Everyone knows that coal is bad, right? Stop burning it ASAP! While mostly true, coal has two primary uses — it’s burned to generate electricity, or to make steel. Thermal coal is burned to produce steam that’s piped into turbines to create electricity.

Coking coal is converted into coke in an oven, which is then burned alongside iron ore in a blast furnace (“BF“), to make steel. There are ways to deliver greener power (nuclear, hydroelectric), but no near or medium-term scalable & affordable alternatives to coking coal.

That’s why after 20+ years of steel companies trying to substitute away from BFs, Wood Mackenzie estimates BFs still account for 72% of steel production, with 28% coming from scrap metal based electric arc furnaces (“EAFs“).

Large-scale replacement of coking coal with hydrogen to reduce emissions is, at best, decades away. More serious emission reduction efforts are underway at the plant level, like smokestack scrubbers, and the emergence in the 2030s of battery-powered containerships.

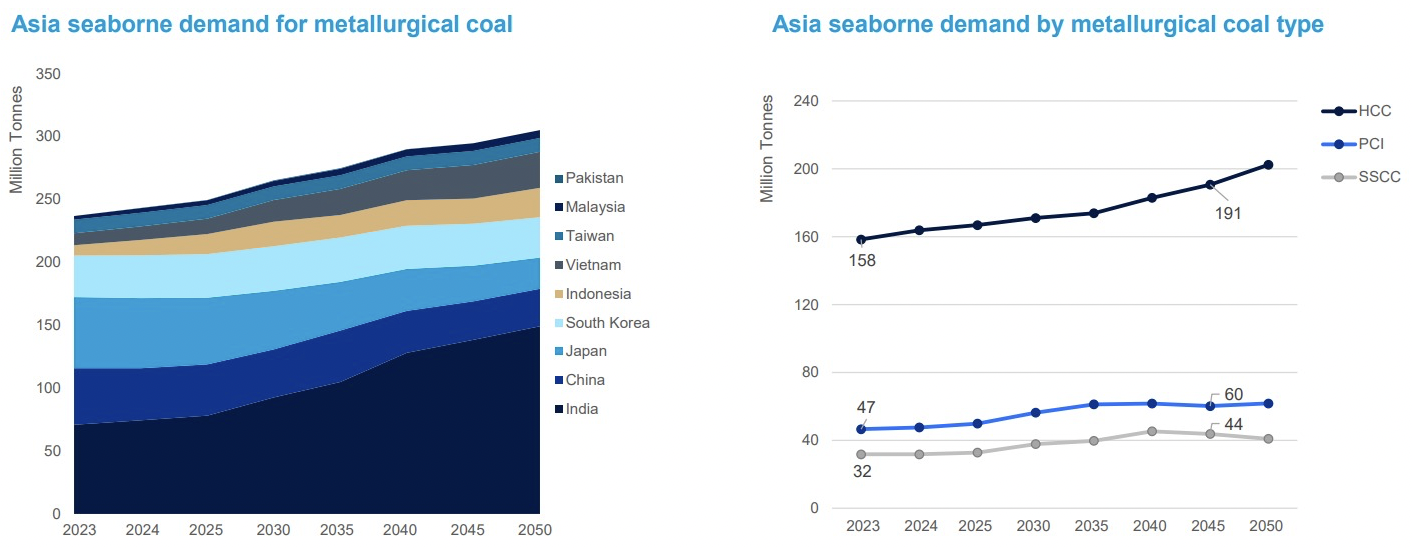

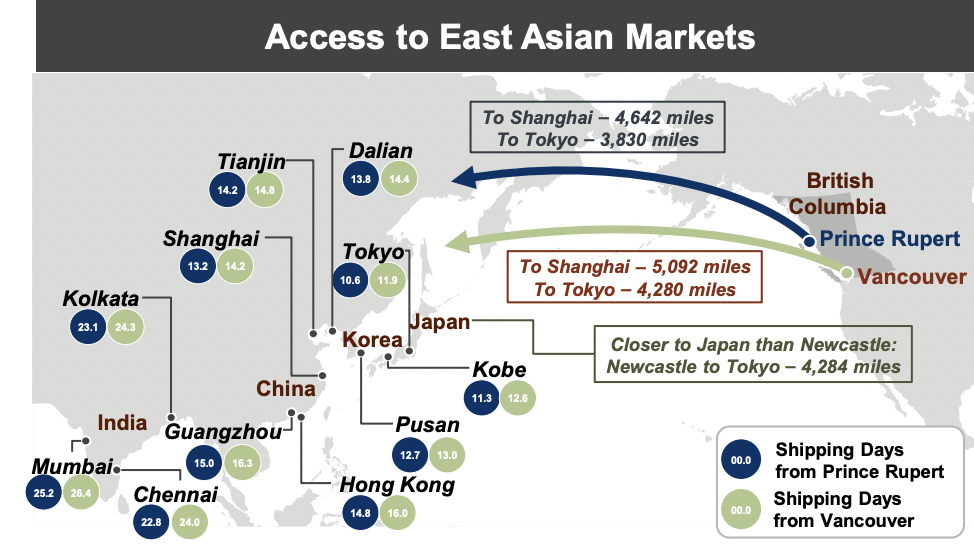

Asia is, and will remain, the dominant force in steelmaking. Therefore, it’s critical to recognize where Asian steelmakers place their existing & planned BFs — near ocean ports — making them extremely reliant on seaborne coking coal.

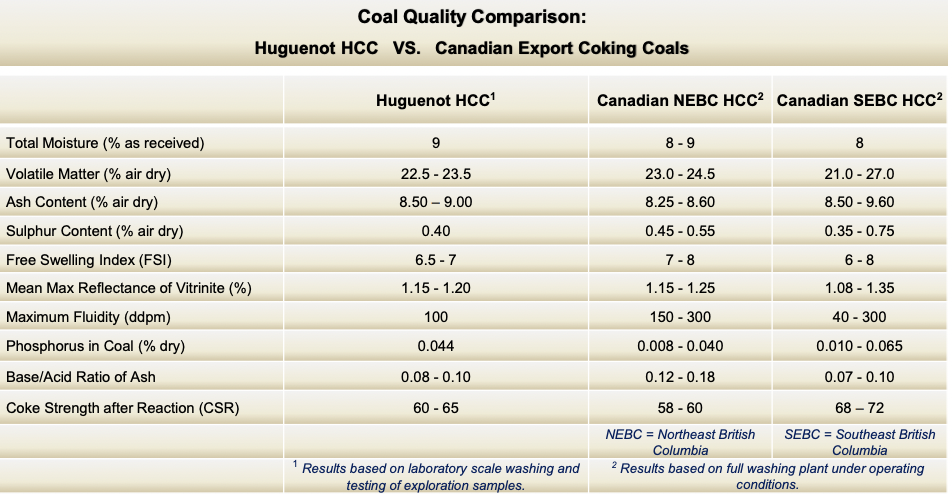

Notice in the chart above the growth in the highest quality HCC seaborne coals. HCC = Hard Coking Coal, PCI = Pulverized Coal Injection, SSCC = Semi-Soft Coking Coal. There’s a wide range of HCC quality, but Colonial’s premium HCC is near the top.

Regarding PCI & SSCC, those prices can fall well below HCC levels. Along with Australia’s Bowen Basin, B.C.’s PeaceRiver Coalfield (“PRC“) is best positioned. Australia is facing more frequent & severe flooding, labor shortages, wage pressure, sharp mining cost inflation & rail / port bottlenecks.

Major ports on coasts of China, Korea, HK, India & Japan — that’s where the blast furnaces are

By comparison, western Canada has the greenest, lowest cost energy on the planet and is better situated regarding logistics, weather and cost increases.

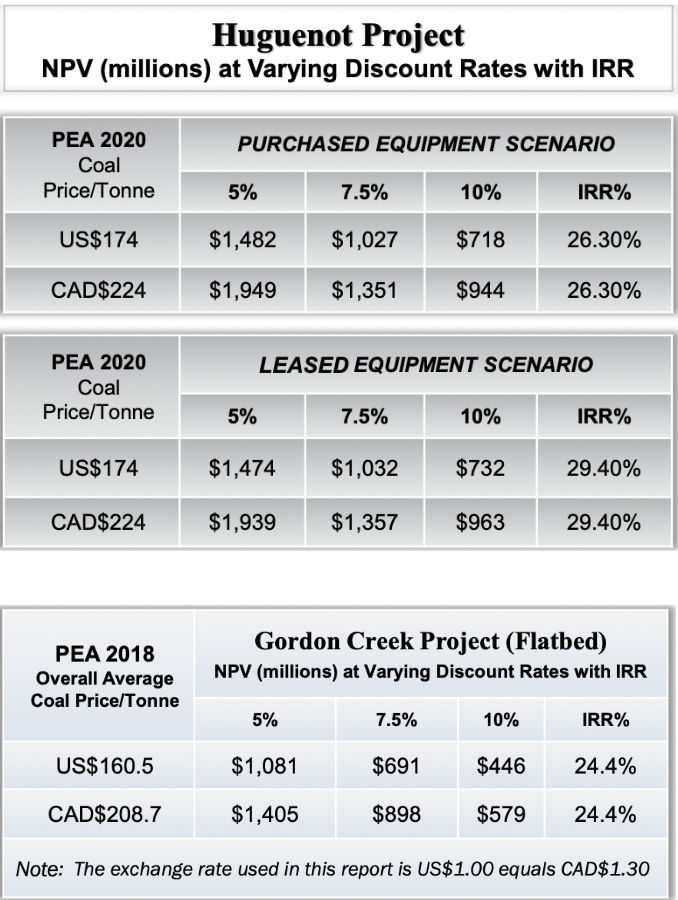

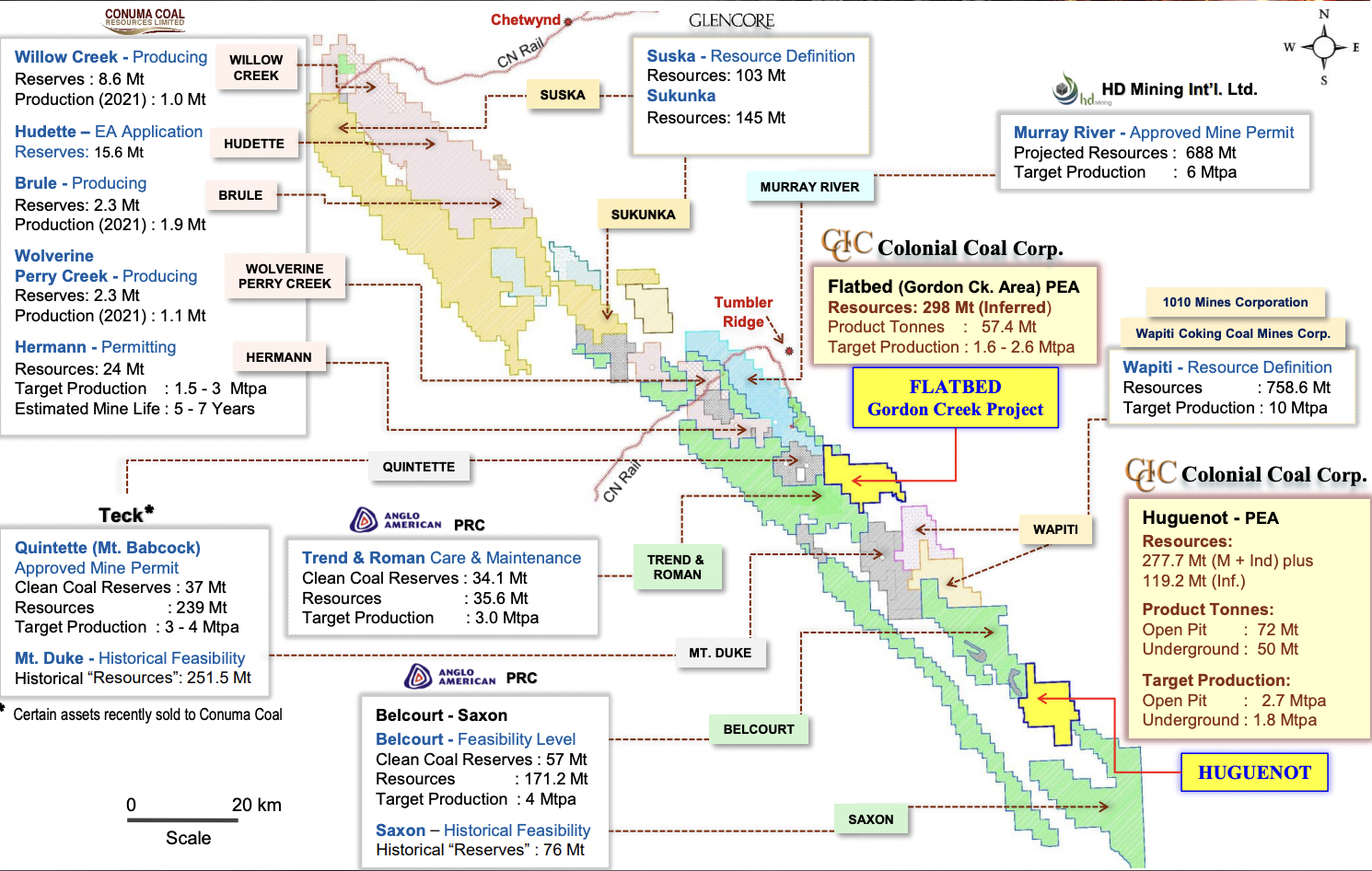

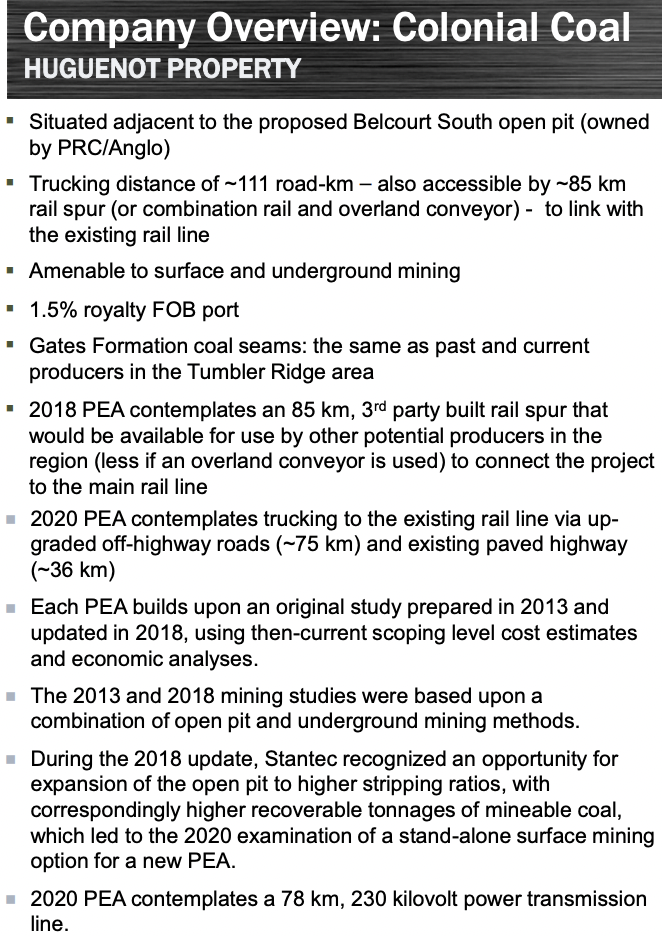

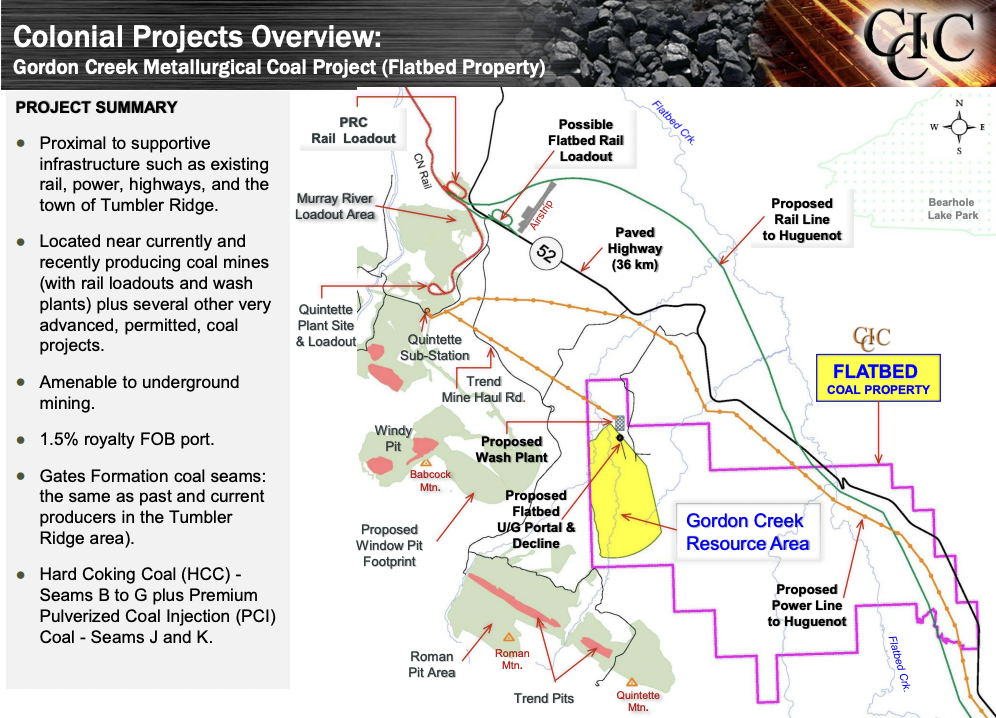

What does this mean for a favorite of mine, Colonial Coal (TSX-v: CAD) / (OTC: CCARF)? Its two 100%-owned, PEA-stage projects have a combined 695M tonnes of resources, (not reserves). Since late 2019, both projects have been up for sale. {see corporate presentation}

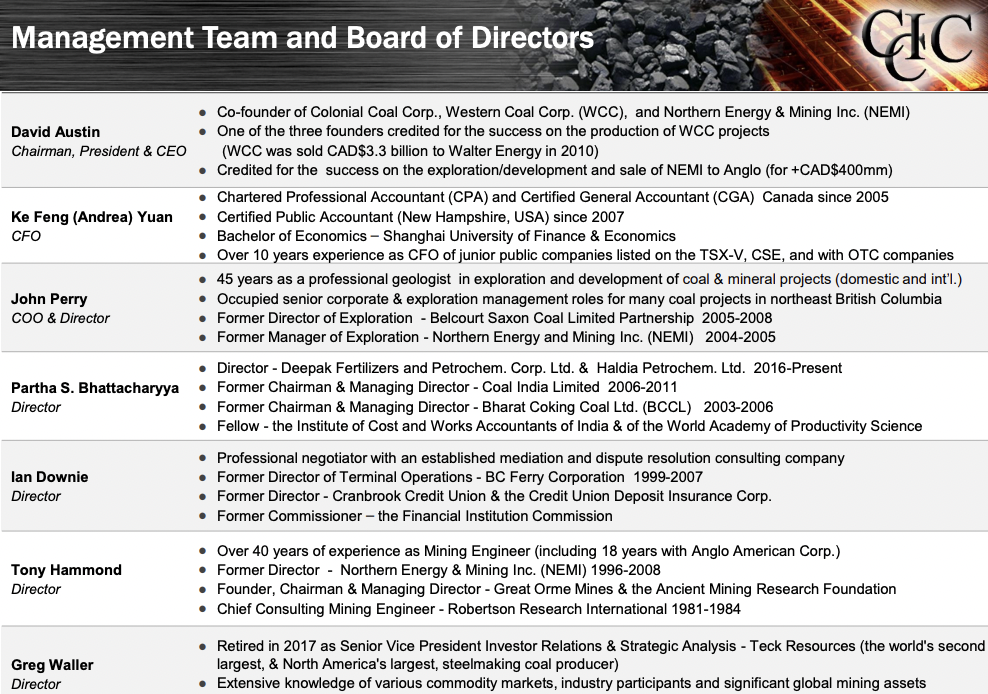

The management & board of Colonial include seven top-notch execs with extensive coal & steel industry expertise, including in operations.

They are specialists in M&A, with strong contacts in China, India, the U.S., Canada & Australia, and ties to many companies, including; Anglo American, Teck Resources & Glencore. CEO/Chairman David Austin soldWestern Coal & NEMI at the top of the market in 2011 for over US$3B.

Combined post-tax NPV = C$2.3B @ avg. price = US$167/t vs. current benchmark price = ~$260/t

Few, if any, know more about the B.C. coking coal market than Mr. Austin & COO/Dir. John Perry. Dir. Partha Bhattacharyya is former Chairman of Coal of India, the largest coal company on earth, Dir. Greg Waller worked for Teck for over 20 years, retiring as SVP.

Ninety-four (94%) of Colonial’s resources rank as low-ash, low sulfur & low phosphorus premium hard coking coal — nearly on par with Australia’s Peak Downs index (minus $5-$10/t). One of Colonial’s largest shareholders, Warren Irwin of Rosseau Asset Management remains optimistic,

“At present, buyers are clamoring for mines in production like Teck’s, but those will soon be gone. The next logical step is high-quality projects like the two owned by Colonial Coal. The world is figuring out how rare high-quality coking coal projects outside of China, Mongolia, Africa & Russia are. It’s not often one’s able to buy coking coal for US$0.30/t in the ground when the end product sells for US$300/t.“

Wait, if Colonial’s assets are so great, why is the sales process taking so long? Yes, complex intl. deals involving highly bureaucratic public & private entities, government officials + sets of lawyers, consultants, accountants & financial advisors, interrupted by a once-in-a-century global pandemic & geopolitical snafus, can take longer than expected.

From time to time, the Canadian government has diplomatic fallouts with China & India. Not good, those two countries host 11 of the 15 largest steelmakers {Wikipedia}. If China or India are temporarily out of favor, why doesn’t management turn to the U.S., Australia, Japan, Korea or other Canadian groups?

Management wants to maintain competitive tension, so when China or India are sidelined, the process slows to allow them back in.

Prospective investors in Colonial fear that, 1) the Canadian gov’t is so inept / anti-mining / liberal that coal projects won’t get permitted, 2) environmental concerns will stall projects 3) caribou, and 4) hydrogen displacing coking coal.

I believe, as does Colonial’s team, that caribou migration & hydrogen substitution are NOT major risk factors. Regarding the other risks, readers are reminded that the provincial, not the federal government, controls permitting. B.C. is far more mining-friendly (less liberal, less woke) than fancy politicians in Ottawa.

Coal exports from B.C. generate billions in taxes, royalties & economic activity. Revenues will grow quite substantially with the additions of Colonial’s projects and others in the PRC.

By contrast, Canada’s oil & gas revenue is expected to grow only modestly (oil sands out of favor) and forestry revenue is challenged from climate change (forest fires, pests, disease). Bottom line — B.C. will not kill the goose that lays the golden [premium HCC] eggs.

CEO Austin has maintained strong relationships with key First Nation communities for well over a decade. He and/or team members speak with key groups weekly. They’re in favor of developing Huguenot & Flatbed.

Colonial’s coal quality is well understood and is among the best in the world…

I could go on about multiple risk factors, but more than 16 prospective bidders have been in the data room this year. Most have had multiple meetings with one or more of; Austin, Perry, Waller, Bhattacharyya, directors Tony Hammond & Ian Downie, CFO Andrea Yuan, plus various Canadian / B.C. officials.

Teams from giant steel & coal companies have traveled, (and continue to travel), to B.C. to conduct due diligence. These sophisticated groups clearly understand the risks. Austin reports that interest in Huguenot & Flatbed is as high as ever.

Shareholders feel that Colonial’s projects, surrounded by operations owned by Teck, [NOTE: Teck announced plans to sell its coking coal operations to Glencore 77%, Nippon Steel 20% & POSCO 3% on Nov. 14th] and projects by Anglo American, Conuma & Glencore, are worth US$2.00+ per resource tonne.

At US$1.00/t, the implied share price is ~C$5, at US$1.50/t, ~C$7.5 and at US$2.00/t, ~C$10 per share. However, investor fatigue is a powerful force, the current price is C$1.39. In the bull market of 2011, many of the groups in the data room today watched properties trade hands at US$2-$3/t.

Since then, four things have happened; 1) steelmakers’ balance sheets have grown larger & stronger, 2) inflation means that $2-$3/t then = $2.7-$4.1/t now, 3) some bidders need the coal more urgently, and 4) Russian supply is extremely uncertain.

Despite these bullish developments, the market values Colonial’s HCC tonnes at US$0.29, a level seemingly below a fire sale scenario! In my view, bidders feel no sense of urgency, because there hasn’t been any urgency so far.

At some point, a credible bid will surface, the stock will be temporarily halted, and an auction process will begin.

A recent coking coal acquisition provides an interesting valuation comparison. Whitehaven (“WHC“) purchased two mines from the BHP Mitsubishi Alliance for US$2.33/t (incl. US$465M of stated reclamation liabilities).

The mix of tonnes is 68% HCC, and 32% PCI / semi-soft. By contrast, Colonial’s 695M resource is 94% premium HCC. Adjusting for quality & reclamation liabilities, WHC paid US$3.43 per tonne of HCC. By contrast, Colonial’s HCC tonnes are valued at just US$0.29.

In March, privately-held Conuma acquired Teck’s Quintette mine + 238.2M tonnes of resources for US$90M plus ~US$100M in reclamation obligations. In addition, a 25%! Net Profit Interest will be paid.

At US$250/t, on a 12-yr. mine life, the NPV of a 25% royalty is ~US$600M. Therefore, Conuma effectively paid ~US$3.20/t. Colonial’s HCC tonnes are valued at 1/10th of that!

Buyer(s) of Colonial’s projects get a clean slate, no legacy or other long-term liabilities. They can bypass or minimize some of the problems legacy companies face. The next owners also have a clean slate on mine planning.

Austin’s team believes the operating potential of the combined projects could potentially grow to 8-12M tonnes/yr. That’s about a third to nearly half of Teck’s [soon to be Glencore’s] annual production from western Canada.

Opportunities to secure large quantities of premium HCC outside of Africa, China, Mongolia & Russia are few and far between. All roads lead to western Canada & Colonial Coal (TSX-v: CAD) / (OTCQX: CCARF).

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Colonial Coal, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Colonial Coal are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares in Colonial Coal, and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)