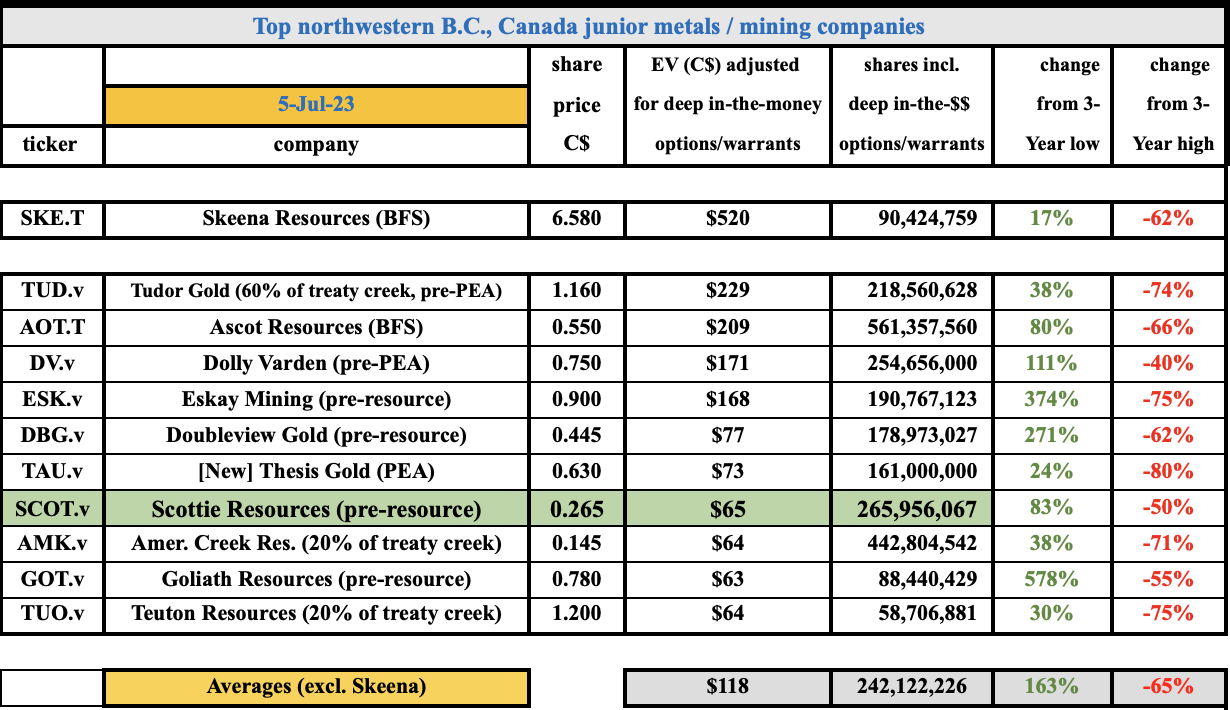

While I try not to talk incessantly about M&A in the gold junior space, it’s getting harder not to. More specifically, M&A in B.C., Canada is picking up steam and could remain strong for quite some time. Newmont is acquiring Newcrest in part for its high-grade Brucejack gold, and 70% interest in the Red Chris gold-copper, mines.

Thesis Gold is merging with Benchmark Metals to form a 5M oz. company with a new PEA slated for mid-2024. Canadian bellwether Teck Resources is selling its coking coal operations and is thought to be looking at (among other things) gold and/or copper assets in B.C.

Teck already has JVs on two world-class projects, Galore Creek (50%) & Shaft Creek (75%), and recently made an investment in American Eagle Gold. Freeport McMoRan & Boliden AB have investments in Amarc Resources. Newcrest announced a study to extend the life at Red Chris mine by decades.

In another potential blockbuster deal, Glencore is trying to acquire Teck, but Teck is pushing back hard against the proposal. Might Glencore be interested in other assets in B.C.?

Freeport McMoRan, Boliden AB, Kinross, Centerra Gold, Seabridge & Hecla Mining are invested in B.C., and BHP acquired a 19.9% stake in Brixton Metals. In January privately-held Peruvian firm Ccori Apu invested C$45M for a 19.9% interest in Ascot Resources.

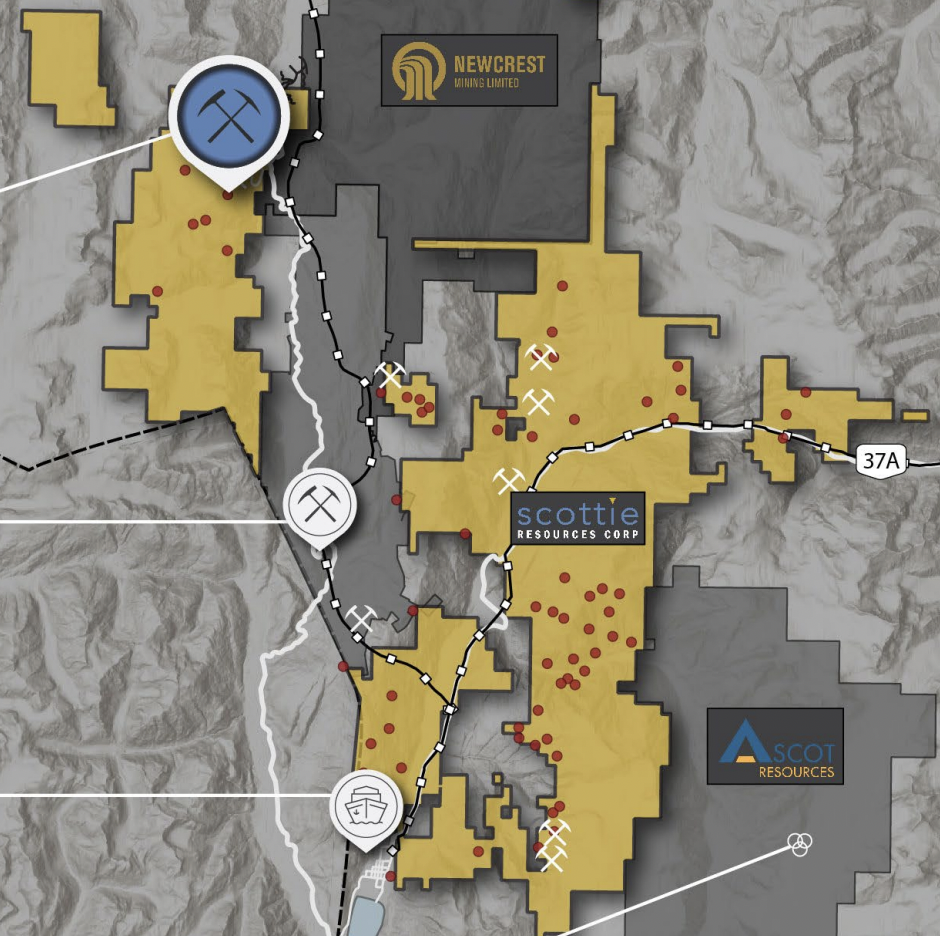

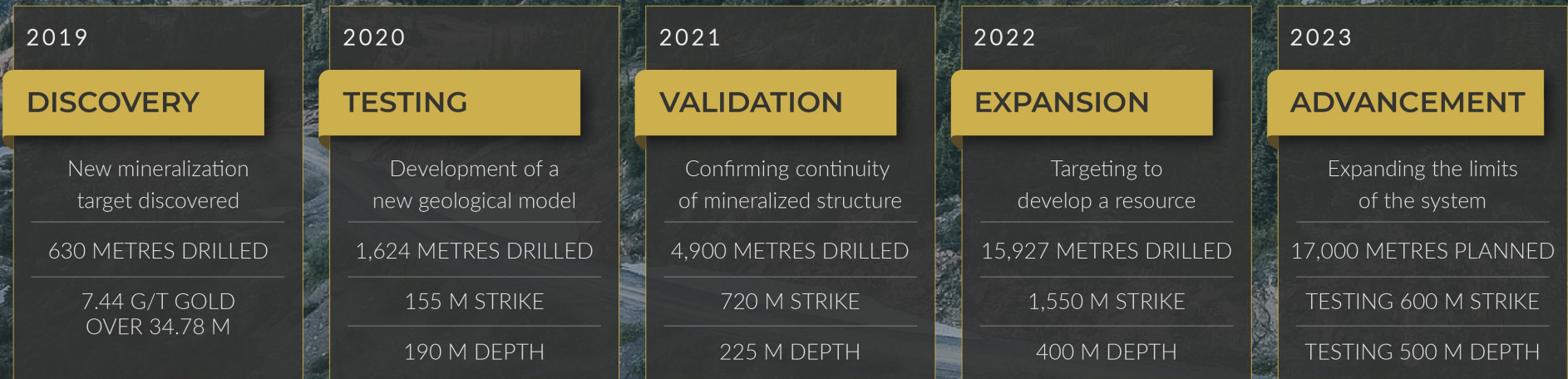

In June Scottie Resources Corp. (TSX-V: SCOT) / (OTC: SCTSF) started a 20,000 meter drill program on its 100%-owned (no royalties) high-grade, road-assessable, Blueberry Contact Zone (“BCZ“), only a tiny portion of Scottie’s 60,000 hectare land portfolio.

The BCZ is ~20 km NW of Ascot’s Premier project coming online in 1Q 2024, ~25 km south of Newcrest’s Brucejack mine, and two km N-NE of the past-producing Scottie gold mine (also 100%-owned, royalty-free). This season’s focus is on expansion of the BCZ’s structure at depth & along strike. So far the deposit measures ~1,550 meters long by ~400 meters deep.

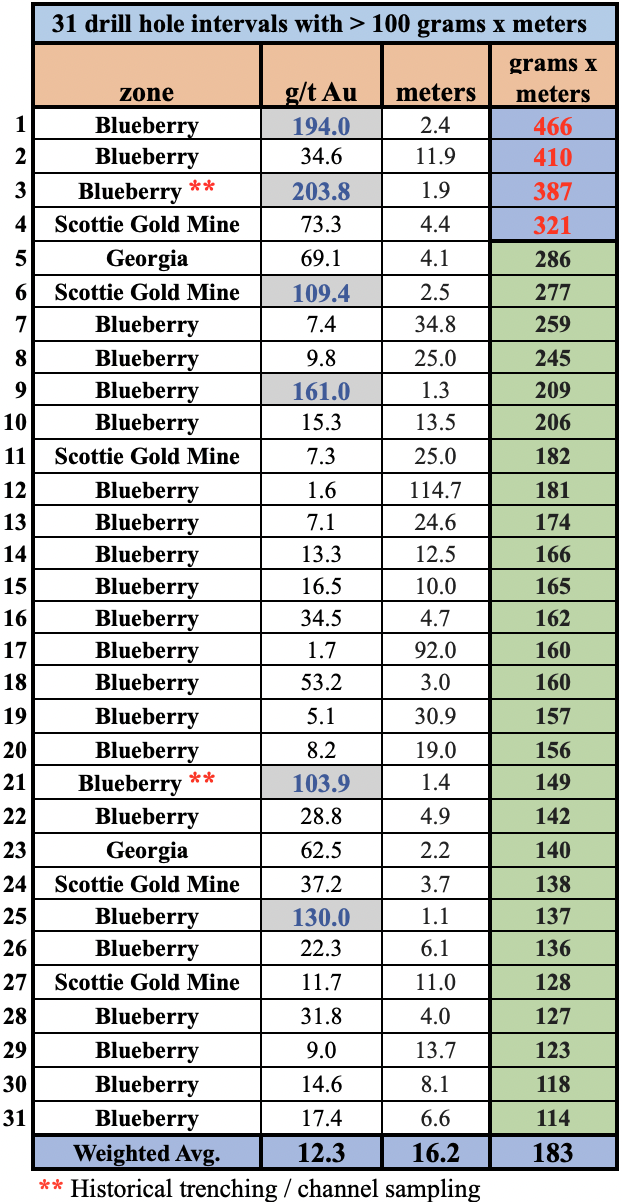

Please see the latest corporate presentation. Scottie has delivered excellent exploration results, see the 31 drill hole intervals chart above. Scottie has delivered thirty-one 100+ gram-meter intercepts (incl. two historical trenching / channel samples) with lengths averaging 16.2 m at a (weighted-avg.) grade of 12.3 g/t gold.

The SGM project that hosts Blueberry has an active permit allowing for the mining of up to 75,000 tonnes/yr., ~200 tonnes/day. This is interesting given that Newcrest & Ascot each have mills within ~25 km of the BCZ.

Initial drill results should begin to be announced in August as the initial three holes have been logged and sent to the lab. Two thousand (10%) of the 20,000 meter program has been completed and three rigs are turning.

Continued strong intervals from the BCZ would be even more exciting given the preliminary metallurgical testing recently announced. Using multiple methods & parameters, gold recoveries of 87.2% to 97.6% were achieved.

CEO Brad Rourke and team are excited by the preliminary met work because they were not sure how recoverable BCZ mineralization would be. While they already understand recoveries at the past-producing SGM, nothing had been done at the BCZ, until now. This news further de-risks the BCZ as the [potential] ounce count hits 2M (my guess, not guidance from Scottie).

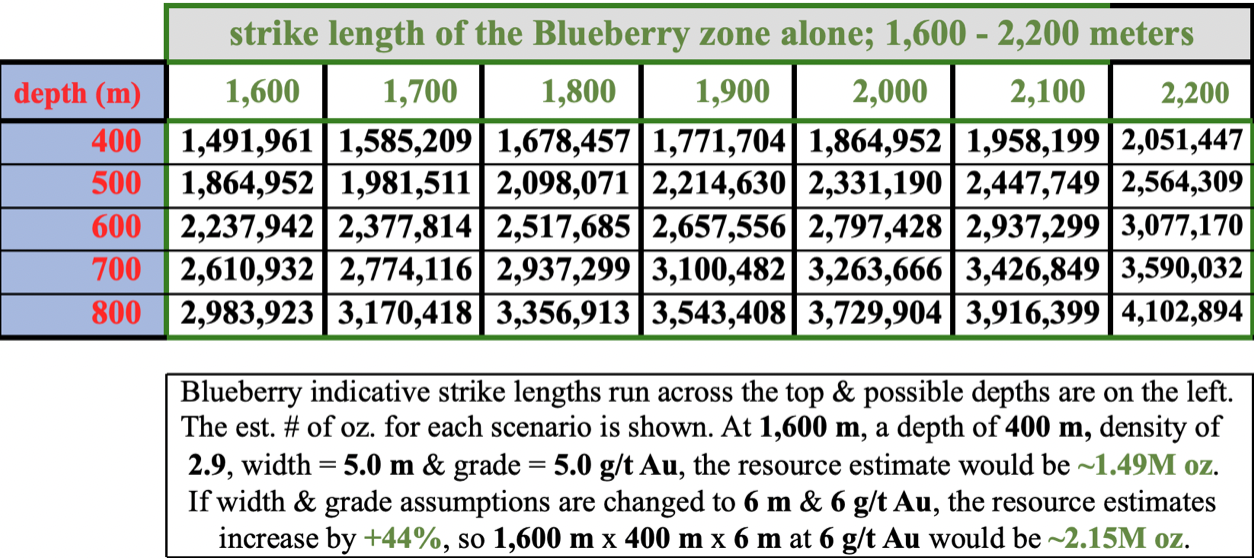

The BCZ likely has 2M, and possibly 3M+ ounces of gold, see chart above. Not just any ounces, high-grade ounces within just 20-25 km of two significant third-party gold mills. Scottie is sandwiched between Newcrest/(Newmont) & Ascot.

A potential lateral extension ends at 2,200 m. How much deeper than 400 m could it run? Brucejack & Red Chris are mineralized to at least 1,800 m. Please note, this doesn’t mean Scottie’s deposit at the BCZ will be nearly as deep, but it will be tested to 500 m depth this summer.

Combining Ascot/Scottie with Brucejack would generate cost saving opportunities, valuable operating flexibility & economies of scale. Newmont would have two mills instead of one, and would benefit from the addition of several high-grade deposits within 50 km of both mills.

While Newmont îs best positioned to take out Ascot/Scottie, Teck should not be ignored. As mentioned, it’s selling its coking coal assets (for > $12B) and could redeploy some of the proceeds into gold/copper assets in B.C.

Teck could temper Newmont’s dominance in B.C. by acquiring Ascot/Scottie — which combined likely hosts 5M high-grade ounces — enough to produce 250k oz./yr for 20 years. However, assuming aggressive drilling across Ascot’s & Scottie’s entire land packages, Newmont or Teck or Freeport could possibly book millions more ounces.

Freeport would also benefit from acquiring Ascot/Scottie. It has a toehold position in B.C., and is arguably overly exposed to Indonesia with a 49% interest in Grasberg, the world’s largest copper-gold mine.

Readers are reminded that Newmont, Teck & Freeport aren’t the only games in town. A dozen or more NDA’s have been signed by mid-tier, Major & super-Major miners. Companies with $100s of millions in cash, or billions if the suitor happened to be Newmont, Teck, Freeport, BHP or Glencore. [note, I don’t know the names under NDA].

Many management teams reviewed Scottie’s core samples at this year’s PDAC where Scottie was one of a limited number of juniors invited to display at the Conference’s Core Shack. Interest from PDAC bolstered the number of requests for site visits. Interest is only growing after news of the promising metallurgical test results.

Another scenario to consider, although not a primary focus, is Scottie farming-out or forming JVs on the 31,736 hectare Cambria and/or 17,625 hectare Georgia projects. These two royalty-free blocks are formidable & geologically promising, but Scottie hasn’t had the funds to advance them.

Given their sizes / locations, they could be worth millions of dollars as part of separate entities, but are currently ascribed minimal values as all eyes are on the BCZ & the SGM. To be clear, Scottie has no interest in selling out this year unless at a very attractive valuation. There’s too much drilling to be done and management is funded for this year’s program.

Readers are encouraged to take a closer look at Scottie Resources (TSX-V: SCOT) / (OTC: SCTSF). A quick review of the maps in the corporate presentation provide a clear indication of why Scottie is a prime takeout candidate, but probably not before delivering a robust maiden mineral resource estimate, a resource that would likely include this year’s and next year’s substantial drill campaigns.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Scottie Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Scottie Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Scottie Resources was an advertiser on [ER] and Peter Epstein owned shares in the company

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)