Will gold have another strong year? It was up +13% in 2023, but that barely beats annual mining inflation these days. Every January analysts come out with predictions, yet they’re typically up/down 5%-10%. In looking at the past 55 years of returns I was surprised to learn that 60% of the time the gold (Au) price went up.

The average gain of the 33 up years was +23.5%. The last time the U.S. experienced high inflation similar to 2021–2023 was the late-1970s to early-1980s. In the 4-yr. period ended 1981, the Au price soared +345%, a CAGR of +45%. The inflation-adjusted, all-time high Au price is $3,324/oz. ($843/oz. in 1Q 1980).

However, it’s not just lower interest rates helping precious metals, other factors include; a weakening US$, central bank buying, and elevated tensions in the mideast, (not to mention Russia/China vs. the West). J.P. Morgan has one of the more bullish forecasts, saying it will hit $2,300/oz. next year vs. ~$2,020/oz. today.

Japan’s largest banking group —Mitsubishi UFJ — thinks we could see $2,350/oz. this year. And, if U.S interest rate cuts are more aggressive than expected, Bank of America envisions a possibility of $2,400, while UBS says $2,250 is likely.

I’m even more bullish on silver (Ag). There are two very important drivers for higher Ag prices. First, its use in solar panels is increasing at a rapid pace as the latest technology for panels uses higher Ag content, AND solar farm deployments are soaring globally, up nearly +30% in 2023.

Second, the Au:Ag ratio of 89:1 is quite elevated vs. the 40-yr average of ~64:1. Often when this happens the Ag price outperforms Au. All else equal, if the ratio were to revert to 80:1, the Ag price would rise +11% to $25.40/oz. from today’s $22.90/oz. If Au were to rise, and we get back to 80:1, that would be even better.

An Au-Ag junior that would really thrive with higher precious metal prices is Aztec Minerals (TSX-v: AZT) / (OTCQB: AZZTF). Aztec has two exciting Au-Ag-Copper (“Cu“) projects and is backed by Alamos Gold. Please see new Corp. Presentation.

This is a company that made very significant progress in 2023. President & CEO Simon Dyakowski, commented,

“Aztec significantly advanced each of our emerging discovery-stage projects in 2023, highlighted by the discovery of bonanza-grade Ag at the Tombstone project. The 75% Tombstone JV acquired a strategically located mining claim adjoining the Contention zone that hosts the historic Westside mine.

At the Cervantes project in Arizona (USA) we focused on surface exploration ahead of our recently completed 13-hole RC drill program, expanding the mineralization area of the primary California zone oxide gold target to one km in strike by 250+-meters in width. All drill holes encountered potential for gold mineralization and the California target remains open.”

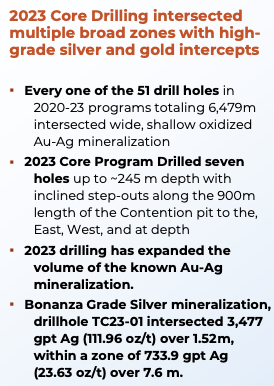

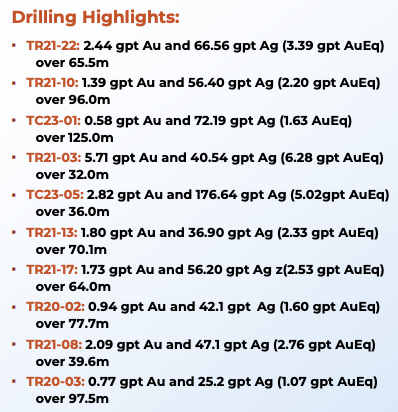

In 2023, the Company completed a 7-hole drill program that expanded the mineralized zones around / below the Contention open pit area of the Tombstone project in Arizona, (USA). Broad intersections of oxidized Au-Ag were found.

Management expanded the Tombstone JV by acquiring the historic high-grade Ag-Au Westside Mine. The claim immediately adjoins the Tombstone property’s core patented claims to the NW, expanding opportunities to explore new targets.

Management will commence a surface exploration program at Tombstone ahead of planning & commencing a follow up RC drill campaign targeting further expansions of high-grade shallow Au & Ag around and below the Contention open pit.

1879 to 1939 Arizona’s Tombstone Au-Ag district produced 32M oz. Ag, 240K oz. Au, 65M pounds Lead, and 1.1M pounds Zinc. At spot prices, that equates to an Au Eq. grade of ~13 g/t. Aztec’s Tombstone project covers much of the historic district.

Note: Grade thickness [gram x meters] is not to be construed as gross metal value, nor as a resource estimation. And, it may not be reliable in comparing to other company’s drill results. Every project has unique geology & mineralogy.

Tombstone highlights include 4 intervals of [Au Eq. gram x meters] figures > 200

Drilling by Aztec from 2020-23 demonstrated that the Contention zone has significant oxidized Au-Ag mineralization open in all directions. Due to limitations of de-watering technology, nearly all historical mining ended at a depth of ~190 meters, so this project is not mined out.

Ten of 11 intervals above have [gram x meter] figures > 100 Au Eq. Aztec’s focus at Tombstone is discovering new zones of shallow, open pit-able, oxidized mineralization around the Contention pit. Importantly, higher-grade, carbonate replacement deposits (“CRD“), could lie beneath the underlying Paleozoic limestones.

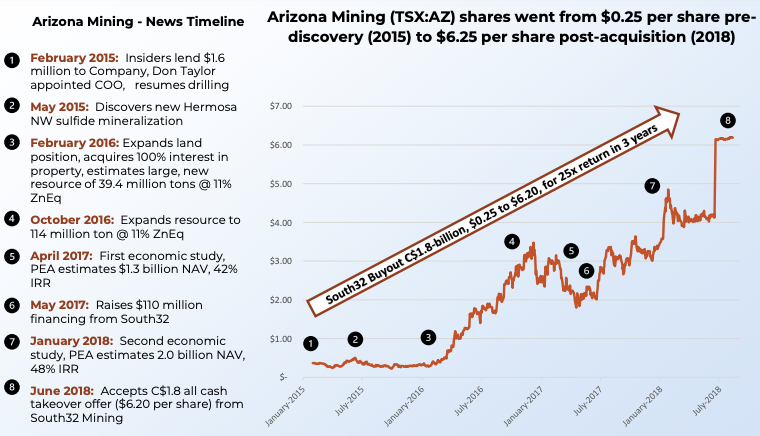

While the low-hanging fruit is in the top several hundred meters, there could be a huge prize hundreds of meters below that. Management believes deeper limestone units have similar geology to Arizona Mining’s Hermosa-Taylor CRD project ~60 km to the SW. Hermosa-Taylor had 138M tonnes at 8.61% zinc eq. (~3.4 g/t Au Eq.).

Even if a 10% chance of the next Hermosa-Taylor, that carries substantial option value not reflected in today’s market cap. We’re talking about serious blue-sky potential. If Aztec could find one-tenth of what Hermosa-Taylor has, that would be worth 10x the entire Company’s valuation of ~C$16M. {$0.16/shr.}

Arizona Mining’s deposit was one of the largest primary zinc discoveries in decades and was acquired by South32 for $1.8 billion. Freeport McMoRan has five operating mines — Morenci, Bagdad, Safford, Sierrita & Miami — in Arizona. It is no doubt watching Aztec’s progress.

BHP & Rio Tinto own the giant Resolution Copper project, which has been tied up by legal challenges. Hudbay Minerals has the 1.5B tonne, PFS-stage Copper World project, and Capstone Copper‘s Pinto Valley has produced > 4B lbs. of Cu since the mid-1970s.

Major & mid-tier companies should care about Aztec’s Tombstone. A single deep hole was drilled prior to Aztec taking over, it hit 9.1% combined lead / zinc, + 0.61% Cu + 32 g/t Ag over 7.2 meters.

Could Aztec’s Tombstone host a Hermosa-Taylor-like deposit at depth?

Aztec’s 100%-owned Cervantes is ~35 km NE of Osisko Development’s San Antonio mine, ~45-60 km west of Agnico Eagle’s La India mine and Alamos Gold’s Mulatos mine, and~40 km NW of Minera Alamos’ Santana Au deposit. Further to the west of Cervantes is Argonaut’s La Colorada mine.

As mentioned, Alamos is a strategic investor in Aztec. Importantly, Cervantes is not merely a “closeolgy” play to four Major / mid-tier mining companies, it already has strong drill results on over 10,000 meters and is shaping up to be an attractive open pit, heap leach project.

Simple, low-cost, low-risk heap leach operations can be quite profitable with high Au prices. They are often in the bottom quartile of All-in-Sustaining-Costs, and have low upfront capital.

Permitting should be straightforward as there are many open pit heap leach operations in Sonora. Therefore, Cervantes could be relatively fast to market.

Last year the Company completed 13 RC holes totaling 1,646 m, expanding the potential mineralized area of the primary California Zone oxide Au target to 1 km strike x 250m+ width. All holes encountered potentially Au-favorable mineralization and the target remains open for expansion.

Drilling in the 2022 program intercepted strong mineralization at the California Zone, California Norte & Jasper targets. In 2023, near-surface, oxide Au mineralization was successfully expanded in every direction and to depth and is approaching the adjacent California Norte mineralized target.

Management announced its first drill result; 30.4 m @ 1.0 g/t Au, incl. 1.5 m @ 13.8 g/t Au. Surface exploration is ongoing at Cervantes in preparation for follow up step-out drilling.

This year’s drill program at Cervantes will continue stepping out into shallow, near-surface Au oxide mineralization. Importantly, management is looking for additional high-quality bulk tonnage Au +/- Cu +/- Ag opportunities in safe jurisdictions in the Americas.

Cervantes, California Zone highlights — excellent for a heap leach operation!

Aztec Minerals (TSX-v: AZT) / (OTCQX: AZZTF) has two exciting assets in world-class, safe, prolific mining jurisdictions, surrounded by numerous significant mining companies including strategic investor Alamos Gold.

Both projects are pre-maiden resource, but are fairly low-risk and have massive upside potential at depth. Drilling is ongoing in Sonora.

In a bull market for Au & Au, Aztec is a name one should be looking at. It’s post-discovery, so we know it has precious metals, but new discoveries & expanded zones in 2024 could drive the share price.

Please see new Corp. Presentation.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Aztec Minerals, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Aztec Minerals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned no shares, options or warrants in Aztec Minerals. As of October, 2023, the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)