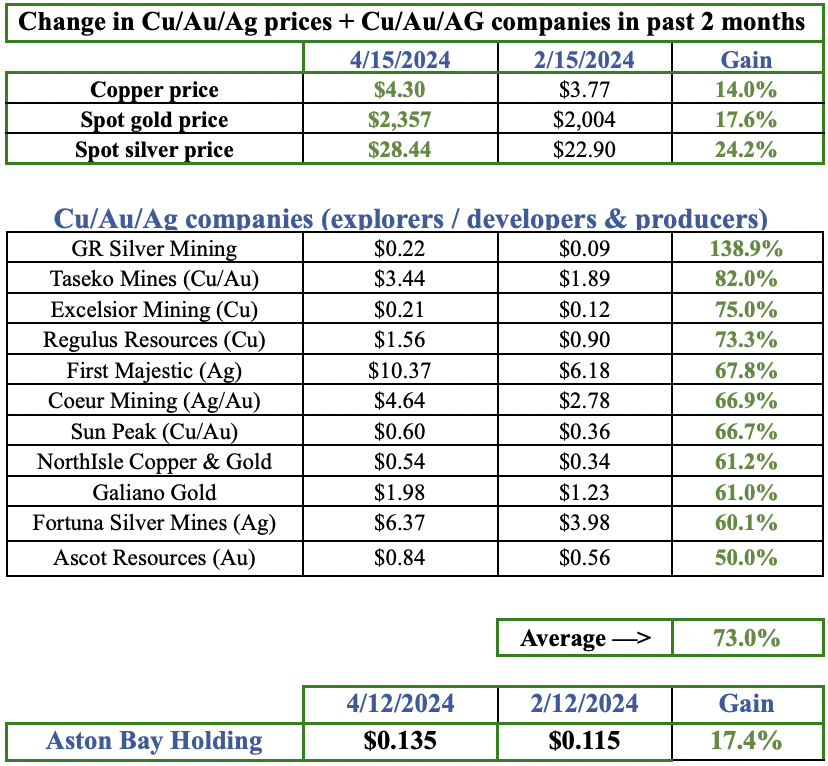

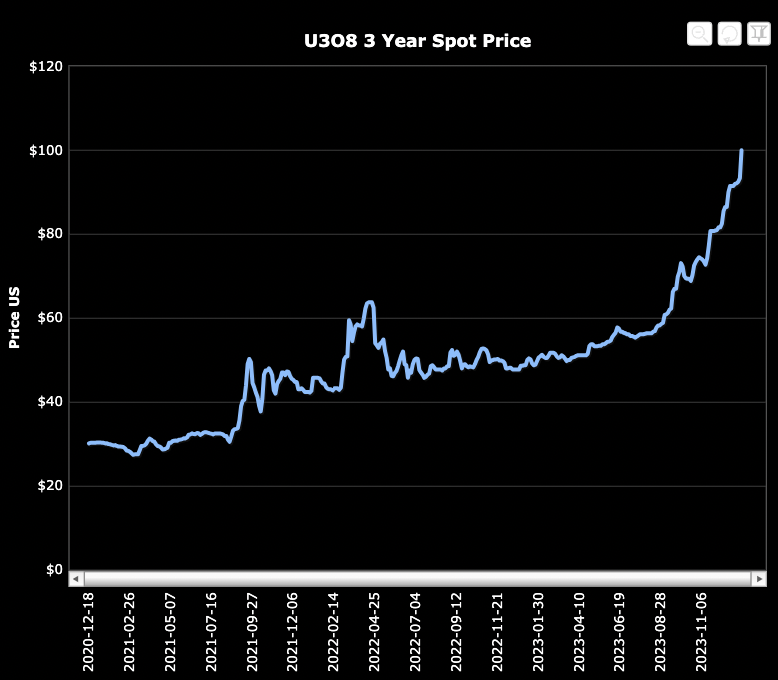

For years I’ve been writing about #uranium juniors saying that the price was poised for a big move to US$70 or $80/lb. Like many, I was early on that call. Here we are in early-2024 and the spot price sits at a 16-yr. high of ~$103.5/lb.

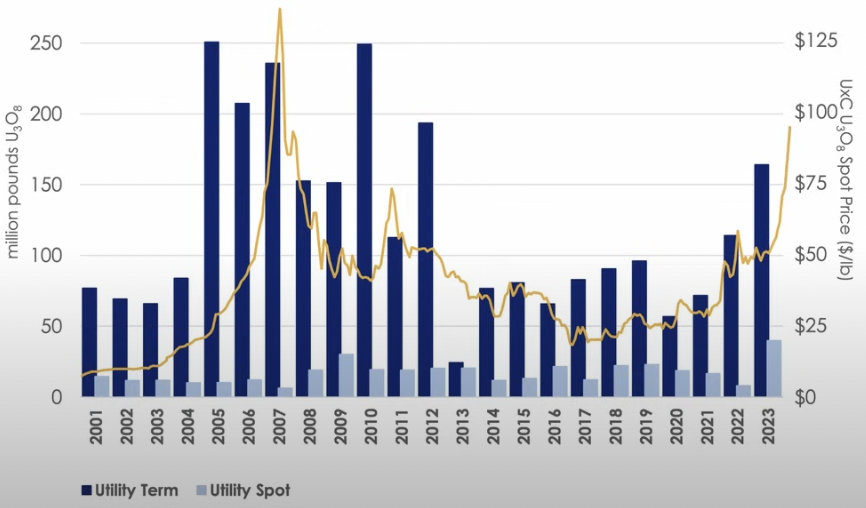

Will the price continue to soar? I don’t know, but consider some key facts on the ground. First, utilities (able to pay any price to keep reactors running) have barely begun to cover their future needs via contracting. {See chart below, from UxC}

The last period of over-contracting in 2005-07 is when the uranium price peaked at ~US$138/lb., equal to ~$208/lb. adjusted for inflation.

2023 was year 1 of a multiyear period of over-contracting, after 10 years! of under-contracting from 2013-22. It’s difficult to see a scenario in which uranium prices decline significantly in 2024 or 2025.

Second, Kazatomprom — by far the largest uranium company on earth — announced last week that production in 2024 & 2025 could come up short. The news got a lot of attention, but the takeaway is even more bullish.

Pundits feared that Kazatomprom could flood the market with 10’s of millions of incremental pounds. Last week’s news eliminates that risk for AT LEAST 2024 & 2025.

Third, the U.S. government is close to (possibly) banning imports of uranium from Russia. There will be loopholes, but the headlines and Russia’s reaction to this provocation could drive the uranium price higher.

Fourth, a tsunami of M&A activity could soon be washing ashore. Cashed up producers & advanced development-stage companies with valuations that have doubled (or more) are on the hunt for projects that can move the needle.

Fifth, some uranium producers like Cameco are running out of steam… It has locked in fixed prices for the next 3-5 years. Cameco is already trading at an EV/EBITDA multiple of 18x-20x its 2024-2025e earnings. Does it have the legs to keep up if the uranium price continues to soar?

If one can’t buy Cameco to gain full exposure to the uranium trade, which stocks still work? There are ~15 juniors that have tripled (or more) from 52-week lows, I would have difficulty buying those, as they have already moved so dramatically.

There are another ~15 that are down 70% (or more) from 52-wk. highs. Those names are difficult to get behind (if $103.5/lb. hasn’t helped, what will?). That’s 15+15 = 30 juniors I would avoid, representing ~20% of the uranium companies I’m tracking listed in Canada, Australia & the U.S.

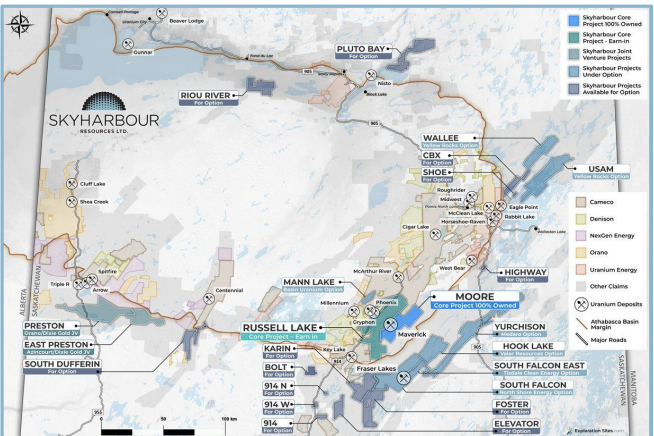

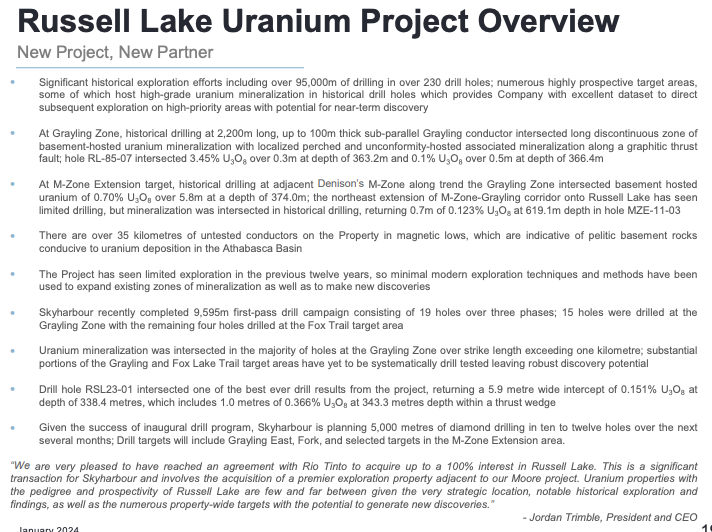

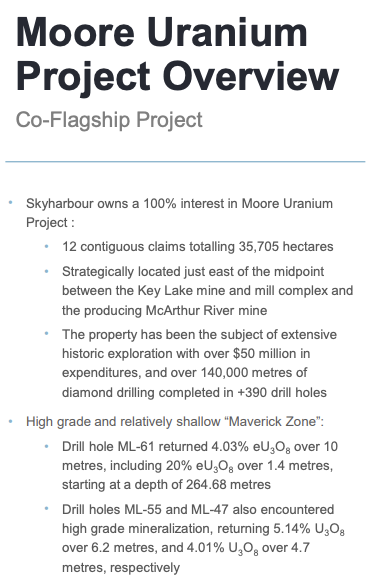

Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) continues to be well positioned & cheaply valued. It has a Top-2 footprint in the Athabasca basin (~523,100 hectares/ 25 properties) the single best basin on the planet.

See brand new corp. presentation. The Athabasca basin hosts the world’s highest grade deposits, routinely > 1.00% U3O8, which is equal to 34.6 g/t Au Eq. at spot prices.

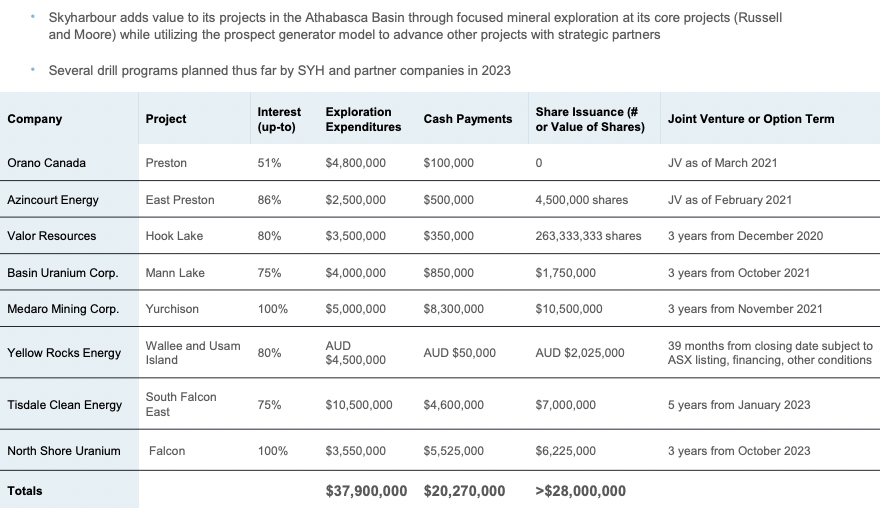

Fourteen are open for option, nine are farmed out or part of JV agreements. Moore Lake is 100%-owned and management is earning into up to 100% of Russell Lake. Skyharbour is not getting credit for the value of its properties, 100% of which are arguably worth 100% more than they were just six months ago.

For readers who think that $103.5/lb. is not sustainable, that the price will fall back to $60-$70/lb., then investing in uranium stocks is not for you. However, if one believes that the uranium price should remain above $100/lb. for several quarters, or climb higher, then one can’t ignore the value of Skyharbour’s 25 properties/523,100 ha.

By no means am I saying uranium is headed much higher, who knows. Yet, six months ago I would have said that the chances of the spot price hitting $103.5/lb. in January, 2024 were 5%-10%. Now, there’s a 5%-10% chance we see $200+/lb. by mid-year! Some might say the chances are meaningfully higher.

Importantly, Skyharbour doesn’t need the price to move up. It just needs to continue farming out properties, advancing core projects & collecting earn-in payments.

Every single aspect of the project generator model is kicking in now. Juniors that Skyharbour is partnered with are better able to raise cash to explore & drill Skyharbour’s properties.

The likelihood of Skyharbour being paid (in cash & shares) 100% of the contractual amounts owed, is going up by the day. The ability to farm-out the remaining properties is improving by the day, AND the terms of farming out properties are presumably improving.

Finally, the residual interests of the properties, typically 25% to 30% if partners earn in fully, are increasing in value. Think of it this way, Skyharbour has 25 call-options on Athabasca basin properties. At zero cost to Skyharbour, each call option has had its expiration date extended by a a few years by virtue of an EPIC bull market.

The value of the call options that actually pay off, properties that hit on drilling, even if just 2 or 3 of them, has gone up substantially. There are dozens of early-stage juniors with properties in Canada and/or the U.S. valued in the C$30 to $90M range.

In a year, those companies could be worth twice as much and Skybarbour and/or its partners might have made meaningful discoveries. Not only will Skyharbour benefit from discoveries on its portfolio, it will benefit from the discoveries of neighboring operators.

Skyharbour and its partners have been granted extra years of a strong market to incubate multiple valuations like that, while at the same time one can not rule out the discovery of what could develop into the next F3 Uranium Corp. or IsoEnergy.

I continue to believe that Denison Mines, Uranium Energy Corp. (UEC), Paladin Energy, Boss Energy, Energy Fuels, Deep Yellow, Encore Energy, Global Atomic, UR-Energy, Lotus Resources & Bannerman Energy would greatly benefit from acquiring Skyharbour for one very simple reason.

Any uranium player would benefit in a bull market from acquiring 523,100 hectares in the Athabasca basin. The above-listed companies are valued between C$500M & C$4B. They have projects in the U.S., Australia and/or Africa. Diversifying into a leading land position in the world’s best basin makes tremendous sense.

Any of those prospective buyers could afford to do more drilling than Skyharbour has planned, across more properties (if warranted). Make no mistake, with uranium at $103.5/lb. there’s no rush for management to sell the Company anywhere near today’s valuation of < $100M.

Time is on Skyharbour’s side, the value of everything is increasing, equity dilution going forward should be minimal. Readers are reminded that management secured the vast majority of its giant property portfolio when the uranium price was less than half today’s level, in some cases less than a third.

I listed five bullish uranium market factors in my opening paragraphs, I could easily have listed 10. For various reasons, not all uranium stocks are ideally positioned to rally (or continue rallying).

Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF) is in a sweet spot, not too hot, not too cold. If it’s destined to break in one direction — up a lot or down a lot — I think that direction is clear. See brand new corp. presentation.

Disclosures / Disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Skyharbour Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Skyharbour Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Skyharbour Resources is an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)