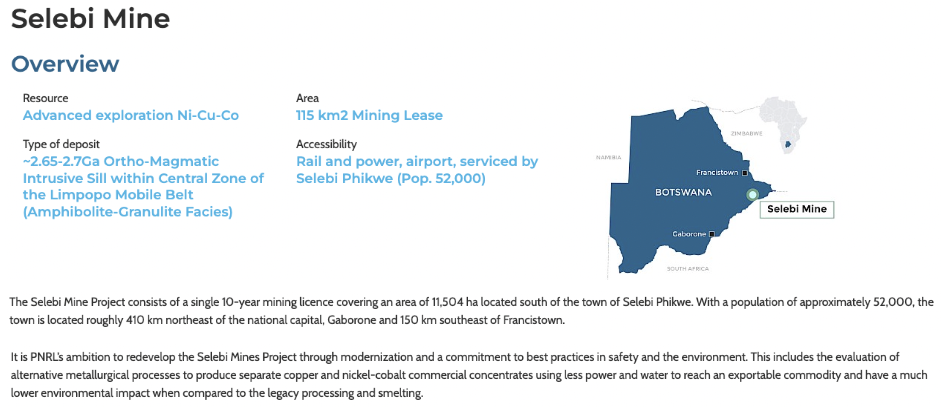

Premium Nickel Resources (TSX-v: PNRL) / (OTCQX: PNRLF) has two 100%-owned, past-producing, nickel (Ni) / copper (Cu) / cobalt (sulfide) mines in Botswana, the best mining jurisdiction in Africa.

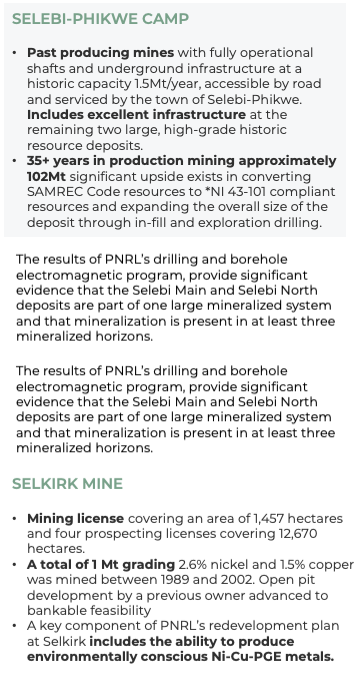

The focus of this article is on the high-grade Ni/Cu/cobalt Selebi mine complex restart, beginning at Selebi North (SN). The four mines of the Selebi complex operated from ~1980 to 2016.

All stakeholders in Botswana want to see a return of the thousands of jobs lost when mining stopped in 2016 due to insurmountable operating issues at the predecessor’s smelter. Despite the angst over the current Ni price, it’s a lot higher now than in 2016…

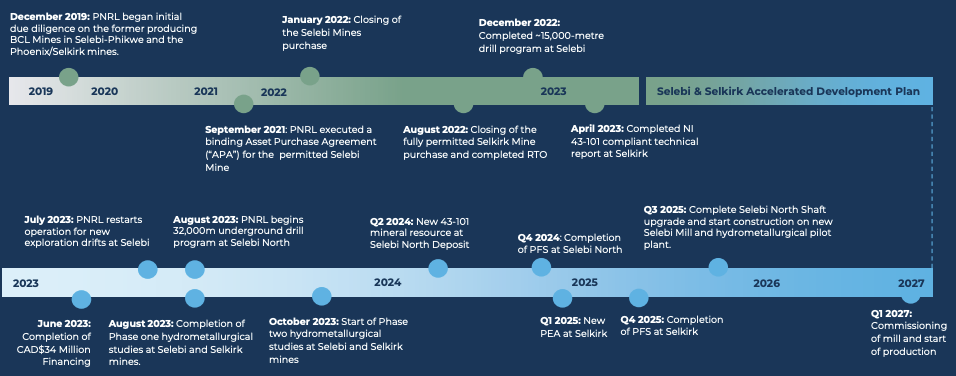

Management is drilling Selebi North to deliver a NI 43-101 compliant resource in May/June showing that tonnage/grade in the SAMREC resource stands up to Canadian standards.

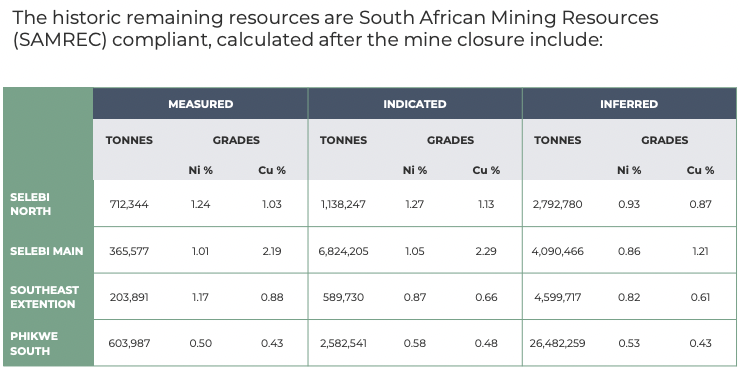

The resource estimate above comes from SAMREC, the S. African equivalent to Canada’s NI 43-101 classifications. The total [non 43-101 compliant] resource was 50.9M tonnes at a weighted avg. Measured + Indicated + Inferred grade of ~1.13% Ni Eq. (@ spot prices).

Premium Nickel’s technical team believes that drilling, mapping & modeling, combined with borehole electromagnetic (BHEM) imaging, shows SN + Selebi Main are [probably] connected, and possibly “much larger” than previously known.

BHEM is like a large metal detector finding conductivity below & around drill holes. Since in the case of Selebi the only thing that’s conductive are the sulfides, combining BHEM + confirmation & step out drilling is powerful & repeatable.

Management plans to build a hydro-metallurgical facility that runs more efficiently & cleaner than a last-century smelter. Tailings will be back-filled into the mine, a well accepted & green practice.

Restarted operations will use modern mining methods requiring less power & water, and utilizing solar + existing grid-connected electricity. Ore sorting is a key enhancement to the proposed flow sheet.

With ore sorting, the historical 30% dilution (waste rock) brought to surface can hopefully be reduced to under 10%. Selebi is being designed to have a minimal carbon footprint and be a low-cost operation.

Shareholders are hoping for 5M to 10M tonnes at 1.60%+ Ni Eq. on SN alone in May or June, and up to 15M tonnes nine months later when a Preliminary Feasibility Study (PFS) is delivered on SN. The PFS will likely capture < 20% of the overall tonnage of the Selebi complex.

In my view, SN could restart at 500k-1M tonnes/yr., as soon as 2027 (according to mgmt., if/when a strategic partner gets onboard) and double or triple production by expanding to Selebi Main in the early 2030s. Expansion could be largely self-funded with cash flow from SN.

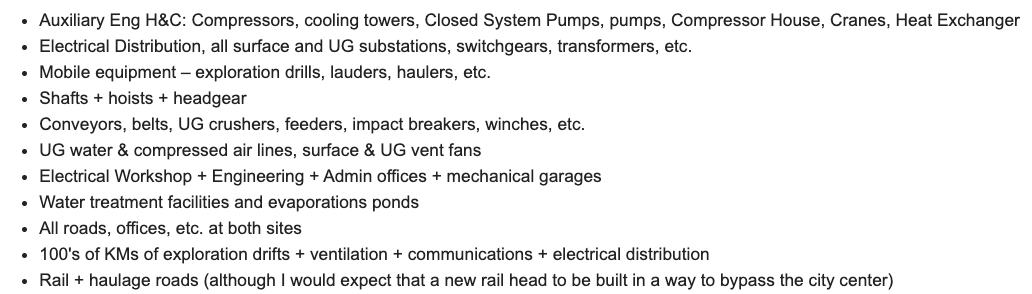

It’s crucial to understand that Selebi is a fully-permitted complex with a mining license and > C$500M [my estimate only] of (still operable) infrastructure.

Premium Nickel’s Selebi assets were acquired out of bankruptcy after an extensive 2-yr period of due diligence. Importantly, the transaction did not include the smelter or predecessor company liabilities.

The list below gives a sense of the valuable infrastructure at Selebi North & Selebi Main…

Upfront cap-ex should be meaningfully lower than the C$2 billion+ of some Canadian base metal projects.

The past-producing Selkirk Ni-Cu-Co-Pd-Pt-Au mine project, offers bulk tonnage at low grade, with a non-compliant, SAMREC resource of ~1.7B Ni Eq. pounds. I can’t imagine a scenario in which Selkirk isn’t worth > $100M.

Turning back to Selebi, assays from ~24 drill holes at SN have been reported and drilling is ongoing.

Highlights include; 15.3 m @ 2.96% Ni Eq. [1.84% Ni + 1.85% Cu] incl. 8.5 m / 3.07% Ni Eq. [2.15% Ni + 1.40% Cu], & 6.9 m / 4.01% Ni Eq. (2.72% Ni + 1.97% Cu) & 13.5 m / 1.86% Ni Eq., (1.34% Ni + 0.84% Cu) & 22.0 m / 1.74% Ni Eq. (1.22% Ni + 0.89% Cu).

In the lab are cores with 100+ meter intervals believed (visually) to be well-mineralized. If assays of 100+ m at 1.00%+ Ni Eq. are returned, that could be a game-changer.

Most readers know little about Botswana as it has steered clear of the headline-grabbing economic, political & security issues of other resource-rich countries.

Botswana ranked in the Top-20% of 185 countries in Transparency International’s Corruption Perceptions Index and 2nd best in Africa, and #10 of 62 jurisdictions in the Fraser Institute Survey of Mining Companies, (#2 in the mining policy perception category).

Botswana is the longest-running continuous democracy in Africa. Mining is a key economic sector. There are no First Nation, Aboriginal or Indigenous people issues anywhere near Premium Nickel’s two mines.

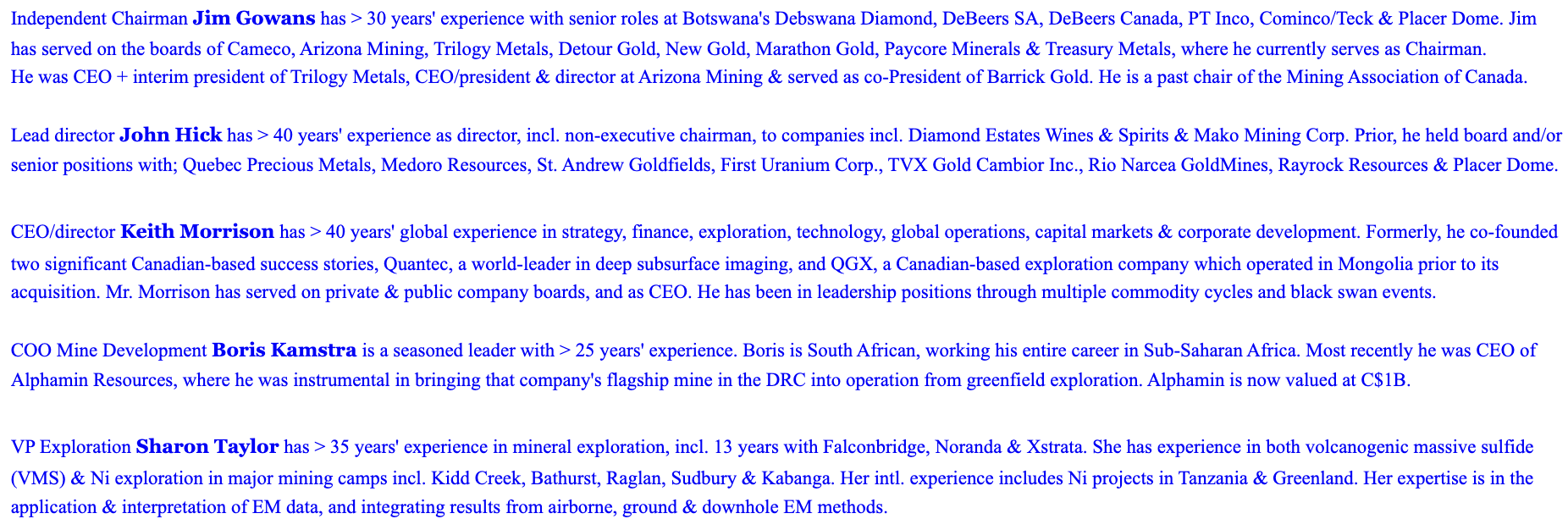

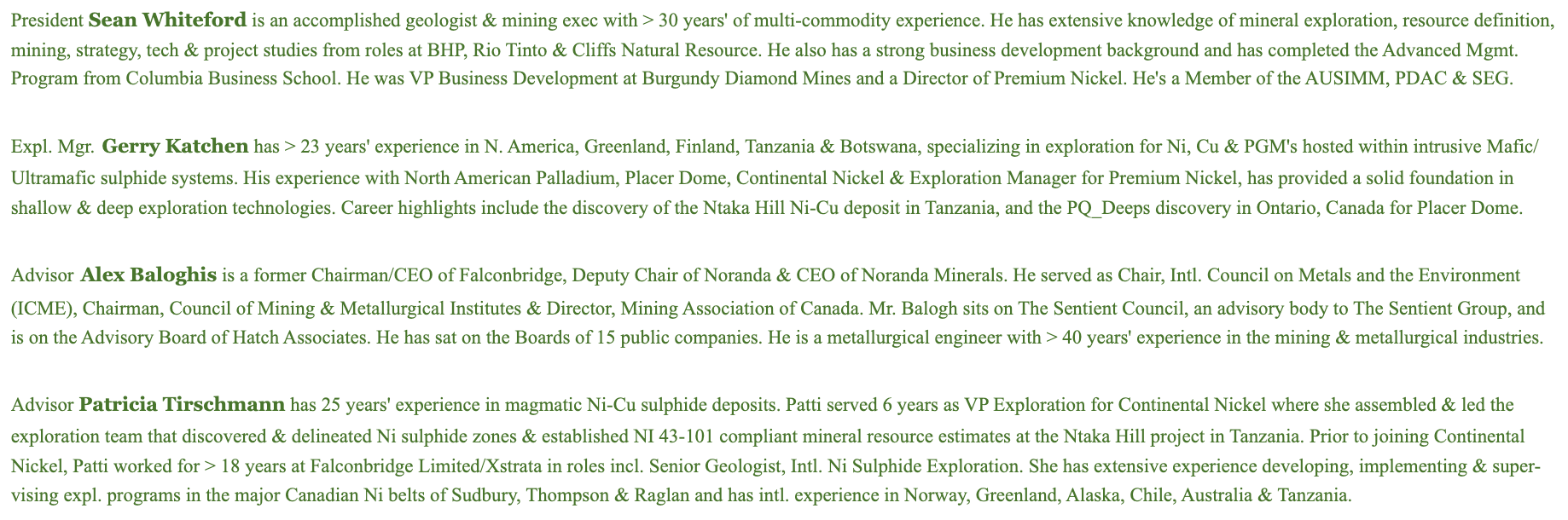

Assuming one’s comfortable with Botswana, the next question is — can this management team get Selebi back into production? The above execs have 25-40+ years’ of African, [juniors / Majors] mining [exploring / developing / operating] experience + base metals expertise.

Four additional profiles are shown below. I believe the team is excellent, but don’t trust me, read the bios and decide for yourself. A lot more info is available in this corp. presentation & on the Company website.

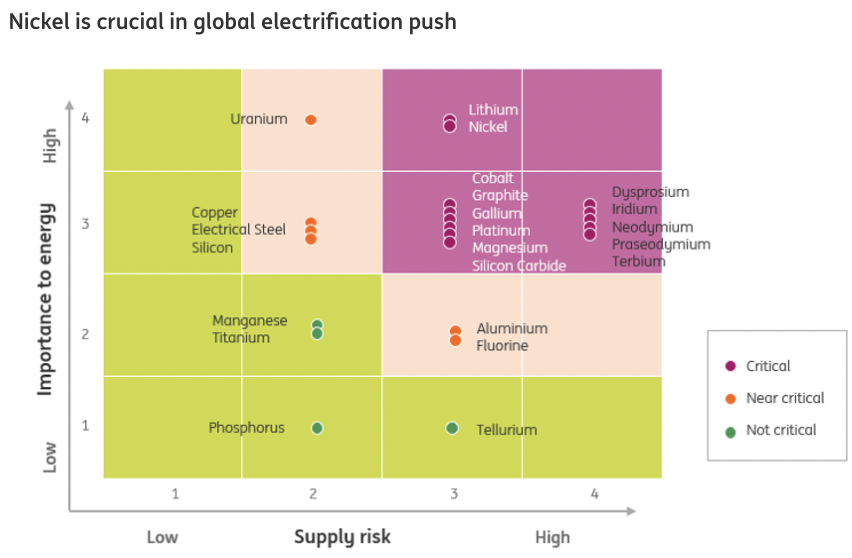

What about the investment case for Ni, isn’t the adoption of Electric Vehicles stalling? No, the rate of growth is moderating, but global EV sales were up +31% in 2023 and are expected to rise +25%-30% in 2024 (source: Rho Motion).

Interest rates are falling, lowering monthly car payments, and lower-cost EV models are proliferating.

Notably, certain Li-ion batteries are using less Ni and/or cobalt, or none in the case of LFP batteries. However, demand for high-density batteries from western-friendly sources, that meet ever more stringent ESG mandates, remains robust.

So far in January, Sumotomo Metal Mining & Samsung SDI invested in FPX Nickel & Canada Nickel, and Canada Nickel also received a cash injection from major Canadian gold producer Agnico Eagle, marking its first foray into Ni.

As exciting as the battery opportunity is, ~82% of Ni still goes into stainless steel & Ni-alloys/superalloys that offer superior strength, corrosion resistance & heat tolerance — making them ideal for aerospace, defense & power generation.

Annual growth in these critical non-battery sectors is solid at ~4%-5%, while Ni in batteries is growing at ~2-3x that rate.

NOTE: {a risk to the Ni narrative is that non-battery Ni growth is only 2.0%-2.5%% & demand for Ni in batteries grows just 5%-7%/yr. This risk is offset by most major auto OEMs & battery makers wanting to source Ni from clean, green, safe, long-term sustainable, Western-friendly sources}.

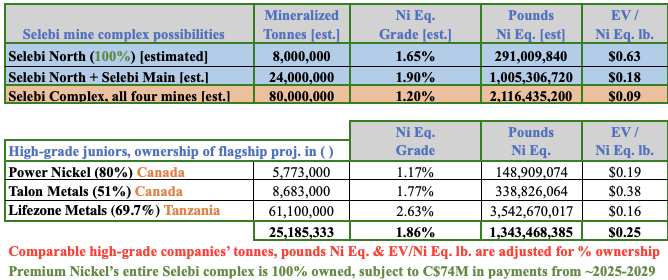

Resource sizes/grades scenarios at Selebi North, Selebi Main & all 4 mines (my estimates only)

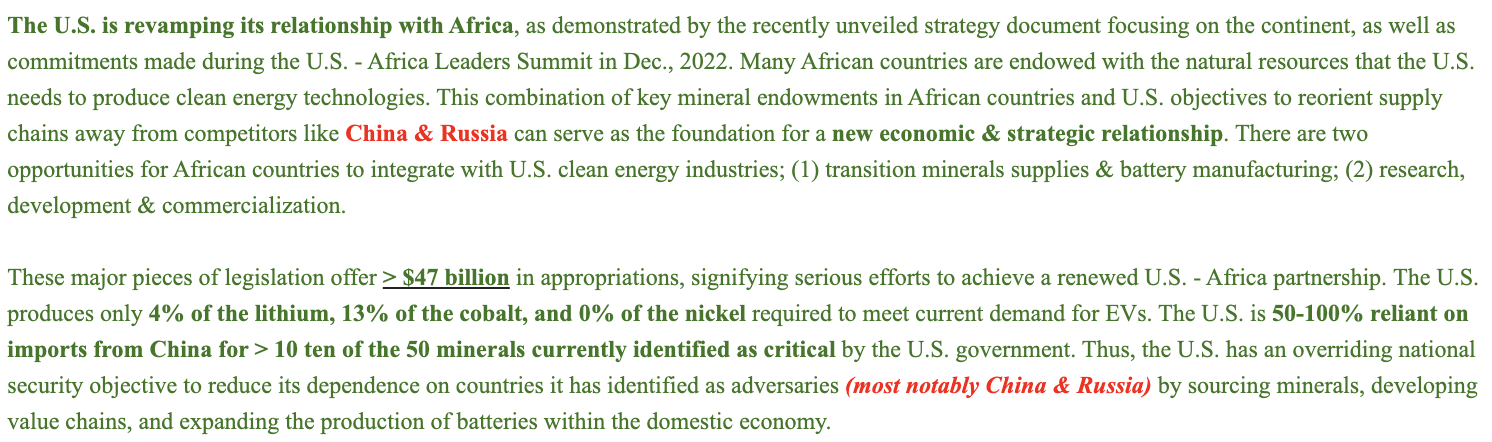

Multiple branches of the U.S. government are facilitating the development of battery metal projects and Premium Nickel is on U.S. radar screens. Why is the U.S. concerned about Ni supply?

Two-thirds of Ni comes from Indonesia, ~50%, the Philippines ~10%, and Russia ~7%. And, Indonesia’s market share is forecast to rise > 70% by 2030!

In the U.S. Dept. of Energy chart near the top of this article, Ni is shown to be BOTH critically important and at significant risk of supply shocks. Even more alarming is that China dominates Indonesia’s Ni industry.

Geopolitical & economic tensions between the West & [China/Russia] are high. The U.S. has explicitly stated its aim to stop the spread of Chinese/Russian influence in Africa’s natural resources.

Auto & battery makers are keenly aware of this paradigm shift in geopolitics. In addition, Indonesia’s Ni industry is energy & carbon-intensive (heavily reliant on coal power), is causing excess deforestation & the polluting of rivers. Therefore, Indonesia’s market share will not soar past 70%.

Significant players in the Ni market are; BHP, Rio Tinto, Vale, Glencore, POSCO, Anglo American, South32, Lundin Mining, Sumitomo Metal Mining, IGO Ltd., Eramet & First Quantum.

Battery players CATL, Samsung SDI, LG Energy Solution, SK Innovation & Panasonic have entered the Ni space, as have OEMs Tesla, BYD, Stellantis, Volkswagen, Toyota, Ford & GM. Japanese trading houses Mitsubishi Corp., Sumitomo Corp., Marubeni Corp., & Mitsui & Co, are jumping in.

Any of those 30 companies could be interested in relatively near-term green (solar power + clean refining) Ni/Cu supply from a Tier-1 jurisdiction like Botswana. Premium Nickel has $12M in cash to continue drilling and deliver a resource estimate on SN next quarter.

CEO Keith Morrison recently stated,

“…mineralization continues beyond the bottom of the legacy resource, reinforcing our theory that the Selebi North & Selebi Main deposits are connected at depth and are much larger than previously understood.“

Two milestone installments remain for the Selebi complex, totaling ~$74M. ~$33M in 1 or 2 years, (subject to a routine mining license renewal), and ~$41M in 2029 or 2030, after production has commenced.

Debt of $21M, with a friendly holder, matures in ~2.5 years. Essentially management is paying < $100M, spread over 7-9 years, for a permitted mine complex, with a mining license, and > $500M (my guess) invested. A mine that can start years ahead of Canada’s yet to be permitted, First Nation reliant, pre-construction plays.

In many respects, Premium Nickel’s Selebi complex has been meaningfully de-risked. The mine is partially pre-paid with valuable infrastructure in place. Yet, the enterprise value {market cap + debt – cash} is just $182M ($1.16/shr.).

This valuation is very low for a *potential* 80M tonne, high-grade Ni/Cu/cobalt sulfide mine + the blue-sky potential at Selkirk, vs. peers in riskier countries, hosting smaller tonnage and/or lower grades, or 6-10+ years from production, with huge upfront cap-ex hurdles.

Next quarter, hopefully in a better Ni/Cu market, Premium Nickel Resources (TSX-v: PNRL) / (OTCQX: PNRLF) will be positioned to secure a strategic partner and/or cornerstone/(strategic) equity investor if warranted. Or, management might wait for the PFS. In the meantime, drill results this quarter could be market moving.

In 1Q 2025, a PFS should show strong evidence of the potential for a large, high-grade, Ni/Cu/cobalt project at a relatively low upfront capital cost. Near-term production from a past-producing mine complex makes this story more compelling. This year should be truly transformative on multiple fronts.

Drilling, resource definition, metallurgical testing + (potentially) a strategic investor… a PFS in 1Q 2025… each could deliver a nice move in Premium Nickel’s share price.

Disclosures: At the time of publication on January 22nd, Peter Epstein / Epstein Research had no prior or existing relationship with Premium Nickel Resources or any company mentioned in this article. Readers are advised to consult with trusted financial advisors before investing in any small cap junior mining stock. The content in this article is based on publicly available information that Mr. Epstein believes to be accurate. Any estimations or speculations made herein our entirely those of Mr. Epstein, not that of management. Readers should visit Premium Nickel’s website and review its corp. presentation as part of a meaningful due diligence effort.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)