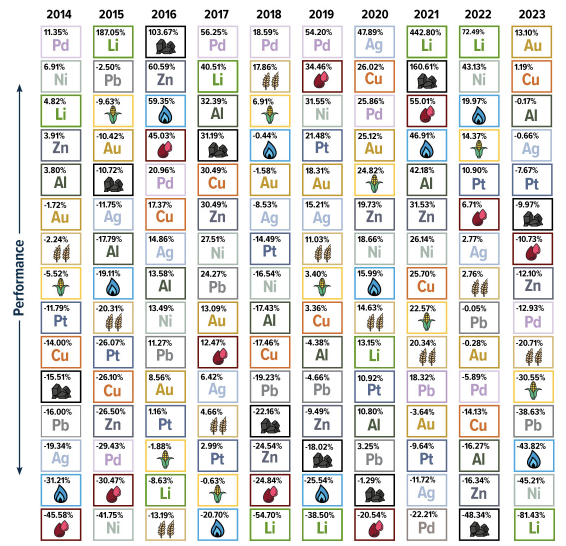

To say the lithium (“Li“) market is volatile would be a gross understatement. Over the past 10 years, the Li price ranked #1 or #2 (among 15 commodities; source Visual Capitalist) four times! However, Li was #14 or #15 in four other years! Will 2023-24 follow the path of 2018-19?

Li juniors really need to worry about the Li price when they’re closer to production, needing to raise $100s of millions for construction. Today’s spot price in China for battery-quality Li carbonate (a closely watched index) has been pinned in the low-to-mid US$13,000s/tonne for two months. Does that mean we’ve hit bottom?

Most pundits believe we’re at or near bottom, and the price will end 2024 in the $15,000-$25,000/t range. I agree. If > $20k/t, Li could find itself in the #1 or #2 spot again this year. At current levels, Li companies nearing production, and some in production, are feeling the pain.

Recently, Australia’s Core Lithium, Sayona Mining & Liontown Resources announced strategic reviews and have stopped advancing key operations. The world’s largest Li mine Greenbushes (Tianqi/IGO/Albemarle) is scaling back as well.

It’s brutal in the Li sector. Real companies with strong prospects are down 70%-85% from 52-week highs. Even majors like Albemarle, SQM & Arcadium are down 60%-65%.

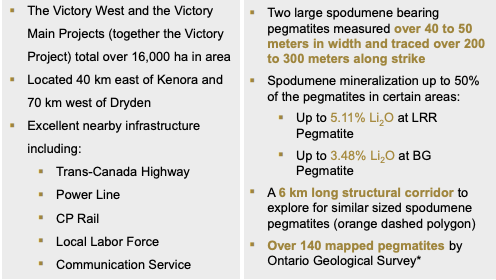

Beyond Lithium has 34M shares outstanding, and a $6M ($0.18/shr., 2/15/24) enterprise value {market cap + cash/investments – debt}. Its Victory & Ear Falls projects host high-grade grab samples including up to 5.11% Li2O at Victory and 4.54% Li2O at Ear Falls. Ear Falls has 13 km of prospective strike length, and Victory 6 km.

Management has done more in six months (on a tiny budget) than most Li juniors with assets in Canada.

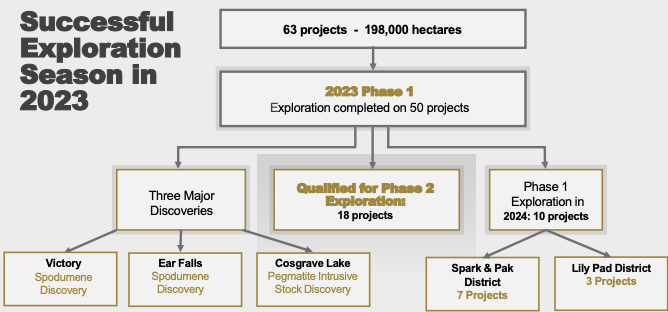

While still early stage, Beyond has 18 properties that it thinks warrant further attention. Victory & Ear Falls will remain 100%-owned, but other promising properties have started to get farmed out.

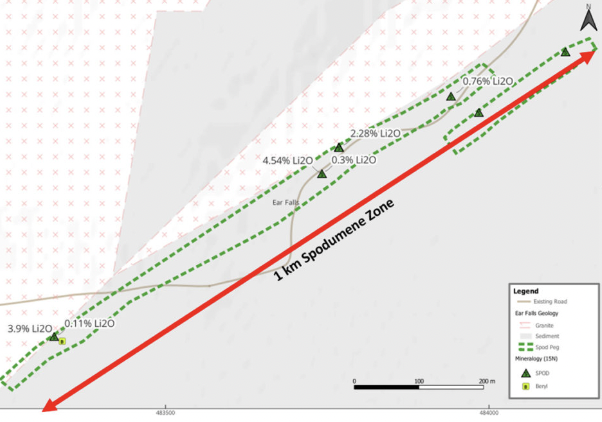

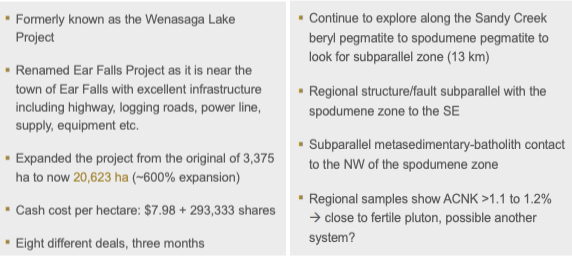

Ear Falls, big blue-sky potential on expanded 20,623 hectare project

For example, Australian-listed Patriot Lithium signed a deal for ~$130k (current value) in shares + a $2.5M earn-out to Beyond if Patriot delineates 20M tonnes of Li20 at 1.00% Li20 on the acquired land. CEO Allan Frame & Co-Founder Alain Lambert are talking to several other parties, including much larger companies.

As a frame of reference, if one believes there’s a 20% chance that Patriot delineates 20M tonnes at 1.00% Li20, and discounts that payday of [20% x $2.5M = $500k] back two years at 12%, that’s a present value of $400k.

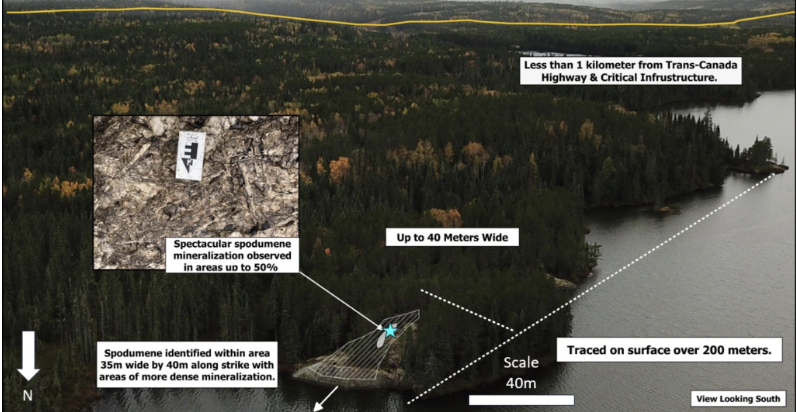

The spodumene-bearing pegmatites at Victory are five km apart along a six km exploration corridor. They measure 40-50 m wide by 200-300 m long. Victory totals 16,682 hectares. In addition to further drilling at Ear Falls, a maiden drill program at Victory is planned for later this year.

Victory/Victory West, > 16,000 ha nearby key infrastructure

The property includes two spodumene-bearing pegmatites, Bounty Gold & Last Resort. A rail line, highway & power line run east/west along the southern border of Victory.

In certain areas, spodumene mineralization has been observed to cover up to 50% of the pegmatite. This Dryden-Ear Falls region is emerging as a Li hub, with a favorable geological setting for Li, Cesium, Tantalum (“LCT”) pegmatites.

The Ear Falls project has excellent infrastructure including highway & logging road access, power lines, services & local labor.

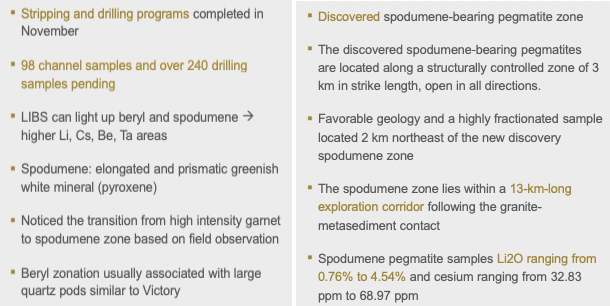

The technical team has confirmed a 13-km exploration corridor with Li mineralization.

Phase 2 exploration includes high-resolution drone imagery, detailed mapping, stripping, channel sampling & drill testing the spodumene zone. A total of 205 individual pegmatite outcrops have been mapped along the main exploration corridor.

Stripping & channel sampling extended the spodumene pegmatites, exposing subparallel dykes on surface. Seven shallow drill holes at Ear Falls (done with a small, mobile drill rig) delivered encouraging results.

They averaged only 47.1 m in length, testing 200 m of strike of an initial 1,500 m of trend and 13 km of strike, but 6 of 7 returned Li values and ended in mineralization. The best interval was 9.77 m @ 1.06%, incl. 3.84 m @ 2.30% Li20.

A subparallel pegmatite dyke was found at depth, one not exposed on surface. There’s potential for numerous subparallel pegmatite dykes, as drilling to date has barely scratched the surface.

The technical team points out that it’s highly unlikely that modest drilling to date will be the best results. There’s still potential to find additional outcropping pegmatites at Ear Falls.

These drill results come on the heels of channel samples, the four best of which returned 1 to 2 m of 1.03% to 1.88% Li2O. This very modest drill campaign covered < 1.0% of the 20,623-hectare project. While not earth-shattering, the results give the team confidence to drill much deeper than 47 meters in the upcoming drill program.

In listening to Beyond’s “geochats” and other videos on Youtube, [theJuniorExplorer] / [geochat #4] one can assess the enthusiasm of VP of Exploration Lawrence Tsang & senior advisors Graeme Evans & Paul Baxter. The team expects (subject to drilling) that a larger system is yet to be found. Tsang commented,

“In general, the wider the alteration halo around the pegmatites is, the larger amount of fluid and the larger the system that altered a large area of surrounding rocks…. at the Wenasaga North Zone, Li & Cs values in the host rocks and the alteration halo around the spodumene-bearing dykes persist for 10 to 30 m indicating these pegmatites are probably connected to a larger system at depth or along strike…”

The team now has a better understanding of the Ear Falls system in terms of, “geochemistry, structure, lithology, mineralogy, size and potential”

One thing I found interesting is that Lambert & Frame suggest that investors should be careful comparing Beyond’s 3.86 m of 2.30% Li2O to much wider intercepts from peers as Beyond’s intercept is very shallow. Many of the other stronger intercepts are 300+ m deep.

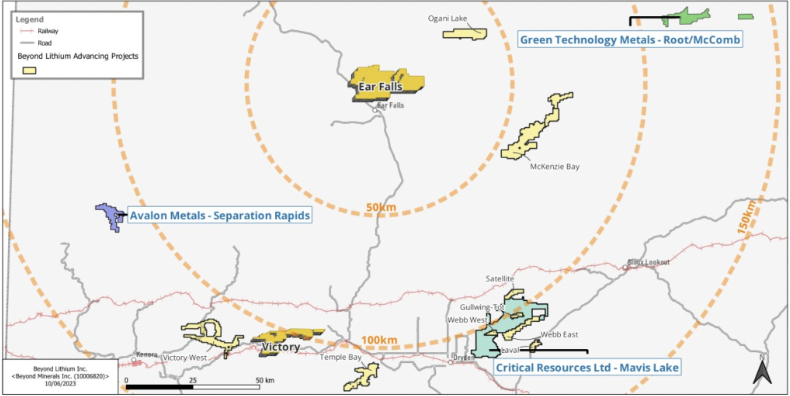

For example, Avalon Advanced Materials is mineralized down to 556 m at Separation Rapids, Azimut recently reported an excellent intercept ending at 330 m, Green Technology Metals at 318 m, and Critical Resources at 382 m.

An upcoming program at Ear Falls (awaiting drill permits) this Spring will target at least a few holes to depths of 300 m.

Cesium (“Cs”) showings at Ear Falls are interesting. It’s too early to know if Cs could be economically viable alongside Li mineralization, (it’s too early to know if the Li is economically viable) but Cs pricing is similar to gold in the $50/gram area.

It should be noted that district-scale synergies exist among Beyond’s Victory & Ear Falls — and eight Mavis Lake properties (Satellite, Laval, Gullwing-tot, Webb East, Webb West, Temple Bay, Ogani Lake & McKenzie Bay) — within a 100-km radius.

Three projects held by juniors in the area have resource grades ranging from 1.07 to 1.38% Li2O. 2024 is shaping up to be an exciting year. If Li prices rebound even modestly, investor sentiment in the sector should improve.

Ear Falls, significant pre-drilling work done, strong Li2O samples

A very small amount of drilling at Ear Falls returned promising results. Victory has no drilling on it, but at 5.11% Li2O it had higher surface samples than Ear Falls. Both projects will see drill programs this year, permits at both are for up to 30 drilling sites & 20 stripping locations.

With a valuation of just $6M ($0.18/shr.), Beyond Lithium (CSE: BY) / (OTCQB: BYDMF) offers a compelling risk/reward proposition. The potential for discoveries with assays of 10-20+ meters at > 1.00% Li2O is reasonably high.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Beyond Lithium, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Beyond Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Beyond Lithium was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)