Investors in Argentina lithium hopeful Portofino Resources (TSX-v: POR) / (OTCQB: PFFOF) waited a long time for BIG news on an auction in Salta Province, Argentina, in which management bid on the right to develop two lithium (“Li“) concessions.

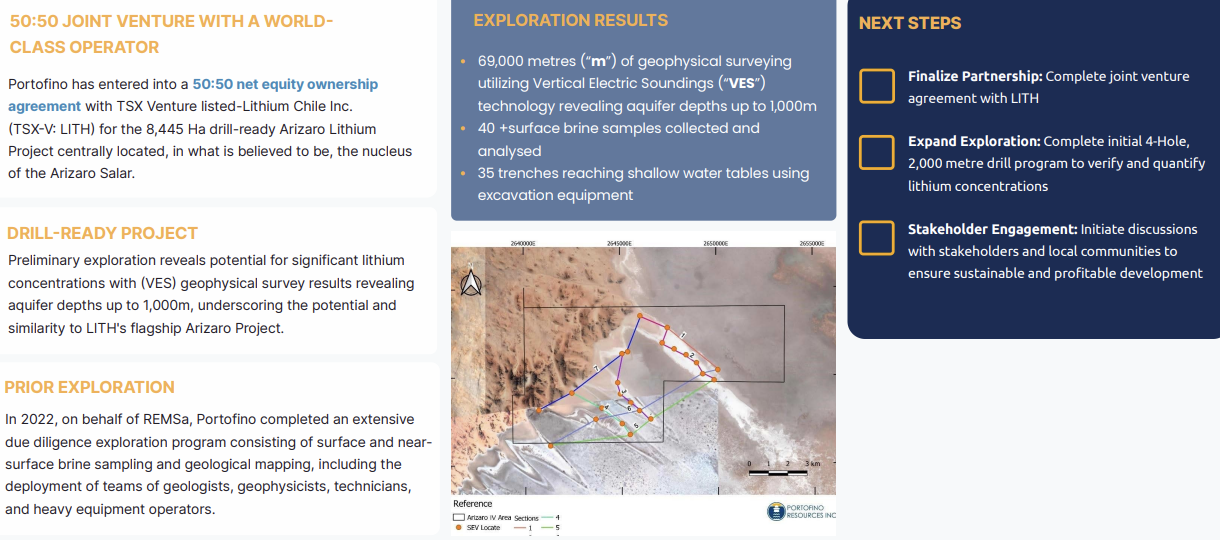

Congratulations are in order! Portofino is forming a 50:50 net equity Partnership Agreement with Lithium Chile, in which Lithium Chile will be the operator, for an 8,445 hectare concession in the Arizaro Salar.

The Arizaro salar is centrally located in what some consider one of the best brine regions in the world (outside of Chile). This outcome is ideal for Portofino as it might have struggled to come up with the entire purchase price in a weak Li market.

While there’s no urgency to raise capital this month, management is looking to take down C$5-$10M this quarter. Raising $5M would cover its share of Arizaro’s first payment (~$4M), and a portion of exploration & drilling costs on both Arizaro and the 100%-owned Yergo project.

Portofino partnering with Lithium Chile on Salta province project

Importantly, Portofino’s second & final payment for the Arizaro concession is not due for about a year. Fears of massive equity dilution are overblown (I’m looking at you, CEO.ca). Portofino will be reimbursed for as much as $1M in exploration work.

Other sources of cash could come from asset sales in Canada (perhaps another $1-$2M in 2024). Upcoming dilution will be meaningful, a necessary evil, but if drilling hits good grade on either project, it will be worth it.

The Company stands to benefit from Lithium Chile’s larger size & exploration success at its own 20,800 Arizaro asset nearby. That project has a 3.3M tonne resource at 322 ppm Li & a PEA with an after-tax NPV of $1.1 billion. Further drilling in support of a PFS is ongoing.

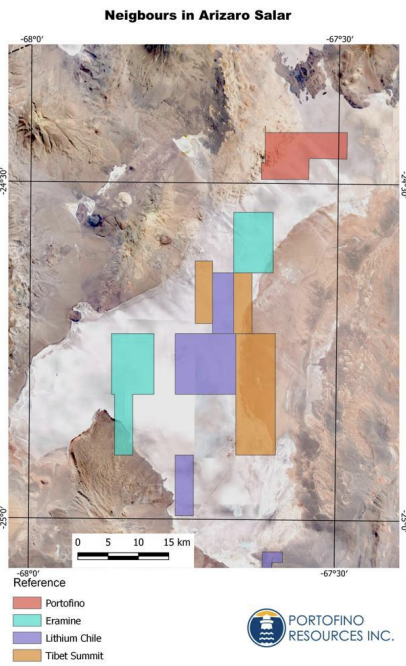

Readers are reminded that $3B Eramet SA is nearby in a 50/50 JV project with China’s Tsingshan Group Holdings that’s entering production this year. It plans to reach an annual run-rate of 24,000 tonnes of Li carbonate. This will draw attention to the salar.

Also in the area {see map below, Portofino controls 50% of top box} is China’s Tibet Summit, which could comfortably afford to acquire Eramet, Lithium Chile & Portofino. Not on the map, but winner of several Salta concessions, is Ganfeng Lithium. Those much larger players are < 25 km from Portofino’s new footprint.

This is a district that’s clearly going to be developed, which means Portofino’s JV with Lithium Chile could potentially be valuable as a satellite deposit if not developed into a standalone mine.

Yesterday, Portofino’s share price was unchanged on heavy trading volume. Everyone knows that dilution is coming, I believe management is looking to raise C$5-10M. The press release states that there are, “strong expressions of interest” for funding.

I think investors might be missing the bigger picture in fear of future capital raises. One should think beyond the next few months to what Portofino might look like a year from now.

Upon drilling success in an upcoming 4-hole, 2,000 meter program, the Company’s 50% stake in the new project could be worth $20-$30M, (depending on Li sector sentiment), pre-PEA. Combine that with the $30M+ potential value of the 100%-owned Yergo project described below.

New Arizaro is close to the regional centre of Tolar Grande, and has road & railway access. A VES survey showed aquifer depths up to 1,000 meters, similar to Lithium Chile’s flagship project nearby.

Some adjacent properties have been drilled to depths > 500 m, hitting intervals of 100’s of meters at > 500 ppm Li. Surface & trench samples returned values consistent with other exploration programs in the area.

On behalf of REMSa, Portofino conducted a due diligence program consisting of brine sampling & geological mapping. This important field work resulted in > 40 surface brine samples, 35 trench samples & 69,000 meters of geophysical data. Management believes there’s potential for “significant lithium concentrations.”

This news on Arizaro is a vote of confidence in Portofino’s management & technical teams, and the in-country connections the Company has built with REMSa and other entities over the years.

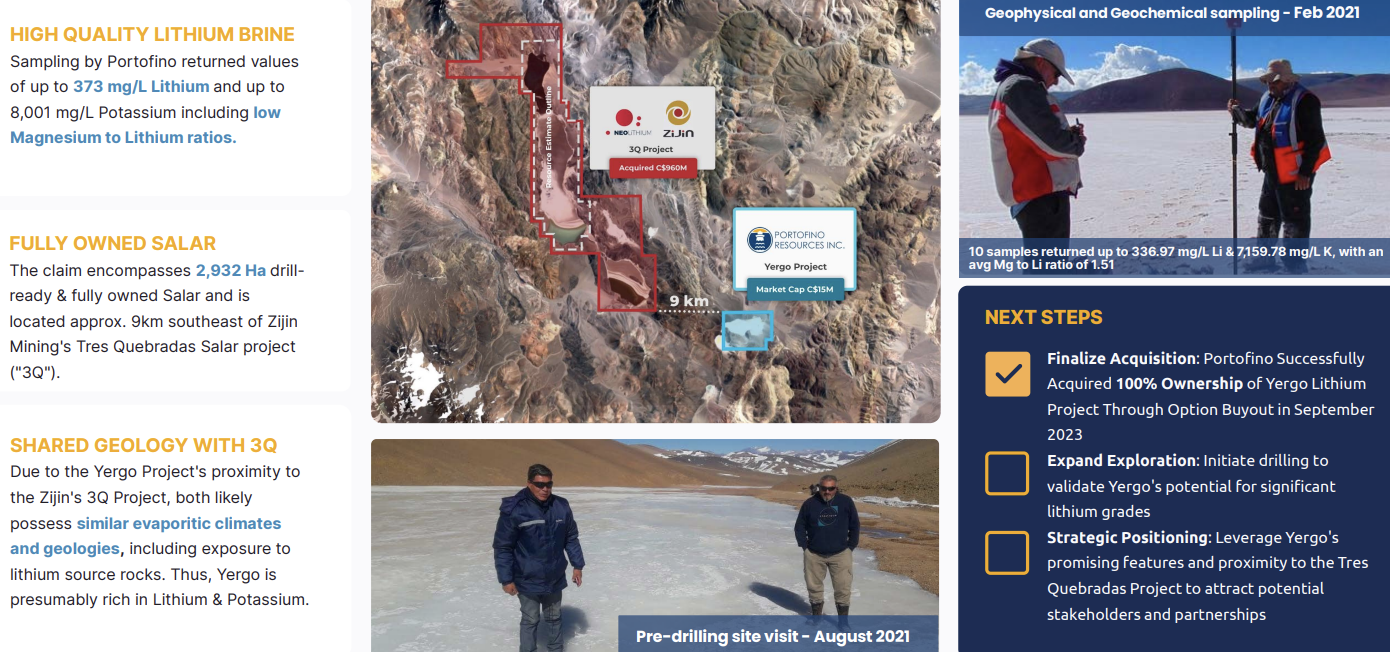

100%-owned Yergo, next to world-class Zijin project, could be a game-changer

The 100%-owned Yergo project covers the entire Aparejos salar, and is located just 10 km from the substantial 3Q project developed by Neo Lithium and acquired by Zijin Mining in 2022 for $960M. Two large aquifers measuring ~2.3 x 1.0 km and 1.8 x 2.5 km have been identified on Yergo.

Surface sampling returned up to 373 ppm Li. However, those samples possibly understate the grade as they were done during the wet season. Four drill targets have been finalized for a total of ~400 meters.

In a recent CRUX Investor interview, CFO Jeremy Wright said that exploration of the two aquifers could potentially expand their dimensions both laterally and at depth.

The Company’s technical team thinks that 3Q & Yergo *probably*, “share a common evaporitic climate & local geology (within the same volcanic package & exposure to the same Li source rocks.)”. Zijin will enter production this year, which should focus investors on Yergo.

With Direct Lithium Extraction (“DLE“) companies crawling all over Argentina, a minimum Li grade of ~150-200 ppm might be all that’s needed. However, based on surface results, Yergo’s grade could be 3x higher. In fact, even higher grades can’t be ruled out as Yergo is so close to the 3Q project that hosts 900+ ppm Li.

Zijin might want to acquire Yergo simply to prevent competition. If Zijin doesn’t bite, Rio Tinto, Ganfeng, POSCO and Tibet Summit have made major acquisitions or investments in Argentina with price tags of US$721 to $962M. Lithium Americas (Argentina) (“LAAC“) acquired two projects for a combined US$584M.

Oil/energy companies Pluspetrol & Tecpetrol are looking to expand nascent Li interests in Argentina. In November, Glencore announced a significant strategic investment in Galan Lithium. That’s a dozen companies that could be interested in Yergo and/or Portofino’s 50% of Arizaro.

Does this suggest Yergo could be worth $100’s of millions? No, not anytime soon, but could it be worth north of $30M upon decent drill results? Absolutely. All eyes are on Argentina as Ganfeng/LAAC, Eramet/Tsingshan, Zijin & POSCO ramp up in the 2024-27 timeframe.

There are probably a dozen EV OEMs and half dozen battery makers ready, willing & able to invest globally to secure Li supply. Stellantis recently made a 20% investment into pre-maiden resource junior Argentina Lithium at an eye-watering implied valuation.

DLE companies like Lilac Solutions, Sunresin New Materials and Summit Nanotech would likely appreciate the advantages of operating on a salar with no competing companies.

Yergo’s footprint of 2,932 hectares is small, but by no means tiny. Lithium South Development has (so far) booked an impressive 1.6M tonnes of high-grade (700+ ppm) Li on just 1,542 hectares.

Therefore, there’s potential, (subject to drilling), for Yergo to host 2M+ tonnes. Several months ago, Alpha Lithium’s PEA-stage project was acquired for ~$60/tonne. Readers are reminded that it only takes a few drill holes to define a meaningful brine resource.

Portofino has four gold & three Li properties in Ontario, Canada. Several of these properties could be attractive farm out or sale candidates, but they are early-stage. All the action continues to be in Argentina.

Portofino Resources (TSX-v: POR) / (OTCQB: PFFOF) is valued at just $12.5M (C$0.075/shr.), and is surrounded by companies 10x-1,000x larger… It offers a lot of Li brine bang for the buck ahead of two high-profile drill programs in the coming months.

Disclosures/Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Portofino Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Portofino Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of funds. It’s assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Portofino Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)