Could copper (“Cu“) be the next uranium? For years uranium bulls said a major move was right around the corner, finally they were vindicated. The spot price has doubled in the past year. Uranium is up for good reason, a supply/demand imbalance that will take years to resolve. Note: {article updated to reflect move in commodities prices}

Last year, the U.S. Dept. of Energy put Cu on its critical materials list. Perhaps something about China, Russia, Kazakhstan, Zambia & the DRC being among the Top-10 Cu producing countries?!? Chile & Peru are #1 & #2, but very high elevations, decades old mines (costs increasing) water scarcity & local opposition plague operations in S. America.

Copper is indispensable for decarbonization, EVs, renewable energy, electrical grid expansions & 5G wireless. Not to mention the,“Internet of Things,” data centers, the Cloud/AI, supercomputers, robotics, crypto-currency mining, smart homes/cities, etc.

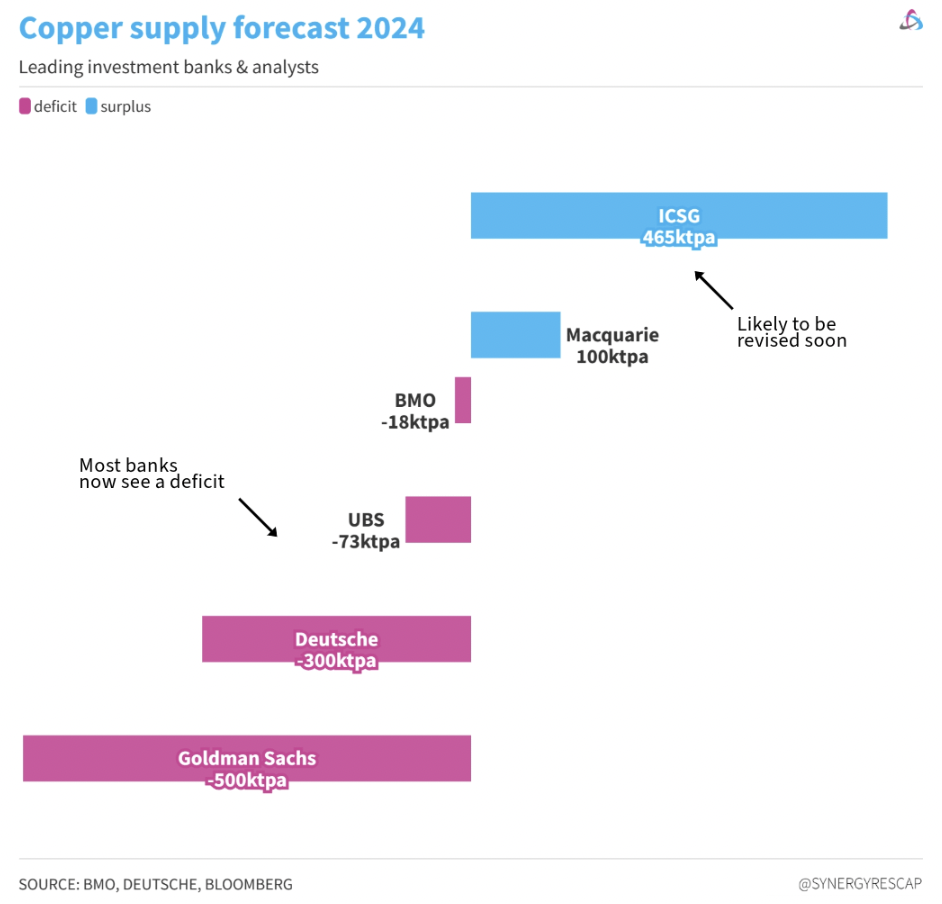

Mining legend Robert Friedland has said that $15k/t is probably needed to incentivize companies to invest billions and wait 20+ years for a return. The chart above shows the Cu supply/demand outlook for 2024. Deficits are coming, how will supply ever catch up?

Several pundits & investment banks are very bullish on Cu, Goldman Sachs recently said, “Our confidence that Cu substantially re-rates into 2025 [to $15k/t average], is now substantially higher…” $15k/t = $6.80/lb.

Citigroup, “higher renewable energy targets could boost Cu demand by extra 4.2M tonnes by 2030, potentially pushing Cu prices to $15k/t in 2025.“

Citi, Goldman & Mr. Friedland are all saying $6.80/lb. is a reasonable possibility in the next year or two. Even a move to $4.50/lb. would attract a great deal of media attention, and that’s only +14.6% from today’s $3.93/lb. {Mar. 7th}.

The combination of Cu + gold (Au) / silver (Ag) in a junior miner’s portfolio is good because they typically move independently, but this year & next ALL three metals could do really well. Au sits at US$2,159/oz. {Mar. 7th} +$175/oz. from February’s low.

Imagine the media frenzy there would be on a gold price of $2,300/oz… yet, $2,300 is only +6.5% from here! The Au:Ag ratio at 90:1 is stretched. Over the long-term it has been closer to 65:1.

If the ratio were to revert halfway back to the norm, and Au remained unchanged, the Ag price would be $27.85/oz. Ag stocks would go through the roof.

Separate from the bullish outlook for Au, anchored by robust central bank buying by China & BRICS countries looking to get away from US$ assets, demand for silver (“Ag“) from solar power installations could be a game-changer. Ag demand from solar is already 14% of total demand, and could double to 28% by 2027.

Lately, lithium stocks have been melting up on a modest rebound in prices. A group of 12 are up an average of +85% this year. Might Cu, Ag & Au stocks be the next to melt up? Gold is approaching $2,200/oz., yet many gold juniors are well below 52-wk highs. Turbo-charging the fundamentals is China’s economic recovery & U.S. interest rate cuts.

Readers should consider looking at metals & mining stocks that are meaningfully undervalued vs. tech/growth stocks. Prismo Metals (CSE: PRIZ) / (OTC: PMOMF) is a tiny company with three promising Cu/Ag/Au assets, and a tremendous technical team + advisors. In bull markets it can be quite rewarding to step out on the risk spectrum.

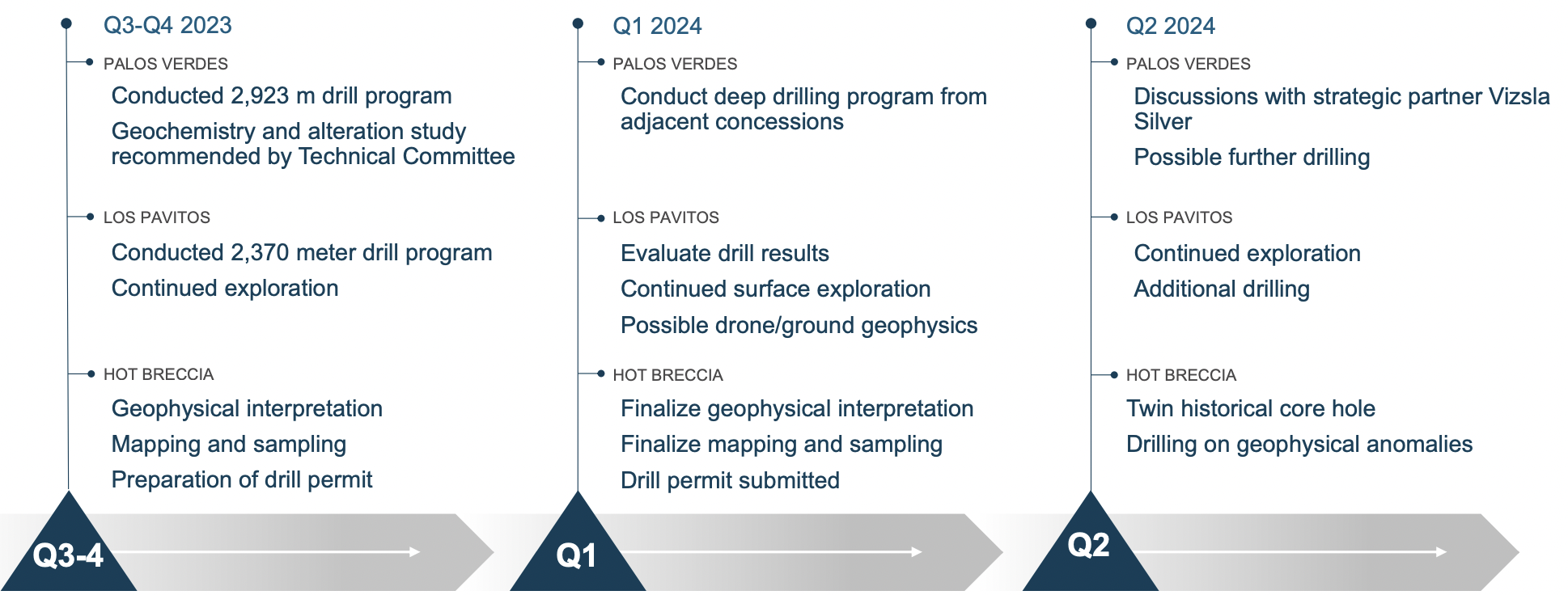

Last year, a decent amount of work was done on the 5,300 hectare Los Pavitos project in Sonora, Mexico. The best result from the maiden drill program was 11.9 m of 5.8 g/t Au + 31 g/t Ag.

Importantly, a new zone with several structures was identified & sampled in the previously unexplored NE portion of the project where surface sampling yielded the highest Ag assay to date, 1,130 g/t Ag, + 1.33 g/t Au.

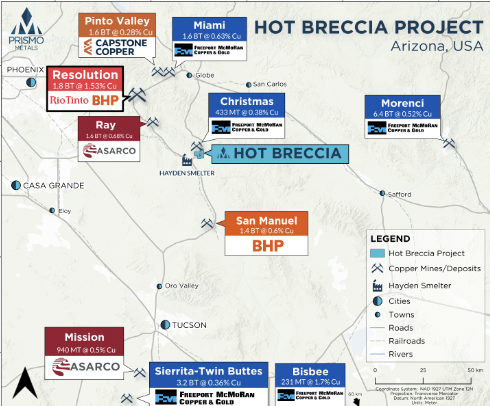

More geophysical work will be done leading to a possible follow up drill program, but two other exciting projects will be drilled first. Prismo’s HOT Breccia Cu project (1,420 hectares 227 contiguous mining claims) is surrounded by a number of mid-tier & Major companies, making it a closely watched project.

In my view, this asset alone alone is worth more than Prismo’s entire enterprise value {market cap + debt – cash} of C$6M {Mar. 7th}. Last week management announced that an AI-optimized drilling company will develop a new set of targets at HOT Breccia.

According to the press release,“The process quickly generates thousands of solutions that cluster on the best fits between the geological and geophysical data and then generates trajectories designed to cut those clusters most effectively.”

CEO Dr. Craig Gibson points out that AI-powered target generation is ideally suited at HOT Breccia due to numerous well-understood deposits in the area. Prismo’s ZTEM survey from last year found a very large conductive anomaly directly beneath breccia outcrops. AI can hopefully point to where, and at what depth to drill.

HOT Breccia is in one of the world’s best zip codes for monster deposits, the heart of the prolific Arizona Copper Belt between Tucson & Phoenix. Just look at the map…

Freeport McMoRan, BHP, RIO Tinto, Grupo Mexico (Asarco), Hudbay, South32 & Capstone Copper have mines or development projects nearby. Asarco’s Hayden smelter complex is just two km to the north, and the past-producing Christmas mine is four km away.

Since 1910, Arizona has been the leading producer of Cu in the U.S. Ten major Cu mines reside in the state. There are dozens of promising early-stage Cu hunters in Chile/Peru, some of which are attractive, but Arizona has great infrastructure and well over a century of successful mining in the south-central U.S.

It’s possible HOT Breccia hosts similar mineralization to that mined at Christmas, as the same productive geologic units that host high-grade Cu skarn mineralization at the adjacent Christmas Mine, have been found.

In the 1970s & 1980s, Phelps Dodge & Kennecott drilled on & around Prismo’s existing footprint hitting intervals such as; 18.3 m of 1.4% Cu + 4.65% zinc, and 7.6 m of 1.7% Cu. Another program included 381 m of (non-continuous) skarn mineralization, with several intervals > 1.00%, and up to 3.16% Cu.

Drilling later this year could be impactful. I met with seasoned geologist, CEO Gibson at the PDAC metals & mining investment conference on Sunday. Craig spent two weeks at HOT Breccia in February and took over 30 samples that will be sent out for assays soon.

Another prized project is Palos Verdes, surrounded by strategic partner Vizsla Silver, (C$351M market cap, 9.9% owner of Prismo), who days ago closed a C$34.5M capital raise. Vizsla owns a prominent portion of the Mexico’s Panuco District, incl. a project with an Indicated + Inferred resource of 215M Ag Equiv. ounces.

Prismo’s best drill intercept to date is a half meter of 102 g/t Au + 3,100 g/t Ag, which at spot prices is ~12,280 g/t Ag Eq. or 136 g/t Au Eq. If Prismo has the same mineralization profile as Vizsla, each ounce of Ag Eq. found could be worth ~C$1.45, (the value of Vizsla’s ounces).

Although it’s too early to have an estimate, (pre-drilling) one can’t rule out tens of millions of Ag Eq. ounces at Palos Verdes based on info it has thus far and analog deposits, most notably Vizsla’s neighboring resource.

For example, if Prismo could book 10M Ag Eq ounces, that alone might be worth C$14.5M, more than twice the company’s entire enterprise value of just C$6M.

Few companies have both Cu & precious metals exposure in world-class jurisdictions with such a strong management team + advisors. Readers should keep a close eye on commodities and on Prismo Metals (CSE: PRIZ) / (OTC:PMOMF).

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Prismo Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Prismo Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Prismo Metals was an advertiser on [ER] and Peter Epstein owned shares and/or stock options in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)