All else equal, the risk of owning junior miners — while always high — falls after precipitous declines in valuations. That’s hardly a comforting opening sentence, but a fact worth considering. This Summer is shaping up to be a great opportunity to buy cheap metals & mining companies.

Copper juniors have performed terribly of late, many are down 35%-70% from 52-week highs. This, despite copper (“Cu”) being #1 on any list of battery/green energy, high-tech metals.

Highly respected mining financier Robert Friedland recently opined that long-term Cu supply is increasingly uncertain as new mines are not coming online fast enough. Cu inventories at the LME, CME & Shanghai Futures Exchange totaled 165,000 tonnes on June 23rd, the lowest since 2008.

Friedland said, “my fear is that when push finally comes to shove, copper prices can go up 10 times…” No one wants prices to soar that high, it would kill the economy. Yet fundamentals are pointing decisively to higher levels. Only China’s slower than expected economy is holding Cu back, but that won’t last.

Citigroup is calling for up to $6.80/lb. by 2025 vs. $3.75/lb. today. Several other investment banks & industry consultants believe $5.00+/lb. will be the new normal.

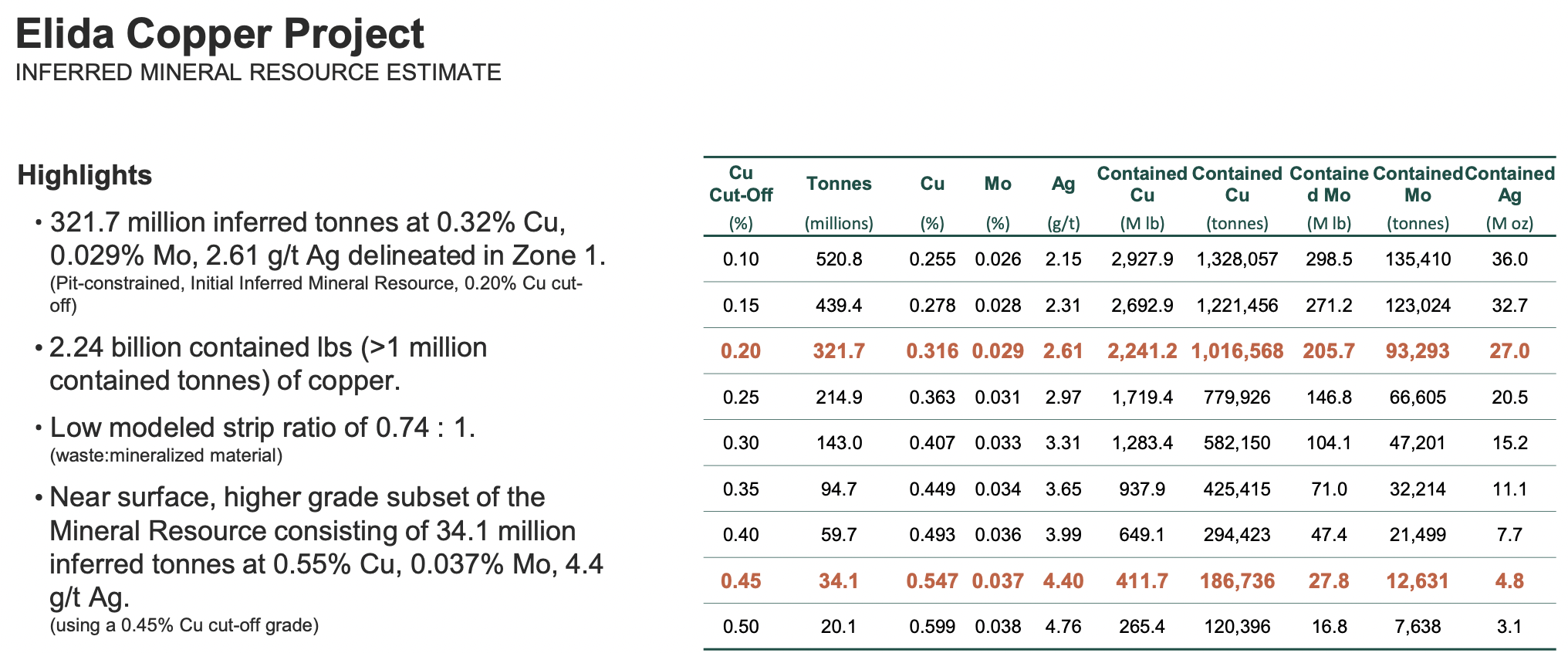

I continue to like Element 29 Resources (TSX-v: ECU) / (OTCQB: EMTRF) for its ultra-low valuation and blue-sky potential in Peru. The Company has discovered 2.24 billion pounds of Cu + ~206M pounds of Molybdenum (“Mo”) & ~27M ounces of silver (“Ag”), but there’s an opportunity to deliver a multiple of that endowment.

Readers are encouraged to revisit my last article and continue reading this interview with CEO/Pres./Dir. Steve Stakiw. Element 29’s new corporate presentation is a must see as well. Management is in the middle of raising C$2M, which would result in an enterprise value {market cap + debt – cash} of ~C$14M.

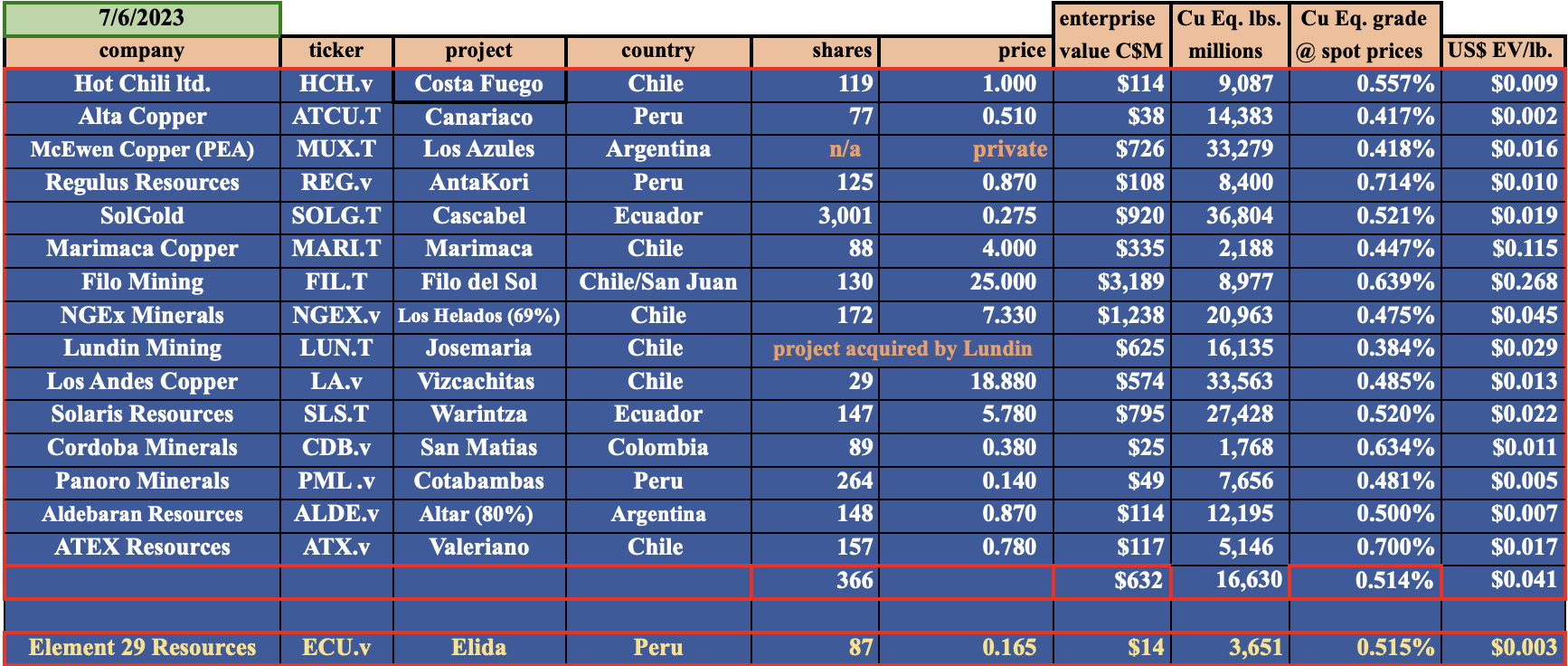

Element 29’s two primary projects (of four total) are fairly new, they’re not plagued by legacy issues that have slowed or stalled projects in S. America. The Company is valued at just US$0.003/Cu Eq. lb. vs. US$0.010/lb. among peers (not incl. more advanced projects owned by Filo Mining, Marimaca, SolGold, Solaris, NGEX, McEwen Copper, Regulus Resources, Lundin Mining, Los Andes Copper & Alta Copper).

Steve, please give readers the latest snapshot of Element 29 Resources.

Sure. Element 29 Resources is a Cu explorer/developer advancing our 100%-owned Elida & Flor de Cobre projects in Peru with a focus on growing Cu (+ Mo/Ag) resources by expanding mineralized zones across multiple untested targets and making new discoveries.

Both projects compare favorably to peers. They sit at relatively low elevations, have access to water, and are near major roads, green hydroelectric power, ports & skilled workforces.

Both projects are in proven mining regions and have drill permits. There are no competing uses on the project areas. Elida is a significant porphyry Cu discovery with a high concentration of Mo and substantial expansion potential. Drilling is planned to increase & upgrade the initial mineral resource and test other porphyry centers.

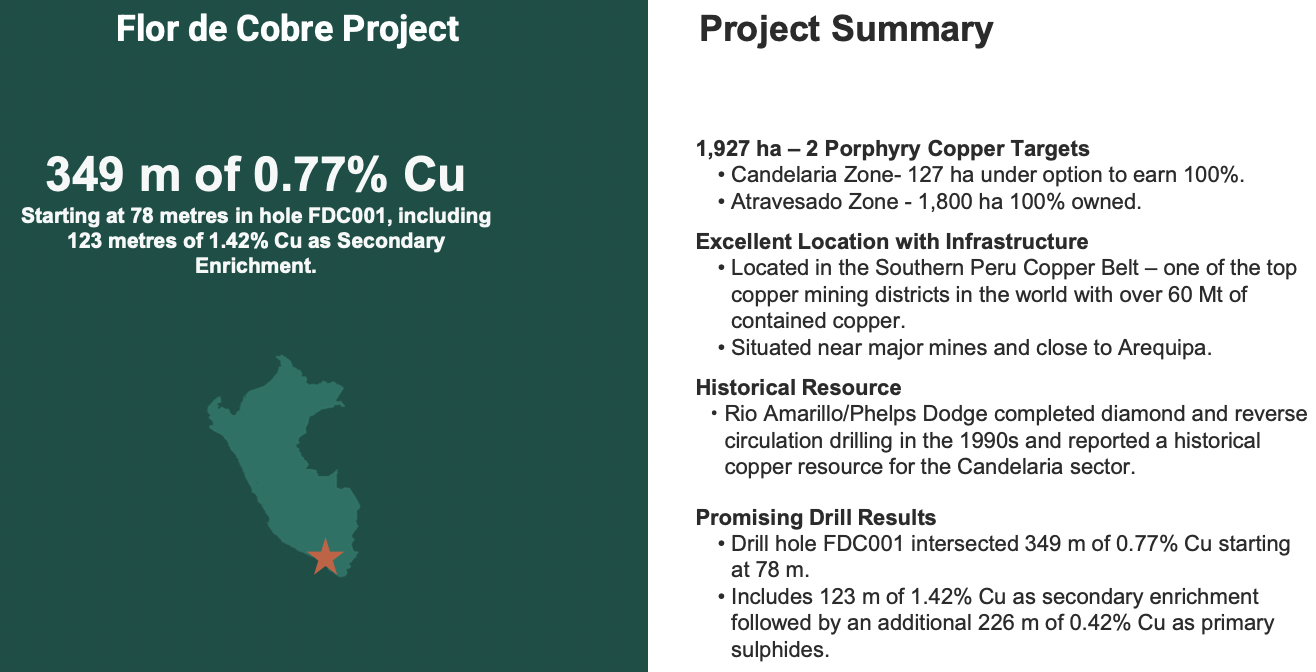

Recent drilling at the Candelaria zone at Flor de Cobre confirmed past drilling data from an historic resource estimate. We plan to complete a new resource estimate on this near-surface deposit. We’re also looking to drill the large untested Atravesado porphyry zone.

Tell us more about your co-flagship projects Elida & Flor de Cobre.

Elida is in west-central Peru and hosts a maiden mineral resource of 322M tonnes grading 0.32% Cu + 0.03% Mo & 2.6 g/t Ag. That’s a total of 2.24 billion pounds of contained Cu at a 0.20% cut-off grade, and ~206M pounds of Mo.

A near surface, higher-grade subset of the Resource hosts 34.1M tonnes at 0.55% Cu, 0.037% Mo + 4.4 g/t Ag has the potential to be mined with minimal stripping in the initial years. At spot prices, that’s a Cu Eq. grade of 0.82%.

The 322M tonne resource is on just one of five porphyry centers identified so far. Drill results included a 405 m interval of 0.45% Cu, 0.032% Mo + 3.6 g/t Ag (0.60% Cu Eq.) starting from 45 m. Importantly, that hole ended in mineralization grading 0.75% Cu, 0.032% Mo + 7.2 g/t Ag (0.93% Cu Eq.).

Our Flor de Cobre project is in the Southern Peru Cu Belt, ~26 km SE of Freeport McMoRan’s giant Cerro Verde mine (sixth largest Cu mine). It hosts two Cu porphyry systems; the Candelaria zone (with an historic resource of 57.4M tonnes of 0.67% Cu associated with a near-surface supergene enrichment zone).

The second system is the large, untested Atravesado porphyry zone (> 1.5 by 2.5 km) with coincident geophysics and widespread Cu oxide mineralization.

Do exploration & development projects in Peru enjoy advantages in terms of costs, logistics & other factors compared to projects in Chile, Argentina and/or Ecuador?

Yes, we think so. Peru is the world’s 2nd largest Cu producer and a great place to operate. Compared to many S. American countries, Peru stands out for its stable mining legislation, global free trade agreements & bilateral investment treaties.

Peru ranks above Chile, Mexico, Colombia and the Argentinian provinces of Jujuy, Salta & Catamarca in the latest annual Fraser Institute Mining Survey – Investment Attractiveness Index.

The world’s largest Cu producers are active in Peru investing billions in mine expansions & new operations — a strong endorsement of the country. Peru is a low-cost jurisdiction in S. America, and even more so compared to the U.S., Canada & Australia.

The largest Cu mines are decades old. What can your team learn from existing operations?

Good question. Globally, mined grades have been declining for decades, making the hunt for new Cu discoveries increasingly urgent. We have learned a tremendous amount from existing producers.

Meaningful cooperation with local communities must begin immediately, access to water is paramount, operating at relatively low elevations is a key advantage, and being close to ocean ports is critically important.

Your team announced an interval at Elida of 405 m of 0.45% Cu + 0.032% Mo, for a Cu Eq. grade of 0.60%. The last 13.4 m returned 0.75% Cu / 0.93% Cu Eq. Please talk about your prospects at depth.

Yes, results from our Elida Phase 2 drill program improved our understanding of the continuity of mineralization and increased our confidence level in the near-surface, higher-grade zone of mineralization.

Additionally, the presence of strong poly-metallic mineralization at the bottom of that hole is very encouraging. It provides a high-priority target for future drilling. Our deepest drilling to date returned significant grades to depths of > 900 m.

As good as that hole was, don’t forget our Phase 1 drilling highlights; 909 m at 0.55% Cu Eq., incl. 340 m at 0.67% Cu Eq., and 384 m at 0.71% Cu Eq., incl. 315 m at 0.76% Cu Eq.

Elida’s Mo concentration is well into the top quartile of mines / projects in S. America. Can you discuss the benefits of having a strong Mo credit?

Molybdenum is mostly used to make stainless steel alloys that boost strength, hardness & conductivity, and enhance resistance to high temperatures & pressures, corrosion & wear.

Mo is a fairly common by-product in porphyry projects, however Elida’s grade of 0.03% is meaningfully higher than average. With Mo setting record (nominal) highs above $40/lb. in February, and still at $24/lb. today, the outlook is bullish.

At spot pricing, Elida’s Cu Eq. grade at is the same or higher than the adjusted grades of key projects & mines owned by Anglo American (Los Bronces & Quellaveco), Southern Copper (Toquepala), Codelco (Radomiro Tomic, Salvador & Chuquicamata), Teck Resources (Quebrada Blanca), Freeport McMoRan, (Cerro Verde), Antofagasta Minerals, (Centinela, Antucoya, Los Volcanes, Zaldívar & Polo Sur), Alta Copper, McEwen Copper, NGEx Minerals, Lundin Mining (Josemaria, Chapada, Caserones & Candelaria), KGHM, South32 (Sierra Gorda), SolGold, First Quantum (Taca Taca & Haquira), Los Andes, Hudbay Minerals, (Constancia), Solaris Resources, Marimaca Copper, Aldebaran Resources & Panoro Minerals.

Longer-term projections average ~$14/lb., but adjusted for inflation Mo traded around ~$50/lb. in 3Q 2008. Prices above $14/lb. are reasonably possible. Our resource of ~206M pounds of Mo has an in-situ value of nearly US$5 billion at spot, and nearly US$3 billion at $14/lb.

Please talk about Flor de Cobre’s ultra high-grade zone, an area that could potentially be mined sooner than other areas?

The Candelaria zone at Flor de Cobre hosts an historic resource of higher-grade Cu in a near-surface supergene enrichment zone. Last year we successfully confirmed the higher-grade and we’re planning a new mineral resource estimate.

Drilling at Candelaria returned 349 m of 0.77% Cu starting at 78 m, incl. 123 m of 1.42% Cu within the enrichment zone.

Despite already booking 2.24 billion of pounds of Cu & ~206M pounds of Mo, some fear that your projects are too small for the largest companies to care about. Do you agree?

Elida has many attributes important for enhancing its economic potential. Drilling demonstrates that mineralization comes to the bedrock surface, including higher-grade zones. This provides an opportunity to potentially mine better grades early on in the mine plan.

The resource has a low strip ratio of just 0.74:1. Extensive mineralization is supported by steeply oriented drill holes that returned well-mineralized intervals exceeding 350 m of vertical depth. One hole tested a vertical column of continuous mineralization to 900 m, ending in mineralization.

The current drill hole array shows good lateral continuity. Elida is at ~1,600 m elevation, well below the 3,500 m threshold where elevation begins to have a significant impact on operating costs & logistics. The project is close to public transportation routes and an electrical transmission network.

Is there anything else you would like to address?

No, just that we have four projects, two are world-class and our primary focus. We already have porphyry discoveries, one at Elida (and a maiden mineral resource), and another at Flor de Cobre, (maiden resource coming soon).

Our flagship projects are new, near major mines & projects, and are surrounded by critical regional infrastructure. Both projects are relatively low in elevation and have good access to water. Our team has extensive experience in copper, in porphyries and in Peru / S. America.

Element 29 is years ahead of anyone looking to acquire greenfield properties. We have exciting drill programs coming up and we’re very optimistic on long-term Cu prices. We’re trading at just US$0.003/lb. of Cu Eq., and we think there’s a lot more Cu Eq. to be found on our projects.

Thank you, I look forward to ongoing updates on Elida & Flor de Cobre and a stronger Cu price!

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Element 29 Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Element 29 Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this interview was posted, Element 29 Resources was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)