In about a decade, the U.S. will be consuming 20-25% of global lithium (“Li“) supply, roughly a million (+/-100k) tonnes of Lithium Carbonate Equiv. (“LCE“)/yr. Currently, it produces ~5k tonnes. Scaling up from 5k to 1M tonnes/yr. (a +70% CAGR) won’t be a problem, Direct Lithium Extraction (“DLE“) will save the day… right?

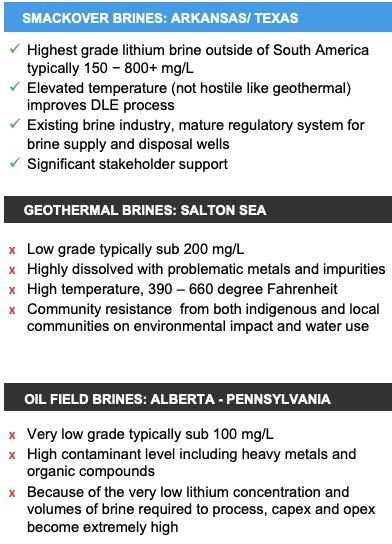

Wrong, DLE is no silver bullet. Each project is a highly complex specialty chemicals AND mine engineering challenge. Yet, some western Canadian brine projects are counting on DLE for resources grading < 100 ppm Li.

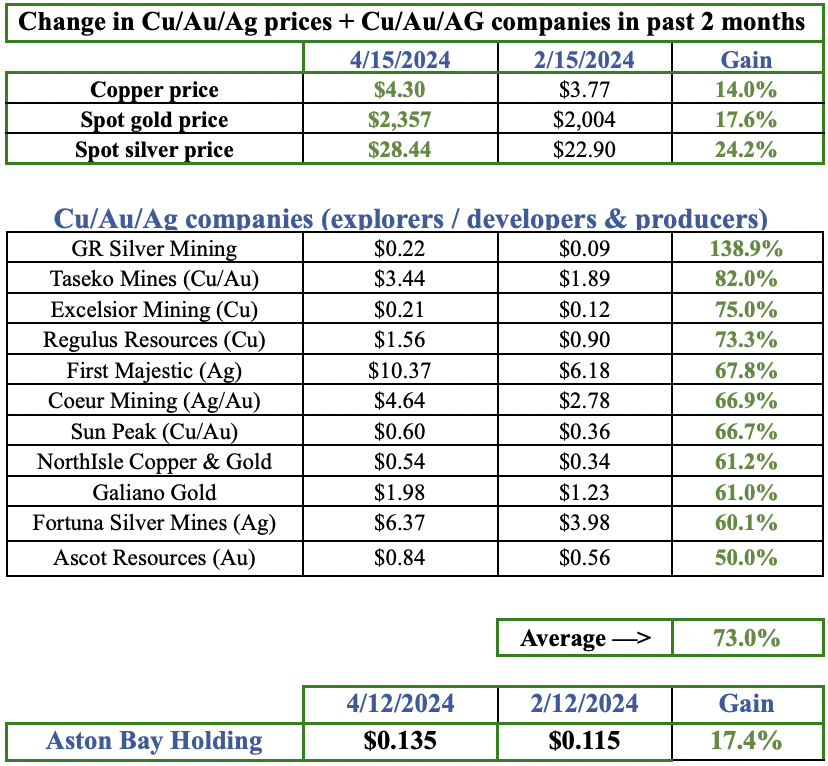

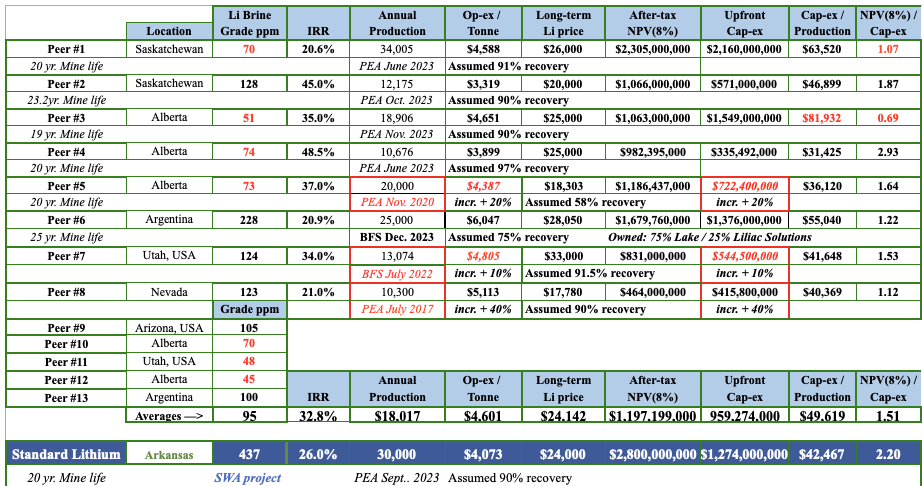

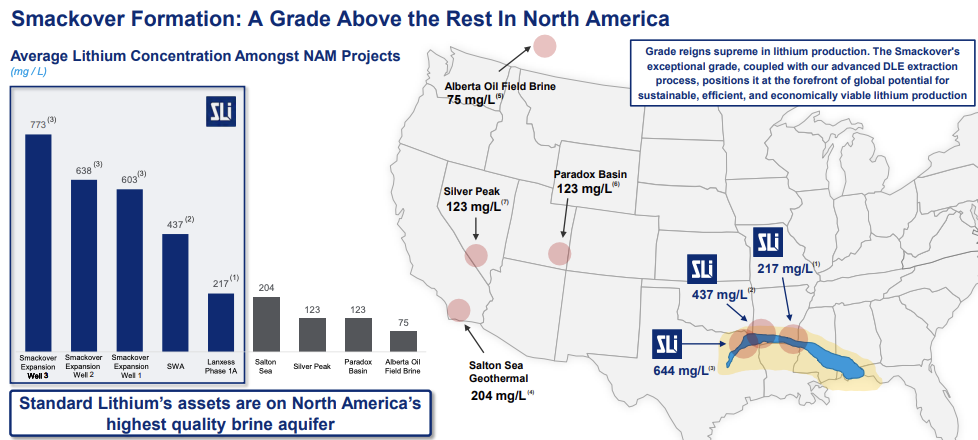

One company in Alberta has a resource grading 73 ppm, with Li hosted in ~4.0 trillion liters of brine! Albemarle’s remaining resource at its Nevada Silver Peak operation averages ~130 ppm Li. In the following chart, the average Li concentration of 13 DLE/brine peers is 95 ppm.

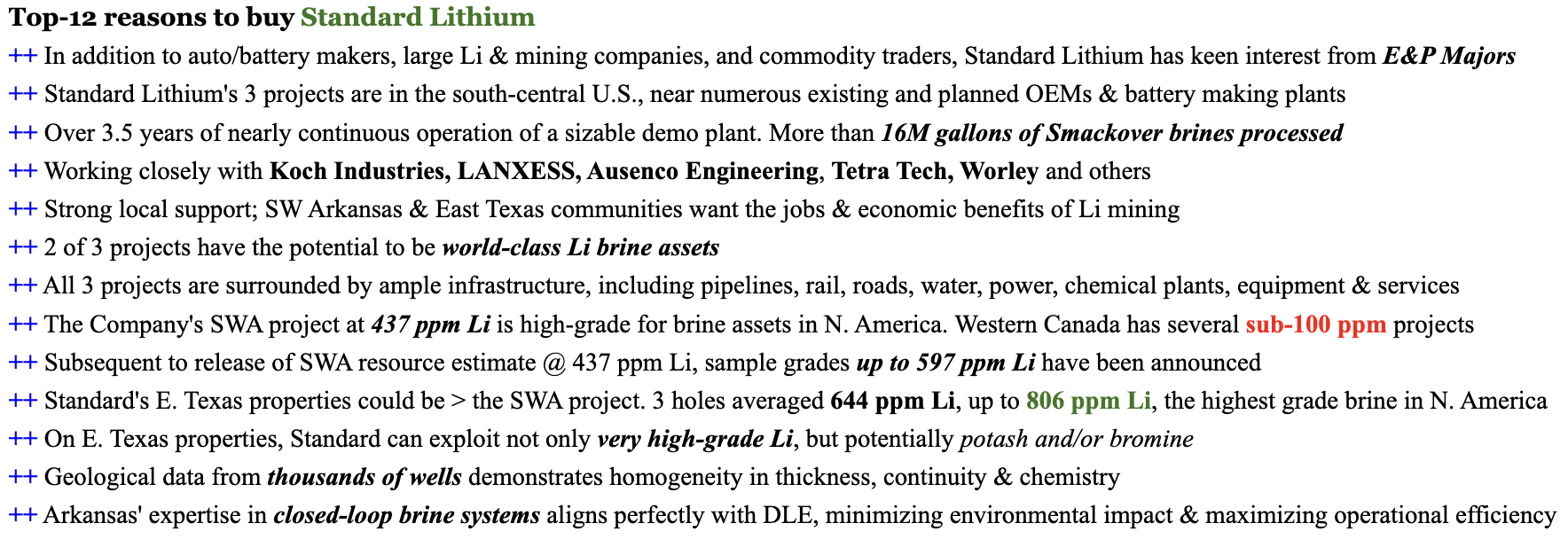

By contrast, Standard Lithium’s (TSX-v: SLI) / (NYSE American: SLI) SWA project has a grade of 437 ppm Li. The lower the Li grade, the more it costs in BOTH cap-ex & op-ex to build and operate a processing facility, and re-inject brines (minus the Li).

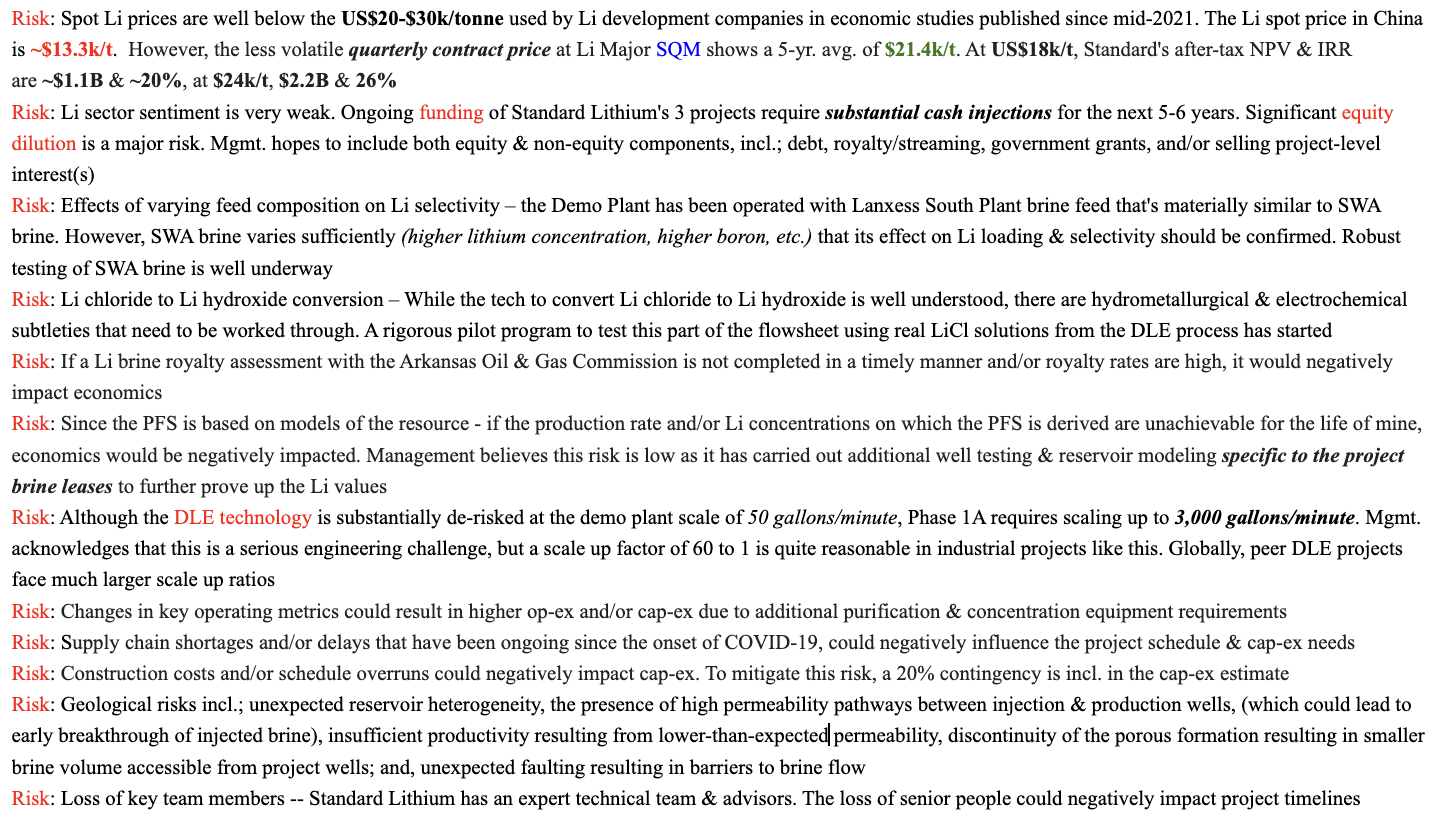

In order for such high-hanging fruit to be exploited, spot prices in China need to be above today’s US$13.5k/tonne. Readers are reminded that the spot price soared past $80k/t in 4th qtr. 2022. Support for higher prices is found in SQM’s trailing 3 / 4 & 5-yr. quarterly contract levels of $25.2k / $22.4k & $21.4k.

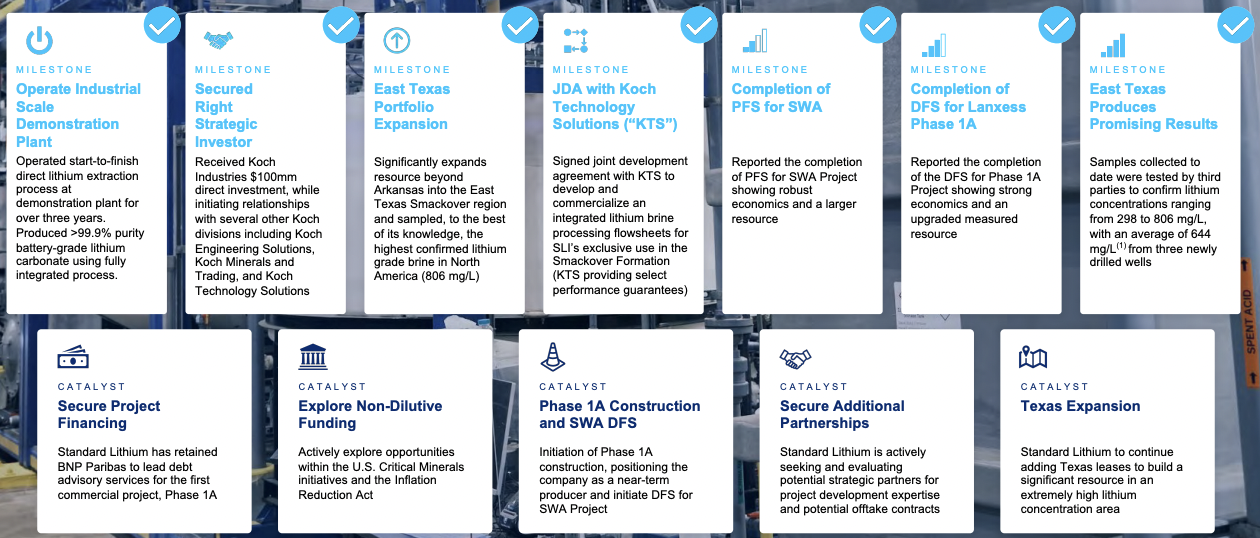

Standard is years ahead of most pre-construction peers. It has the proof-of-concept DLE/brine LANXESS project in SW Arkansas, with a Bank Feasibility Study (“BFS“) on it, plus two major Li assets (1 in SW Arkansas + 1 in east Texas). Management had cash of $15M at 12/31/23. There’s no debt.

In very weak Li markets, it’s incredibly important to have a strong team, Standard’s is stellar. The seasoned execs shown above are led by CEO Robert Mintak, see bios on those eight and more.

Albemarle has bromine operations adjacent to European specialty chemicals company LANXESS and is testing in-house DLE technology. The LANXESS asset consists of three staged expansion projects — South, Central & West. The BFS is on just the South portion, known as “Phase 1A.”

Standard Lithium is negotiating with long-term supporter LANXESS on terms to lease property & utilize that company’s significant infrastructure & services.

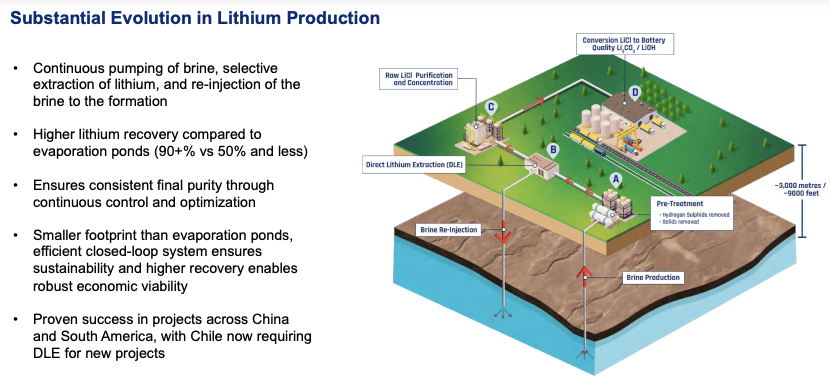

Unlike the vast majority of DLE offerings testing systems around the world, Standard’s DLE approach is tailor-fit to SW Arkansas & east Texas brine chemistries. While Standard faces many risks {see above} the primary ones are 1) the long-term price of Li, 2) funding cap-ex for multiple projects, and 3) technical & geological risks.

Koch Industries & LANXESS + third-party consultant groups incl. Ausenco Engineering, Worley ltd. & Tetra Tech, continue to work with Standard’s technical team & independent advisors.

The Company’s business model was recently validated when ExxonMobil announced big Li plans nearby. Last summer, Exxon acquired 120,000 gross acres for US$100M.

Exxon is following LANXESS & privately-held conglomerate Koch in demonstrating belief in what Standard has been doing in the red hot Smackover Formation. Koch made a US$100M equity investment into Standard Lithium in 2021 (at a much higher share price) and remains a strong DLE partner.

Exxon has very substantial oilfield capabilities, as does Chevron, BP, Shell, Occidental Petroleum, Equinor ASA, Imperial Oil, Schlumberger & Devon Energy, all of whom are thought to be (based on Google searches) looking at DLE/Li brine plays.

The chart above shows possibilities of strategic investors/acquirers. It might be better to buy into the Smackover Li trend than build, but there’s only three companies to acquire; Standard Lithium, a small Australian-listed junior (~12k acres, pre-drilling, no direct DLE experience) & Tetra Technologies.

Tetra has a 729k tonne LCE resource, but is focused on bromine and has partnered with Exxon. It takes years to negotiate hundreds, even thousands of land deals to assemble a meaningful footprint. Albemarle’s bromine operations span 99,500 acres and required the signing of 9,500 lease agreements!

Standard’s team has been building its land position in SW Arkansas for seven, and in east Texas, for three years. It knows the Smackover Formation as well as anyone and has more data than most (drill hole logs, pumping tests, hydrology studies, etc.).

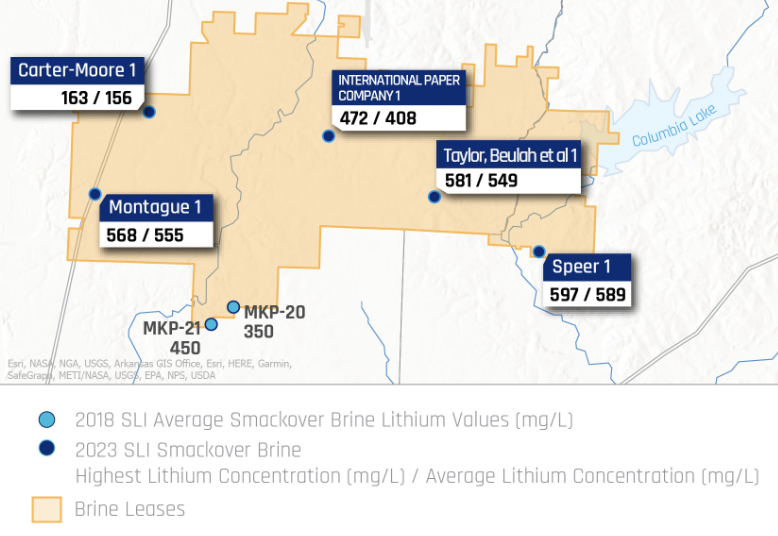

The Company has 4.6M tonnes, (2.8M tonnes @ 217 ppm Li at LANXESS (BFS-stage) + 1.8M tonnes @ 437 ppm Li at its South West Arkansas (“SWA“) project (PFS-stage). There’s upside potential to the 437 ppm Li grade as up to 597 ppm Li has been reported.

Until a few years ago, the 3-stage LANXESS’ project was the sole asset and Standard was expected to own just 30%-35%. Today, the Company owns 100% of three valuable assets in the Smackover Formation.

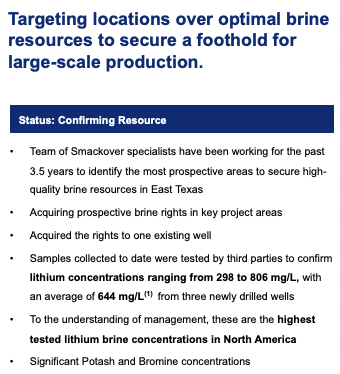

While Phase 1A is important, it has been eclipsed by the much higher grade SWA (437 ppm) project & east Texas (644 ppm) lease portfolio — all using the same DLE. The east Texas properties have high levels of bromine & potash that can potentially be exploited alongside the Li. Albemarle’s EBITDA margin on bromine averaged 27.7% from CY 2021-23.

SWA has a Pre-Feasibility Study (“PFS“) showing an after-tax NPV of C$2.8B & IRR of 26% at US$24,000/t hydroxide, or ~$1.5B & ~20% at $18,000/t from 30,000 tonnes LCE/yr. There’s also an upside case in the PFS of 35,000 tonnes/yr. The upcoming BFS might have a 35,000 tonnes/yr. base case.

Assuming Standard’s projects attract strong partners, initial production from Phase 1A is expected in 2026, with SWA starting in 2027. The reason SWA & east Texas are so valuable is that they have the large scale that E&P companies, auto OEMs, battery-makers, etc. need to move the needle.

Since 2019, the Top-4 M&A deals in Argentina valued Li brine projects — using solar evaporation ponds with recoveries of 40%-50% — at an average of US$811M. Buyers Rio Tinto, Ganfeng Lithium, Zijin Mining & Tibet Summit paid between US$721M & $962M.

Lithium Americas (Argentina) owns 45% of a 40k tonne/yr. project and is valued at C$1 billion. In JV with Ganfeng, it started production and is ramping up to full capacity this year using evaporation ponds. Therefore, 100% of that operation is valued at C$2.2B. Compared to 40k/yr. Standard’s 30-35k tonne/yr. SWA project is a similar size.

By contrast, in collaboration with Koch, Standard’s DLE technology, (post BFS-stage), boasts recoveries of 90%+. Both SWA & east Texas could be globally significant resources, not sub-100 ppm, but 437-644 ppm Li. Add to that, the potential of bromine & potash — the value of east Texas could be a multiple of SWA.

Majors paid US$811M = C$1.1B for Argentinian brine assets at PFS / BFS stages. In a better Li market, SWA & east Texas could also be billion dollar assets. Standard owns 100% of both.

On a Feb. 12th conference call, CEO/Dir. Mintak, President, COO & Dir. Andy Robinson, PhD, newly hired Chief Development Officer Mike Barman & CFO Salah Gamoudi spoke at length about the Company’s long-term vision & goals for 2024. Conference call replay… transcript… This was an upbeat call, full of important info.

Takeaways, 1) discussions with strategic investors & off-take partners are ongoing, some are at advanced stages, 2) several sizable DoE & DoD grants are being pursued, 3) east Texas could be worth a multiple of SWA, [but early days], and 4) there’s substantial interest in the Company’s projects, especially SWA.

Last year, Citigroup & BNP Paribas were retained to facilitate strategic investments, off-takes & debt funding. On the call, management expressed cautious optimism of being awarded one or more grants, adding that a few are for, “material” amounts.

News on at least one grant is expected by September. I take material amounts to mean US$100M+. Last year, Piedmont Lithium was awarded $142M. Off-take agreements are centered on upfront cash payments. For example, selling 2,500 tonnes LCE/yr. @ US$12,500/t for five years, with the first two years’ totaling $50M paid upfront.

If Standard were to sell 70% of the SWA project, in exchange for being free-carried through positive cash flow, its remaining 30% interest would potentially be worth (30% of the after-tax NPV), ~C$450M @ US$18,000/t hydroxide, or ~C$840M @ $24,000/t, [midpoint = C$645M @ $21,000/t].

Management could also farm out 70% of east Texas, with potentially even larger economics, but probably not before 2025 or 2026.

Standard’s enterprise value {market cap + debt – cash} is ~C$265M (C$1.55/shr., 2/22/24). And then there’s Texas, everything’s BIGGER in Texas… Drill results from three wells delivered Li grades up to 806 ppm, averaging 644 ppm, on the Company’s east Texas Smackover properties.

It would be hard to overstate how significant 806 ppm Li is. In N. America, it’s the single highest grade brine result ever reported. In Argentina, it would be a top-decile drill hole, and the average of 644 ppm Li would probably be top-quartile. Those holes alone are enough for a maiden resource estimate by year end.

Getting critical materials by train/truck in a day vs. weeks by oversea container ship makes a huge difference. And, with geopolitical tensions / economic rivalry increasing between the West & China, made in America could become incredibly important.

This week’s sold out Arkansas Lithium Innovation Summit on Feb. 15-16, spearheaded by Standard Lithium, will highlight the made in America narrative and draw considerable attention to the Company.

Albemarle, Exxon, and many others are sending representatives, 600+ tickets were sold. Benchmark Mineral Intelligence & Fastmarkets will be there, as will the WSJ + Bloomberg News.

Commissioned in May-2020, the pilot/demo plant has operated nearly 24/7, processing > 16M gallons of Smackover brine at 50 gallons per minute, providing invaluable data that has led, and will continue to lead, to process improvements this year & next.

Scaling up from 50 gallons/min to 3,000 for Phase 1A, a factor of 60:1, is routine for industrial projects. Some DLE technologies are facing scale-up factors of > 1,000:1. This scale-up will greatly de-risk the SWA scale-up to 7,925 gallons/min.

Dr. Robinson commented,

“Over 3.5 years of rigorous testing & integrated process improvements have provided us with unrivaled knowledge of Li extraction from Smackover brines. We selected Smackover brines for their existing commercial operations, exceptional grade & straightforward geochemical nature, distinguishing them as N. America’s premier Li brine. Whilst we anticipate challenges, our extensive experience & knowledge, in combination with our technology partners and the expertise of our plant’s engineers & operators, sets us up for success.“

Even though there’s been a great deal of progress made and blue-sky potential has soared with two new projects, Standard Lithium’s share price is far below what Koch paid in 2021.

Management can’t control Li prices or investor sentiment, but it has been prudently moving the ball forward. Dozens of companies are closely following what’s going on in SW Arkansas & east Texas. Non equity-dilutive funding is a major goal for 1H 2024.

Standard Lithium (TSX-v: SLI) (NYSE American: SLI) is a one-stop shop for Li/DLE extraction, it has the right team, projects, scale, community support, and is in the heart of the prolific Smackover Formation, the best Li brine jurisdiction in N. America.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Standard Lithium, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Standard Lithium are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Standard Lithium, but the Company was NOT an advertiser on Epstein Research. Standard Lithium was an advertiser in 2019.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)