The spot Lithium (“Li“) price (battery-quality, Li carbonate) in China has settled in the low US$40,000s/metric tonne after trading above $80,000/mt in November. Any price above $20,000/mt is excellent for [most] Li juniors, and > $30,000/mt for an extended period would be extraordinary.

Needless to say, Li-ion battery makers/users were not happy with prices above $80,000/mt, levels that encouraged a move to a new battery chemistry — sodium-ion — that doesn’t use Li.

However, both Fastmarkets & Benchmark Mineral Intelligence have said that by 2030 sodium-ion batteries are likely to represent < 10% of the total EV battery market (Fastmarkets forecasts 9% penetration in EVs in 2033).

Most analysts, consultants & pundits agree that Li will remain in short supply, or be under-supplied, for much of the next decade. There’s a sweet spot for Li prices, perhaps in the $25-$40,000/mt range, where producers & endusers thrive and there’s less incentive to pursue alternative battery chemistries.

I continue to love Canada as one of the best places on earth to explore/develop Li prospects due to its nearly 100% green, low-cost hydro-electric / nuclear power, close proximity to the U.S. EV market and dozens of high-quality, low technical risk conventional hard rock Li projects.

Quebec & Ontario are not only Canadian Li-ion / battery metal hubs, they’re emerging as globally significant jurisdictions that will have a number of spodumene conversion facilities. SE Manitoba, host to the only active Li mine in Canada, is next to NW Ontario and is also developing into an important hub.

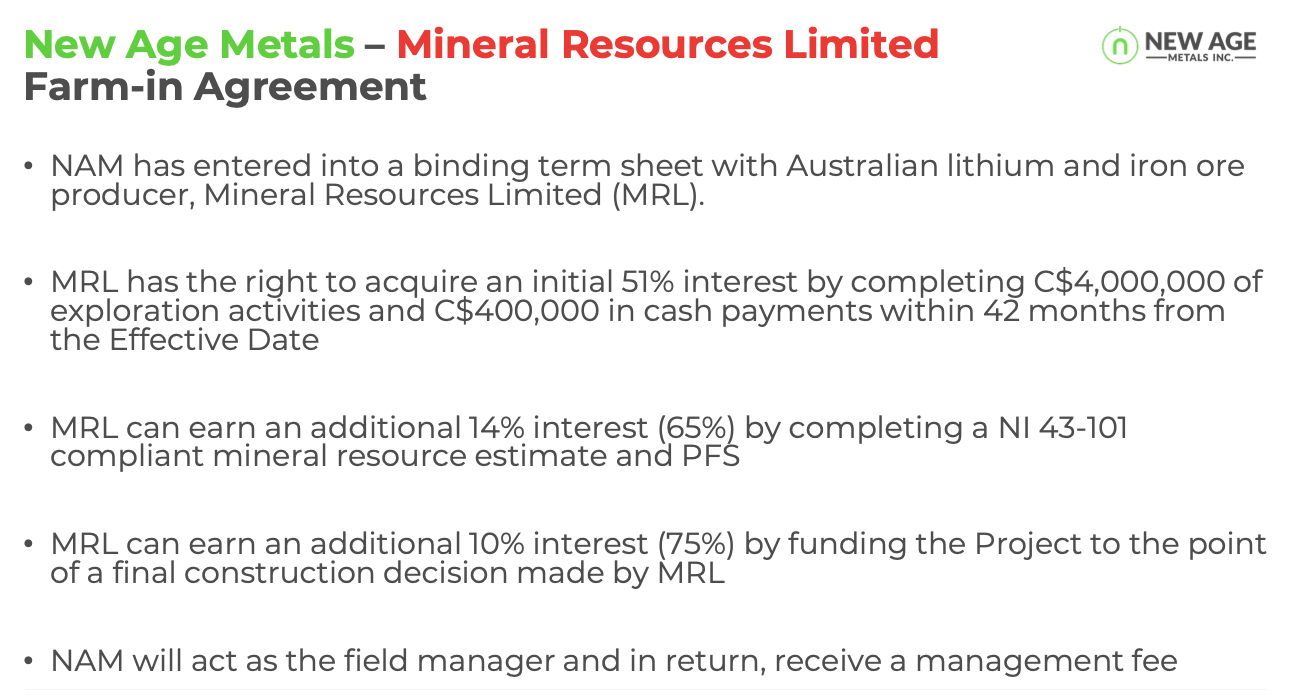

New Age Metals (TSX-v: NAM) / (OTCQB: NMTLF) has a promising 21,611 hectare portfolio of Li properties in SE Manitoba being farmed-out (up to a 75% interest) to Australian Li Major Mineral Resources (“MinRes“).

If MinRes earns the full 75%, it will have free-carried New Age for several years through delivery of a Definitive Feasibility Study (“DFS“) and a final construction decision. At that point, MinRes will have, (in my view) invested $25M+ in drilling + other exploration + a PEA, PFS & DFS.

I believe a 25% stake in the project, if a move forward decision is made to start construction, could be worth C$50M [or more] based on advanced-stage projects owned by Critical Elements & Rock Tech Lithium that host an average of 25M tonnes at ~0.91% Li20. Despite this, New Age’s enterprise value {market cap + debt – cash} is just C$6M.

Consider that a potential future value of C$50M would not mean all that much if management planned to dilute shareholders twice a year for the next several years. New Age doesn’t need to do that, not even close.

Readers are reminded that New Age’s properties are close to the high-grade Tanco mine. Unlike the vast majority of peers, New Age will not need to issue more shares anytime soon. It’s sitting on ~C$4M in cash and has minimal cash burn as MinRes is paying for 100% of the exploration in SE Manitoba.

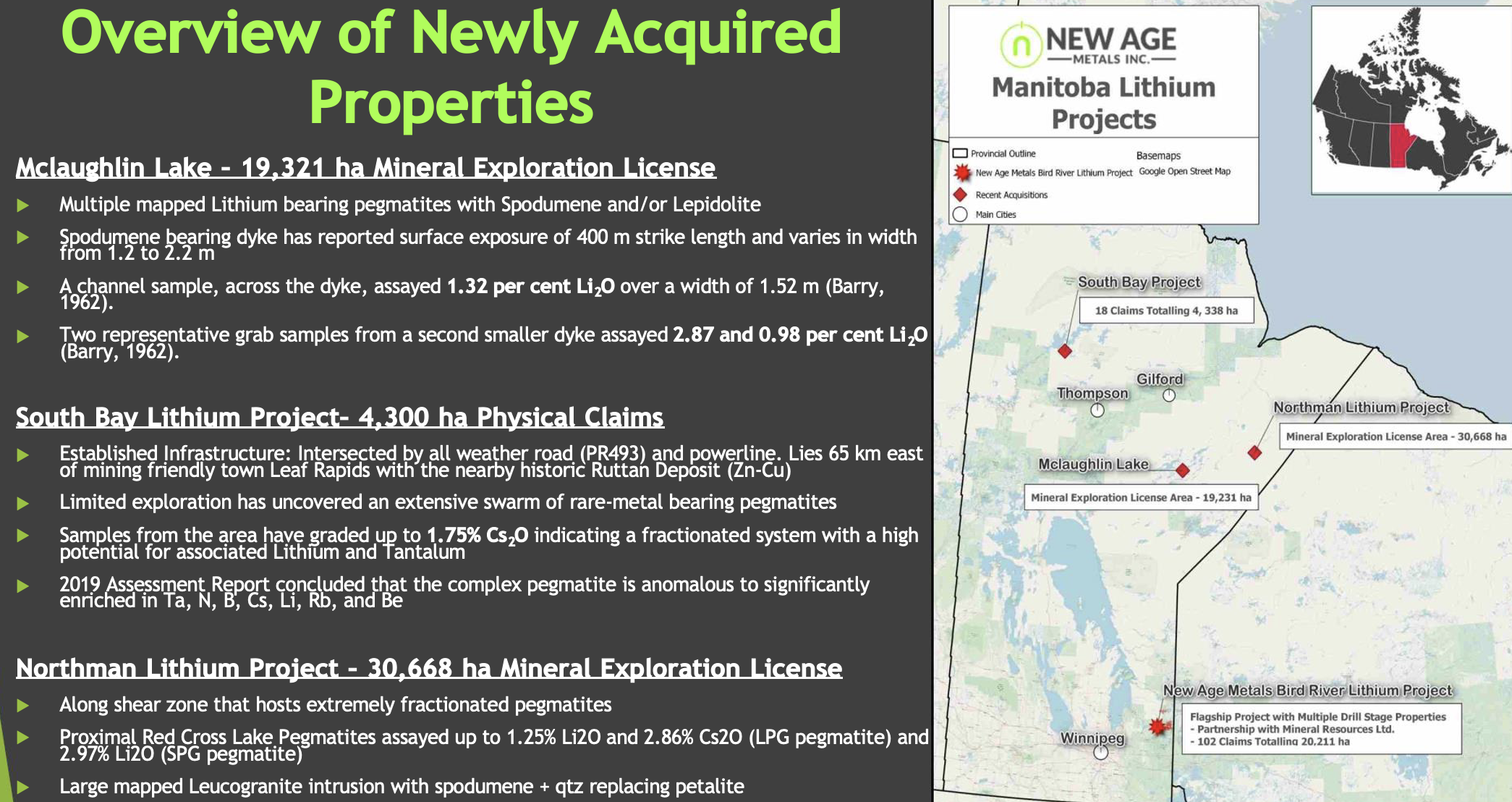

Management recently secured 30,668 hectares at Red Cross Lake, its 3rd property acquisition of the year. The Northman Lithium project has 28 km of strike length surrounding a LCT pegmatite swarm with historical sample assays up to 1.25% Li2O & 2.86% Cs2O from lepidolite pegmatite and up to 2.97% Li2O from spodumene pegmatite.

For those wondering if N. Manitoba being is too remote, it’s no more remote than parts of northern Ontario or Quebec, and in some cases less remote than parts of B.C., Saskatchewan, Yukon and the Northwest Territories.

Interest in Li properties in Canada remains high. At March’s PDAC conference in Toronto, CEO Harry Barr’s team held meetings with five Major Li and/or auto and/or Li-ion battery players about its N. Manitoba properties.

Barr continues to negotiate prospective farm outs on parts or all of the N. Manitoba portfolio. In addition to Majors, there are at least 42 Australian-listed juniors, plus private groups, already invested in Canada.

Partnering with New Age is much easier & more efficient than staking/acquiring ground, opening offices, hiring new employees, obtaining permits, doing environmental studies & building relationships with First Nations.

Australian-listed companies in Canada include; Winsome Resources, Green Technology Metals, Critical Resources, Benz Mining, Cygnus Metals, Burly Minerals, Loyal Lithium, Patriot Lithium, Koba Resources, Recharge Metals, Cosmos Exploration, Battery Age Minerals and Leeuwin Metals (in Manitoba).

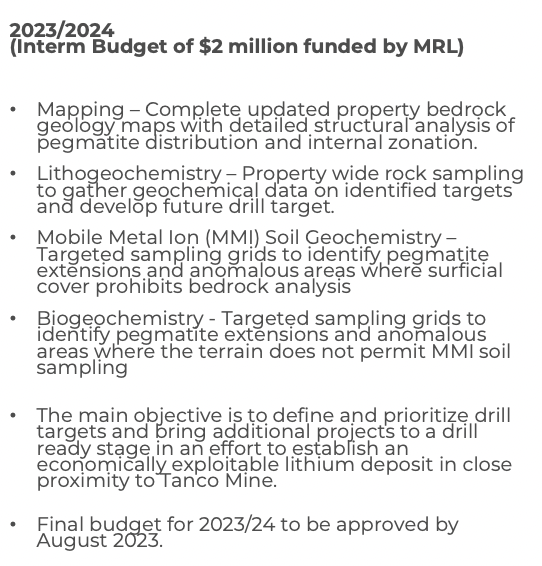

Importantly, in August New Age will announce the budget that MinRes plans to deploy in SE Manitoba for the year ending 6/30/24. Through 6/30/23 the budget was C$2.2M. A C$2.0M interim budget for summer/fall has been approved. I’m hoping to see another C$4-$5M more deployed through mid-2024.

As Major & mid-tier Li producers, EV & battery makers blanket Quebec & Ontario, it’s becoming harder to find large new projects to invest in. That’s why promising prospects in other provinces are rising to the top of investor lists.

The following Australian companies are known (or thought to be) looking in Canada; Pilbara Minerals, Wesfarmers, IGO Ltd., Liontown Resources, Core Lithium & Sayona Mining.

Add to that global OEMs including; Volkswagen, BMW, Tesla, Ford, GM, Stellantis, Honda, Mercedes-Benz… and battery makers; Umicore, SK Innovation, LG Energy Solution, Panasonic, Samsung & BASF.

Mining/Li companies include; Rio Tinto, Glencore, Albemarle, SQM, Allkem, Sibyane-Stillwater, Lithium Americas, Livent & Lithium Royalty Corp. In the past month alone Rio has announced two meaningful farm-ins with Azimut Exploration & Midland Exploration.

Even without a single Chinese player (due to geopolitics), there are dozens of companies trying to gain a presence or expand in Canada. Management is taking a prudent, risk-minimizing approach.

Switching gears to talk about New Age’s PGM prospects, the 3.9M oz., River Valley Palladium (“Pd“) project is the flagship (non-Li) asset. A new PEA just came out with an after-tax NPV of C$189M.

In a world of tight Li supply, OEMs might be forced to double down on hybrids to sell more units. Palladium is a hedge against a shortage of Li as hybrids utilize a considerable amount of PGMs. I believe the market ascribes zero value to this project. Admittedly, PGM assets are out of favor.

I also believe the market ascribes zero value to the potential that the Company’s SE Manitoba portfolio hosts economically viable credits from cesium, tantalum and/or rubidium alongside its Li mineralization.

The owner of the nearby Tanco Li mine (also a major source of cesium) is considering a large expansion. However, Tanco is Chinese-owned, so who knows what will happen. It seems reasonable that Tanco might be sold to a non-Chinese group.

I think the planets are aligned for a bull market in juniors like New Age Metals, especially companies far less reliant on raising equity capital. Management is in discussions with multiple parties to help develop Li assets in N. Manitoba and is partnered / (free-carried) with MinRes on its SE Manitoba portfolio.

At C$0.045/shr., New Age Metals is down 55% from its 52-wk high, but many of the Li juniors listed above are down 35%-65%. With the spot price in China up over 80% from April’s low, global EV sales strong, and M&A activity picking up, Li juniors in hot jurisdictions like Canada could bounce back quite considerably.

Disclosures/Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about New Age Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of New Age Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of funds. It’s assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, New Age Metals is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)