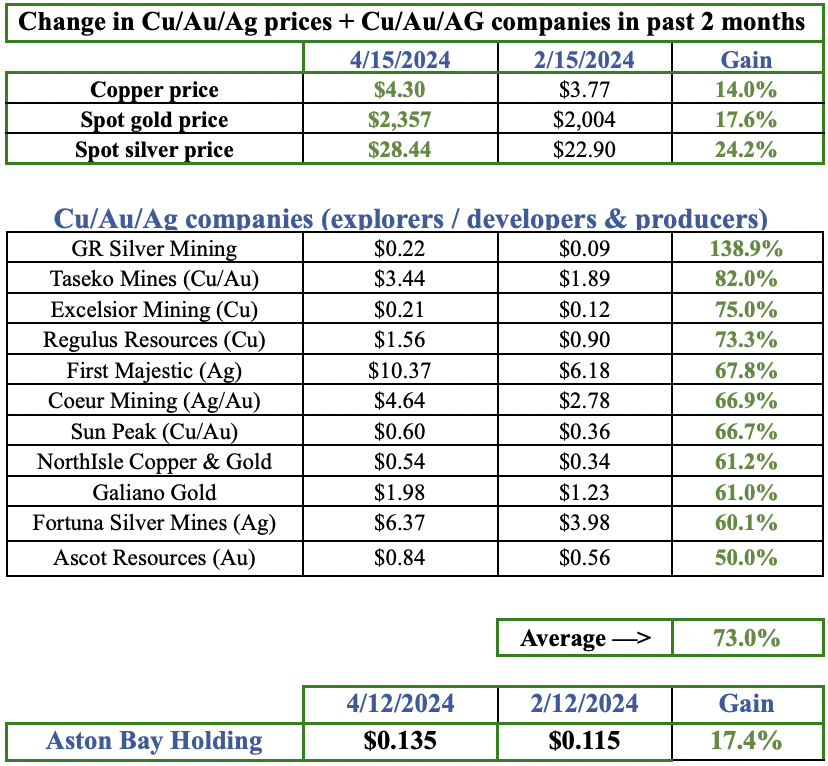

All dollar amounts US$, unless indicated otherwise…

Will gold have another strong year? It was up +13% in 2023, but that barely beats annual mining inflation these days. Every January analysts come out with predictions, yet they’re typically up/down 5%-10%. In looking at the past 55 years of returns I was surprised to learn that 60% of the time the gold price went up.

The average gain of the 33 up years was +23.5%! Another takeaway was that streaks of up/down years are common, highlighted by a 12-yr. positive stretch ending in 2012.

The last time the U.S. experienced high inflation similar to 2021–2023 was the late-1970s to early-1980s. In the 4-yr. period ended 1981, the gold price soared +345%, a CAGR of +45%. The inflation-adjusted, all-time high Au price is $3,324/oz. ($843/oz. in 1Q 1980).

By no means does that guarantee that as rates decline the gold price will have years of double-digit gains. However, it’s not just lower interest rates…

Other factors include; a weakening US$, central bank buying, and elevated tensions in the mideast, (not to mention Russia/China vs. the West). Moreover, global Au production is growing only modestly. Newmont & Barrick expect industry growth of just 1%-2% over the next five years.

So, anemic growth, and costs have been rising at an unsettling pace. Newmont’s All-in-Sustaining-Cost (AISC) is +54% since 2019. This suggests a higher long-term gold price. J.P. Morgan has one of the more bullish forecasts, saying it will hit $2,300/oz. next year vs. ~$2,025/oz. today.

Japan’s largest banking group — Mitsubishi UFJ — thinks we could see $2,350/oz. this year. If U.S interest rate cuts are more aggressive than expectations, Bank of America envisions $2,400, while UBS says $2,250 is likely.

Admittedly, I’m reporting the highest forecasts, but they’re from very reputable sources. I can’t find any under $1,950.

A gold developer that should have a strong year is Thesis Gold, (TSX-v: TAU) / (OTCQX: THSGF) but you wouldn’t know it from recent trading action, its enterprise value {market cap + debt – cash} has dropped to C$70M (C$0.046/shr.).

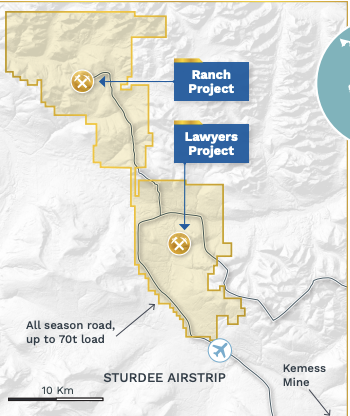

Yet the Company owns 100% of a contiguous, 32,500 hectare, PEA-stage, land package in the heart of northwestern B.C.’s Toodoggone region, just east (inland) from the Golden Triangle.

As a reminder, Thesis is the surviving entity after 2023’s merger with Benchmark Metals. Both companies had promising project, but COO Ian Harris believes economies of scale and better access to funding will make the combined project world-class.

Due to ESG mandates and more capable & frequent local opposition, the time from discovery to initial commercial production has grown by years, not months.

According to Statista.com, it now takes an average of 16.9 years! Elevated costs + longer timelines = higher risk and fewer projects getting started. Thesis could be in production in 4 or 5 years.

The combined Ranch/Lawyers project has better access to regional infrastructure than projects that are more remote in B.C. Readers should note that some developers closer to the coast face much harsher winters compared to the more temperate climate around Ranch/Lawyers.

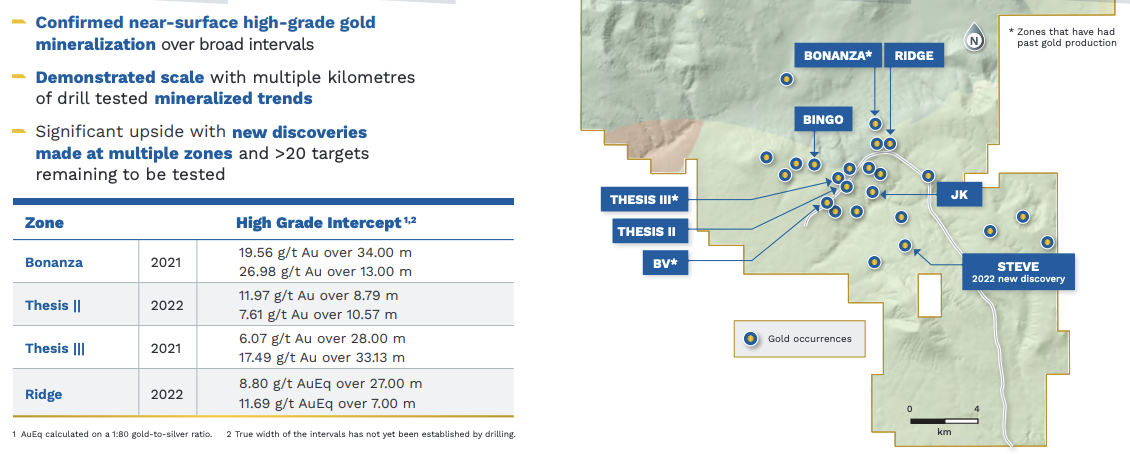

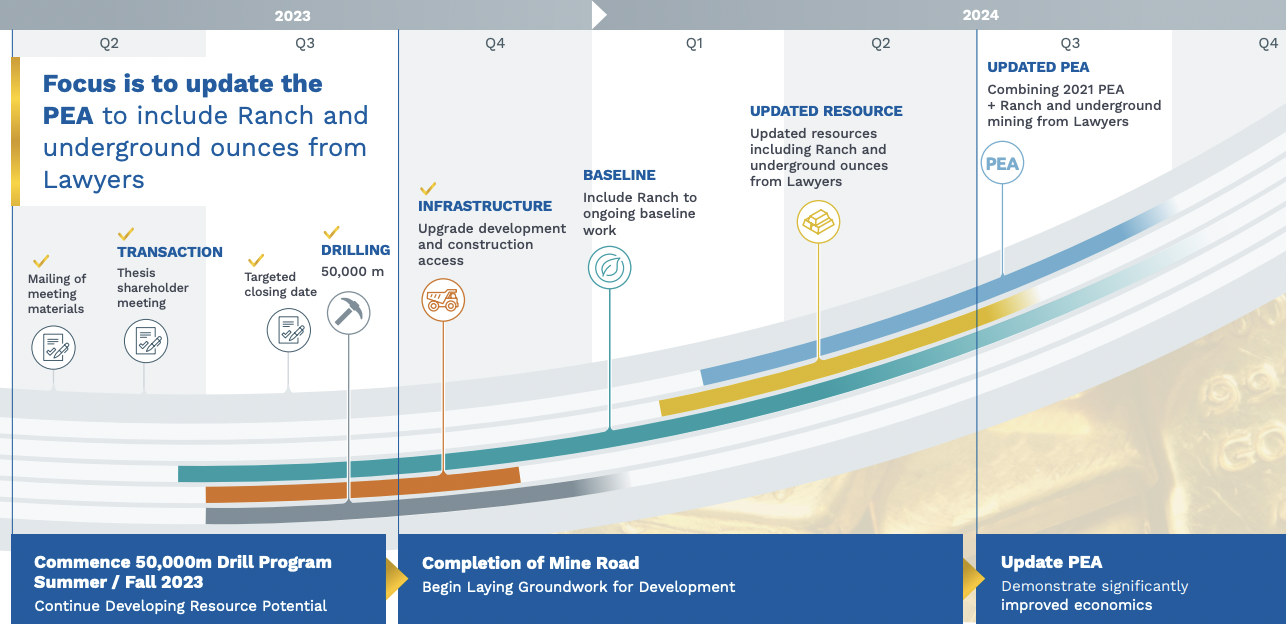

From 3.5M ounces Au Eq. ounces, management is confident it will have at least 5.0M in April’s maiden mineral resource estimate. That figures has the potential to grow substantially as long as management keeps delivering blockbuster drill results.

At a time when most gold juniors are desperate to raise cash, Thesis has already booked blockbuster intervals such as last year’s 4.1 m at 119.5 g/t Au, incl. 2.0 m at 231 g/t. That’s a [gram x meter] figure of [4.1 x 119.5 = 484 g-m]. And, it has enough cash to operate through delivery of the new resource estimate & PEA in April & August.

So far, 2024 is off to a strong start with yet another excellent assay of 128 m at ~2.5 g/t Au Eq., ~320 g-m. Readers are reminded of 2021’s best intervals averaging a whopping 622 g-m! [34 m @ 19.6 g/t] & [33.1 m @ 17.5 g/t]. The compelling value proposition for Thesis is quite straightforward.

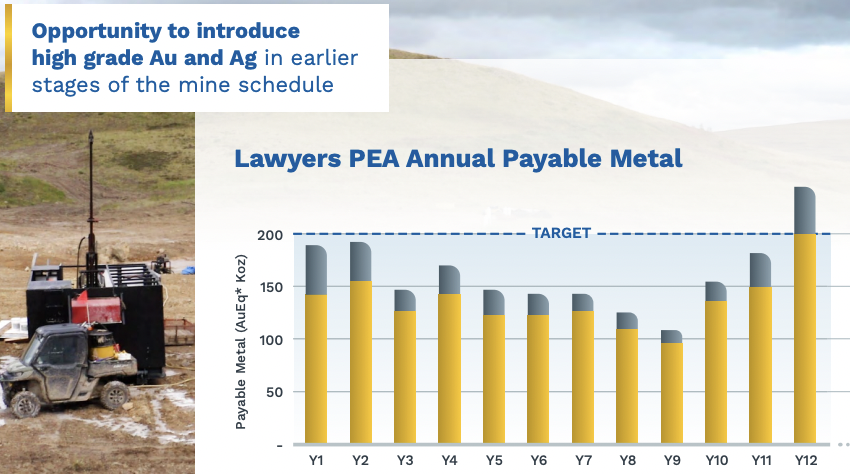

An entirely new mine plan is pulling forward & adding high-grade ounces, filling in the gaps in the chart above. Synergies, economies of scale & a larger resource will keep per/oz. costs in the bottom quartile.

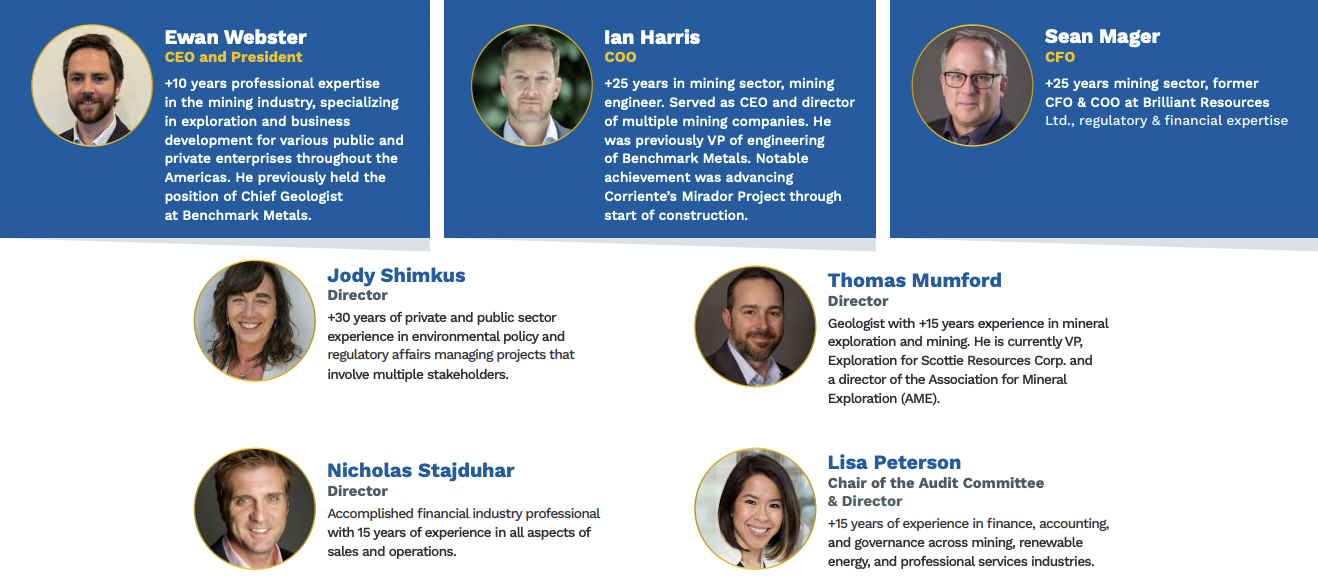

Importantly, recent drilling at Lawyers and modeling work by the technical team is validating management’s assumptions about geology & structure, making them increasingly confident in the mine plan. CEO Ewan Webster is a Phd geologist & COO Ian Harris is a very experienced mine engineer.

Thesis doesn’t need $2,200-$2,400/oz. gold, $2,025 is just fine as the upcoming enhanced PEA including BOTH the Lawyers & Ranch projects should boast an All-in-Sustaining-Cost (AISC) of roughly $1,000/oz. Compare that to Newmont’s at $1,400.

Very substantial exploration targets, mostly at Ranch, could add millions more ounces, especially in the hands of a much larger player who could drill aggressively. Management believes that Ranch could rival Lawyers in terms of mineral endowment. Over 20 high-quality, drill-ready targets have been identified.

Unless Newmont could gain significant synergies by acquiring Thesis to combine with its B.C. portfolio of producing mines; Red Chris & Brucejack + advanced development projects; Galore Creek & Saddle North, Thesis is probably too small for Newmont.

Still, there are many others that would greatly benefit from acquiring Thesis. For example, meaningful players in B.C. include; Teck Resources, BHP, Freeport McMoRan, Boliden AB, Kinross, Centerra Gold, Seabridge & Hecla Mining.

Hecla acquired B.C.’s Alexco Resources & ATAC Resources in 2022-23. Privately-held, Peruvian company Ccori Apu delivered a timely cash injection to the Golden Triangle’s Ascot Resources. Ascot is pouring first gold by mid-year, which will attract attention to the region.

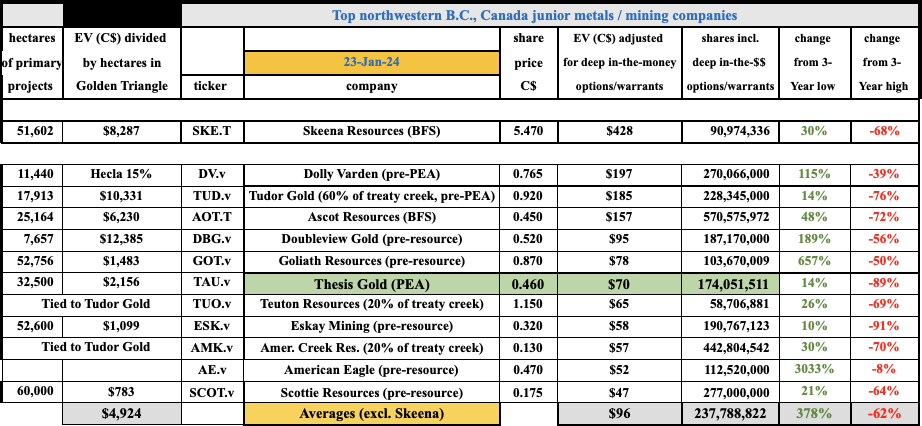

Thesis is more advanced than B.C. peers Tudor Gold, Eskay Resources, Goliath Resources & Doubleview Gold, none of whom have a PEA. In fact, Eskay, Doubleview & Goliath are pre-maiden resource.

Yet, Thesis’ valuation at C$70M, $0.46/shr., is 62% below the average valuations of Dolly, Doubleview & Goliath. {see chart of peer B.C. juniors above}.

In the map above, one can see that Newmont (Newmont acquired Newcrest) & Teck have assets to the west, but Freeport (through an interest in Amarc Resources) & Centerra Gold are much closer, < 50 km, and Centerra was sitting on C$665M in cash as of 9/30/23.

I believe Thesis would also be a good fit for Agnico Eagle, who does not have operations in B.C., but has a major presence across Canada. B2Gold expanded its Canadian footprint by acquiring Sabina Gold. Perhaps it might be looking for B.C. gold?

Readers might notice I mentioned a lot of companies that could care to acquire Thesis Gold (TSX-v: TAU) / (OTCQX: THSGF). That’s because the Company routinely states that it wants to be acquired. My bet is that might happen next year, unless the gold price jumps 10%-15%+. Then, an acquirer could bite after the August PEA.

At a C$70M valuation, I believe investors are buying in at just 5% to 7% of the after-tax NPV(5%) in the upcoming PEA. That’s absurdly cheap. CEO Webster & COO Harris make a strong team. I’m highly confident they will get the company sold at a much higher valuation.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Thesis Gold, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Thesis Gold are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares of Thesis Gold and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)