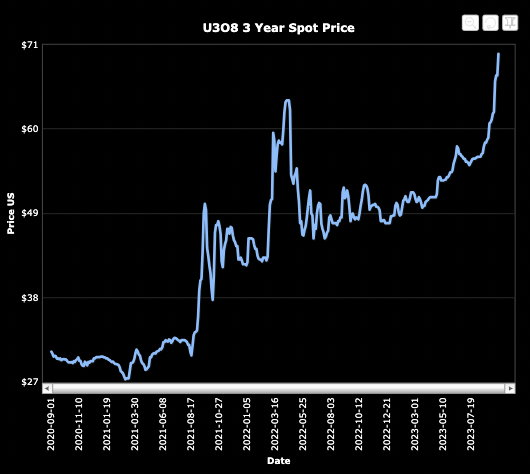

The uranium spot price has soared to US$71.00/lb. from $49.75/lb. six months ago, up +43% to a 12.5-year high. While reports of panic buying by utilities are probably exaggerated, demand is outpacing readily available supply.

Previous bull markets have shown instances of longevity (from Dec., 2000 to June, 2007 the price rose an average of +3.8%/month for 79 months!), and shorter periods of tremendous gains (up +155% in the nine months ending June, 2007).

If a +155% gain were to be repeated from the mid-March low, spot would reach ~$111/lb. by year end. Adjusted for inflation, the all-time [nominal] high of ~$140/lb. is ~$206/lb. Perhaps $111/lb. isn’t as crazy as it sounds.

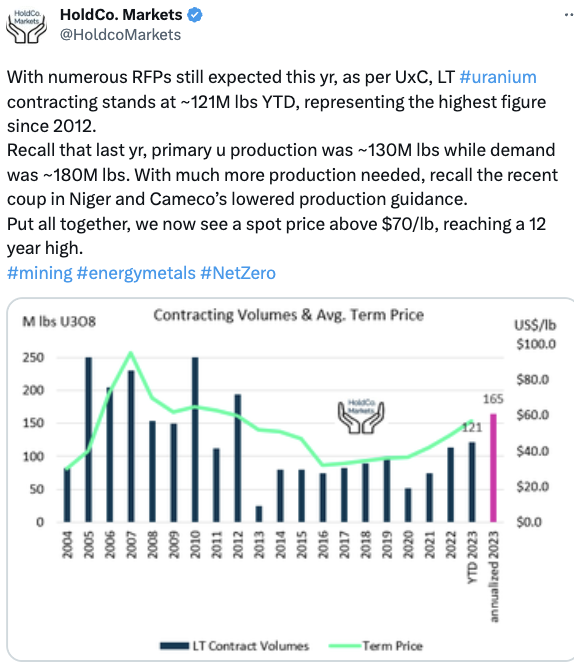

There are reasons to believe this is not a head fake like in April-May, 2022 when the price rose to ~$64.5/lb., before retreating to the mid $40s/lb. After years of under-contracting, 2024 should be the start of a multi-yr. period of over-contracting by utilities (i.e. > 180M lbs./yr.). According to UxC, 2023 is tracking at ~165M pounds.

During this momentous rally there have been virtually no meaningful announcements of new supply. Instead, we see increased demand from utilities, countries like Finland, Sweden & Poland reversing anti-nuclear policies, the promise of Small Modular Reactors (“SMRs“), reactor lifespan extensions / restarts, and investment funds + Cameco buying uranium in the spot market.

As I write this on Sept. 26th, there’s new commentary about Russia’s State-owned Rosatom looking to purchase spot uranium. Founder & Publisher of the Uranium Insider Pro Newsletter Justin Huhn points out there’s roughly 200M lbs. of uncovered demand needed to be contracted over the next five years, yet Kazatomprom & Cameco are sold out through 2027.

The Sprott Uranium Trust has enough cash piled up to buy ~960k pounds @ $71/lb., assuming they could find that much without nudging the price up. In a prior article on Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) I discussed the potential of SMRs. Since then, their future potential has only grown.

Microsoft just announced plans to utilize SMRs & micro-reactors to power its data centers & AI initiatives. How long before (Google/Alphabet, Nvidia, Meta, Samsung, Intel, etc.) announce similar goals?

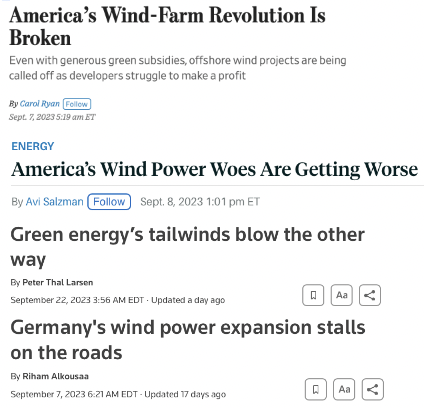

At a time when the electrification of everything means decades of strong electricity demand, renewables have yet to prove they can bridge the gap. Solar deployments remain robust, but there have been negative stories about wind farms lately. Only new reactors + SMRs + micro-reactors can make a difference.

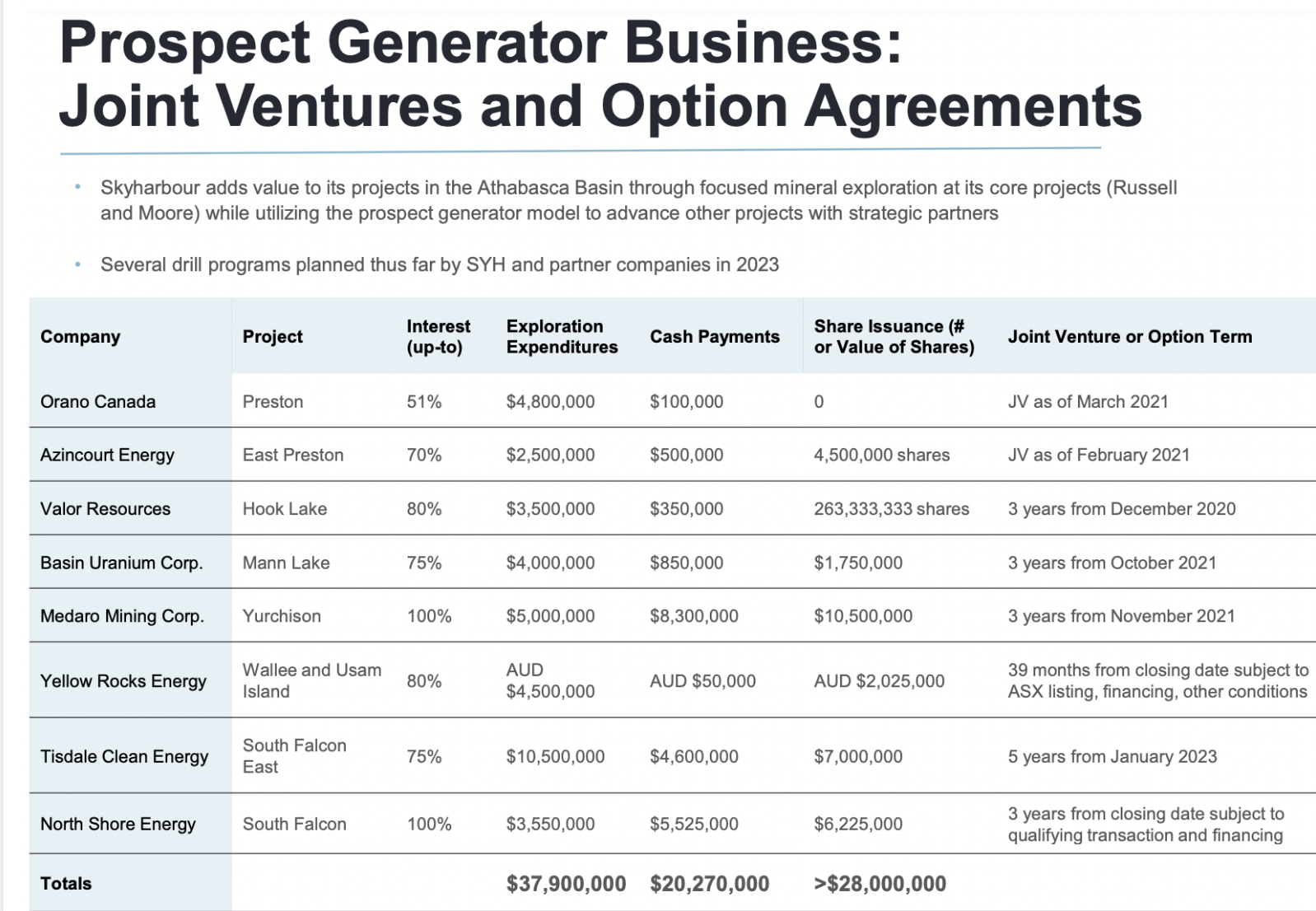

One of my favorite names to gain exposure to the bullish uranium narrative is Skyharbour via its hybrid model consisting of the development of two flagship assets and employing a prospect generator model on 22 additional properties. Prospect generator businesses get turbocharged in bull markets and in periods of heavy M&A.

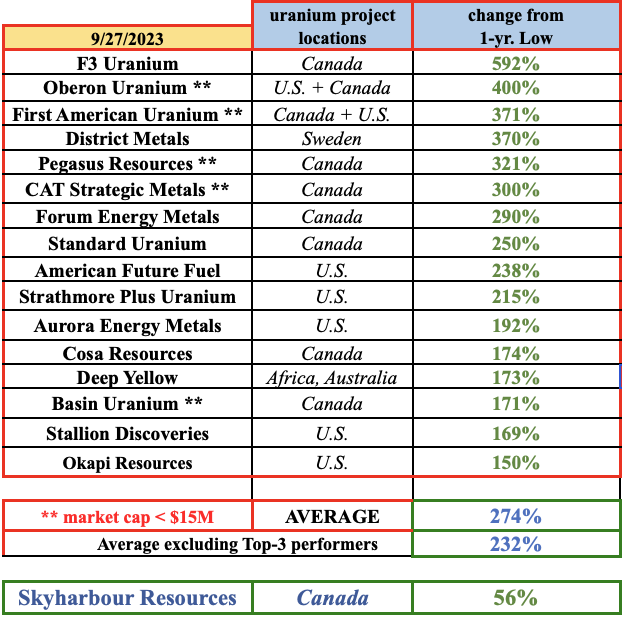

The following chart shows 16 uranium juniors, plus Skyharbour. These 16 are up an average of +274% (+232% excluding the Top-3 performers) from 1-yr. lows. By contrast, Skyharbour is up far less at +56%.

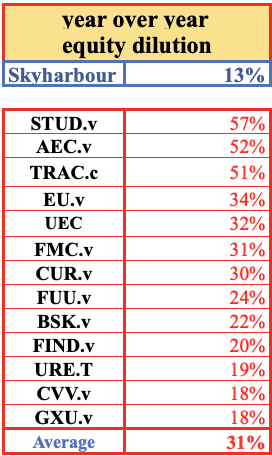

This makes no sense, especially as Skyharbour’s prospect generating strategy allows it to be less dilutive than peers {see chart}. Uranium players are poised to enjoy a BIG 4th qtr., and Skyharbour could outperform.

Since 2016, management, the board & advisors have been working hard on the 100%-owned, 35,705 hectare Moore Lake (“ML“) project in the eastern part of the Athabasca Basin. ML continues to show promise with high-grade hits extending into the basement rocks. The best results include; 4.03% eU3O8 over 10 m, incl. 20.8% eU3O8 over 1.5 m, and another interval of 9.12% U3O8 over 1.4 m and 5.29% over 2.5 m.

Complimenting, enhancing & expanding upon the ML opportunity is an earn-in agreement to acquire 51%, then 70%, and up to 100% of Rio Tinto’s 73,294 ha Russell Lake (“RL“) project.

Russell Lake + Moore Lake surrounded by Cameco, Denison, NexGen, Orano & UEC

RL has been the subject of significant historic exploration, with over 95,000 meters of drilling. Adjusted for inflation, I estimate up to a combined C$100M has been invested into ML & RL.

In looking at the map, imagine how nicely ML + RL would fit into the portfolios of Cameco, Denison Mines, Fission Uranium, UEC and privately-held Orano Canada. Those companies should want to acquire Skyharbour to make themselves more attractive takeover targets.

Some readers presume that Skyharbour is many years from initial production. That’s not necessarily true. CEO Jordan Trimble and his expert team are watching closely what’s happening right next door. Denison Mines’ Wheeler River project is going into production (2027 or 2028) via In-Situ Recovery (“ISR“) mining. Denison recently released a blockbuster PFS.

Many expect a dramatic increase in demand by, “the West” for supply from the western-friendly countries of the U.S., Australia and especially Canada. The West, most notably the U.S., cannot count on Kazakhstan, China, Russia & countries in Africa for security of supply.

A paradigm shift is at hand in which China & Russia (and several “BRIC” countries) are increasingly unwelcome trading partners and/or geopolitical rivals, forcing them to scramble for natural resources in places they are welcome — namely Africa, the Middle East & South America.

This major shift could result in U.S. utilities having to pay a premium for safe, green, long-term sustainable supply. U.S. production is not capable of ramping up as fast as needed, it currently produces less than 1M of the roughly 50M pounds it consumes.

Growth in the U.S. is coming almost entirely from ISR mines, which are typically good for 1-2M pounds/yr. Therefore, by 2030 I estimate U.S. production could reach 15-20M lbs./yr. That would leave ~35M pounds to be sourced elsewhere, mostly from Canada.

I’m particularly excited about this year’s gains in Cameco, NexGen, Fission Uranium & Denison, up an average of ~92%, all four could be acquirers of Skyharbour. Moreover, a quick glance at the map suggests that whoever takes out NexGen, Denison or Fission should also want to own Skyharbour.

There are a number of Australian-listed uranium players that could leverage recent valuation gains to diversify into Canada. Companies like Paladin Energy, Deep Yellow, Boss Energy, Lotus Resources and Bannerman Energy, some of which have projects in Africa.

Make no mistake, Australia has good deposits, but they’re not high-grade compared to the Athabasca basin. And, distances from key projects to coastal ports — then shipped to the U.S. or Europe — is more costly, time consuming and logistically challenging then sending uranium to the U.S. from Canada.

In the U.S., Energy Fuels, Encore Energy, Centrus Energy Corp. & UR-Energy (avg. market cap > $600M) could be interested in Skyharbour as the M&A game picks up. The U.S. is not an easy jurisdiction to operate in, companies could de-risk long-term operating plans by adding high-quality Canadian assets.

France’s multi-billion dollar Orano operates in Kazakhstan, Canada & Niger. In Niger there was a military coup. France announced it would no longer provide military support to that country. Orano is big in the Athabasca Basin, might it be an acquirer of Skyharbour (or Denison or UEC or Fission) to diversify away from Africa?

Few companies are better takeout candidates than Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF). It’s ~C$80M valuation is tiny compared to the companies mentioned above. I believe any medium or large sized M&A in the region will highlight the compelling valuation & opportunity of Skyharbour’s flagship projects & nearly 520,000 hectares.

Most of the Company’s prospects were obtained when the uranium price was much lower.

Readers are reminded that Skyharbour has up to $86M of upcoming exploration expenditures + share & cash payments (some already received) from eight JV or option partners. The value of these arrangements and remaining 100%-owned or controlled properties will rise with the uranium tide.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Skyharbour Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)