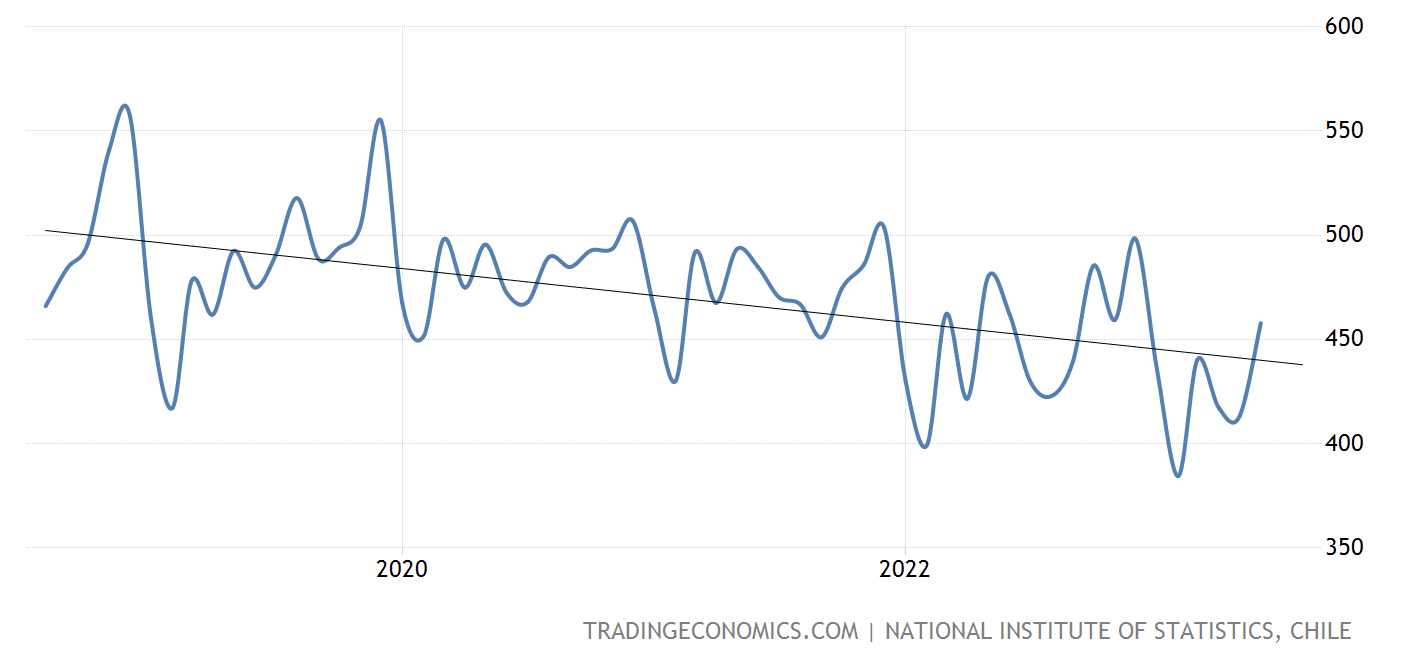

Chile’s copper (“Cu“) production continues to come under pressure. For example, Codelco, the world’s largest Cu company, recently announced a guidance revision of 5% to below last year’s level, which was -7% from 2021.

Look at the clear trend line in Chile since mid-2018. This is somewhat alarming given that Chile accounted for ~29% of total mined Cu among the top-12 producing countries in 2022.

monthly Cu production in Chile (1000’s of tonnes)

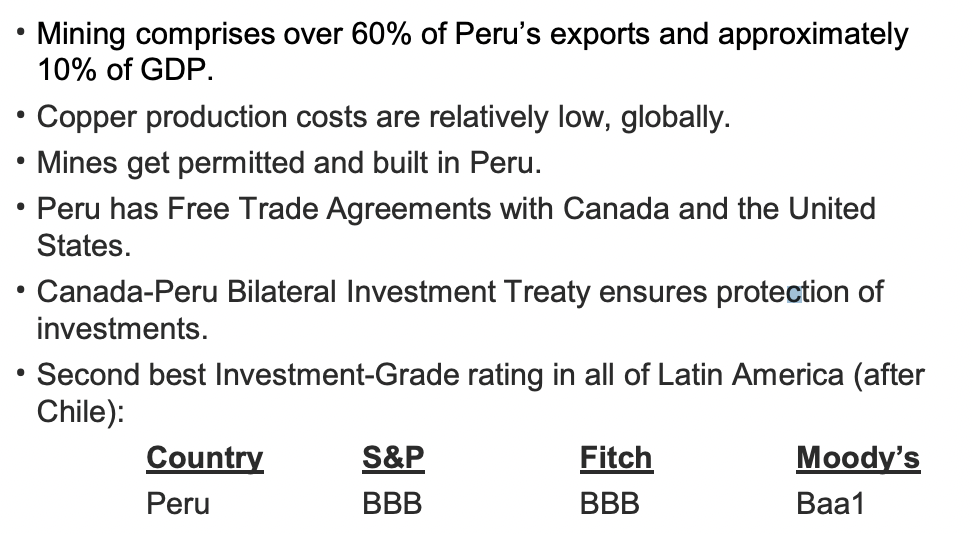

Make no mistake, Chile will remain a dominant force, but can it be counted on for robust growth? Peru, the world’s second largest producer, also faces challenges, however it ranks above Chile, Mexico, Colombia and the Argentinian provinces of Jujuy, Salta & Catamarca in the latest annual Fraser Institute Mining Survey – Investment Attractiveness Index.

I could go on and on about bullish supply/demand fundamentals. Consider that after Chile & Peru, four of the next five largest Cu producers last year were the DRC, China, Russia & Indonesia! What could possibly go wrong?

Goldman Sachs recently said that upwards of half of new Cu supply may have to come from places like Papua New Guinea, Botswana, Panama, Zambia & Mongolia.

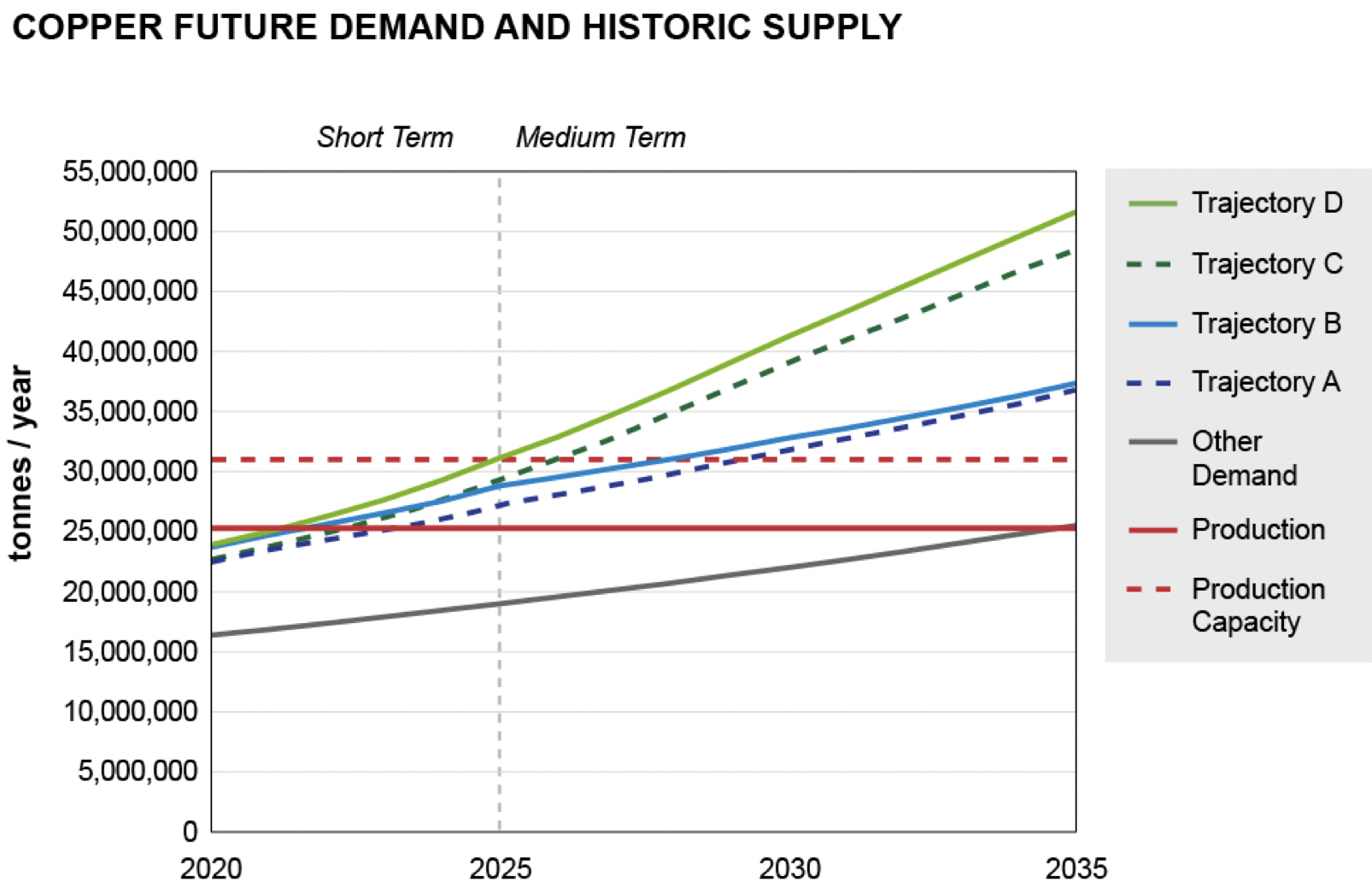

On the demand side, the following data from the IEA (July 2023) is quite compelling. Although a busy chart, the math says annual demand growth through 2035 is expected to be between 3.1% & 5.8%, up from roughly 2.8%/yr. since 2000.

Copper sits at the crossroads of all things high-tech & transportation-related, and is mission-critical to global decarbonization efforts — both power generation & storage. Prices need to move higher (perhaps a lot higher) to incentivize robust production in mining-friendly locations.

Citigroup is calling for US$6.8/lb. in 2025 vs. $3.8/lb. today. Even an increase to $5.0/lb. would make a world of difference. Readers are reminded that Cu traded as high as ~$8.7/lb. (in today’s dollars) back in 1974, averaging ~$5.65/lb. that entire year.

What was happening in the mid-1970s? That’s right — high inflation, sound familiar? Juniors with attractive projects, led by strong management teams, in healthy cooperation with local communities, are well positioned.

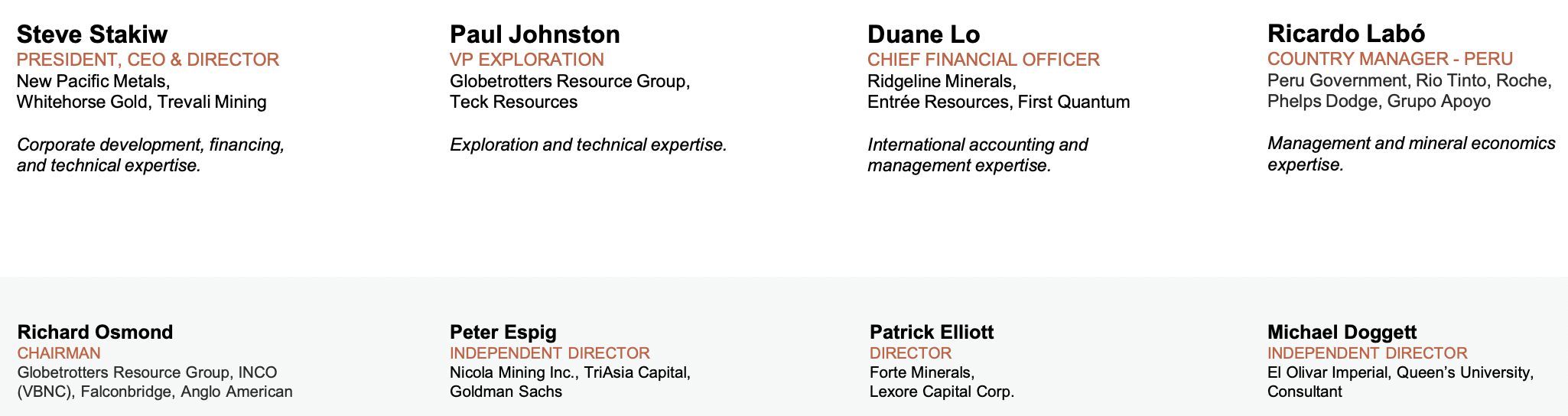

One such company is Element 29 Resources (TSX-v: ECU) / (OTCQX: EMTRF), a junior that has booked a resource estimate of 2.24B lbs. Cu + 206M lbs. Molybdenum (“Mo”) + 27 million oz. silver (“Ag”) on just one of five porphyry zones at its 100%-owned Elida project in west-central Peru. That’s ~4.0 billion Cu equiv. pounds.

see new September corporate presentation…

Management is in the midst of raising up to $2.9M, which would result in an enterprise value {market cap + debt – cash} of $14M[@ C$0.16/shr.). Importantly, Element 29’s primary projects are new, not plagued by legacy issues that have slowed or stalled others across S. America.

Elida is a significant porphyry Cu discovery with a high concentration of Mo and substantial expansion potential. Drilling is planned to increase & upgrade the initial mineral resource and test additional porphyry centers.

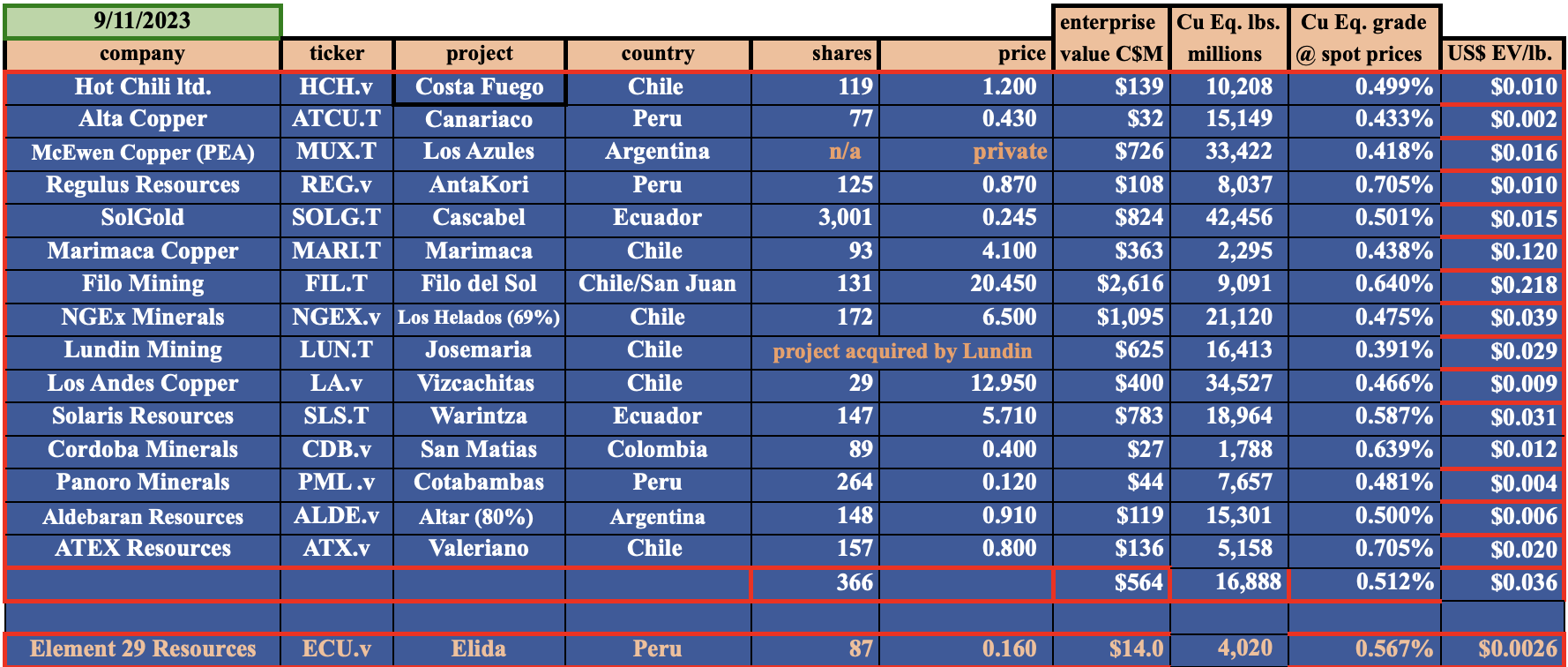

Despite many positive attributes, Elida is valued at just US$0.0026/Cu Eq. lb. {assuming spot pricing} vs. ~$0.01/lb. among peers (not incl. advanced projects owned by players like Filo Mining, Marimaca, SolGold, Solaris, NGEX, McEwen Copper, Regulus Resources, Lundin Mining, Los Andes Copper & Alta Copper. {see chart below}

At spot prices, Elida’s 4.0 billion lb. Cu Eq. resource has a grade of 0.567%. Compare that to mines in western Canada such as Teck Resources’ giant Highland Valley mine with a remaining Measured + Indicated + Inferred resource of ~0.29% Cu Eq.

In addition to Elida there are three more prospects, one of which is of near-term interest. Recent drilling at the Candelaria zone at Flor de Cobre confirmed past exploration data derived from an historic resource estimate. A new resource estimate is expected later this year.

Flor de Cobre is in the Southern Peru Cu Belt, ~26 km SE of Freeport McMoRan’s giant Cerro Verde mine. It consists of an option to earn 100% of the past-producing Candelaria (with an historic resource of 57.4M tonnes of 0.67% Cu associated with a near-surface supergene enrichment zone) and the large, untested Atravesado porphyry zone (> 1.5 by 2.5 km).

Both projects benefit from nearby infrastructure including roads, power lines, ports, water & skilled workforces. Importantly, both are at low-to-moderate elevations, are in proven mining regions, and have drill permits. There are no competing uses for the Company’s project areas.

Given exploration, development & operating cost inflation and longer timelines to production, producers are turning to M&A and strategic partnerships to enhance production pipelines. In my opinion, (I don’t know which companies management is speaking with) potential strategic partners for Element 29 include:

Rio Tinto, Teck, Barrick Gold, Newmont, Vale, BHP, Anglo American, Glencore, Fortescue Metals, Grupo Mexico/Southern Copper, Zijin Mining, Freeport, First Quantum, Antofagasta Minerals, Sumitomo Metal, Mitsubishi Corp., Buenaventura S.A.A., KGHM, South32 Ltd., MMG Ltd., Lundin Mining, Sibyane-Stillwater, Hudbay & Capstone Mining.

Drill results at Elida included a 405 m interval of 0.45% Cu, 0.032% Mo + 3.6 g/t Ag (0.60% Cu Eq.) starting from 45 m. That hole ended in strong mineralization grading 0.75% Cu, 0.032% Mo + 7.2 g/t Ag (0.93% Cu Eq.). The Project is just 85 km from the coast and has a low anticipated strip ratio.

Regarding molybdenum, it’s mainly used to make stainless steel alloys that boost strength, hardness & conductivity and enhance resistance to high temperatures & pressures, corrosion & wear.

Although early stage, Element 29 Resources is years ahead of any green field project in S. America. Copper is at $3.8/lb., if/when it moves decisively above $4.5/lb., a company like Element 29 could see its valuation double. If so, it would still be valued at a steep discount to peers.

China produces over 40% of the world’s Mo, a geopolitical risk factor that favors Element 29.

Elida’s Mo grade of 0.03% is moderately higher than average. With Mo setting a record (nominal) high of US$43.55/lb. in February — and still at $26.65/lb. [tradingeconomics.com] — the outlook is favorable.

According to S&P Global,

“No significant secondary moly production from primary Cu mining has come online since Las Bambas in early 2016. There are no new mines in any advanced stage of planning or permitting, let alone under construction – the supply deficit is unlikely to get resolved in the near-to-medium-term.”

The initial resource of ~206M lbs. Mo has an in-situ value of ~US$5.5B at spot, or ~$3.5B at $15/lb., a level cited as a reasonable long-term expectation. $15/lb. is 44% below the spot price. Mo traded above $60/lb. in today’s dollars in mid-2005. So, $15/lb. going forward is hardly a stretch.

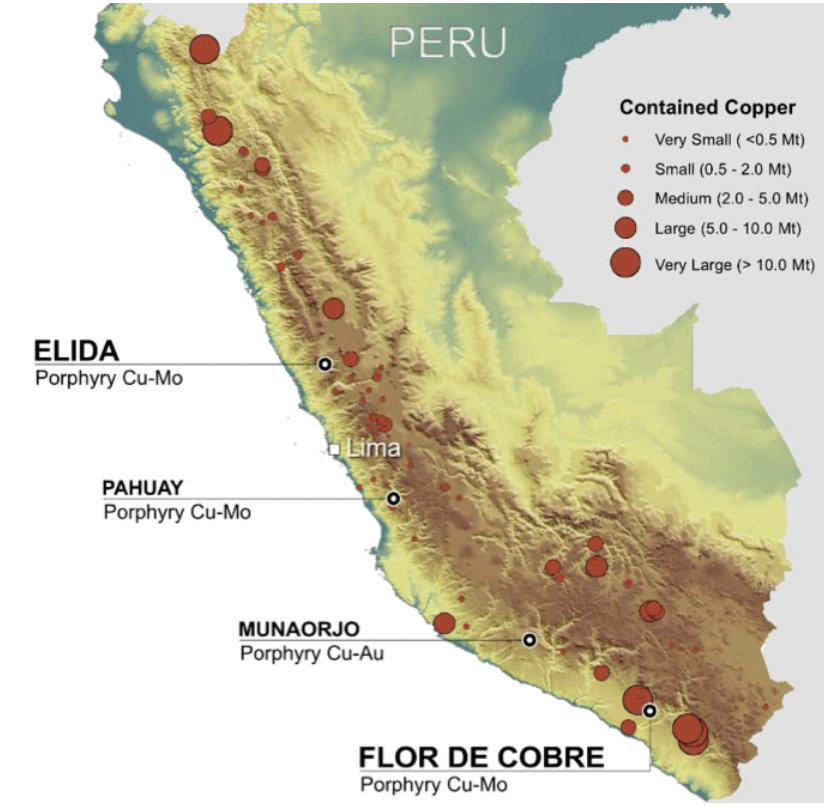

The following map of Peru captures Element 29’s compelling opportunity in several key respects. First, notice that Elida & Flor de Cobre are clearly near medium, large & very large mines.

That means they’re close to critical infrastructure. Also worth noting is that many of the red circles are to the right of Elina & FdC — they are farther from coastal ports. Finally, some of the mines sit at ultra-high elevations of 4,000+ meters, which negatively impacts operating logistics & costs.

At a time when junior miners are under pressure, Element 29 Resources (TSX-v: ECU) / (OTCQX: EMTRF) has increased the size of its private placement to (up to) $2.9M. This cash will go a long way in the Company’s near-term exploration activities.

Additional drilling success will attract a lot of attention among the dozens of prospective strategic partners & acquirers mentioned above.

Majors are certainly watching what management is up to. New high-grade projects surrounded by critical infrastructure, at reasonable elevations, near coastal ports, with access to water & workers are increasingly sought after.

see new September corporate presentation…

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Element 29 Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Element 29 Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this interview was posted, Element 29 Resources was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)