While I’m not surprised, it was nonetheless heralded as BIG NEWS, that Citigroup Inc. (“Citi“) is now leading the charge to facilitate a sale of Colonial Coal’s two hard-coking coal (“HCC“) projects in the prolific Peace River Coalfield of B.C., Canada. Readers may recall that the sale of these assets has been underway since late 2019.

Note: {when I started writing this update Friday morning, the share price was $2.19, it closed at $2.69…}.

I say I’m not surprised because Citi has been involved as the lead or a prominent investment banker in many of the major coal & fossil-fuel-related transactions this century. According to Bloomberg, “JPMorgan Chase, Citigroup, Wells Fargo & Bank of America were the top four fossil-fuel funders in the world in 2022…”

Citi is playing a substantial role in the soon-to-close Teck Resources/Glencore HCC transaction. It has connections to the dozens of companies that were unsuccessful in acquiring Teck’s coking coal assets — groups already comfortable with B.C., Canada’s mining challenges.

Colonial has a stellar management team, led by CEO & Chairman David Austin, who sold two western Canadian coking coal companies in 2010 for over US$3B. Also extremely impressive are the COO/Dir. John Perry & Dir. Partha S. Bhattacharyya, and others — see bios above.

This team has expertise in permitting, developing, building & operating mines in B.C. Canada. Citi is the icing on the cake, it is also an advisor to Nippon Steel in its efforts to acquire U.S. Steel Corp. To say that Citi knows MOST of the steel & coal companies looking at Colonial’s assets would be a gross understatement.

Having Citi involved at this later stage of the sales process can only mean one thing. It believes it can get some of the 20+ prospective buyers off the fence and over to the bargaining table.

Citi adds a tonne of credibility to the process and can help move the ball forward in several critical ways. For instance, Citi could line up funding for prospective bidders. And, it could introduce various parties to each other so that groups can form consortiums to mount more effective bids.

In my view, Citi’s involvement offers tacit support for the long-standing whisper valuation of US$2/tonne of resource. Of course, this doesn’t guarantee the assets will be sold for that much, but it makes it harder for prospective bidders to argue the valuation should be significantly lower.

This news is a true vote of confidence in Colonial’s management team, assets & jurisdiction. Finally, Citi brings one more crucial element to the forefront.

Citi believes it can broker a deal DESPITE numerous risk factors facing successful bidder(s), including, but not limited to; permitting, first nations, caribou migrations + other environmental issues, geopolitical rivalries, hydrogen replacing coking coal in steel-making & HCC prices.

I think that prospective bidders would prefer to deal with mine development challenges in western Canada rather than key coking coal regions like; China, Mongolia, Africa, Colombia & Russia.

Retaining Citi effectively thwarts plans that bidders might have had to wait out Colonial to make them accept a lower valuation. To recap, Citigroup’s involvement increases the chances of a deal happening, but doesn’t necessarily change the timing, and increases the likelihood of a strong valuation being achieved.

In other coking coal news, BHP is trying to acquire Anglo American, seemingly for its copper prowess. However, Anglo’s HCC assets in B.C. might be a meaningful part of the story. Why?

BHP is reportedly very upset over onerous royalties on coal (up to 40%!) in Queensland, Australia. That, combined with a shortage of workers, significant wage & mining cost inflation and transportation bottlenecks is threatening Australia’s HCC dominance.

Major ports in China, Korea, HK, India & Japan — that’s where the blast furnaces are!

BHP recently cut its coking coal guidance for the year ending June 30th to a decade-low 44M tonnes due to wet weather & cyclones on its Queensland operations. If BHP prevails in acquiring Anglo, it would control ~35% of the seaborne HCC market.

Given their views on Australia, might a combined BHP/Anglo beef up its HCC holdings in Western Canada? If so, might Anglo want to acquire Colonial’s assets before getting taken out by BHP? The could effectively buy and then flip the projects.

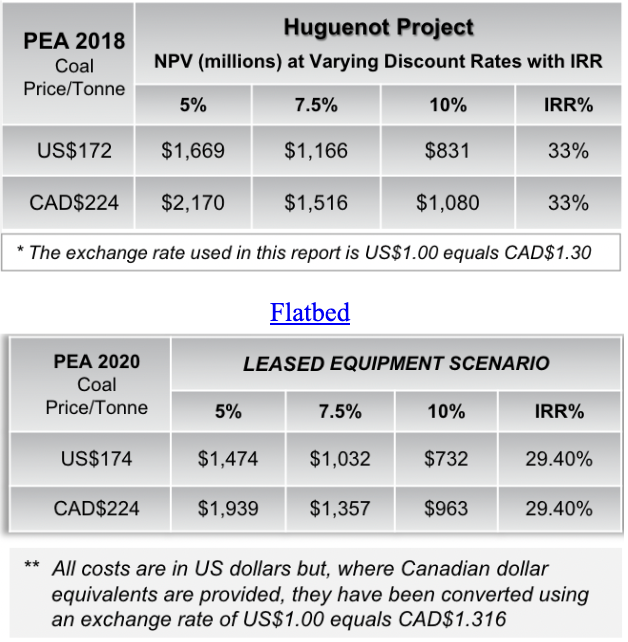

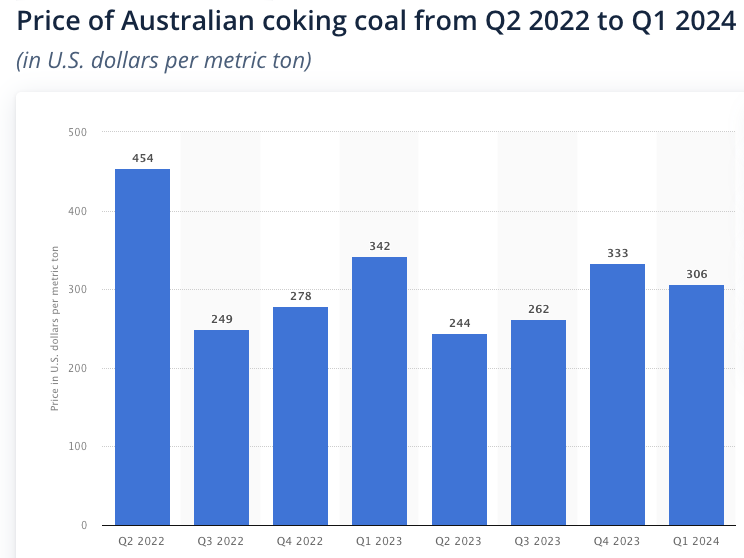

Over the past eight quarters, HCC from Australia averaged US$309/tonne (Statista). That’s +78% above the average long-term price assumptions used in Colonial’s two Preliminary Economic Assessments (“PEAs“) on the 100%-owned Flatbed & Huguenot projects. In March 2022, both Australian & Chinese HCC prices topped US$600/t!

Steel companies operating blast furnaces in China, India, Japan, South East Asia, Korea, Europe & Brazil hate these wild price swings. That’s why they lock in long-term contracts with companies in Australia, Canada & the U.S., companies active in the seaborne market.

The world’s largest steelmakers are highly reliant on two things; 1) consistent, high-quality HCC, and 2) secure delivery of said HCC via the seaborne market. There are several varieties of coking coal including; premium hard (“PHCC“), hard, semi-soft & PCI. Ninety-four percent of Colonial’s 695M tonne resource is either HCC or PHCC.

The seaborne market is critically important for HCC delivery to steel mills. One look at the map above shows why — most blast furnaces are located near seaports (to receive HCC). It’s cost and/or logistics-prohibitive to get HCC overland, so Asian steelmakers have little choice.

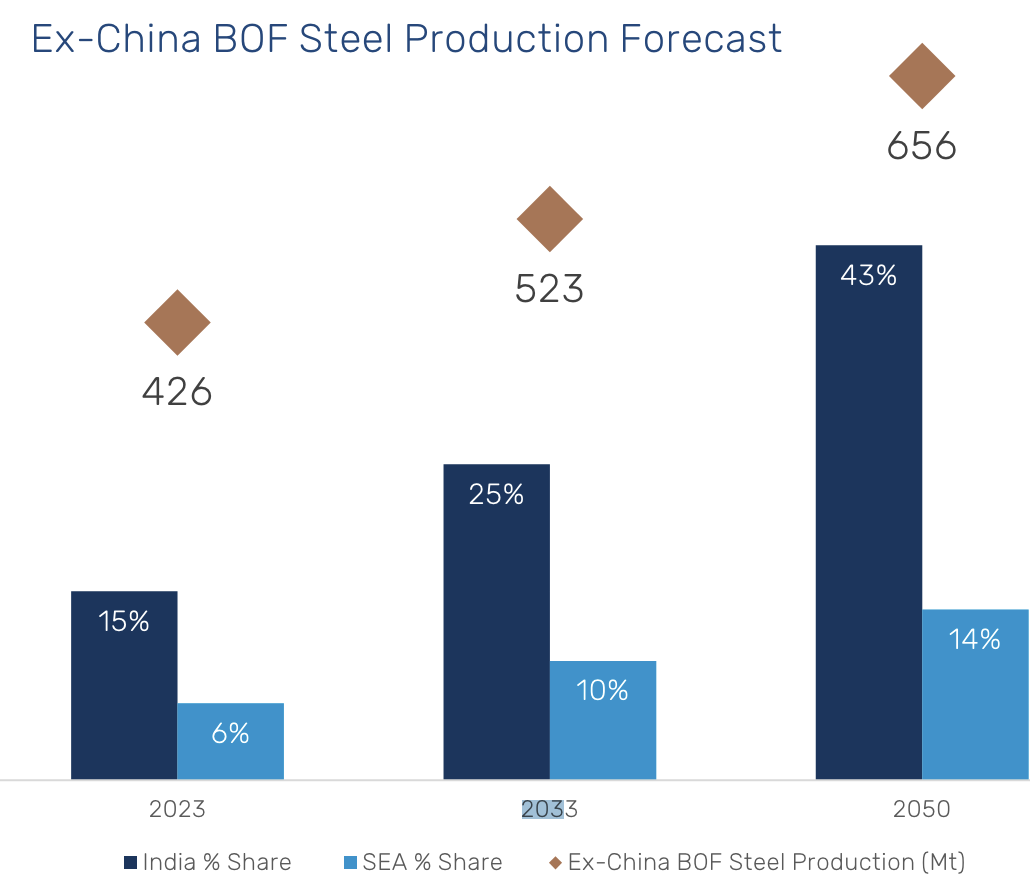

India needs a long-term supply of HCC for decades to come. Chinese interests already have a presence in Canada’s Peace River Coalfield. Indian companies do not, yet India is targeting an almost doubling of steelmaking capacity to 300Mt by 2030, with most of the expansion planned to be blast furnace-based.

Perhaps an Indian steel company, possibly in partnership with a coking coal player, will be the winner(s) of Colonial’s valuable projects.

On Friday, Colonials’s share price was up $0.52 or +24% on heavy trading volume. There have been rumors that naked short selling of Colonial’s stock amounts to far more than the official short interest figure. Friday’s explosive gain sure seemed like a short squeeze.

Now that Citi’s on board, perhaps investors are more confident in front-running an expected transaction. With a doubling, tripling, or even quadrupling of Friday’s close a distinct possibility, Colonial Coal (TSX-v: CAD) / (OTC: CCARF) offers a very compelling risk/reward proposition.

Next week will be interesting, will the share price continue to climb? Are there hundreds of thousands, or even millions of shares sold short illegally (naked) that need to be covered? For more detailed information on the Company, please take a look at these prior articles –> March 20, 2024 –> Jan. 8th, 2024 –> Nov. 13th, 2023.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Colonial Coal, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Colonial Coal are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares in Colonial Coal and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)