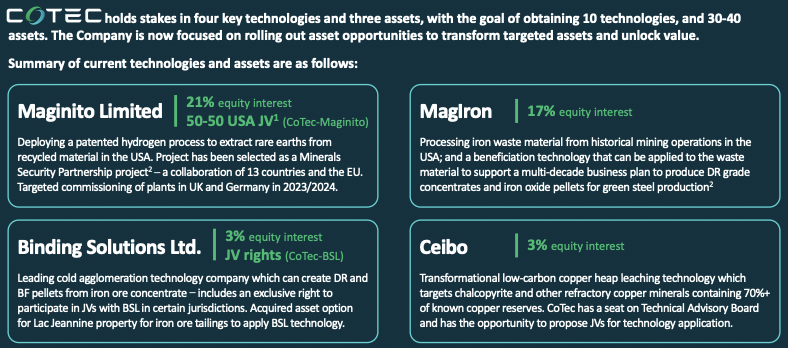

Sassy Resources (CSE: SASY) is a largely unknown spinout from Crystal Lake Mining (now called Enduro Metals). Sassy controls 100% of a promising gold-silver play in the Eskay Camp, at the heart of B.C.’s Golden Triangle (“GT“). The Foremore project covers 14,585 contiguous hectares (“ha“) containing high-grade precious metal targets + showings of zinc, lead & copper.

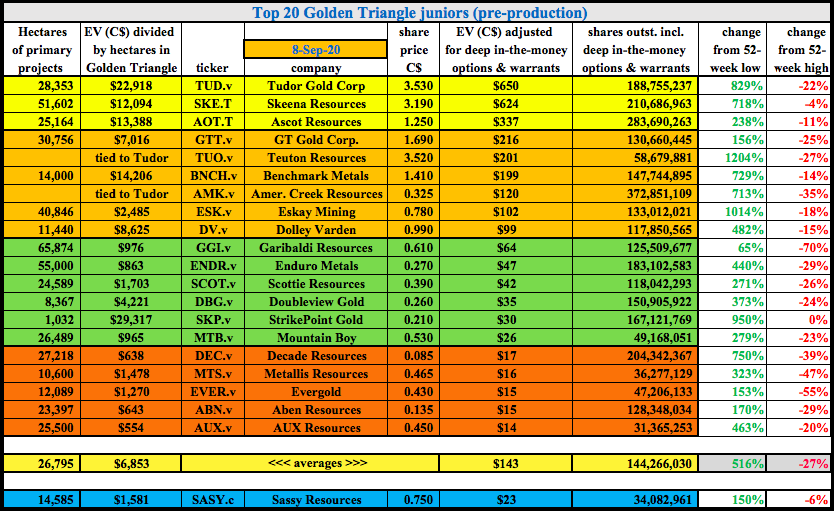

Sassy has an Enterprise Value (“EV“) {market cap + (0) debt – (~$2M) cash} of ~$20M. The capital structure is tight with only 29.1 million shares outstanding. {Please see my prior article here for further details about Sassy’s free float}. Sassy is the 16th largest pre-production junior in the GT.

Sassy’s high-grade Foremore compares in size to well-known GT projects

Compare Sassy’s 14,585 ha footprint to other high-profile GT projects like; Skeena Resources’ Eskay Creek @ 6,151 ha, and Ascot’s Premier (8,133 ha) + Red Mountain (17,125 ha). Tudor Gold owns 60% of the (17,913 ha) Treaty Creek project, and Benchmark Minerals has the (14,000 ha) Lawyers project.

Readers, consider that early next year Skeena (on its 6,151 ha Eskay Creek alone) expects to report an upsized resource of > 5 million ounces gold equiv., at > 5 g/t gold equiv. Sassy’s footprint is both sizable & centrally located.

Exploration on and around the Foremore property dates back > 30 years. It includes prospecting, mapping, sampling, airborne & ground geophysical surveys & 71 drill holes (+11 new ones last month, and a 2,000m program starting soon). Nearly $15M has been invested, $20M+ in today’s dollars.

Nearby projects include — Newmont’s/Teck Resources’ Galore Creek to the northwest, Teck’s/Copper Fox’s Schaft Creek to the north, Enduro Metals’ Newmont Lake to the southwest, and Skeena & Eskay Mining projects to the south.

Australian Major Newcrest Mining is in the GT through its 70% ownership of the Red Chris mine. Billion dollar companies Pretium Resources, Seabridge Gold & Hochschild Mining are active there as well.

Newmont & Teck are building the Galore Creek road passing directly through Sassy’s property, allowing for easier, less-expensive, year-round access to the Foremore site.

Teck is also a partner in nearby Schaft Creek. This bodes well for further investments by both companies into regional infrastructure & mining services, for the benefit of all parties, including Sassy Resources.

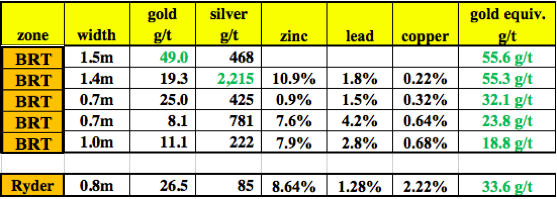

Best historical intercepts from a total of 71 holes:

Phase I was recently completed, followed by borehole electromagnetic surveys at each drilling location (BRT & Toe Showings) within each zone along the 5-km long historic More Creek Corridor. Drilling intersected additional mineralization at shallow depths, extending the base/precious metals-rich BRT zone (gold, silver & base metals) by 115 m along strike. A new style of mineralization was also discovered.

The Company’s technical team is pleased to have confirmed the conductivity of BRT-style mineralization through the use of Borehole EM (“BHEM“) surveys. The More Creek Corridor mineralization was previously thought to be non-conductive, but early success with BHEM at BRT bodes well for its use in ground & airborne EM surveys for future exploration initiatives across the entire project.

Preliminary assays were received for the first three holes of Phase I. The reason the results are not out is that a number of extra steps are being taken to confirm the accuracy of the preliminary assays before announcing the final assays on the three holes.

Broad high-grade gold/silver target Westmore rises to top of must-drill list

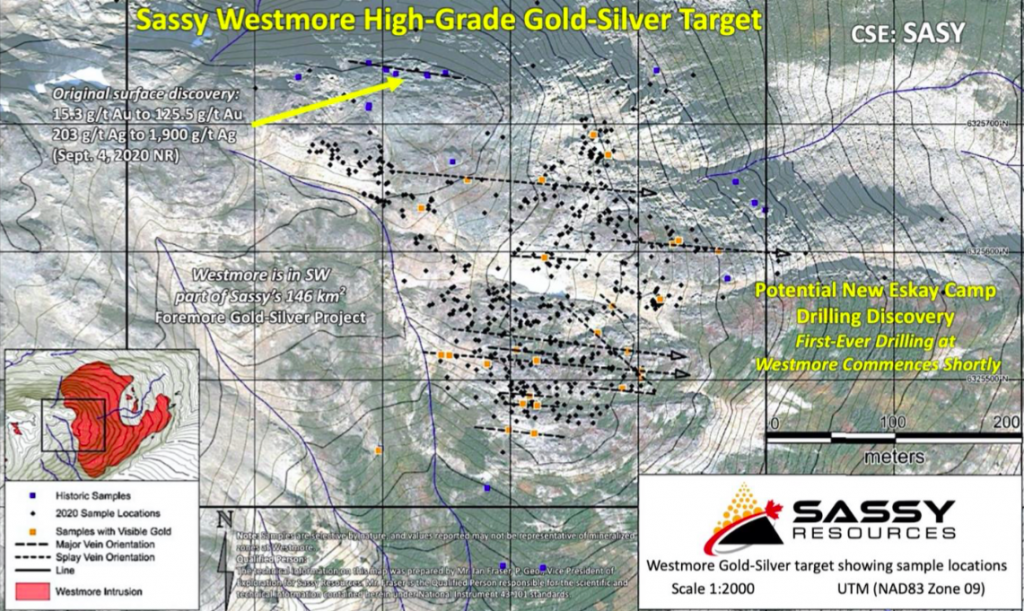

While exciting, Phase I was just the first of two high-grade project areas Sassy is laser-focused on. The bigger prize could very well be 3 km southwest — the Westmore “WM” target — to be drilled for the first time (ever), testing the continuity of the quartz vein-hosted high-grade, gold-silver mineralization to depth.

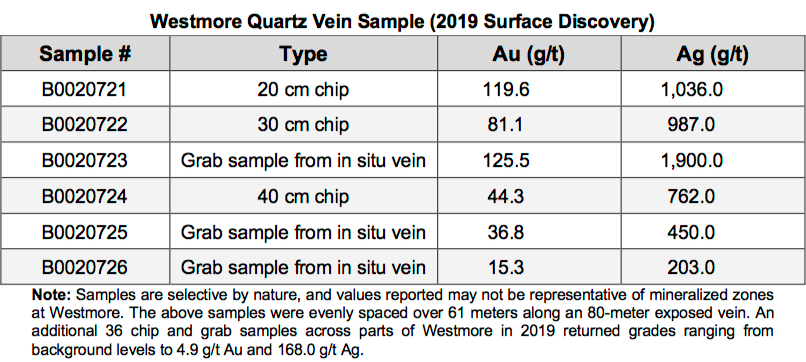

Until recently, much of WM (distinct from the More Creek Corridor), was covered by ice & snow year-round. As a result, there’s been a dearth of exploration. However, the maiden surface program last year, (done when Sassy was a private company), returned 15.3 to 125.5 g/t gold, plus 203 g/t to 1,900 g/t silver in the best six chip & grab samples. At spot prices, the 125.5 g/t gold + 1,900 g/t silver sample = ~152 g/t gold equiv.

New surface discovery, including visible gold, at Westmore….

In recent weeks, further work at WM demonstrated that vein density increases significantly in a south / south-easterly direction up to 400m from the initial surface discovery. Mineralization remains open to the north, south & east, and visible gold has increasingly been observed (assays pending on nearly 400 surface samples).

The primary area of interest covers a minimum of 2 x 2 km. To say that management, the board, advisors & technical team are anxious to start drilling at WM would be a gross understatement! In fact, the Phase II campaign of 2,000 meters is now 100% directed at WM…. Just 1 of 12 known groups of precious & base metal showings within the Foremore project area.

Mr. Mark Scott, Sassy Resources President & CEO, commented,

“We are very pleased with how quickly this new surface discovery is building out and ticking all the boxes at this early stage. We look forward to drill-testing the Westmore target later this month.

Mr. Ian Fraser, VP Exploration added,

“The distribution of veins, up to two meters wide, is impressive, along with the extent of galena. The system has an order & coherency to it at surface which will allow for an effective drill strategy right off the bat. We’re a year into this, and Westmore keeps looking better. This has the earmarks of a potential new Eskay Camp gold-silver drilling discovery.”

Conclusion

Sassy Resources (CSE: SASY) is poised to move forward on a new high-grade, gold-silver target in the heart of the Eskay Camp, in the middle of B.C.’s GT. Management had planned to drill several of 12 high-grade showings. However, recent surface work convinced management to focus entirely on a promising 2 x 2 km area at Westmore.

This is a company with high-grade precious / base metal discovery potential, near-term Phase I drill results, in a world-class jurisdiction, in the midst of a bull market. And, readers are reminded that Sassy has a very tight capital structure, just 29.1M shares outstanding.

I’m tracking 529 gold-heavy Canadian & U.S.-listed juniors with market caps between $3M & $999M. Including Sassy, 36 have substantially all, or at least their most important assets, in the GT. The average gain of the top 20 GT juniors is +516% (from 52-week lows). The top 5 are up an average of +950%, the top 10, +785%. Wow.

Compare that to Sassy at $0.75/shr., up +150% from its last capital raise done at $0.30. Subject to some good luck with the drill bit (based on strong data & expert drill targeting) this story has legs.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Sassy Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Sassy Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Sassy Resources was an advertiser on [ER] and Peter Epstein owned zero shares, options & warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)