an enviable location, hopefully resulting in very attractive economics.

You proudly describe Piedmont’s hard rock Lithium project as being in the best location in the world. Why is that?

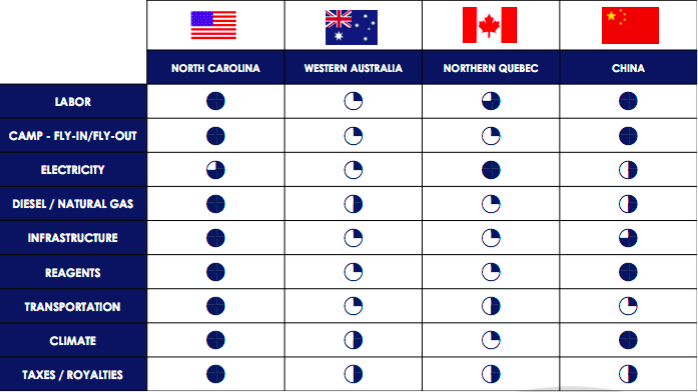

Most hard rock lithium resources are located in remote regions such as western Australia or northern Quebec, where utility, transportation and human resources are non-existent. Our project is located 30 miles west of Charlotte, North Carolina– near the east coast of the U.S., and we benefit from all the infrastructure one would expect to find in proximity of a major, fast-growing metropolis.

What factors lead you to suspect that the Piedmont project could be a low-cost operation compared to global hard rock peers?

Our location provides immense advantages over more remote sites. From a cap-ex perspective we benefit from abundant local and regional infrastructure, including major road, rail & air transport, and pre-existing electric power lines & natural gas pipelines.

From an operating cost perspective we have abundant skilled labor in our local region, so we will not require costly fly-in/fly-out camps that many projects require, and our energy costs will be a fraction of those incurred by many of the western Australian projects.

A number of industry pundits believe there’s a lack of experienced management in the Lithium sector. Does your team have what it takes?

While it is true that there is a lot of lithium in the earth’s crust, it is equally true that there are very few people with any real experience developing and operating lithium mines and conversion facilities. We are fortunate to be located in Gaston County, North Carolina, the cradle of the historic lithium industry and home to more seasoned lithium professionals than anywhere else in North America.

We have several experienced lithium hands on our team either as executives or consultants. As we grow the Company, we will certainly capitalize on the experienced professionals living in our home region.

How is your cash liquidity, will you need to raise capital anytime soon?

No, importantly we don’t need to raise any capital anytime soon. We have a strong balance sheet with US$9.6 M in cash at 3/31/18 and no debt. We did a very successful financing in November, selling 100 million shares at A$0.16 to several quality institutions in a highly-oversubscribed offering. We have the money we need to get through 2018.

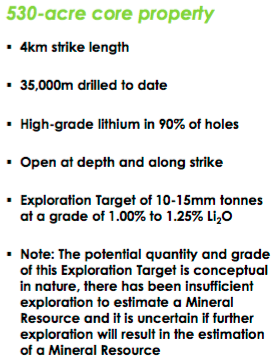

Your core property area is 530 acres. Is that a large enough footprint to potentially host an economically viable mine?

Absolutely! The two precedent open-pit mines in the area were both world-class and operated on even smaller plots of land than we have, the pits themselves were less than 100 acres in size. Our Sunnyside property is over 250 acres and we believe that is enough for a substantial operation as well. Having said that, we have bold aspirations and will continue to add to our land package. The American market will need a lot more lithium and nobody is better-positioned than us to deliver the product.

Lithium prices started moving significantly higher in the 2h of 2015. If development prospects in the past-producing Carolina Tin-Spodumene Belt are so strong, why aren’t FMC Corp. and Albemarle actively pursuing hard rock projects there?

Albemarle {NYSE: ALB} and FMC (NYSE: FMC) are both very large companies, and like most majors they are generally focused on more advanced projects. We are doing the missionary work of assembling the land package, drilling out a maiden resource and putting economic and metallurgical studies around it. If we are able to deliver what we expect to deliver, i.e. a large, low-cost integrated lithium project in the heart of Gaston County, NC, I suspect the larger companies will begin to pay attention.

Why isn’t anyone trying to reopen the past-producing Hallman-Beam or King Mountain Mines?

The Hallman-Beam mine operated for 43 years and by all accounts is fully-depleted. Albemarle owns the old Kings Mountain Mine, and they have recently completed a large exploration program; they are a large company and don’t report drill results but observers seem to feel ALB will put Kings Mountain back into production – that would be fantastic for us as it would bring further processing capacity to the region

When might you deliver a Maiden Mineral Resource Estimate?

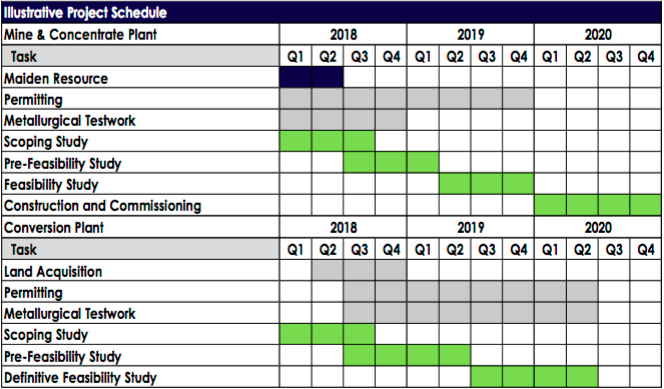

Our Maiden JORC Resource on our core property should be completed in mid-June, and we will follow that with a Scoping Study in July or August. These are critical milestones for us, and we believe will demonstrate to the market that our project has great potential in terms of scale and cost-position.

Can you give readers an approximation of the potential size and/or grade of the Piedmont project, or is it too early to tell?

In December we announced an Exploration Target of 10-15 million tonnes at 1.00%-1.25% Li2O. This Target is on our initial 530-acre core land package, and we see upside along strike and at depth, with future exploration at some of the recent landholdings we’ve added. The TSB is a massive trend, so we hope to build on our maiden resource and expand it substantially over the next several quarters.

At what stage might you be able to begin discussions with interested parties about potential off-take agreements? What type(s) of entities do you think would be interested?

We have been approached by several high-quality parties and expect to accelerate partnership discussions after we release our Scoping Study this summer. One thing that’s clear from our early discussions is that strategic parties and potential offtake partners are excited about the prospect of a secure U.S. supply of lithium chemicals.

Is there the potential to produce and sell other materials besides Lithium? Would byproducts be included in the indicative economics of a scoping study?

Historically, by-products accounted for as much as 50% of the revenue for lithium producers in North Carolina, including products such as quartz, feldspar and mica. Our focus for the Scoping Study is on optimizing recoveries of spodumene, and we will address the by-product opportunities later this year in preparation for a pre-feasibility study early in 2019.

We hope to demonstrate very low operating costs in the scoping study, and expect that those costs will be that much stronger upon the inclusion of relevant by-product credits in our PFS.

Your main stock listing is in Australia, and you recently listed on NASDAQ. Do you expect to generate much investor interest in the U.S.?

Thanks Keith, I’m a big fan of lithium projects in the U.S., especially after lithium was named as critical to U.S. interests, AND…. with a new Federal corporate tax rate of 21% (down from 35%). As you’ve explained, the Piedmont project has a lot going for it. I wish you luck and continued success in your exploration/development efforts!

I, Peter Epstein, CFA, of Epstein Research, have no prior or existing business relationship with Mr. Phillips, Piedmont Lithium or any predecessor companies. I chose to interview Keith because of his very extensive experience in junior mining companies and expert knowledge of valuing early-stage companies.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)