I have a family member who’s very queasy about needles. She injects herself once a week, but gets anxious the night before and morning of her shot. How many reading this sentence would be uneasy having to inject themselves weekly? How about 2-4 times a day!

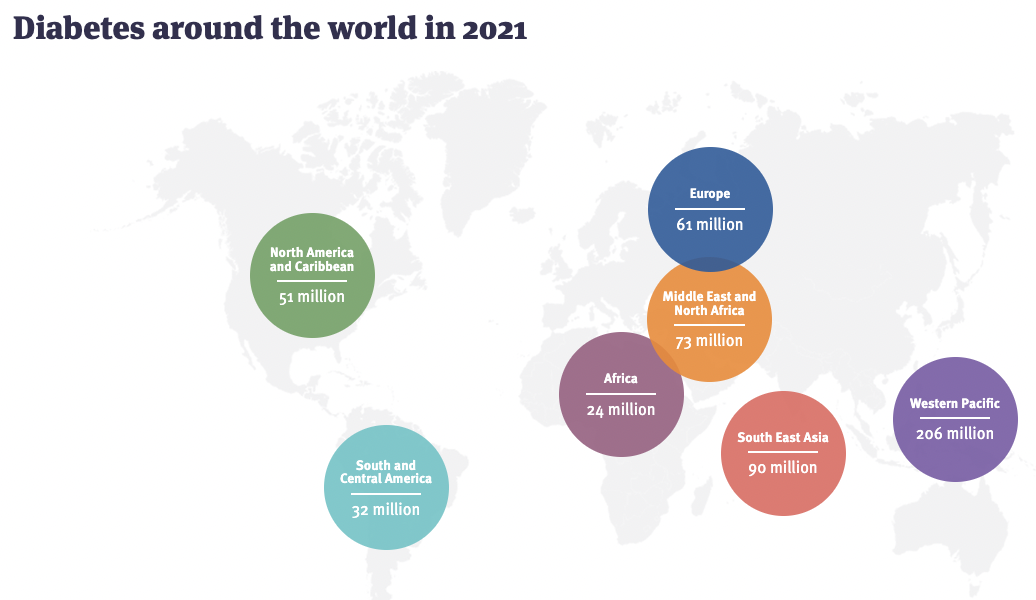

Estimates suggest up to 25% of adults, and of course most children, suffer from a significant fear of needles. Diabetes is a very serious & growing global problem. Globally, there are > 700M diabetics, ~92% are Type 2 (+ other) & ~8% are Type 1. That figure includes an estimate of people with the disease that are undiagnosed.

Of those who use insulin, 2 to 4 daily injections is commonplace. In addition, the elderly, individuals with “essential tremor” and those with Parkinson’s, have unsteady hands, making the safe handling of needles a challenge.

Used needles need to be disposed of in special containers, which is annoying & inconvenient when away from home. Injections can be painful, especially into sore areas. Medical waste is a societal burden as it must be segregated & incinerated (which is costly & results in greenhouse gas emissions).

Improperly disposed of medical waste can result in ecological damage (like needles washing up on shore), or expensive clean up of illegally dumped materials. Beyond fear, pain, inconvenience, and environmental harm, there are “needle stick injuries,” people & healthcare workers stabbing themselves or others, which can result in infections.

Daily use of needles can cause bruises, soreness, itchiness, scarring, numbness and areas of discolored skin. What if people could avoid needles entirely? No pain, infections, fear / apprehension, no bruises, soreness or discolored skin, no “sharps disposal” headaches.

Instead of needles, some diabetics use insulin pumps, but not everyone wants to wear a medical device 24/7/365, with visible tubing a constant reminder of one’s condition, and having to monitor blood sugar levels all the time.

Why isn’t needle-free delivery of medicines, vaccines & supplements ubiquitous? In researching this article on NuGen Medical Devices (TSX-v: NGMD) / (OTC: NGMDF), a main objective was to poke holes, (pun intended) in the story. NuGen sells InsuJet, a spring-loaded, jet stream injection device for needle-free delivery of insulin (and over time, other drugs).

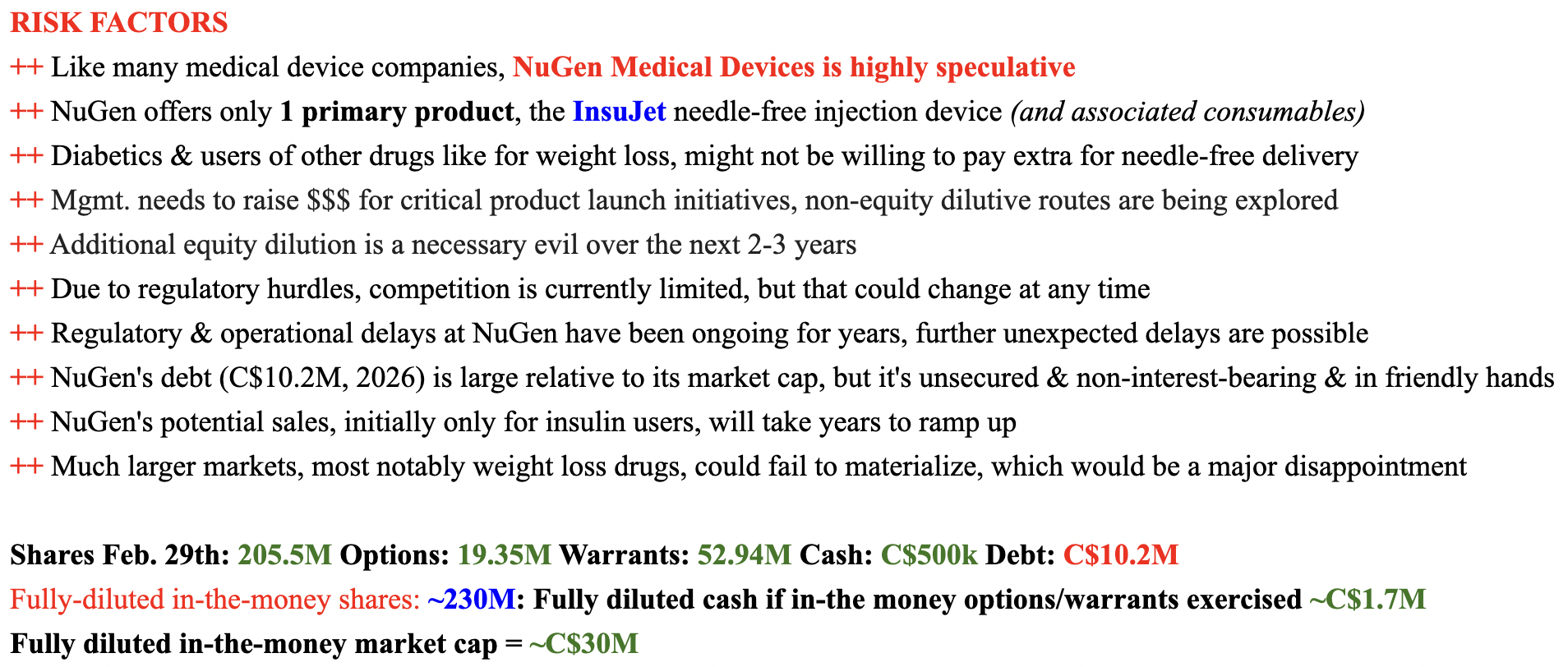

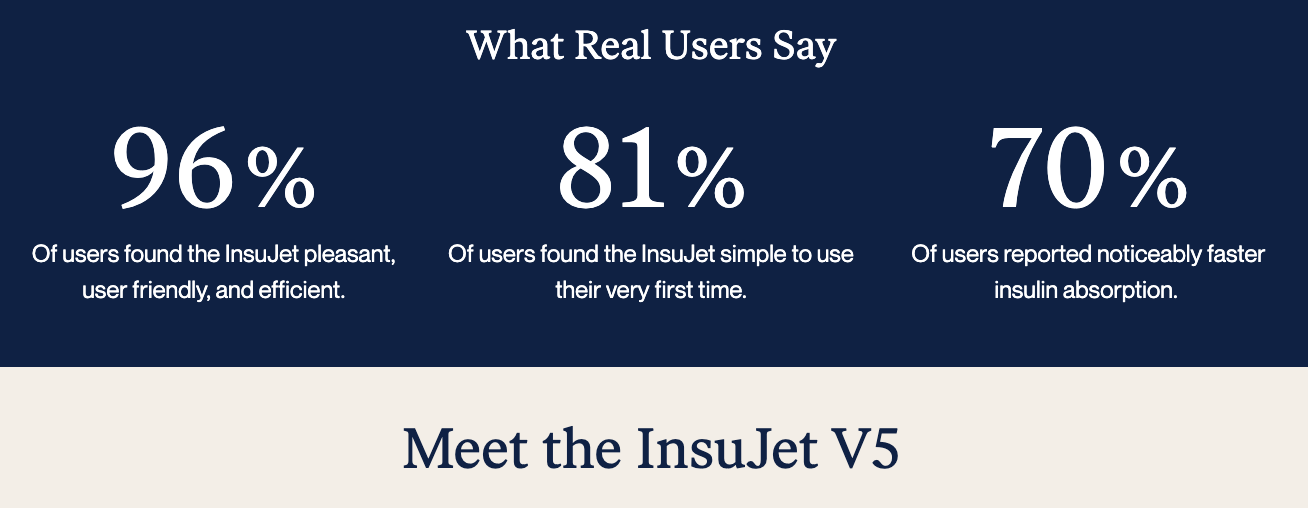

The devices is simple simple to use, see video below. Importantly, NuGen expects to generate the majority of revenue from the sale of associated (required) consumables including nozzles & adaptors. This recurring revenue is akin to the tried and true “razor-razor blade” model. NuGen is a highly speculative company, see RISK FACTORS above.

Why isn’t needle-free the norm? I don’t have a definitive answer, but here are my observations,

++ Not all medicines / vaccines can be administered via a needle-free injection device such as NuGen Medical Devices’ InsuJet. Only medicines delivered subcutaneously, (under skin, but not into muscle) are viable candidates. Many medicines, vaccines, vitamins & supplements are delivered subcutaneously.

++ Since each medicine / vaccine has to jump through regulatory hurdles, it’s easier for healthcare professionals to keep using needles, even though patients would benefit from needle-free delivery.

++ A few large medical device / supply companies make a lot of money selling single-use, disposable needles. By far the biggest player is Becton, Dickinson & Co. R&D for needles is quite low. Becton has little incentive to risk its cash cow needle business, especially as needle-free would cannibalize its needles franchise.

++ Resistance to change makes the status quo the path of least resistance.

++ Incremental costs of an injection device + associated consumables. If patients have to pay more out of pocket for needle-free delivery, many will continue to inject themselves with needles.

Obstacles to greater needle-free adoption ignore one critically important factor… The patient! NuGen believes it can overcome resistance to change by focusing on the low-hanging fruit of insulin delivery to diabetics.

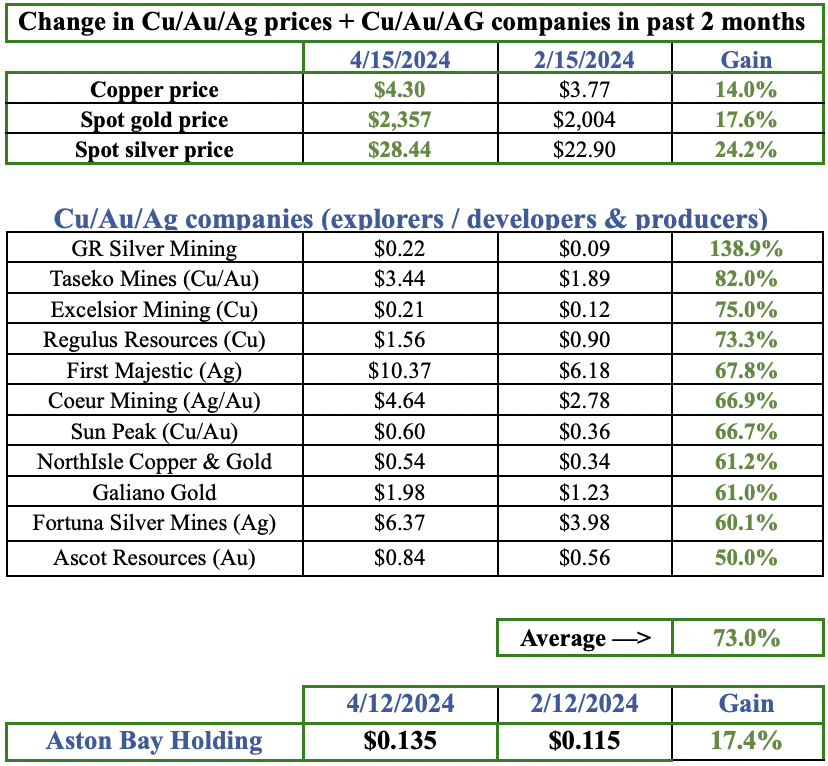

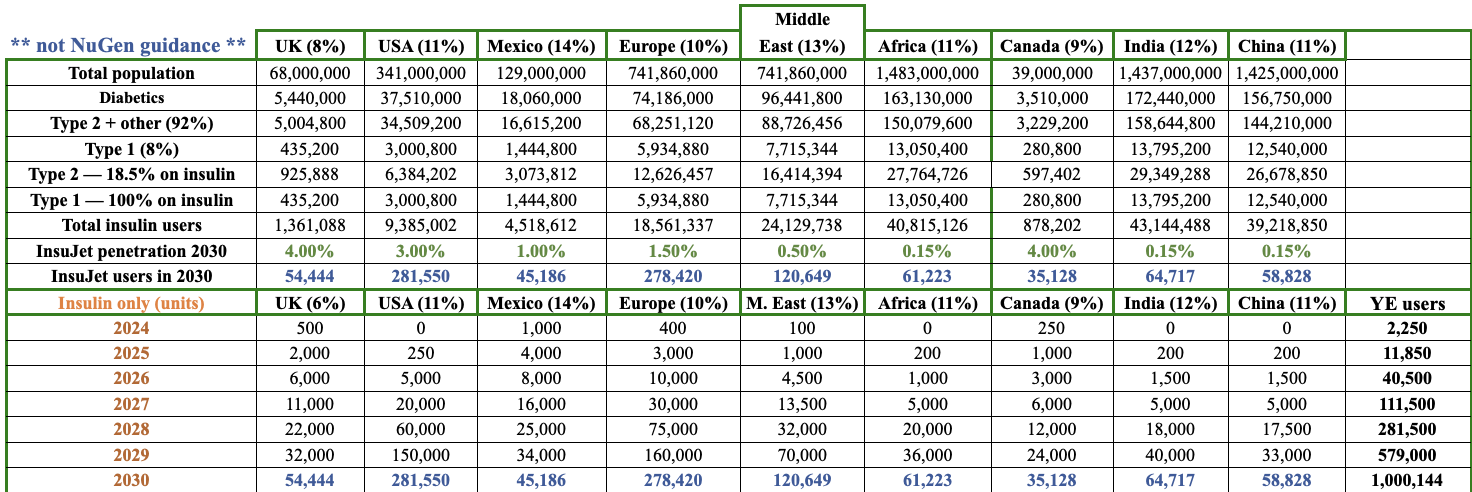

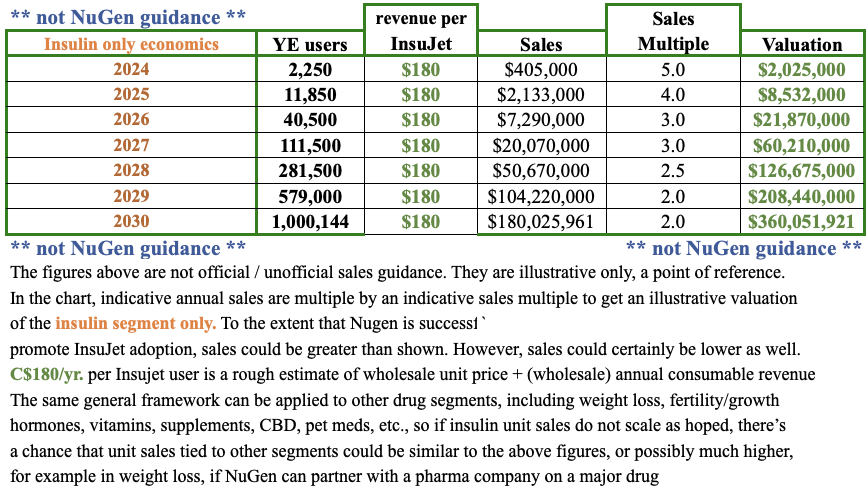

Importantly NuGen doesn’t need to gain leading market share or challenge Becton, Dickinson. In the following chart I show an indicative number of insulin users per region, and an illustrative penetration rate of NuGen’s InsuJet units (for insulin only). These figures are NOT company guidance & should not be relied upon for investment decisions.

The purpose of the chart is to show an approximation of how big the insulin market is, i.e. the addressable market of the world’s insulin users. Estimates come from reputable sources such as the World Health Organization (WHO), and the Center for Disease Control (CDC).

I believe the population sizes (from worldometers.com) and disease prevalence rates are reasonably accurate. By contrast, the indicative penetration rate of NuGen’s InsuJet of 0.15% to 4.00%, and the timing of sales is far more speculative.

The reason I proceeded with this speculative exercise is to demonstrate that NuGen does not need disrupt the entire needle market. Over time, small or even very small penetration of select markets, could amount to meaningful economics. However, numerous challenges remain to product adoption, see RISK FACTORS above.

Clearly, if InsuJet were to gain modest traction in India, China or Africa, penetration of say 1.00% instead of 0.15% would not be a stretch. It is assumed that InsuJet users continue using the device indefinitely, and that they buy consumables + replacement units.

In 2030, if NuGen were to sell a total of a million InsuJets, and continue generating recurring revenue from consumables tied to the device, global penetration of insulin users would be just 0.5%.

In countries like the UK where NuGen’s InsuJet is the only needle-free device approved by the country’s free national healthcare system (NHS), there’s no cost for diabetics to switch from needles to InsuJet, and no cost to use it. They just need a prescription from a doctor for the device. In 2030, I estimate 4% penetration of UK insulin users.

Please note, I show this chart only to give a rough inclination on how lucrative NuGen unit sales could potentially become, timing & quantity of sales could differ greatly. An important observation — although investors have been hyper-focused on sales, in my view sales won’t be significant before 2026.

Investors have been disappointed again & again by a lack of sales, but if one takes a step back to look at the big picture, insulin is merely a stepping stone to multiple drugs. Each success in an insulin market paves the way for successes in other realms.

Investors won’t have to wait years for the share price to improve. As evidence mounts of future robust unit sales, the market will incorporate the net present value of those future opportunities. Therefore, news of collaborations with pharmaceutical, distribution & retail partners could be huge.

The chart can also be used for the rollout InsJet tied to other drugs, such as for weight loss. Or, growth hormones, fertility drugs, vitamins, supplements, CBD, pet meds (more on that later), etc. Several drug classes could be as large or larger opportunities than insulin.

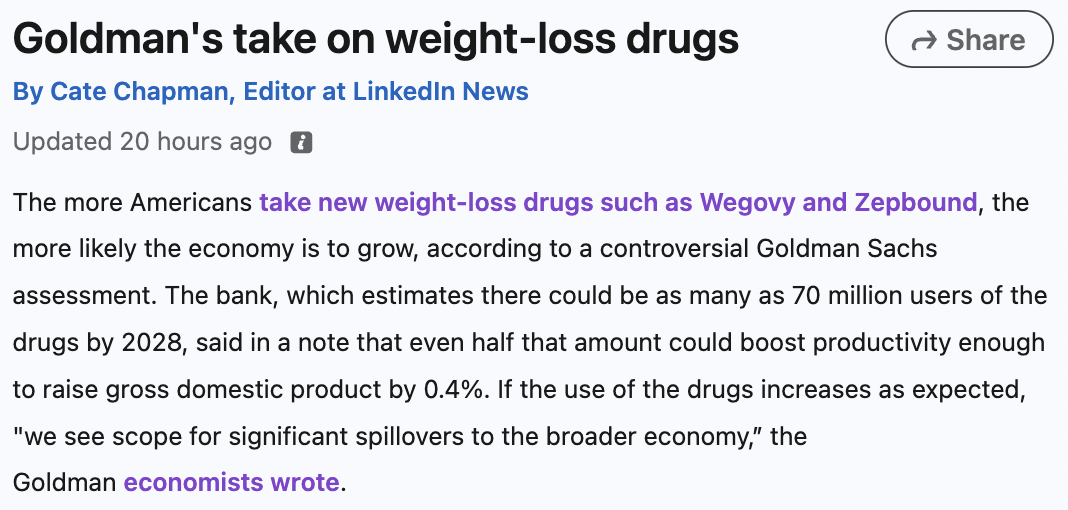

What better way for a weight loss brand to compete than by offering a needle-free option? In terms of an addressable market, ~20% of adults have BMIs of 35+, vs. ~2.5% of adults using insulin, (but, weight loss drug users require fewer injections). If the weight loss segment never materializes, that would be a major disappointment. See RISK FACTORS above.

Millions are paying US$1,000+/month, how many would pay just US$15-$20/month for needle-free delivery once insurance covers weight loss drugs? If 20%, that would be ~10M people in the U.S. alone (20% x [20% of U.S. adults with BMI > 35]). ‘

With such a massive addressable market, there’s room for multiple winners in needle-free delivery. Look at the chart again, even if InsuJet sales tied to insulin don’t scale as hoped, perhaps InsuJet tied to weight loss drugs will increase 2x or 3x as fast

Goldman Sachs reports that up to 70M Americans could be using weight loss drugs by 2028, nearly 8x the # of insulin users in the U.S. Just 2.0% penetration of that segment would be 1.4M units.

For vitamins, supplements & CBD, a huge problem is bioavailability, which is questionable at best in capsule/tincture forms. Subject to further clinical trials, most products should demonstrate better bioavailability if injected needle-free. Imagine the marketing strength of a CBD brand with clinically-proven 2 or 3x the bioavailability of tinctures!

There are ~700M pet cats + dogs on the planet, of which ~0.4% (1 in 250 = 2.8M) require daily insulin. Pet owners are known to be highly protective of their beloved companions, how many might pay extra (if not covered by insurance) for their pet’s comfort?

And, consider the 100s of thousands of veterinarians that could promote their businesses as, “needle-free, pet-friendly.” A crucial consideration in assessing the potential rise in needle-free injections is incremental cost.

Disposable needles are very cheap. However, health care systems & insurance companies are becoming more aware of the considerable costs & logistics of disposal, making single-use needles less attractive.

Therefore, with more awareness at the societal, regulatory & national levels, the medical waste factor should lead to fewer disposable needles being sold.

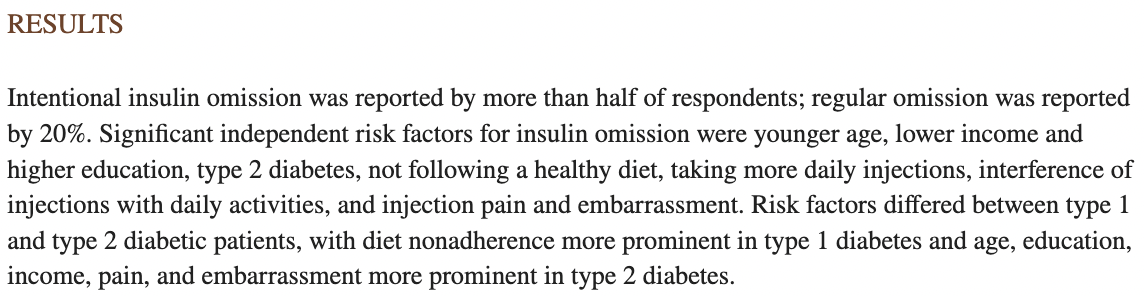

Circling back to patients, there’s another incredibly important factor to consider… Compliance with treatment. On any given day, diabetics requiring say 2-4 shots might take fewer than prescribed. In a well known clinical study, look at the summarized results,

Intentionally skipping shots was reported by > 50% of respondents! Reasons include, interference with daily activities, injection pain & embarrassment. NuGen can help on all three counts. Skipping shots can lead to faster progression of disease.

My guess is that a non-trivial subset of (“anti-vax”) adherents just doesn’t like needles. Vaccine compliance has been falling, leading to fully-preventable outbreaks of diseases like measles. In my view, needle-free injections would make a big difference in combating anti-vax hysteria.

Therefore, the UK’s NHS and other national healthcare systems should, (with education & greater awareness), clearly prefer needle-free injections that result in higher compliance to treatment.

If NuGen & partners can demonstrate that compliance is better in needle-free vs. needle regiments — AND that the amount of medical waste generated (+ medical waste pollution) is lower — that could eventually push national healthcare systems to promote needle-free insulin delivery over needles, a paradigm shift.

NuGen now has a strong team in place educating & building awareness, getting regulatory approvals, signing on distributors & manufacturers, and looking to partner with much larger companies on clinical trials.

I’ve spoken at length with Exec. Dir. Tony Di Benedetto, Pres. & Dir. Richard Buzbuzian. Importantly, I also spoke to key executives with excellent backgrounds; CEO Ian Heynen, COO Nicky Canton, Commercial Lead (UK) Louise Cresswell & Dir. Karen Dunlap. All are well versed in medical devices & healthcare and the challenges / opportunities ahead.

Years of costly & time consuming regulatory work is both a curse and a blessing. NuGen & predecessors have been at this for over a decade. There have been false starts, times when InsuJet sales expectations became too high. A big part of the problem is that in two of the past four years, COVID-19 greatly slowed progress.

However, prior management shares in the blame. Simply put, it’s one thing to sign indicative sales & distribution agreements, but another thing entirely to be able to execute on the potential of those agreements. Moving forward, the regulatory & manufacturing hurdles that have held NuGen back are becoming barriers to entry.

While the Company is building its inventory of devices and unleashing sales & product support teams, all of this requires capital. NuGen has been capital constrained for years. Management is in the process of raising non-equity dilutive capital. I would assume that equity raises will be necessary as well.

From a journal article in Nature magazine,

“Most vaccines & protein therapeutics are delivered using needles & syringes. Despite their common use, needle-based methods have limitations, such as needle phobia, accidental needle-stick injury & improper reuse of needles & syringes in developing countries, leading to HIV & hepatitis B virus cases. Several methods are under investigation for needle-free drug / vaccine delivery. Among these, needle-free liquid jet injections stand out as the method with the longest history in delivering macromolecules. Liquid jet injectors have been used to deliver several macromolecules, including vaccines, insulin & growth hormones in a large number of patients…”

NuGen is in discussions with distributors, pharmaceutical giants and others on ways to collaborate. Companies spend $100s of millions/yr. on advertising for new drugs like Dupixent & Rinvoq (> US$400M each in 2022).

Partnering with NuGen, perhaps obtaining exclusivity on select drugs, would be a drop in the bucket for companies like; Eli Lilly, Novo Nordisk, Johnson & Johnson, Merck, AbbVie, Novartis AG, Roche Holding AG, Abbott Laboratories, Abbott Laboratories or Pfizer.

Once NuGen is established the UK, Europe, Mexico & Canada, it will leverage that valuable knowledge to launch into additional countries and into additional drugs that can be sold with InsuJet. While plenty of challenges are ahead, see RISK FACTORS above, I’m confident in the senior execs I spoke with.

I’m confident in their enthusiasm & commitment to move the needle (pun intended), to make noteworthy inroads in the needle-free injection market for the good of the company and shareholders, but also for society at large.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about NuGen Medical Devices, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of NuGen Medical Devices are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, NuGen Medical Devices was an advertiser on [ER] and Peter Epstein owned shares and/or stock options in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)