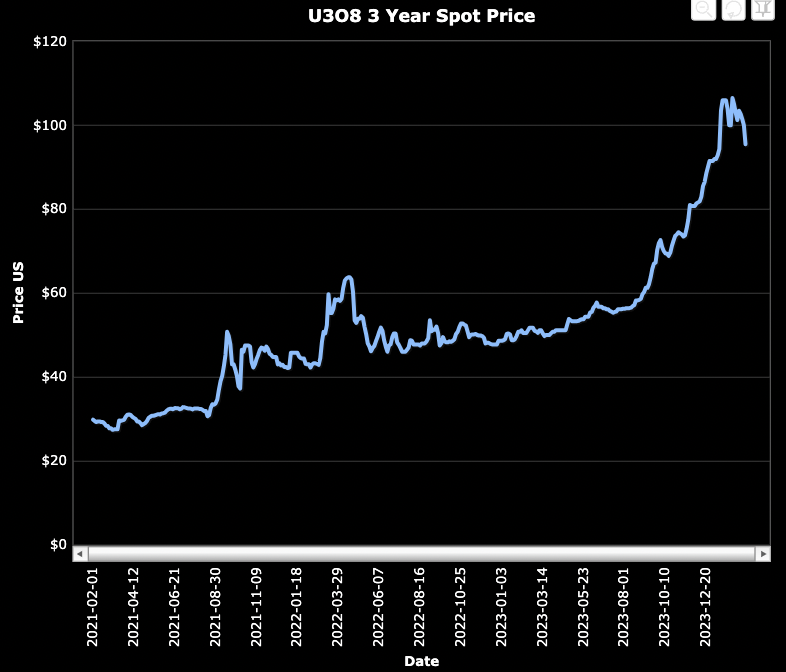

After years of a very low #uranium spot price (high teens to $40’s/lb.), the price more than doubled to a high of ~$107/lb., before easing back to the mid-$90s/lb. Despite pullbacks, many U3O8 stocks have rallied substantially. Do uranium plays have room to run, or has the opportunity largely passed?

The last robust period of over-contracting (restocking) in 2005-07 caused the uranium spot price to hit ~US138/lb., which adjusted for inflation is ~$210/lb. The long-term contract price was pinned at $95/lb., (~$142/lb. in today’s dollars) for 10 straight months from May 2007 to March 2008.

So, today’s mid-$90’s/lb. does not stand out as especially strong. And, 2005-07 was long before financial buyers like Yellow Cake Plc & the Sprott Physical Uranium Trust appeared on the scene. Note, it’s been reported that dozens of hedge funds are now squirreling away physical U3O8.

2023 was a great year, but was just year 1 of a multiyear period of restocking after 10 years of under-contracting from 2013-22. It’s difficult to see a scenario in which the uranium price declines significantly in 2024-25, by significantly I mean below say $75/lb.

Uranium stocks will remain quite volatile, the spot price is down 10-11% from $107/lb., but UEC is down -23%, Boss Energy, -22%, Cameco -20%, and the Sprott Physical Uranium Trust, -18%.

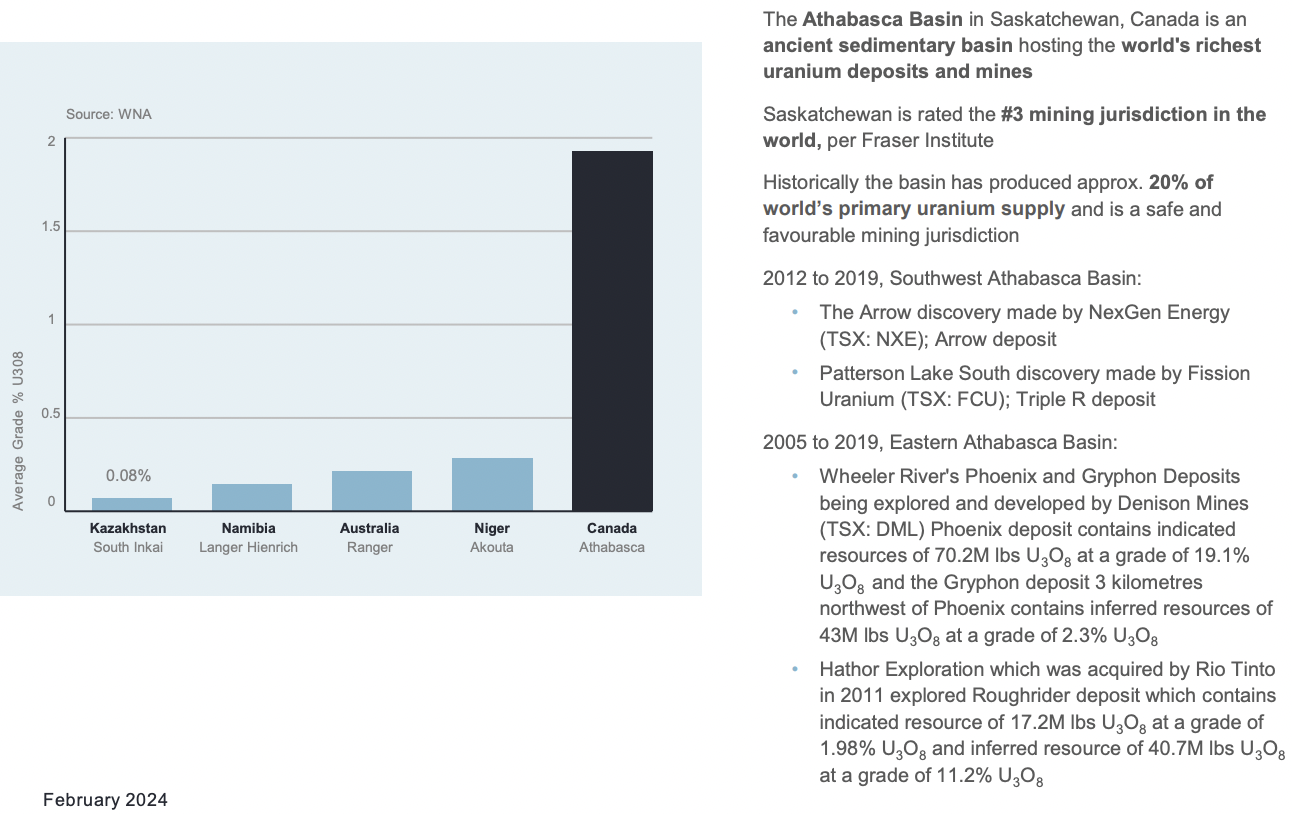

On the other hand, there are scenarios where the uranium price could move much, much higher. The world’s two largest uranium producers, Canada’s Cameco & Kazatomprom (in Kazakhstan) are sold out for years to come. In fact, they might need to purchase U3O8 in the spot market to satisfy sales contracts.

The vast majority of Kazatomprom’s production is headed to China & Russia. Major French producer Orano reported a 5% decline in production last year. Regarding demand, analysts have barely begun including Small Modular Reactors (“SMRs”) & micro-reactors, into long-term forecasts.

From the 2030s on, demand from SMRs will be a significant factor, and micro-reactors will be deployed to power desalination plants, AI / Cloud / Supercomputing initiatives, smart homes & cities, cryptocurrency mining & data centers.

Utility companies, having invested (in some cases) $10’s of billions on nuclear power, can afford to pay $150, $200, $300, $400/lb…. They wouldn’t like it, but what choice would they have? There’s no substitute for U308.

No, I’m not expecting $400/lb., but market participants know it’s a seller’s market for the next 2-3 years. I think we could see contracts with floors of $150 & ceilings of $200/lb., a level below the inflation-adj. high of $210/lb. In my view, uranium stocks are pricing in less than a 5% chance of $200/lb. pricing.

Several high-quality names are below highs of 2021-22 when the uranium price was much lower. While pullbacks in a bull market are routine & healthy, some seem addicted to BREAKING NEWS!! on supply shortfalls & geopolitical tensions. But, the uranium narrative doesn’t need more bullish headlines.

The die is cast, there’s no hidden supply to save the day. Lead times for new mines & mine restarts are well known. It will take a long time, especially as highly-skilled technical people are in short supply!

Much of the new production in the U.S. will be small, million pound/yr.type ISR operations that pale in comparison to the impact of reactor restarts & life-extensions.

Larger uranium companies Cameco, Kazatomprom & China’s CGN Mining, plus development companies like; Denison Mines, Nexgen Energy, Paladin, UEC, Deep Yellow & Boss Energy are up an average of +140% from 52-wk lows.

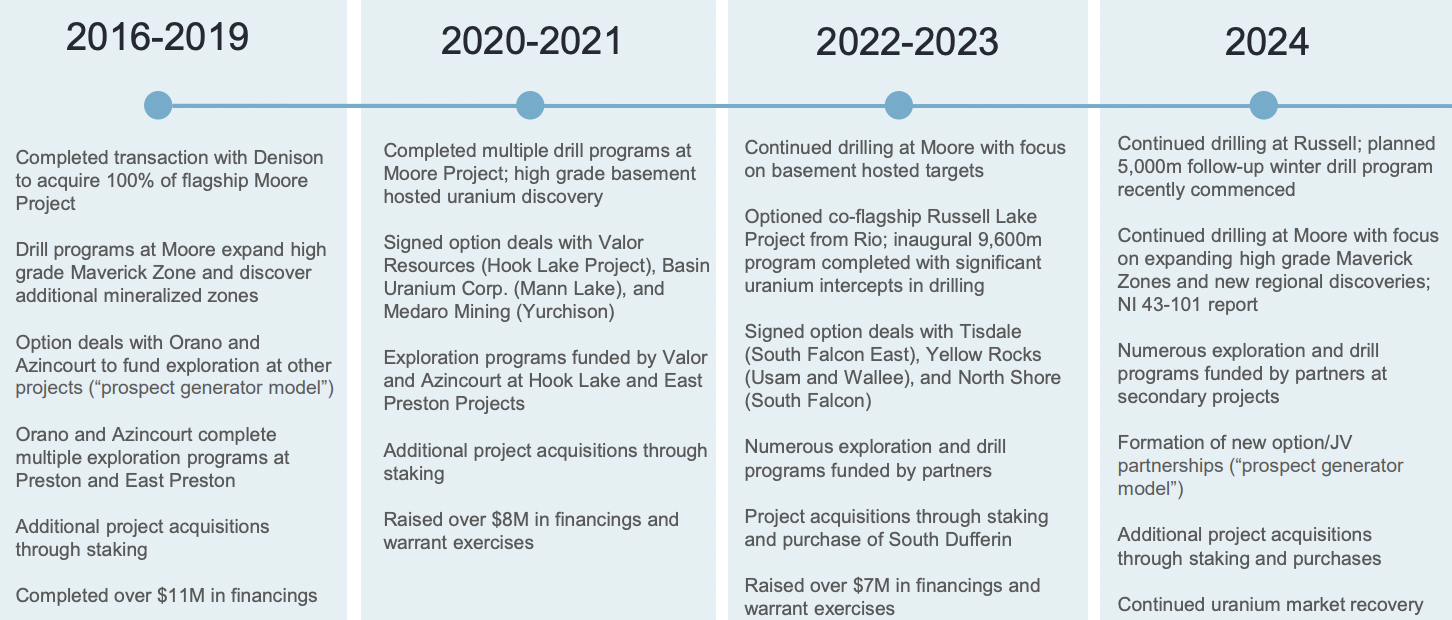

By contrast, some promising juniors have not rallied nearly as much. One such company is Skyharbour Resources (TSX-v: SYH) / (OTCQX: SYHBF). It hit highs of $0.87 in 2021, $0.84 in 2022, but only $0.64 since then and closed $0.43 on Feb. 26th. This might make sense if the Company had massively diluted shareholders over the past few years.

See new corp. presentation for far more detail on key projects/properties

However, as a prospect generator, Skyharbour has NOT diluted shareholders as much as other uranium juniors. Has there been bad news? No, but last year’s drill results at Russell Lake were disappointing to some investors. Management sees them as instructive for future exploration.

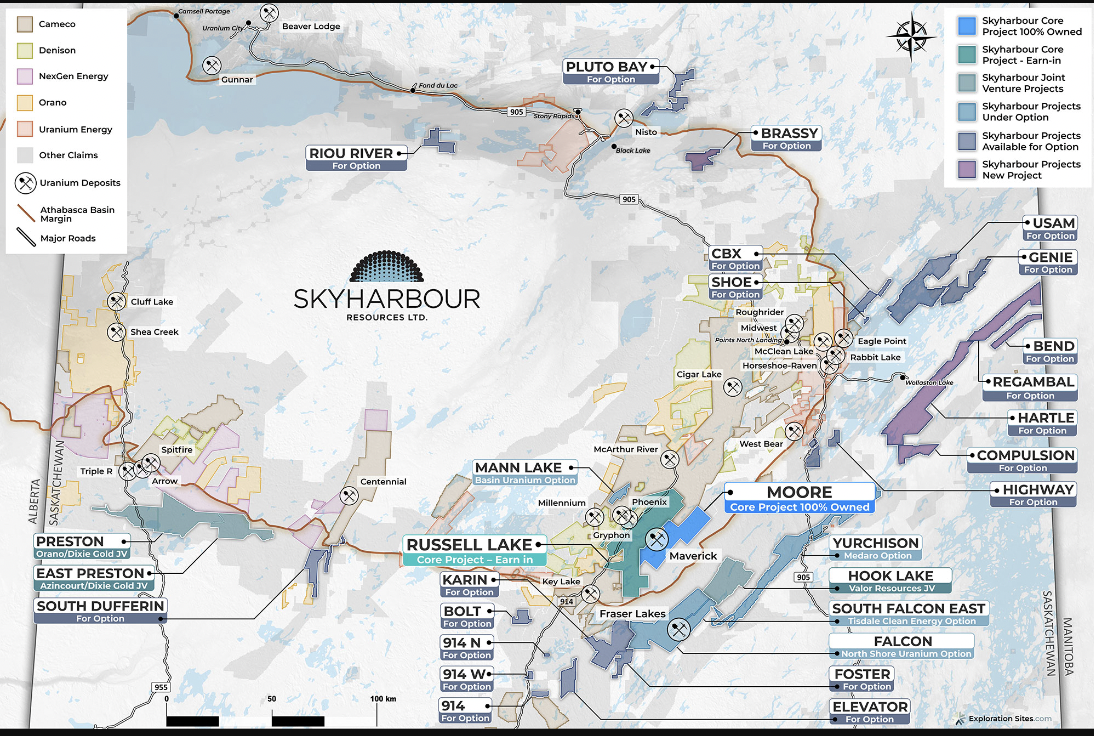

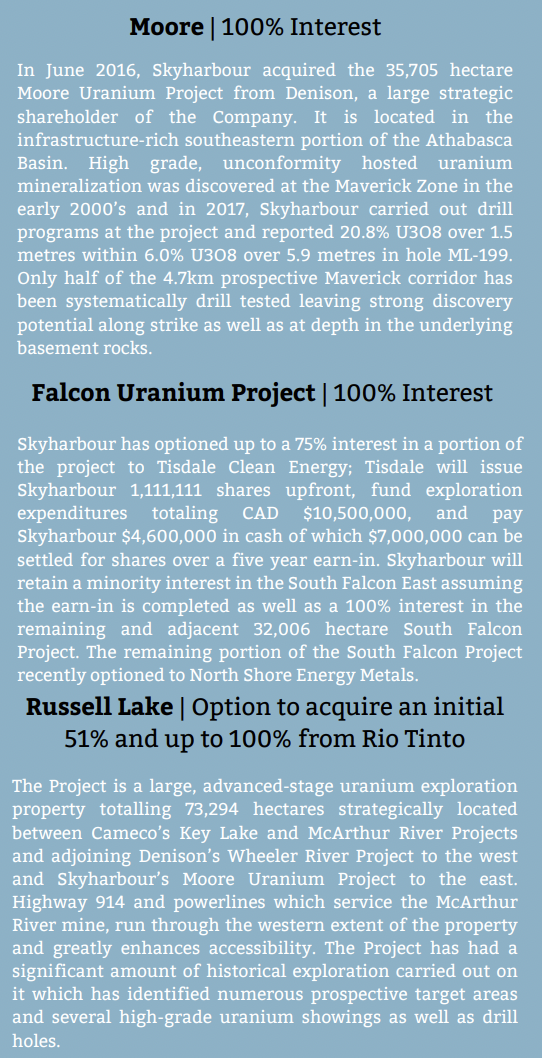

Skyharbour owns/controls 587,364 hectares across 29 properties/projects — the third largest land holding in the region. If readers take away nothing else from this article, please consider the fact that management acquired the vast majority of its portfolio when the uranium price was less than half of today’s level.

I believe the Company is not receiving proper credit for its 29 assets, any of which could potentially be the next F3 Uranium or CanAlaska. All we need is 1 or 2 big new discoveries to move the needle. Yet, Skyharbour, with an enterprise value (market cap + debt – cash) of just C$70M, is valued as if there are zero big discoveries ahead.

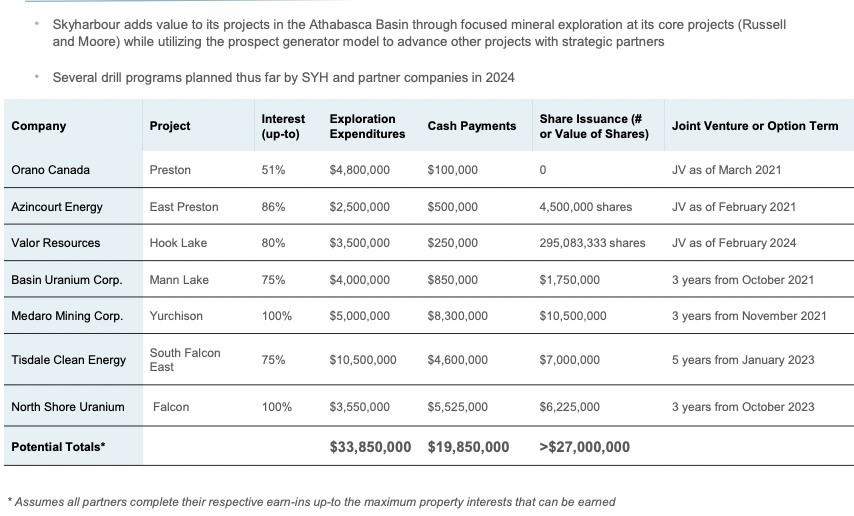

In the following chart, note that potentially up to C$80.7M in [partner exploration expenditures + cash payments + share issuances (some of which already incurred/received)] is accruing to Skyharbour in the coming years. And, the Company has 15 properties available for JV or farm-out at even better terms.

By next year, that $80.7M figure could be well over $100M, above & beyond the considerable value of Moore & Russell.

The technical team remains excited & optimistic for this year’s drill program of ~8,000 meters, 5k at Russell Lake & 3k at Moore. Russell & Moore are contiguous and sit within several kms of Denison’s ($2.1B market cap) world-class Wheeler River project. Moore is 100%-owned, and management is earning up to 100% of Russell.

I believe Skyharbour is not getting proper credit for its two flagship projects being so close to Wheeler River. The value of Wheeler River has tripled in the past two years. Moore and/or Russell could become satellite deposits to Wheeler River if they are not big enough as standalone mines.

While satellite deposit status is not as sexy, the projects could be worth well into the $10s of millions, with minimal cap-ex requirements, which would be very significant relative to the all-in C$70M valuation. Of course, if more uranium is discovered, the projects could be worth $100(s) of millions.

Importantly, drilling at Moore will be focused on expanding the known high-grade zones, so there should be positive press releases on drill hole results. As a reminder, Moore has high-grade extending into the basement rocks. Skyharbour is post-discovery at Moore, a fact that shouldn’t be lost on investors.

Management knows there’s very high grade material, it just needs to find more of it. Drilling in 2017 totaled 9,485 m with high grade uranium in multiple drill holes including 20.8% U3O8 over 1.5m within 6.0% / 5.9 m, and 9.12% U3O8 / 1.4 m, and 4.17% / 4.5 m, plus 2.23% / 9.3 m, all at ~250-280 m depth.

An interesting interval in 2018 returned 1.33% U3O8, 0.44% cobalt & 1.62% nickel over 7.8 m. Could Moore/Russell host nickel or cobalt by-products? To be clear, new blockbuster grades are not needed to greatly advance the prospects at Moore/Russell. Anything over 1.00% U3O8 running multiple meters would be great.

In 2021, drilling returned 2.54% U3O8 over 6 m, incl. 6.80% / 2 m in basement rocks at the Maverick East Zone as well as 0.54% U3O8 over 19.5 m, incl. 4 m of 2.07% U3O8.

In an already established uranium bull market expected to last years, not months, owning a company with serious blue-sky potential, (3rd largest landholding in the region), with a relatively low cash burn rate, offers a compelling risk/reward proposition.

Skyharbour Resources’ (TSX-v: SYH) / (OTCQX: SYHBF) C$70M valuation seems far too low as it has an un-discounted $80.7M in potential future prospect generator value + 15 more properties to farm-out or JV on + two valuable flagship projects in Moore & Russell Lake.

See new corp. presentation for far more detail on key projects/properties

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)