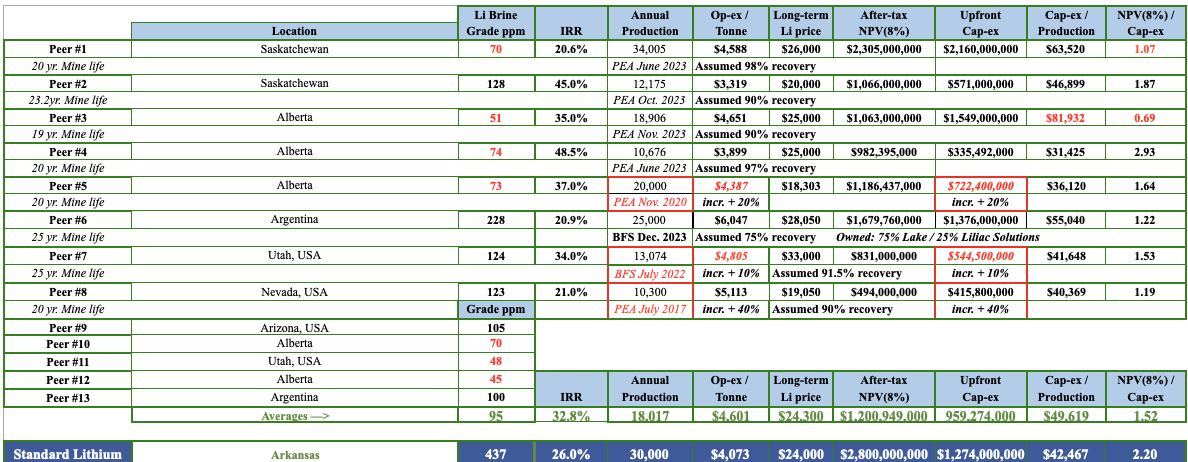

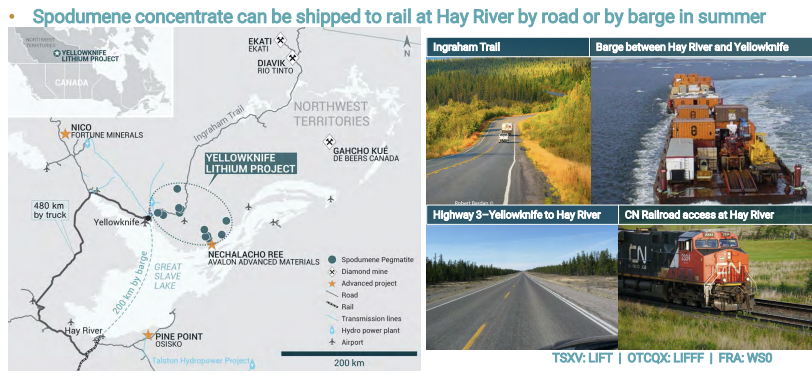

I’m tracking ~240 junior miners with at least one lithium (“Li“)-prospective property in Canada. The vast majority are early-stage Canadian & Australian-listed plays in Quebec & Ontario. Of those, ~100 are trading at $0.05 or less. Many will disappear… or transition to #uranium, (the only hot commodity).

Of those 240, just 20% have announced drill results — 80% have never reported a single assay! Many in that 80% bucket have been “working” on their properties for years. How many Canadian hopefuls have reported a maiden mineral resource estimate (“MRE“)? Less than 10%.

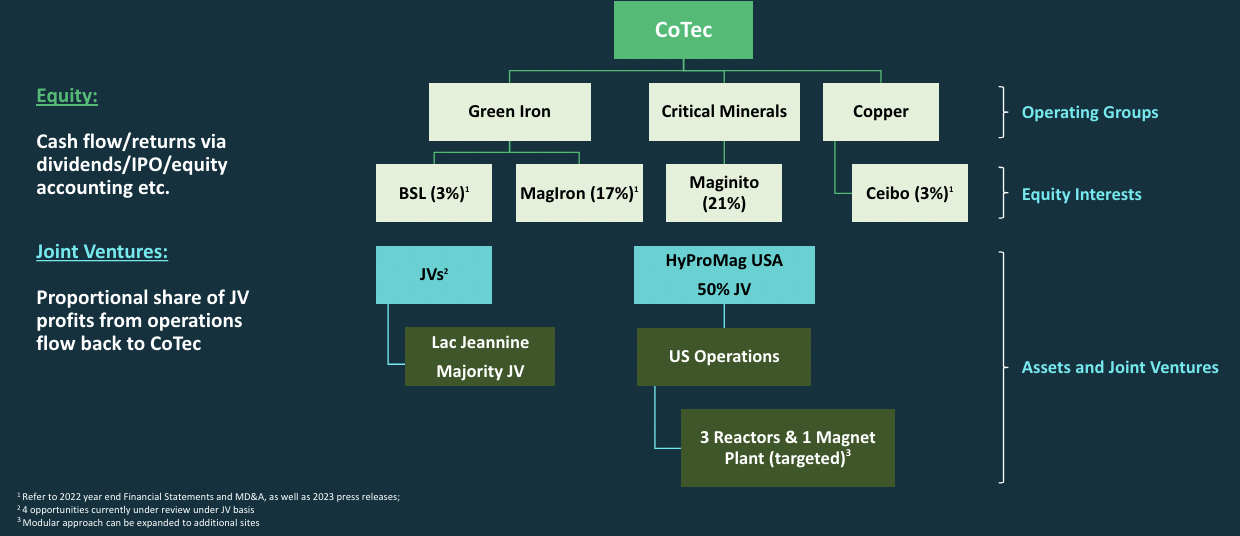

Top 35 of 89 global projects with hard rock assays… Li-FT #20

Looking beyond Canada, globally there are fewer than 50 pre-production hard rock Li resource estimates, (> 10M tonnes), among publicly-listed companies. That’s why I believe Li prices will recover from currently low levels, timing unknown. My guess is that 1q 2024 will be the bottom.

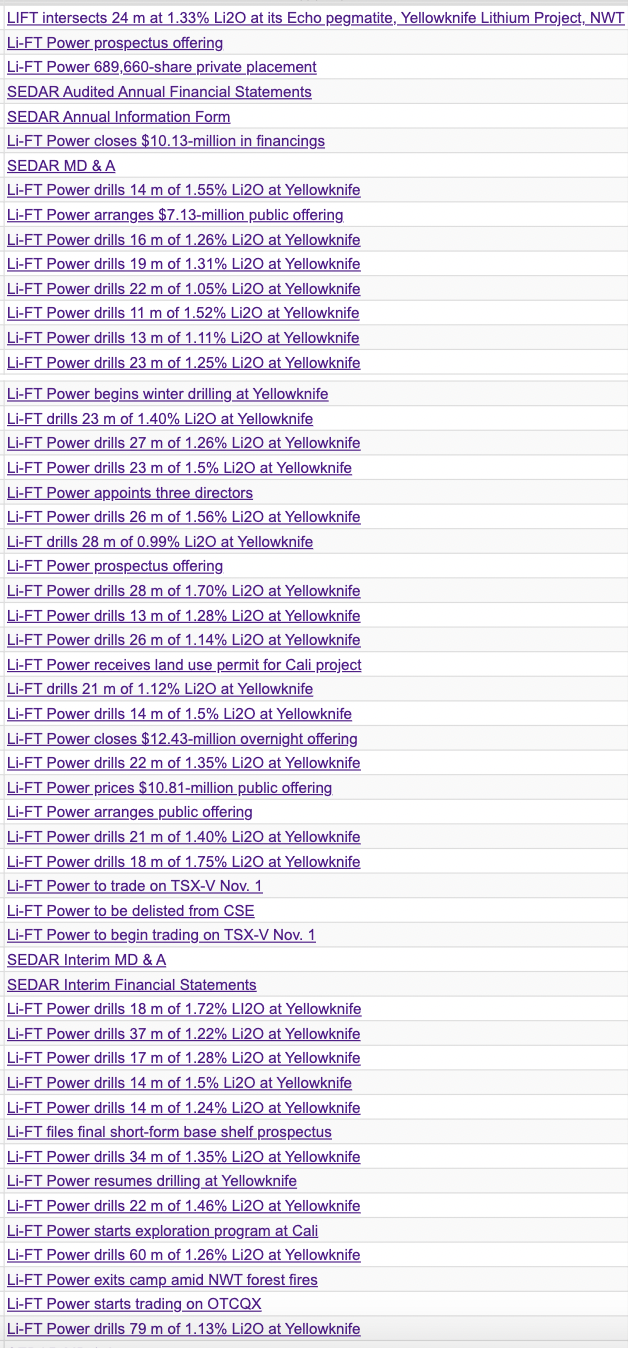

Lithium stocks had a terrible 2023 and are off to a horrific start this quarter. Yet, I firmly believe that the worse things are in 2023-24, the better they will be in 2025-26. Select companies like Li-FT Power (TSX-v: LIFT) / (OTCQX: LIFFF), with an upcoming MRE of 100M+ tonnes at 1.10%+ Li2O in the works, are clear winners.

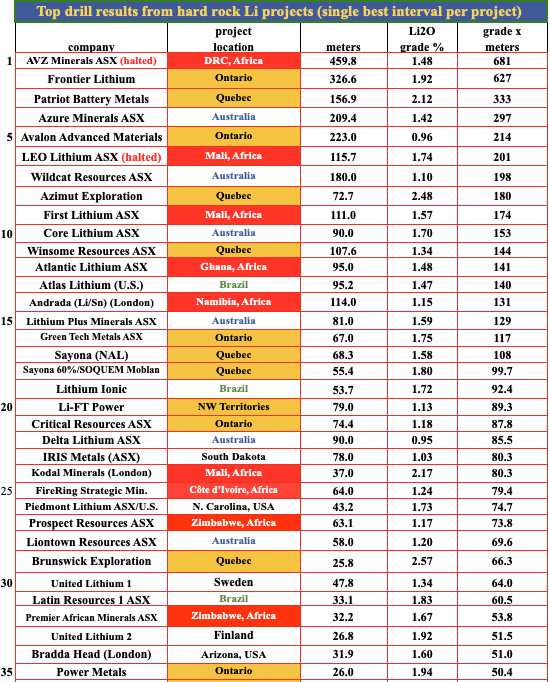

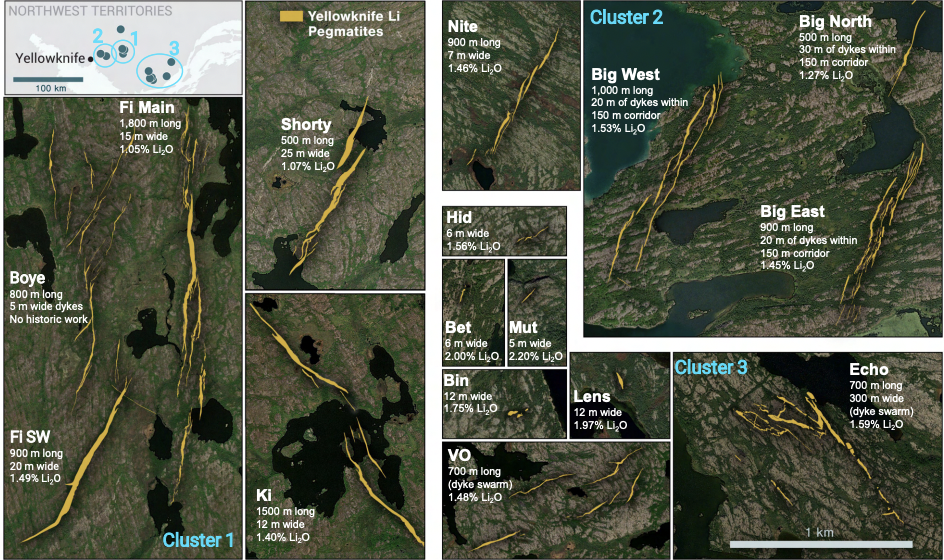

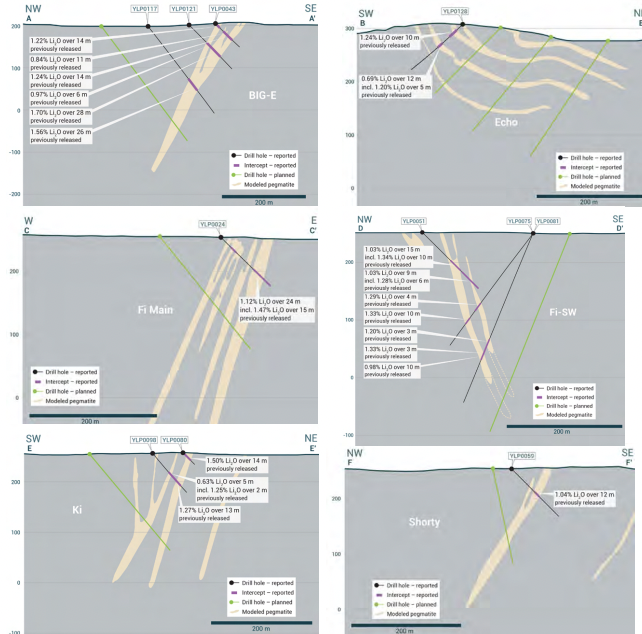

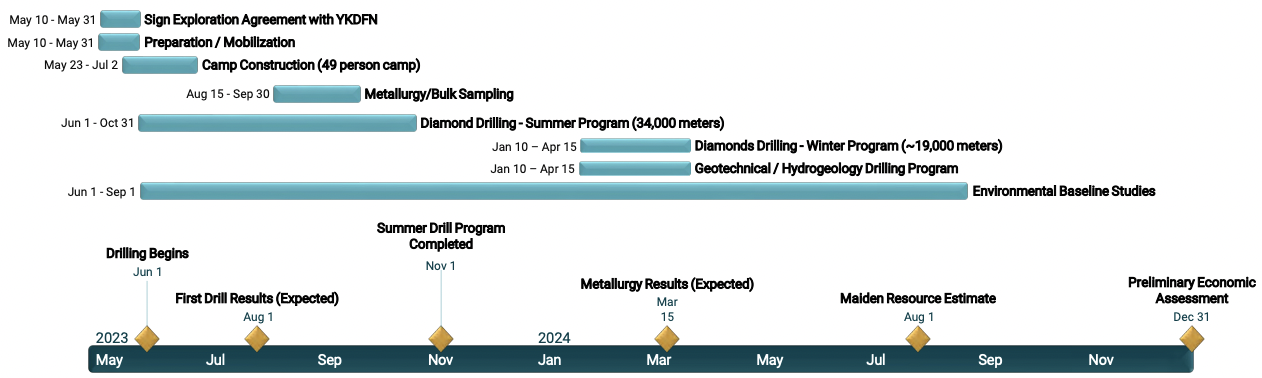

The MRE on the 100%-owned Yellowknife project is expected in September, followed by a PEA several months later. Management believes it has > 100 million mineralized tonnes from 8 of 13 pegmatite systems. Seven of the eight are road-accessible.

Consistent drill results have been coming out nearly every week. The Company concluded its 2023 drill program at Yellowknife with 34,238 m completed. So far, management has reported results from 174 of 198 drill holes (30,666 m).

Upon delivery of the MRE, Li-FT’s Yellowknife project in Canada’s Northwest Territories will be the 2nd or 3rd largest hard rock Li project in N. America, after Patriot Battery Metals’ world-class Corvette and Arcadium Lithium’s James Bay [110M tonnes], both in Quebec.

Other notable projects in Quebec include; Winsome Resources Adina, Sayona Mining’s Moblan & NAL, Critical Element’s Rose, and Nemaska’s Whabouchi. Li-FT’s Yellowknife will be larger than all of them. Ontario hosts just one globally-significant project, Frontier Lithium’s PAK.

As investment sentiment in Li improves, (it can hardly get worse), Li-FT will be among a handful of must-own names. Patriot Battery Metals has a monster project, but its valuation is 5x that of Li-FT!

As the biggest Li name in Canada, I imagine Patriot will get acquired by a company like Pilbara Minerals, Albemarle, Mineral Resources, Arcadium, Rio Tinto or POSCO. Once Patriot is gone, 5 of those 6 (and others) will be all over Li-FT.

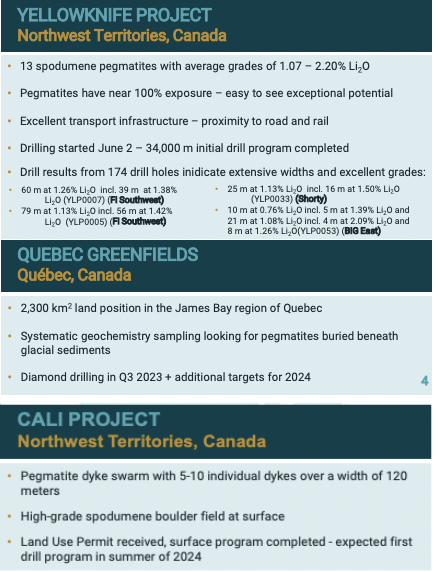

Yellowknife is one of the best positioned of globally significant Canadian hard rock projects in terms of regional infrastructure & product transportation routes. A paved highway from Yellowknife comes within several km of seven meaningful deposits.

Trucking around, and/or barging across, Great Slave Lake (3-4 months/yr.) to a rail line at Hay River is expected to be straightforward & low-cost. From Hay River, concentrate can be railed to a port at Prince Rupert or further south to the U.S.

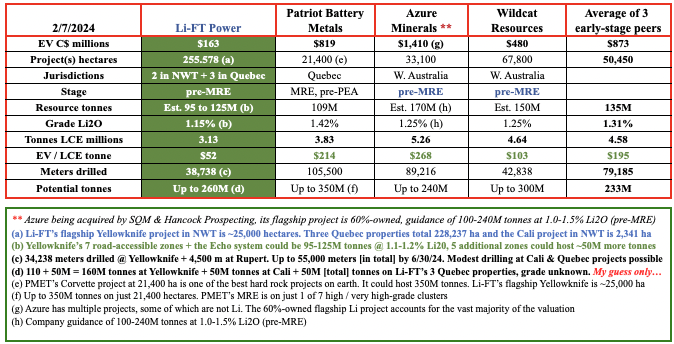

The following chart shows three globally-significant, early-stage hard rock Li peers. Pre-MRE junior Azure Minerals is being acquired for ~$1.4B by SQM & Hancock Prospecting. Granted that deal was negotiated in a better Li market, but Wildcat Resources’ valuation is interesting.

Notice that Wildcat & Azure, both Australian-listed, enjoy strong valuations. Will Li-FT will follow PMET’s lead and co-list in Australia?

Assuming in two years that Li-FT has delineated 160M+ tonnes (combined) at Yellowknife, Cali + one or more of its Quebec properties, and has a PFS out on Yellowknife, the Company could be worth a multiple of today’s enterprise value {market cap + debt – cash} of $163M. (C$4.55/shr.).

Only six juniors with Canadian projects (one in NWT, four in Quebec, one in Ontario) have world-class hard rock Li projects that can reach meaningful production this decade.

Importantly, the large resource size of Yellowknife and considerable value of its regional infrastructure & transportation routes, is boosted by four additional early-stage projects, one in NWT & three in Quebec.

Li-FT’s 100%-owned Cali project has a spodumene-bearing pegmatite dyke system up to 1,200 x 60 x 300 m deep. It has the potential to be over 50M tonnes, but there’s been no drilling on it. Last year, sampling & mapping was done to establish a rough estimate of grade & tonnage.

Fifty million tonnes would be a Top-8 hard rock resource in Canada, yet Cali is barely noticed in the shadow of Yellowknife. In November, the Company obtained a Land Use Permit enabling it to establish an exploration camp, drill, and construct / maintain winter access roads. A modest drill program is planned for the summer.

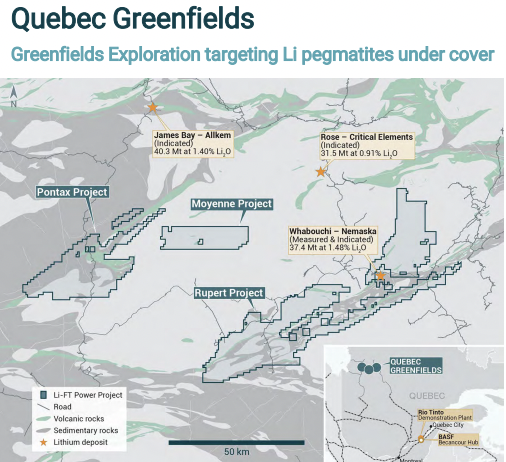

In Quebec, the 100%-owned [Rupert, Moyenne & Pontax] properties span a total of 228,237 hectares. Rupert (141,572 ha) surrounds Nemaska’s advanced-stage Whabouchi project {see map below}. To say that $5B+ Arcadium [formed in merger of Livent & Allkem] should care about Rupert is an understatement.

Moyenne is 25,145 ha, about the same size as the Yellowknife project, and larger than PMET’s 21,400 ha Corvette. It’s within 50-60 km of both the James Bay & Rose projects.

Pontax is 61,520 ha and has the most extensive Li anomaly of the Quebec properties. It has highway access and is < 50 km south of the James Bay project. Any of the three Quebec prospects have the potential to be company-makers if farmed out to third parties.

This bullish article on Li-FT Power assumes Li prices will rebound later this year. A widely-followed Li carbonate spot price in China has been pinned in the low-to-mid US$13,000’s/tonne since December 6th, suggesting it might have bottomed. In fact, for the first time in over three months, that price index rose +2,000 yuan/tonne to 97,500.

18,600 m winter drill program to further test 6 pegmatites

As 2024 unfolds, investors in Li will come to realize the tremendous value in the world’s top low-technical risk, hard rock projects, even early-stage ones. Li-FT Power’s (TSX-v: LIFT) / (OTCQX: LIFFF) Yellowknife project stands out among peers and deserves a lot more attention.

This year & next there will be a tsunami of Li M&A across Canada. By the end of 2025, Li-FT will likely have been acquired by one of the dozens of (auto & battery makers, large Li & mining) companies looking to secure long-term, safe, Li supply in North America.

In my view, a takeout could happen at well above today’s levels. Li-FT’s enterprise value, {market cap + debt – cash} is just $163M!

February Corporate Presentation

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Li-FT Power, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Li-FT Power are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Li-FT Power was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)