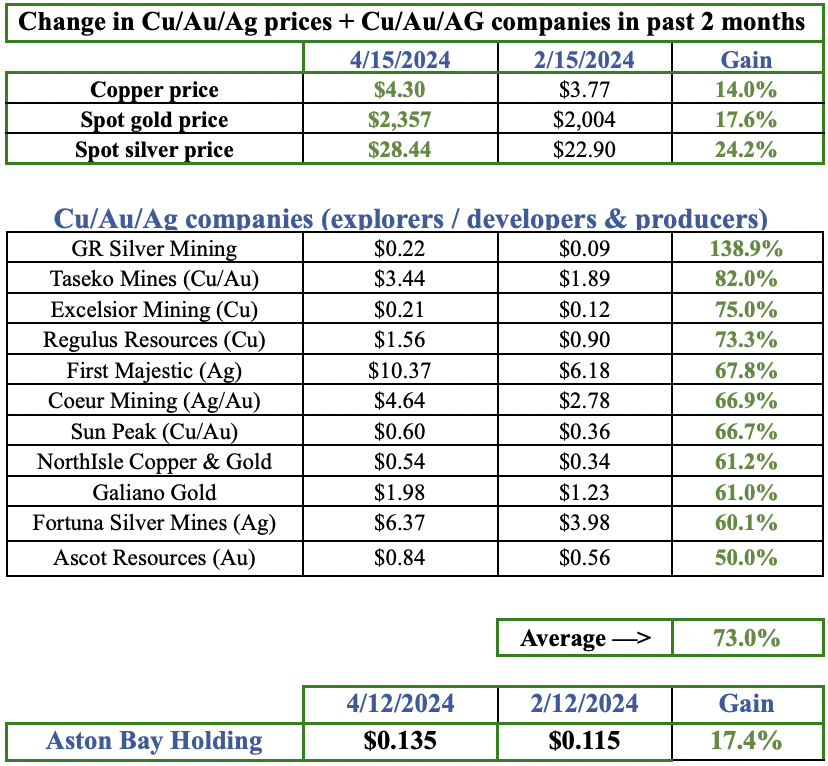

Are we at the beginning of a multi-year M&A binge in the precious metals sector? The gold price at US$1,935/oz. is within 7% of its all-time nominal high. In a giant US$18 billion deal, Newmont is acquiring Newcrest, in part for its very high-grade Brucejack operation and 70% interest in the Red Chris mine, both in B.C., Canada.

Of the Top-3 gold producing countries last year, #1 was China. Russia was tied with Australia for the #2 spot. What’s wrong with this picture!?! Canada is both a safe-haven and a highly desirable clean, green mining jurisdiction with nearly 100% low-cost hydro-electric & nuclear power.

Teck Resources is selling its coking coal operations for billions of dollars, giving it a war chest to acquire outright or invest in gold-heavy assets. It already has JVs on two world-class B.C. projects, Galore Creek (50%) & Shaft Creek (75%).

Boliden AB, Kinross, Centerra Gold, Seabridge Gold & Hecla Mining are also invested in B.C., BHP acquired a 19.9% stake in Brixton Metals and Freeport McMoRan is invested in Amarc Resources.

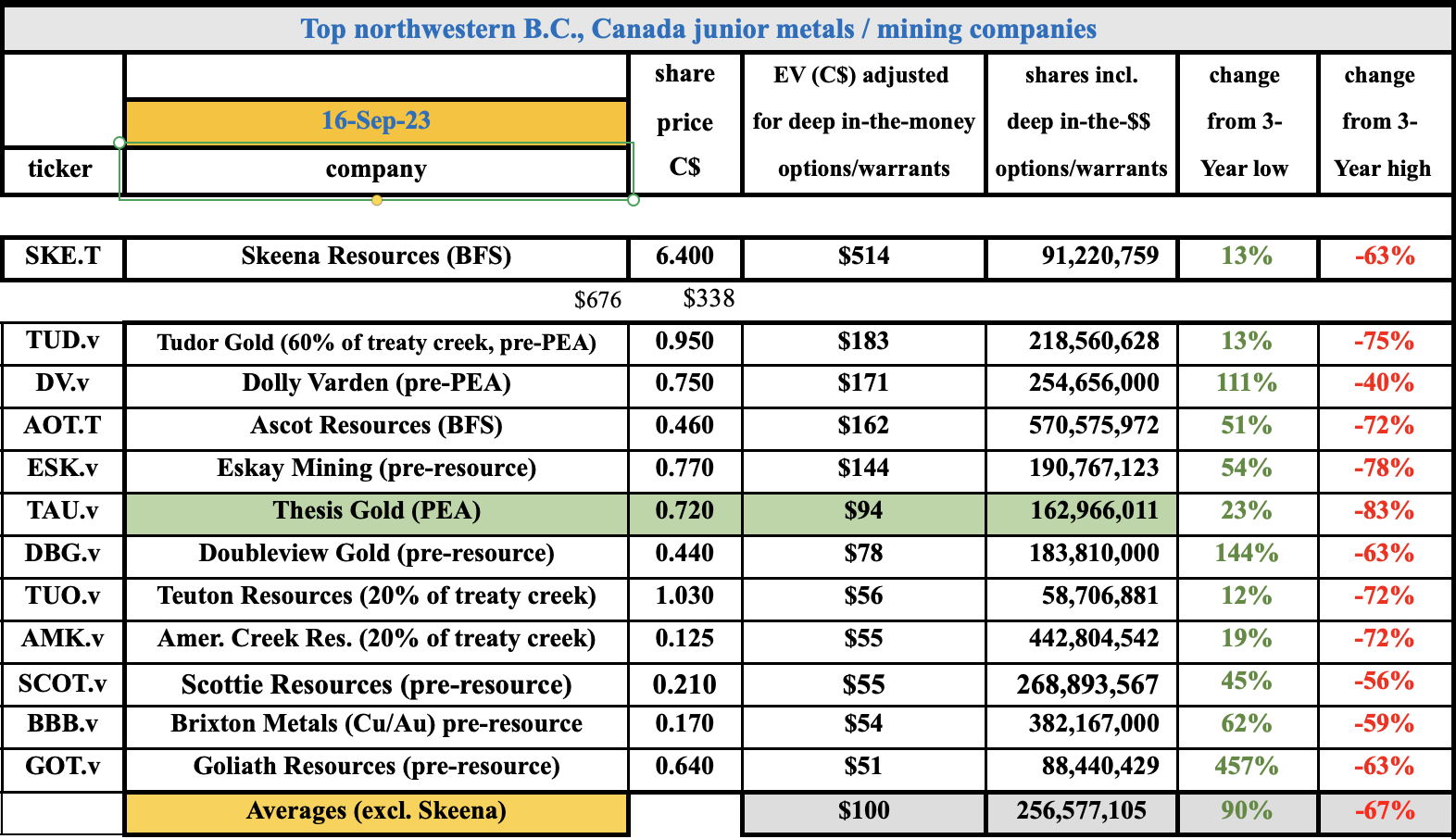

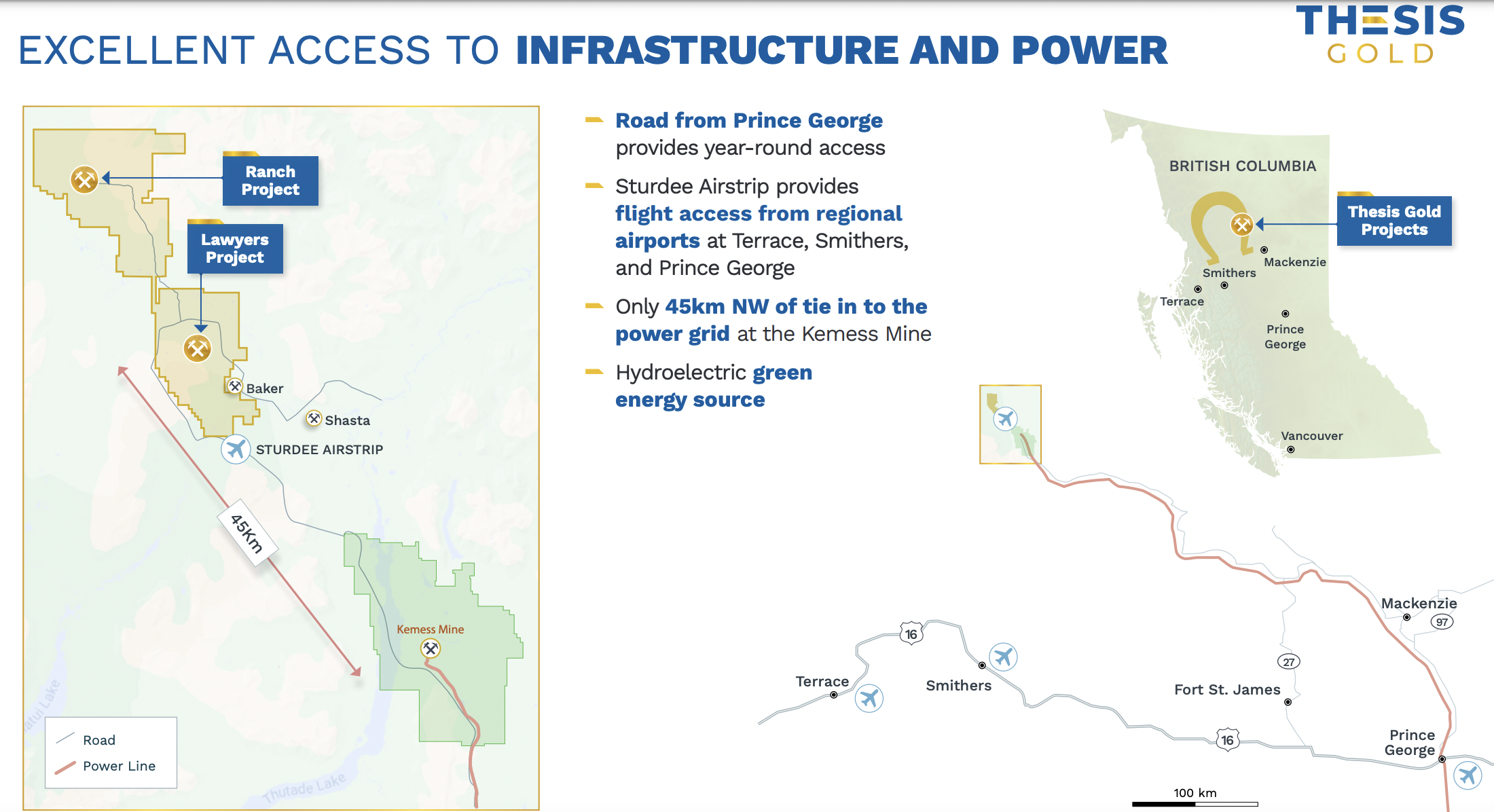

The most recent transaction of note is the completed merger of Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF) & Benchmark Metals. {See latest corporate presentation}. The surviving company, Thesis Gold, now has a PEA-stage, 32,500 hectare land package in the heart of northwestern B.C. (near or in the Golden Triangle, Golden Horseshoe & Toodoggone district).

The Company has an enterprise value [EV] {market cap + debt – cash} of $94M, well below that of fellow northern B.C. juniors Skeena Resources, Tudor Gold, Ascot Resources, Eskay Mining & Dolly Varden. Those five have an average EV of $235M.{see chart below}. Skeena & Ascot are well more advanced, each having Bank Feasibility Studies.

Interestingly, Dolly Varden is valued at $171M despite it being pre-PEA stage. Like Thesis, it has reported bonanza high-grade drill results, even stronger than that of Thesis. However, Dolly is silver-focused and has a land package that’s 35% the size of Thesis’ footprint.

I strongly believe that Thesis will be acquired in 2024 or 2025. Newmont, Teck, Freeport & Centerra have assets closest to Thesis’ Ranch & Lawyers projects, but the new Company is a compelling target to many others as well, especially after release of the new PEA in 9-12 months. Agnico Eagle does not have a presence in B.C., but is very in eastern Canada.

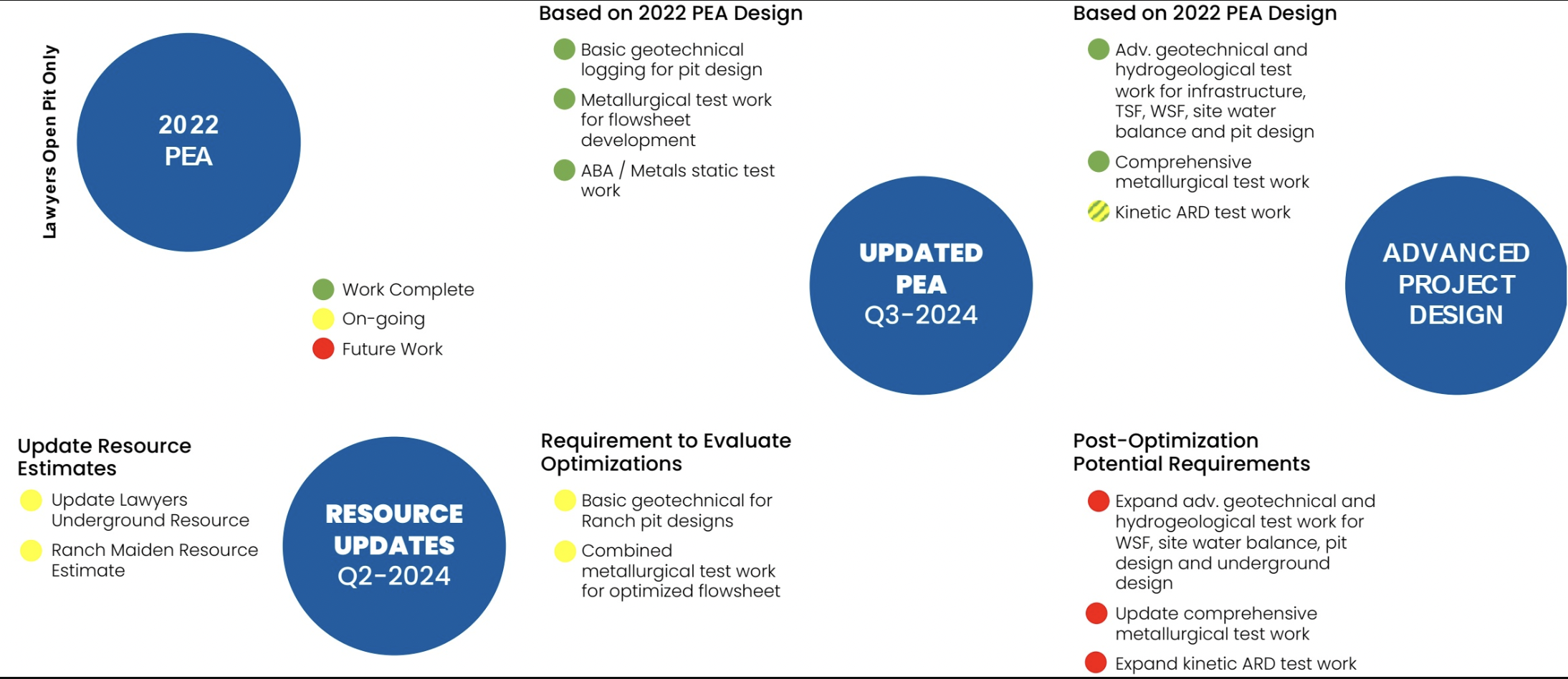

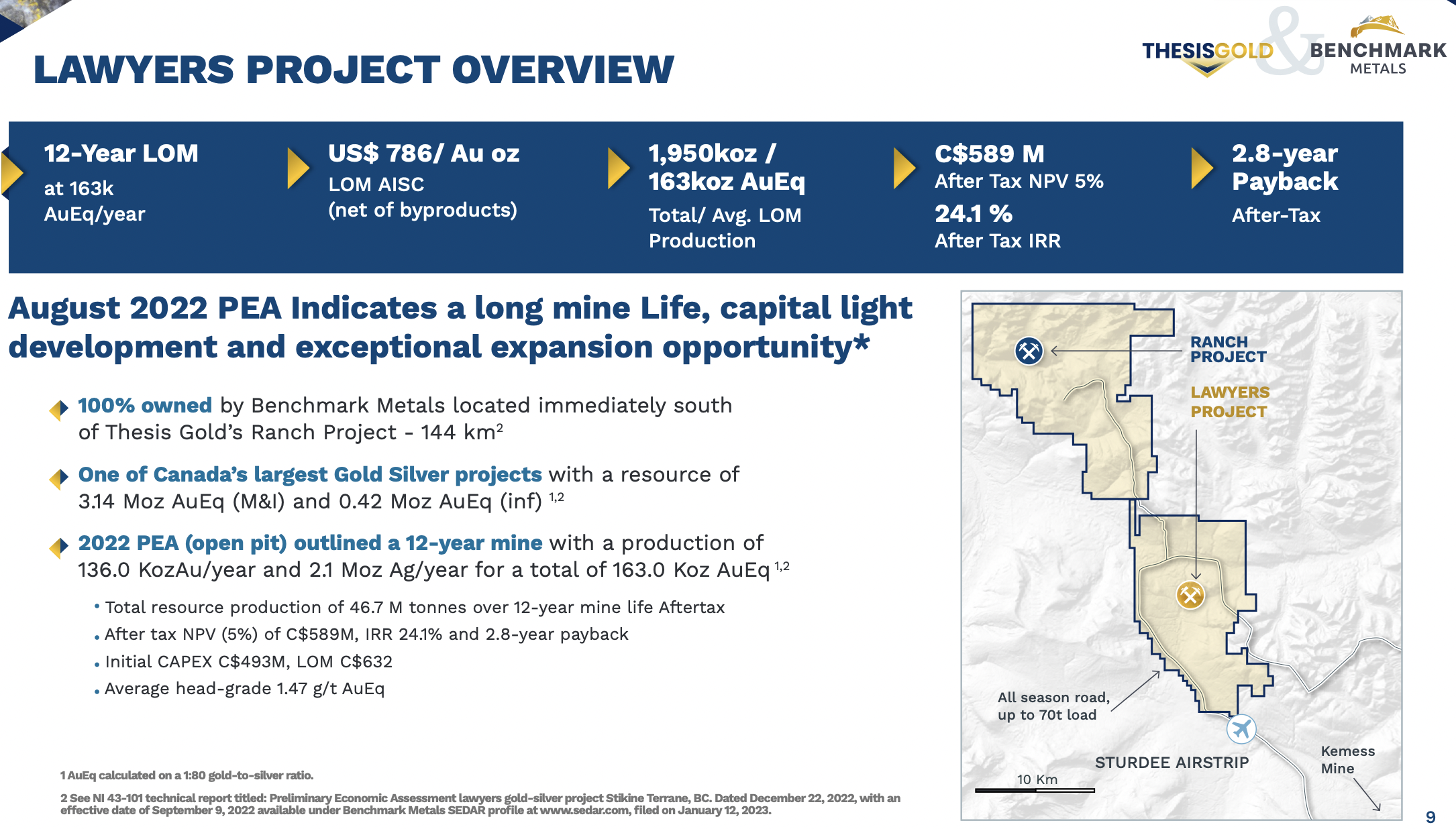

Thesis is linking development of the PEA-stage Lawyers project to the adjacent road-connected, high-quality exploration results & considerable drill targets at Ranch.

Management plans to turbocharge its 3.55M oz. Au Eq. resource at Lawyers with high-grade, near-surface mineralization at Ranch. To that end, the Company is in the midst of a robust 50,000 meter drill program at Ranch (30k) & Lawyers (20k). Drill results will be flowing for several more months.

The combined resource of both projects should be > 5M Au Eq. ounces as soon as mid-2024. Now that Ranch & Lawyers are under one roof, they can be advanced more efficiently & cost effectively as a unified Tier-1 project.

Five million+ ounces would be well more than Ascot currently has, and would approach Skeena’s recently reported 6.5M ounces. Both of those companies are far more advanced, but have an average valuation of $338M vs. Thesis at $94M. An updated & enhanced PEA is expected in 2H 2024.

Please watch the latest corporate video update from the Beaver Creek gold conference, recorded in mid-September. In it, COO Ian Harris makes a remarkable point. All else equal, each 1 g/t Au Eq. increase in grade fed to the mill, [per year], in the early years of the mine plan would add ~C$200M to the NPV. The current grade in the PEA is 1.4 g/t.

By incorporating ~400,000 new high-grade underground ounces (assume 6 g/t Au Eq.) the new average grade could climb by 0.5 g/t. Therefore, if the new mine plan can deliver five early years at 1.9 g/t instead of 1.4 g/t, that would add ~C$500M to the NPV.

Benefitting from economies of scale, logistical & operational improvements, the new PEA should have a longer mine life and/or increased annual production, a meaningfully higher NPV, an enhanced IRR and a better ratio of NPV to upfront cap-ex.

COO Harris also mentioned that the strip ratio of the open pit portion of the new operation will be lower than that found in the current PEA, which was already low.

Based on the existing PEA on Lawyers alone, I think a new PEA could achieve a C$1.0 billion after-tax NPV at US$1,800/oz. Au [my opinion only]. That would compare well to Skeena’s NPV of ~C$1.6B at the same assumed gold price. $1,800/oz. is $135/oz. below the current spot price.

Skeena is trading at ~35% of its NPV vs. just ~9% for my C$1B estimate of Thesis’ new NPV. I believe that Skeena is undervalued and could potentially be acquired at 50%-60% of NPV. This suggests that Thesis could reasonably be valued at 25%-30% of its pro forma NPV after delivery of the new PEA in 2h 2024.

Whatever Thesis might be valued at next year, it should be worth more in 2025 upon delivery of a BFS. By 2025, Thesis could be at roughly the same stage of development as Skeena is now. Turning to Ascot, it expects to be in production within six months. Like Skeena & Thesis, Ascot is a reasonably likely takeover target. A Newmont, Teck or Freeport could easily afford to acquire and fund all three companies.

As mentioned, Ranch’s high-grade drill intervals from 2021-22 including; 19.6 g/t Au over 34 meters, 27.0 g/t / 13.0 m, 17.5 g/t / 33.1 m, & 8.8 g/t / 27.0 m, should allow for the mining of higher-grade zones earlier on. In late August, management announced another strong result — 16.5 m of 9.7 g/t Au Eq.

Readers should note, 19.6 g/t x 34 m = 666 [gram meters] is probably a top-5% high-grade gold interval for N. America, and the average gram-meter value of the above five intervals is just shy of 400.

Thesis’ PEA showed a 12-yr. mine life & a 24.1% after-tax IRR — mining ~1.4 g/t ore at an assumed long-term Au price ~$200/oz. below today’s spot. Although cap-ex & op-ex will increase due to inflationary pressures, the AISC in the 2022 PEA came in at just $786/oz.

Assuming a 20% increase to $943/oz., that would still compare quite favorably to the 2nd qtr. 2023 average of the GDX Top-25 company AISCs (excluding outliers) at ~$1,300/oz. (source: mining.com)

Newmont’s most recent AISC is $1,472/oz.! It would benefit from acquiring a long-lived, Canadian project with an AISC under $1,000/oz. Thesis’ 32,500 ha footprint is less < 50 km from Centerra’s advanced-stage Kemess project, making it potentially attractive to that mid-tier player.

An acquirer could drill more aggressively to [potentially] book millions more ounces, enough to mine 300k ounces/yr. for 20+ years. That would rank in the Top-8 among existing Canadian gold mines.

Assuming 5M Au Eq. ounces, Thesis is valued at $19/oz. in the ground. In precious metal bull markets, M&A transactions often can place at 3x to 8x that $19/oz. figure. Sabina Gold & Silver was recently acquired by B2Gold for ~$130/oz.

Sabina had a higher grade, more advanced project, but it’s in the more difficult & remote northern jurisdiction of Nunavut. Its project had an after-tax NPV of C$1.2B.

Thesis is valued at $94M, which is ~9% of my estimate for its upcoming after-tax NPV. This figure screens very cheap even compared to other high-quality, oversold gold juniors like Skeena & Ascot.

Those valuation metrics are more applicable to companies with projects in very remote or unsafe areas. Or, companies with high technical risk and/or elevated op-ex / cap-ex, or companies with mediocre (or worse) mgmt. teams.

{See latest corporate presentation}

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares of Thesis Gold and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)