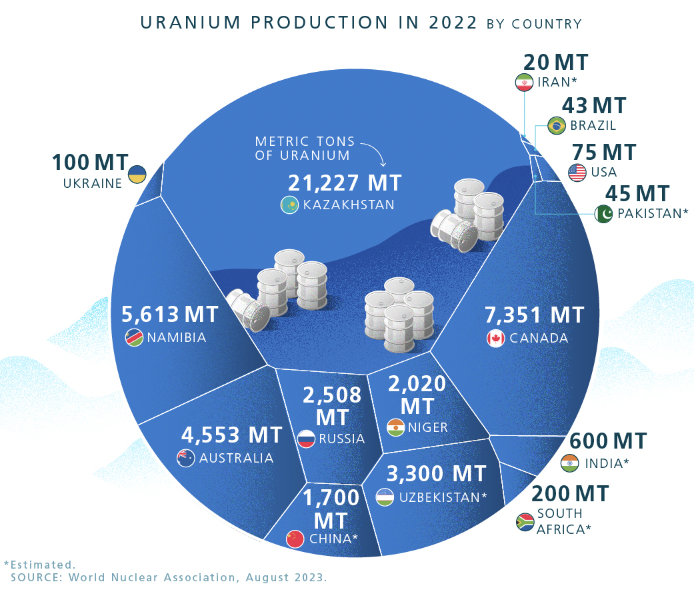

I have no doubt the bullish uranium narrative espoused far & wide will prove to be unprecedented — lasting into the late-2020s — underpinned by more than the 1 or 2 catalysts that defined prior cycles.

Of the nearly 180 uranium companies listed in Canada, Australia, the U.S. & Europe, I bet < 15% will reach production this decade, and most will NEVER cross the finish line.

For instance, except for Denison Mines 2028 and Nexgen Energy & Fission Uranium 2030-31, other meaningful high-grade projects in Canada’s Athabasca basin won’t be online before 2032. This is why the uranium price will remain stronger for longer…

Any company, such as Madison Metals, (with an exciting high-grade discovery, and fast-tracking uranium assets in Namibia), that can reach production in a few years, will be a money-printing machine. More on Madison Metals later…

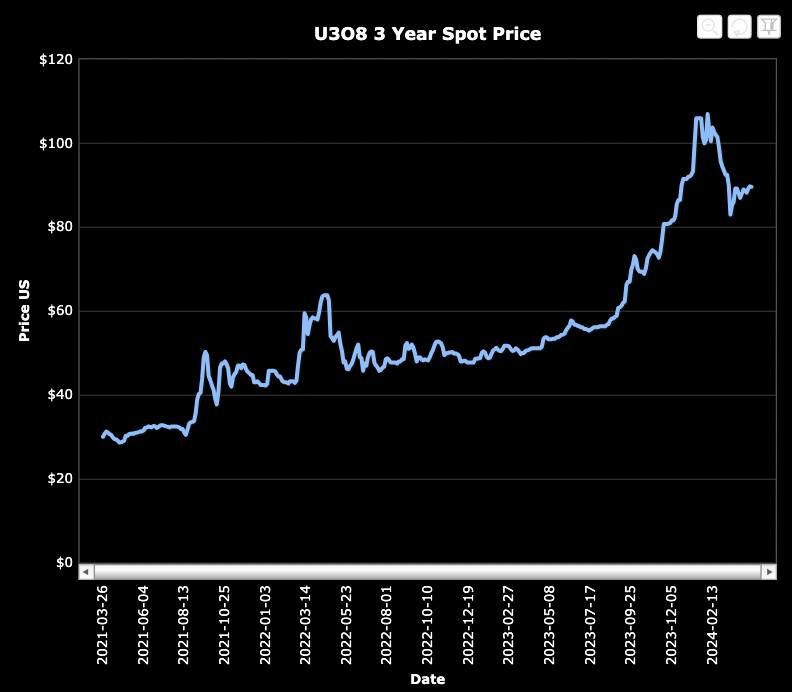

After hitting a high of ~$106.5/lb. in February, the uranium spot price has retreated to $89/lb. How much higher could it go? Bank of America expects a spot price of $120/lb. next year & $135/lb. in 2026. However, many believe it could rise above $200/lb.

Even at $200+/lb. most projects are still 4+ years from production due to permitting, ESG, local community & regional infrastructure considerations. In other words, new supply is highly inelastic. In the last major uranium bull market in the early-to-mid-2000s, the price hit 138/lb. Adjusted for inflation, that’s $207/lb.

For those who say $138/lb. was an outlier, consider that the contract price was pinned at $95/lb., (an average of ~$142/lb. in today’s dollars) from May 2007 to March 2008. So, $89/lb. is not even close to where the price could go.

That prior bull market was long before financial buyers like Yellow Cake Plc & the Sprott Physical Uranium Trust existed, not to mention the Global X Uranium & the Sprott Uranium Miners ETFs.

U3O8 demand is soaring due to; 1) reactor life extensions, 2) Small Modular Reactors (“SMRs“), 3) countries reversing bans on nuclear, 4) France, Korea & Japan restarting and/or building more reactors than expected, 5) dozens of countries building their first nuclear plants, 6) China & India repeatedly increasing their growth trajectories.

Perhaps most compelling is the prospects for SMRs & micro-reactors. Meta’s Mark Zuckerberg is the latest high-powered CEO to say that data centers need nuclear energy, following similar comments by Bill Gates, Robert Friedland & Elon Musk.

China gets 5%-6% of its power from nuclear & India 3%-4%. Those two countries will likely see a quadrupling or quintupling of nuclear power generation, a CAGR of 5.3-6.1 %/yr. through 2050!

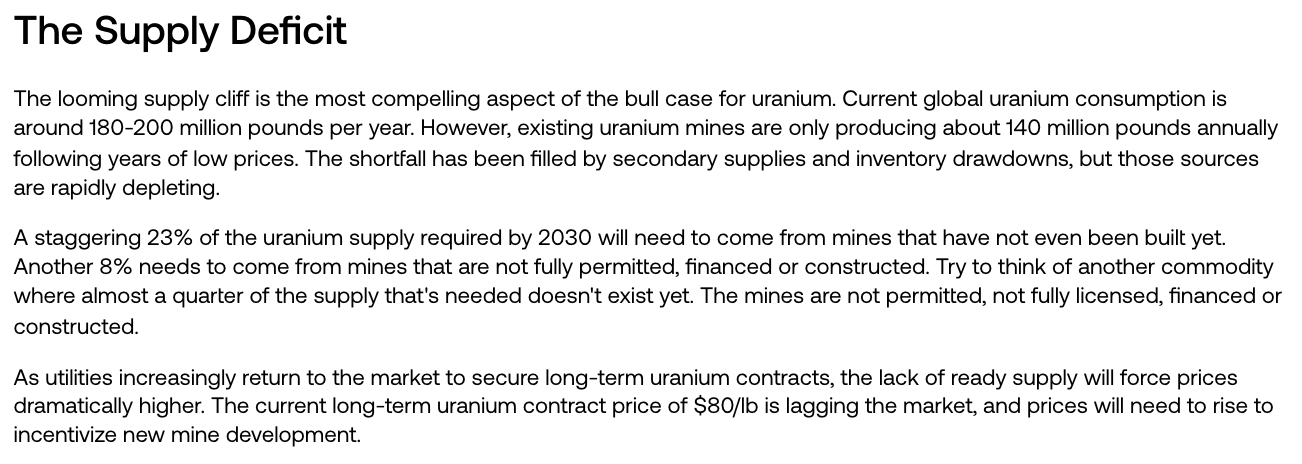

Enough about demand… Where will urgently needed security of supply come from? Kazakhstan? Uzbekistan? Russia? Niger? China? None of those five (among the world’s top-8 producing countries) are good bets to reliably supply Western countries for decades.

The clear winners in the uranium space are the ones, like Madison Metals (CSE: GREN) / (OTC: MMTLF), that can reach production this decade.

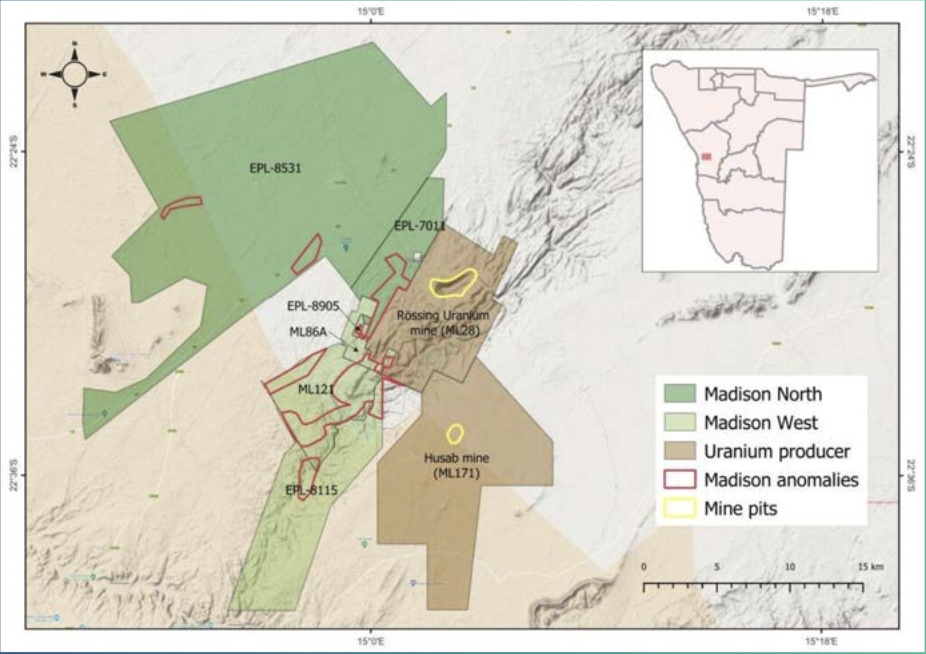

This overlooked pure-play #uranium junior has just 32M shares outstanding. Madison, with promising uranium projects in Namibia, Africa could be producing within 1-2 years as its key assets are just 6 km from the world-class Rössing mine’s processing facility. Until recently, Rössing was toll-milling ore for another giant Namibian mine, Husab.

Why should investors consider Namibia? Because that’s where the uranium is! Ranking behind Kazakhstan & Canada, Namibia holds the title of the world’s 3rd largest uranium producer. If Madison’s projects were in Canada, the Company’s valuation would be a multiple of the current $9M.

Unlike the vast majority of uranium juniors across the globe, Madison’s key project already has a mining license and ample access to regional infrastructure including; roads, power, water, rail, ocean port, skilled workforce, mining services & equipment companies.

Importantly, the Company’s prospects & neighboring Rössing are < 100 km by rail to a major ocean port. By contrast, uranium mined in land-locked Niger is trucked 1,500+ km to a rail loadout, then 400 km to an ocean port.

A toll-milling scenario for Madison is quite plausible as, 1) Rössing wants third-party ore, 2) Madison’s assets are just 6 km away, and 3) Madison recently discovered surface evidence of a high-grade deposit that, subject to drilling, could deliver tens of millions of pounds grading 500+ ppm.

At US$89/lb. U3O8, Madison could potentially blast & truck run-of-mine ore to Rössing at a total cost of US$35/lb., and potentially earn US$27/lb., net to the Company (assuming a 50/50 split of profits from toll-milling). Note: {the 5-yr. futures [CME contract] is at ~$110/lb.}

If toll-milling could produce 1.0 – 1.5M lbs. of U3O8/yr., that would be US$27-$40M/yr. in cash flow. Compare that to Madison’s valuation of C$9M = US$6.6M.

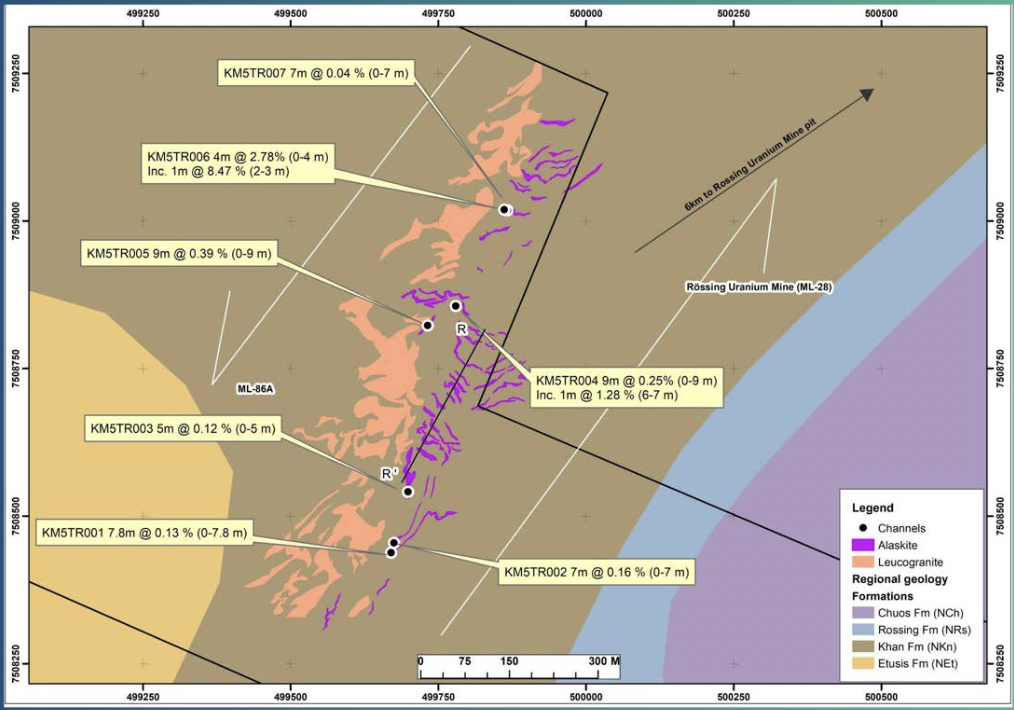

The high-grade Khan project (on ML86A) borders the SW corner of Rössing

Management estimates cap-ex to start blasting & direct shipping ore at ~US$30-$40M. CEO Parnham thinks that between African bank lending group RMB and other lenders, the cap-ex figure would be straightforward to raise, as the payback period could be under two years.

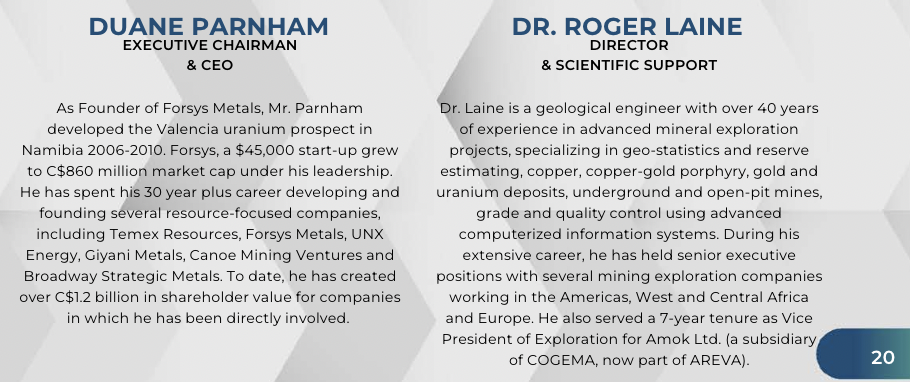

Madison’s two key executives, Duane Parnham & Dr. Roger Laine founded a highly successful uranium play in Nambia at the tail end of the last major uranium bull market in 2007. At one point, Forsys Metals had a market cap of over $800M.

Mr. Parnham has lived and/or worked in Nambia (intermittently) for 23 years. Few outside of Namibia understand its politics, business climate, and culture better than he does. Duane has over 20 years of experience in uranium, and significant exposure to precious & base metals.

In addition to Forsys, he developed & monetized a Namibian Oil & Gas company for $100s of millions as well. Mr. Parnham has been acquiring shares of Madison Metals in the open market since before COVID-19.

Dr. Roger Laine is a geological engineer with > 40 years of experience in advanced mineral exploration projects, specializing in geo-statistics & reserve estimation.

He’s extremely well-versed in both underground & open-pit mines, and an expert in grade & quality control, using advanced computerized information systems. Dr. Laine has held senior executive positions with companies in the Americas, West & Central Africa & Europe.

The following chart shows Namibia’s large, bulk tonnage mines & projects, with an average grade of 284 ppm = 0.0284% U3O8. Notice that GRADE is what separates the producers from the (still) developing…

Anything below 300 ppm is low-grade, but typical of deposits in Africa. At today’s uranium price, 284 ppm is ~US$56.5/tonne of rock. On a copper equiv. basis, it’s 0.57%.

Madison has a small, but otherwise typical 9M pound (historic, SRK 2015, Inferred category) prospect grading 260 ppm. Peer African projects are valued at $2.10/lb. of U3O8 in the ground. 9M lbs. is nothing to write home about, but based on peers is arguably worth twice the Company’s $9M ($0.295/shr.) valuation.

Management was getting ready to drill this project, named Cobra, but is now laser-focused on the much sexier Khan project. Management thinks it could double (or more) Cobra’s resource. The 2015 work done by SRK was based on shallow holes, and the deposit is open in all directions.

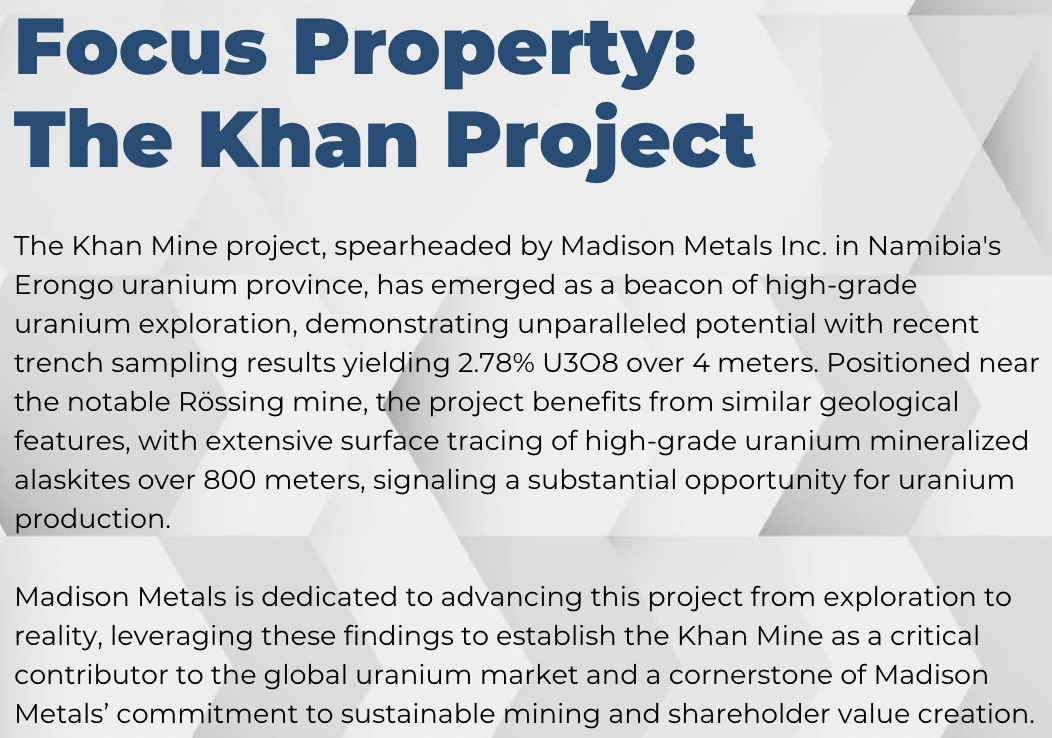

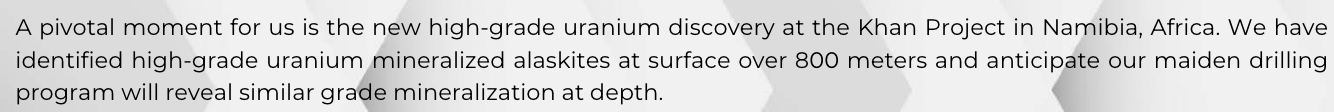

The much bigger story is the Khan project, where the team hit monster trench sample grades. Khan, in Namibia’s Erongo uranium province, has emerged as one of the newest & most enticing high-grade uranium discoveries in Namibia. First-pass trenching yielded up to 2.78% U3O8 over 4 meters.

A modest, but high-impact drill program is expected to start in May, preceded by a program of infill geological mapping along with ground scintillometer & spectrometer surveys. Drill results, expected in July, will be used to vector into a larger drill campaign later this year.

Since Madison’s new project Khan has a mining license, there’s every reason to believe it could be producing within 1-2 years. Just 6 km SW of the Rössing processing facility, the project benefits from similar geological features, with surface tracing of high-grade uranium mineralization over 800 meters.

Like Rössing, Madison’s team believes Khan experienced multiple pulses of enrichment, leaving both high-grade zones & ample secondary mineralization.

Secondary enrichment helps pack on the pounds. Roughly 40% of Rössing’s endowment comes from secondary enrichment zones. Of course, Madison’s best grade to date, 1.0 m @ 84,700 ppm, is not indicative of the entire project.

However, if management could delineate 10s of millions of pounds grading 500+ ppm vs. the regional average of 284 ppm, Khan could become a highly sought-after takeover target.

The Chinese-controlled Rössing mine reportedly has 12 years of remaining life. Could it be extended by acquiring Madison’s higher-grade, (subject to drilling) Khan project? All eight companies on the chart could be interested if it can show line-of-site to 10M+ high-grade pounds.

That’s why results from the maiden drilling will be so important. Madison’s shares traded in the low-to-mid $0.70’s for a few weeks in November 2023, well before the high-grade discovery at Khan and the uranium price touching $106.5/lb.

Many uranium players are down ~15% to 25% from 52-week highs, yet Madison is down 60%. This makes no sense and could change quickly as investors learn more about this exciting Company.

Once one sees how close Madison’s projects are to Rössing, not to mention to Husab, both among the largest uranium mines on earth, the tremendous blue-sky potential of Khan comes into focus.

Make no mistake, Madison Metals (CSE: GREN) / (OTC: MMTLF) is a high-risk/high-return stock, but for those with strong stomachs, now could be a good time to build a position ahead of drill results that management believes will be informative, and potentially impactful.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Madison Metals, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Madison Metals are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Madison Metals was a paying advertiser on [ER] and Peter Epstein owned shares in the company that he acquired in the open market with his own funds.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)