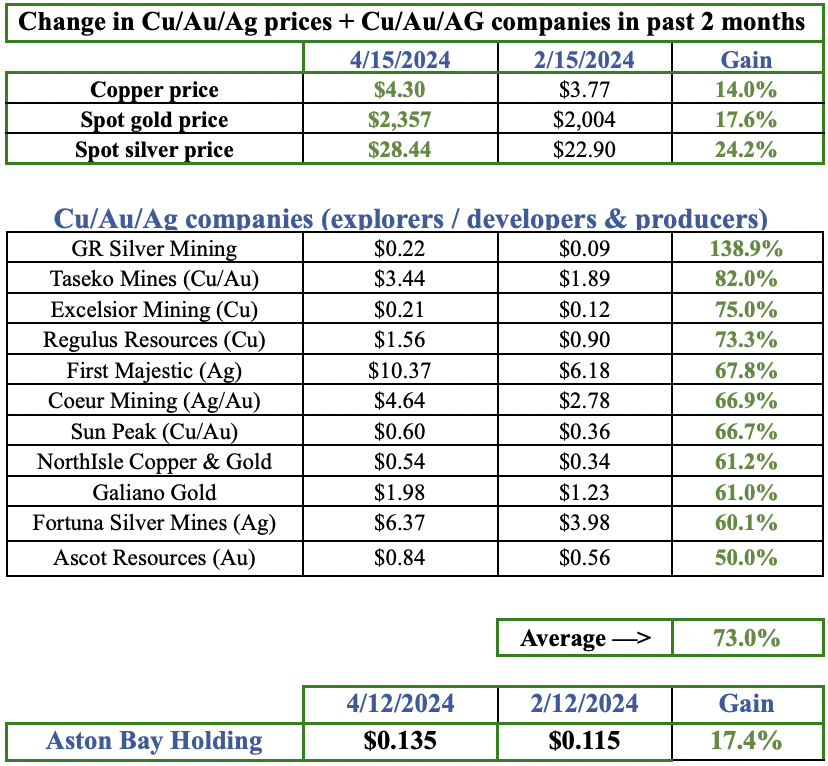

Next year gold will likely continue to experience fairly wide price swings, but the overriding trend should be higher. Both UBS & SocGen forecast the price to be $2,200/oz. in 2H/24.

Decades-high inflation rates have taken a toll on costs, which is supportive of higher commodity prices in the years ahead. Newmont’s All-in-Sustaining-Cost (“AISC“) is up a cumulative +54% since January 2019.

One of my favorite gold developers is Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF). Thesis doesn’t need $2,200/oz. to thrive, it would do just fine at $1,850/oz. vs. $2,038/oz. today. {See new corporate presentation}.

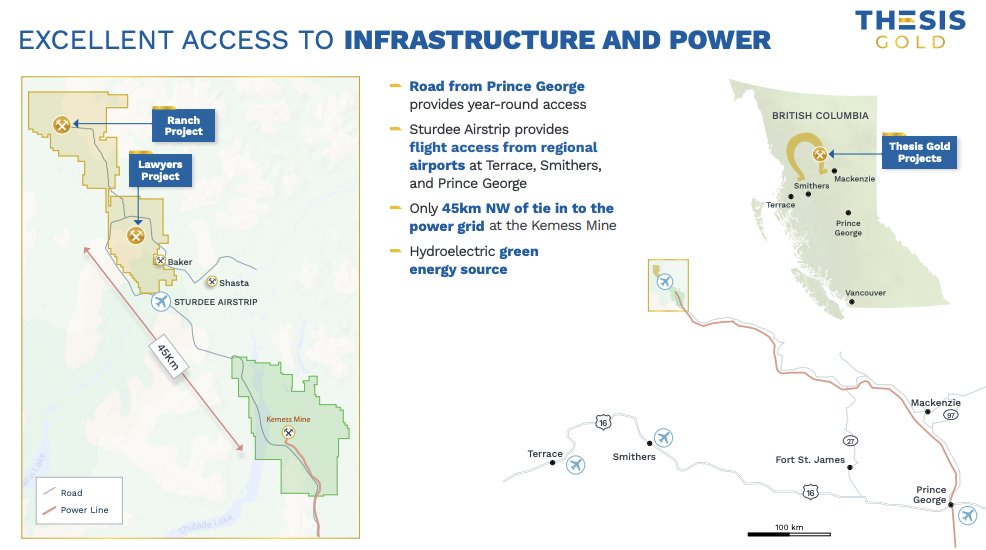

Thesis has a 32,500 hectare PEA-stage, contiguous land package in the heart of northwestern B.C.’s Golden Horseshoe / Toodoggone region.

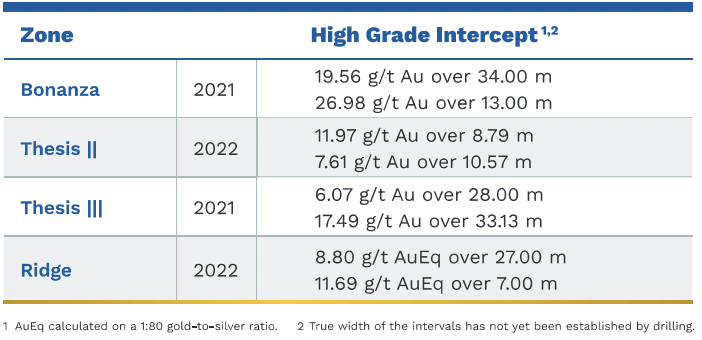

At a time when most gold juniors are desperate to raise cash to drill projects in search of a discovery hole, Thesis has already booked blockbuster intervals such as this year’s 4.1 meters at 119.5 g/t gold, incl. 2.0 m at 231 g/t! That’s a [gram x meter] figure of [4.1 x 119.5 = 484 g-m].

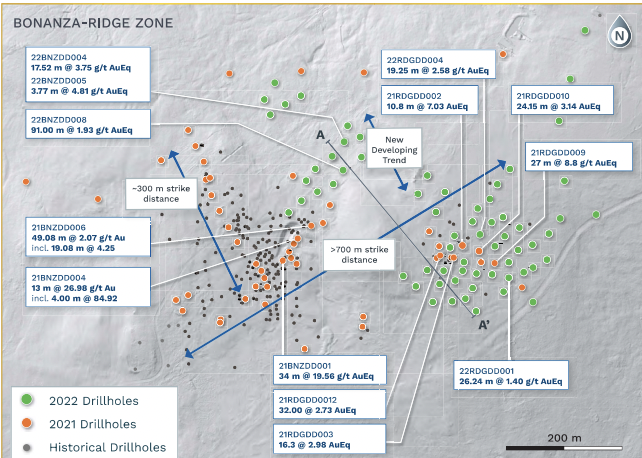

Year-to-date, 231 g/t Au is a Top-8 Au-only grade in N. America (among intervals > 1.0 meter). And, readers are reminded of 2021’s two best intervals averaging a whopping 622 g-m! [34 m @ 19.6 g/t] & [33.1 m at 17.5 g/t]. There’s lots of excitement around the Bonanza & Ridge zones at Ranch.

In the map below, notice that these two zones are now thought to be connected, which has the potential to add more high-grade ounces than initially imagined.

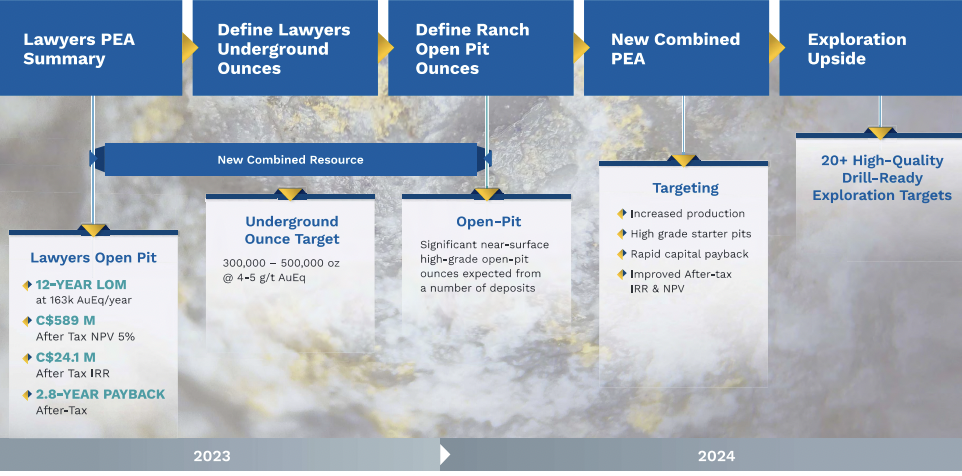

Thesis completed a PEA on its Lawyers project, and is working on a new PEA to incorporate the contiguous Ranch project. Next year will be transformational, as the new PEA will have a longer mine life, and will pull forward & add high-grade ounces to the beginning of the mine plan.

This is not rocket science, a clear path to the enhanced PEA is well underway and fully-funded. Monster drill results are being hit. An estimated 400 to 500k ounces grading 4 to 5 g/t Au Eq. sit beneath the Lawyers’ open pit.

That grade of 4-5 g/t is 3x the head grade in the existing PEA, and those ounces will be added to the initial years of the mine.

World-class Intercepts… the best two boast Top-5% [gram x meter] figures

These critical enhancements should deliver an after-tax NPV of close to C$1 billion and an IRR > 24%. Importantly, Thesis has enough cash to carry it through publication of the PEA in the third quarter.

A lot of gold price appreciation and M&A could be underway between now and then. Notice the high-quality of the mgmt. team and board. CEO & President Ewan Webster & COO Ian Harris have very serious geological/mine engineering expertise.

Director Thomas Mumford has had great recent success helping Scottie Resources develop what looks like it will be a multi-million ounce project. Yet, the Company’s enterprise value {market cap + debt – cash} of $76M is a small fraction of what the Company’s upcoming PEA is expected to show.

In previous articles I have speculated on an incoming wave of M&A in B.C. Newmont’s acquisition of Newcrest has closed, will it be looking at acquiring more assets in Canada?

While I don’t think Newmont would acquire tiny Thesis, many others certainly could. Canada is a safe-haven and a highly desirable clean, green mining jurisdiction with nearly 100% low-cost hydro-electric & nuclear power.

Teck Resources is selling its coking coal operations for $12B, giving it a war chest to potentially acquire Canadian mining assets. It already has JVs on two world-class projects in B.C., Galore Creek (50%) & Shaft Creek (75%).

In addition to Newmont & Teck, BHP, Freeport McMoRan, Boliden AB, Kinross, Centerra Gold, Seabridge & Hecla Mining are active in B.C. Privately-held, Peruvian company Ccori Apu recently delivered a cash injection to Ascot Resources.

Ascot’s pouring first gold by mid-2024, which will attract attention to the area. I believe that Thesis would be a good fit for Agnico Eagle Mines, who does not have operations in B.C., but has a major presence in Canada.

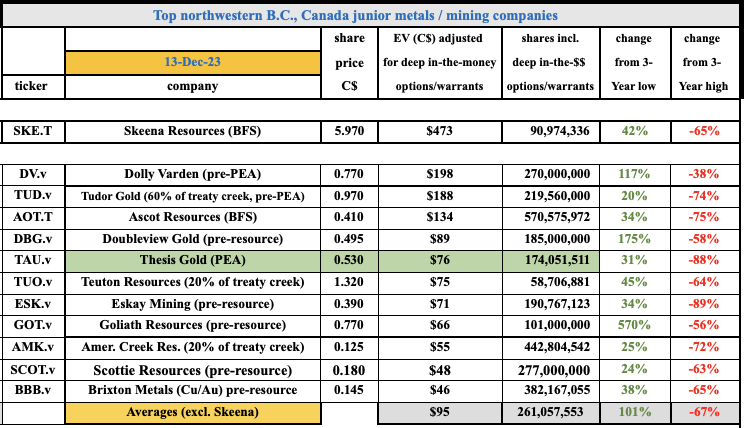

Thesis is more advanced than B.C. peers Tudor Gold, Eskay Resources, Goliath Resources & Doubleview Gold, none of whom have delivered a PEA. In fact, Eskay, Doubleview & Goliath are pre-maiden resource.

Yet, Thesis’ valuation at $76M is 36% below the average valuations of Dolly, Doubleview & Eskay. {see chart of peer B.C. juniors above}.

The combined Ranch/Lawyers project has better access to regional infrastructure than many projects that are more remote. And, some developers closer to the coast face much harsher winters compared to the more temperate climate around Ranch/Lawyers.

Newmont, Teck, Freeport & Centerra have assets nearby Thesis, but the Company is a compelling target to others as well, especially after release of a new PEA and resource estimate in the next nine months. Please look at the map, Centerra is closest and is sitting on $660M in cash.

The Company expects to have ~5M ounces booked along with a new PEA in 3Q/24. Very substantial exploration targets could, over time, add millions more ounces. Management believes that Ranch could rival Lawyers in terms of mineral endowment. Over 20 high-quality, drill-ready exploration targets have been identified.

As additional impressive drill results pour in, and market sentiment in the junior miner space rebounds, 2024 is shaping up to be a strong year. If/when M&A picks up, B.C. Canada could become a hotspot.

Gold has recently had a nice bounce on favorable interest rate news in the U.S. Thesis Gold (TSX-V: TAU) / (OTCQX: THSGF) could meaningfully outperform the broader markets and its B.C. peers.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares of Thesis Gold and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)