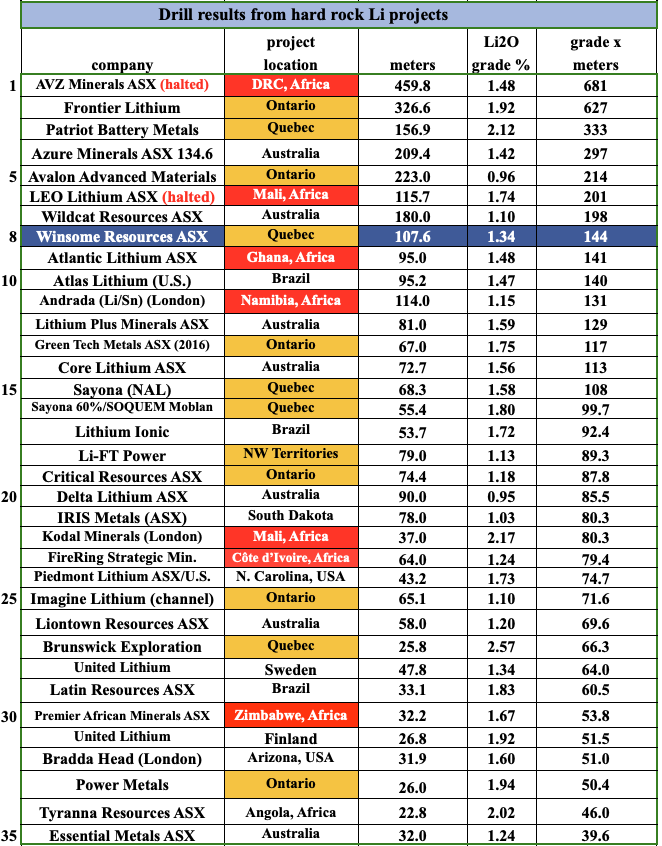

I’m monitoring 230 companies with at least one lithium (“Li”) property in Canada. Fifty-four are Australian (ASX-listed). One of my favorites is Winsome Resources (ASX: WR1) / (OTCQX: WRSLF). Note: Epstein Research has no existing or prior relationship with Winsome.

On Dec. 11th, just 14 months after starting to explore, Winsome delivered a stellar maiden resource estimate (“MRE”). It’s enterprise value {market cap + debt – cash} = ~C$130M. {see December corporate presentation}.

Winsome joins the ranks of about a dozen juniors that have reached the MRE-stage on Canadian Li prospects. That’s right, of 230 names fewer than 5% have a MRE. Based on 27,625 meters drilled, {~100 x ~100 meter spacing}, it booked 58.5M (100% Inferred, JORC) tonnes — grading 1.12% Li2O — on its 100%-owned Adina project in Quebec.

In January, a blockbuster interval was announced — 107.6m @ 1.34% Li2O from 2.3 m depth — (see chart above). Preliminary metallurgical work indicated that a ~5.5% Li2O spodumene concentrate could be produced with ~70% recovery.

Adina’s large, coarse-grained spodumene crystals could be amenable to simple, low-cost, environmentally-friendly dense media separation (“DMS”), but more testing is required to see if flotation will also be needed.

The shallow project hosts two immediately-adjacent, spodumene-bearing pegmatite zones (Main & Footwall) with the expectation that they can be developed in a single operation. If so, that could be low-cost, quick to market & logistically simple.

True thickness ranges from 40 to 80 m over 1,340 m, open to the east & west, up-dip to the north & at depth. Total strike length is 3,100 m. Beyond that 3,100 meters are the prospective Jackpot, Ridge & Far East targets.

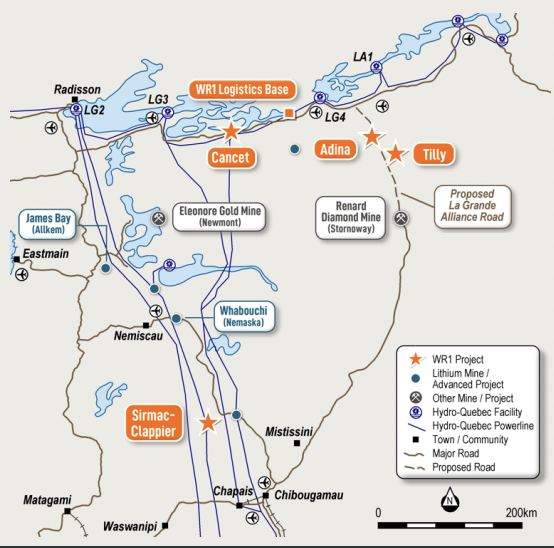

Adina has a 60+ person camp 50 km from a hydropower station. One or two technically easy roads need to be built in the coming years. Management is confident that continued work with First Nation groups & government agencies will facilitate road construction at reasonable costs.

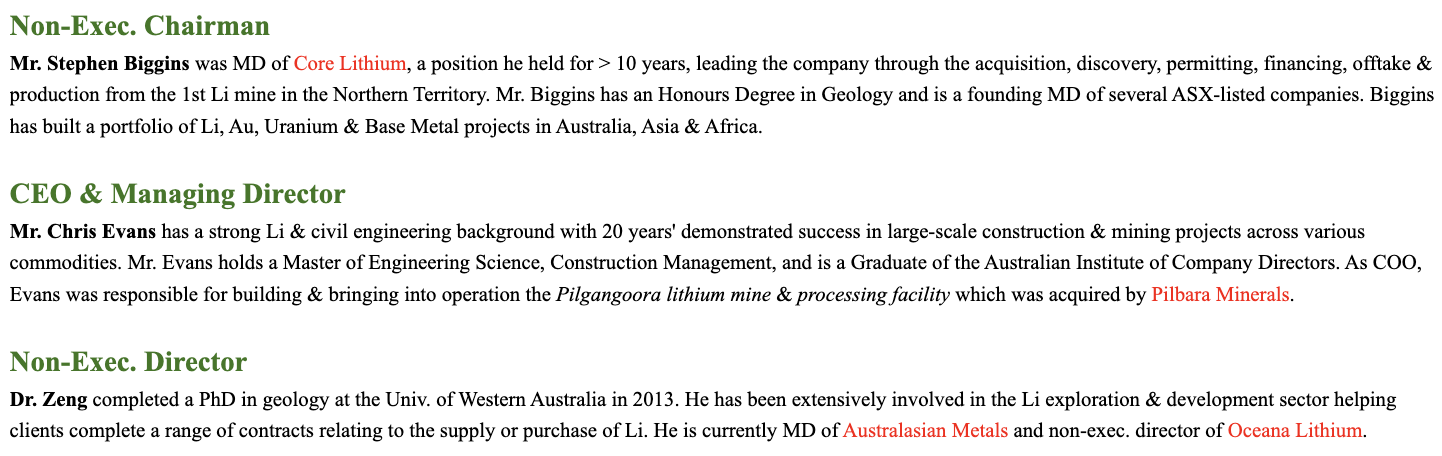

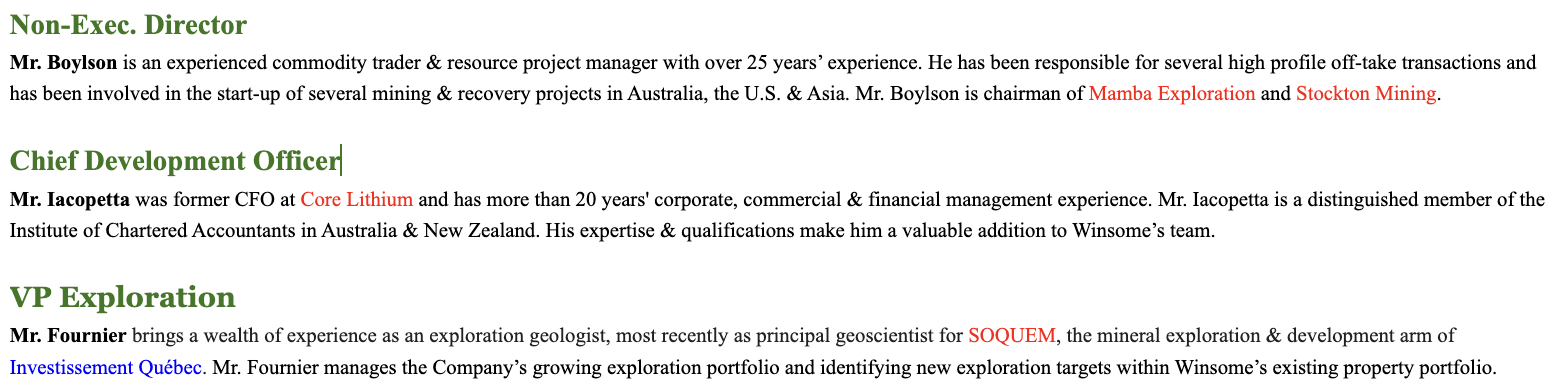

Winsome is led by CEO Chris Evans & non-exec. Chairman Stephen Biggins who have significant experience in mine building and the Li sector. Biggins was the man behind Core Lithium from its early days through production. He has extensive Li expertise & industry ties to help Mr. Evans drive the Company forward. {see bios above & below}.

How big is 58.5M tonnes @ 1.12% Li2O? Two of the most advanced Canadian projects, [both with Bank Feasibility Studies] owned by Critical Elements & Rock Tech Lithium, have an average resource size / grade of 24.5M tonnes / ~0.91% Li2O. Anything > 50M tonnes / 1.00% Li2O is globally significant.

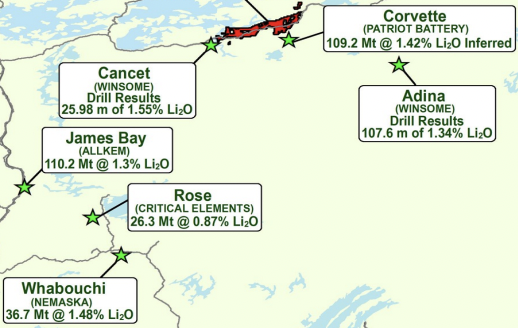

Look at the map below. Patriot Battery Metals’ [“PMET”] Corvette project, PLUS Winsome’s Adina/Tilly, Cancet & Sirmac-Clappier, PLUS the James Bay, Rose & Whabouchi, PLUS other projects not shown, like Sayona/SOQEM’s 71M tonne Moblan, could easily host 500M+ tonnes of Li-rich ore.

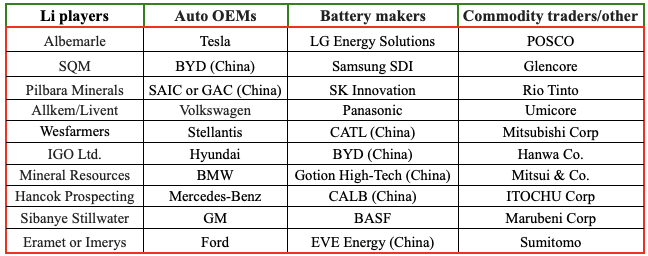

Soon-to-be merged Allkem/Livent Corp. will be a top global Li producer, owning 50% of Whabouchi + 100% of James Bay. It would clearly benefit from acquiring additional assets in Quebec.

Rio Tinto entered the Quebec Li hunt via two earn-ins this year. Albemarle invested in PMET, while Australia’s Mineral Resources & Pilbara Minerals are rumored to have acquired shares. POSCO & Glencore have interest in both Canada & in battery metals. POSCO is partnered with GM on a new battery materials facility in Quebec.

Glencore has signed Li off-take agreements with companies in Argentina, Brazil & the DRC. Anyone who thinks this part of Quebec is too remote to become a major Li hub, is crazy. Government needs to step up with the funding for roads, but they absolutely will! Why?

GM, Ford, Volkswagen, Stellantis, POSCO, LG Energy Solutions, BASF, Umicore, Northvolt — and more to come — have been assured that critical infrastructure will be built. Tens of billions in taxes/royalty payments + wages & economic impact is at stake.

First Nation communities have been promised meaningful benefits from the jobs, infrastructure and other amenities; (dining, shopping, entertainment, etc.) that will follow development.

Despite strong long-term fundamentals for Tier-1 Canadian Li juniors, the sector overall is in a terrible slump. No matter what Winsome or PMET says, investors may not care until Li prices recover somewhat. In the chart below, 97,500 yuan/tonne = ~US$13.7k/t, down from the low-$80k’s/t a year ago…

A quick tangent on prices… The far less volatile quarterly Li carbonate contract price at SQM has a trailing 3 / 4 & 5-yr. avg. of $25,174 / $22,401 & $21,390/t. For those believing that SQM’s contract prices will fall below $15k/t for an extended period (as some banks are forecasting), Li stocks are not for you.

What matters is that, in my view, Winsome can do very well at $$16k+/t. I think PMET’s valuation will be watched closely until it gets acquired. Why is PMET the leading Canadian Li junior? Based solely on a MRE, Corvette is the eight largest hard rock Li project on earth.

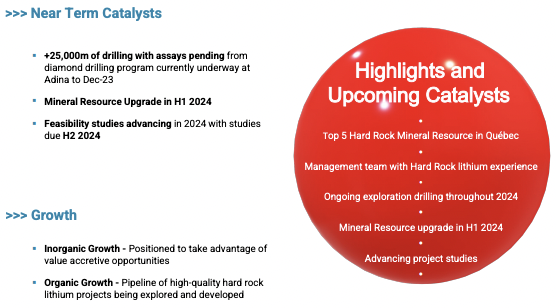

A perfect storm took Winsome shares to A$0.85 on Dec. 13th, -68% from its 52-wk high. On Dec. 15th, shares rebounded to A$1.035. In 3-4 months, an updated resource including an additional 25,000 meters of drilling will show a meaningful increase in tonnage, grade & confidence level.

I estimate 75M tonnes, at 1.20% Li2O, with 40% of the new resource in the JORC Indicated category. Yet, 75M tonnes is still just a stepping stone, management plans another 50,000+ meters of drilling in 2024.

Therefore, by 12/31/24, assays from ~100,000 meters will be in hand, enough to support a resource > 100M tonnes, (~60-70% Indicted). Winsome will then publish a Pre-Feasibility Study (“PFS”). By 1H 2025, the Company could be worth a multiple of its current level. Adina will be an extremely attractive acquisition prize.

Major companies are already calling Evans & Biggins, but with A$60M in cash, there’s no urgency to secure a strategic partner yet. Adina is a major hard rock Li asset in Canada. PMET’s Corvette is #1, with Winsome competing with projects from Li-FT Power, Sayona & Frontier Lithium for slots 2 thru 5.

In the chart below are over three dozen prospective suitors for Canada’s best & brightest Li prospects, fighting over fewer than 10 major new projects coming online in Canada by 2030. Given Corvette’s strength, readers could buy shares of PMET, but it’s valued 10 times higher than Winsome!

That gap should decline Adina continues to be de-risked. Imagine what the Company might be worth after a high-profile, multi-billion dollar acquisition of PMET. Suitors who fail to win PMET would turn their attention to Winsome.

In addition to Adina, there are three other projects that could potentially move the needle. Cancet has delivered excellent intervals including; [21.5 m / 2.24% Li2O], [26 m / 1.55%], and [18 m / 3.14% ]. It’s a large property, management has barely scratched the surface.

The Tilly prospect is just 20 km SE of Adina, could it become a substantial satellite deposit? Sirmac-Clappier hosts outcropping high-grade Li in spodumene-bearing pegmatites.

Extensive mapping was done by predecessors. It’s close to a mining town and has access to roads & power. Sirmac is < 100 km west of Sayona’s Moblan, and relatively near the existing rail line at Chibougamau.

All-in, Winsome has 87,150 hectares across four prospects. In addition, the Company owns ~19.6% of Ontario Li junior Power Metals (and 100% of Power’s off-take rights).

Winsome Resources (ASX: WR1) / (OTCQX: WRSLF) has A$60M in cash, and is burning ~A$3M/month. By the time it needs to raise capital, it will likely have a third resource estimate done, a PFS under its belt, potential new discoveries at Cancet, Lilly and/or Sirmac, and considerably more metallurgical word completed.

And, in my view, the Li sector will be in a much better place. Management will continue to inject cash via Canadian flow-through share offerings at substantial premiums to market. The last three offerings were secured at 74% to 98%, above market — with no warrants!

{see December corporate presentation}

A handful of analysts have Li price forecasts in the $11k-$15k/t range for 2024-26. However, even if bearish analysts turn out to be correct, I think that Winsome will be acquired at a valuation above today’s C$130M. If/when Li prices rebound to $20k+/t, the share price could move substantially higher.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)