Primary silver (“Ag”) mines, those that produce > 50% Ag (by volume), benefit most from higher prices. However, 75%-80% of mined Ag is a byproduct of other mining operations.

Therefore, since Ag supply is highly inelastic, the price could soar past $30 –> $40 –> $50/oz. without a meaningful supply response. Readers are reminded that today’s $28.32/oz. remains astonishingly cheap vs. the inflation-adjusted level of ~$84/oz., for the entire year of 1980.

Today’s price makes no sense, especially as industry-wide all-in-sustaining costs have been rising 8-10%/yr. since 2020 and global inflation (a main driver of 1980’s spike), is still not contained. Notice that surging demand for Ag from solar panels, decarbonization & EVs was virtually nonexistent in 1980.

According to Peter Kraugh — publisher of the Silver Stock Investor — in China, premiums of up to +$3/oz. are being paid to secure physical supply.

This is corroborated by reports from sdbullion.com that, “local demand for Ag bullion, much of which has gone into building out their world-leading solar capacity, has created a price premium now hovering around +10% above COMEX Ag price quotes.”

Given that we’re in the fourth year of mined Ag deficits, and global solar capacity is soaring, it’s hard to imagine how Ag fundamentals could get any better. Will slower growth of EVs impact demand? No, hybrids require just 10-15% as much lithium, but 55-60% as much Ag as fully electric vehicles.

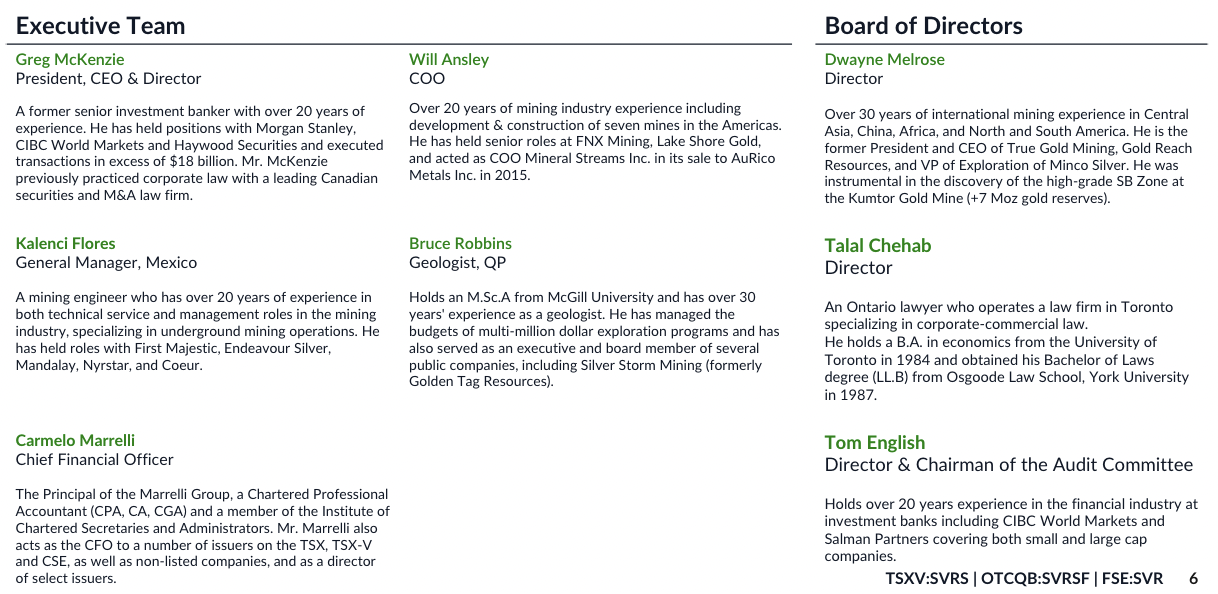

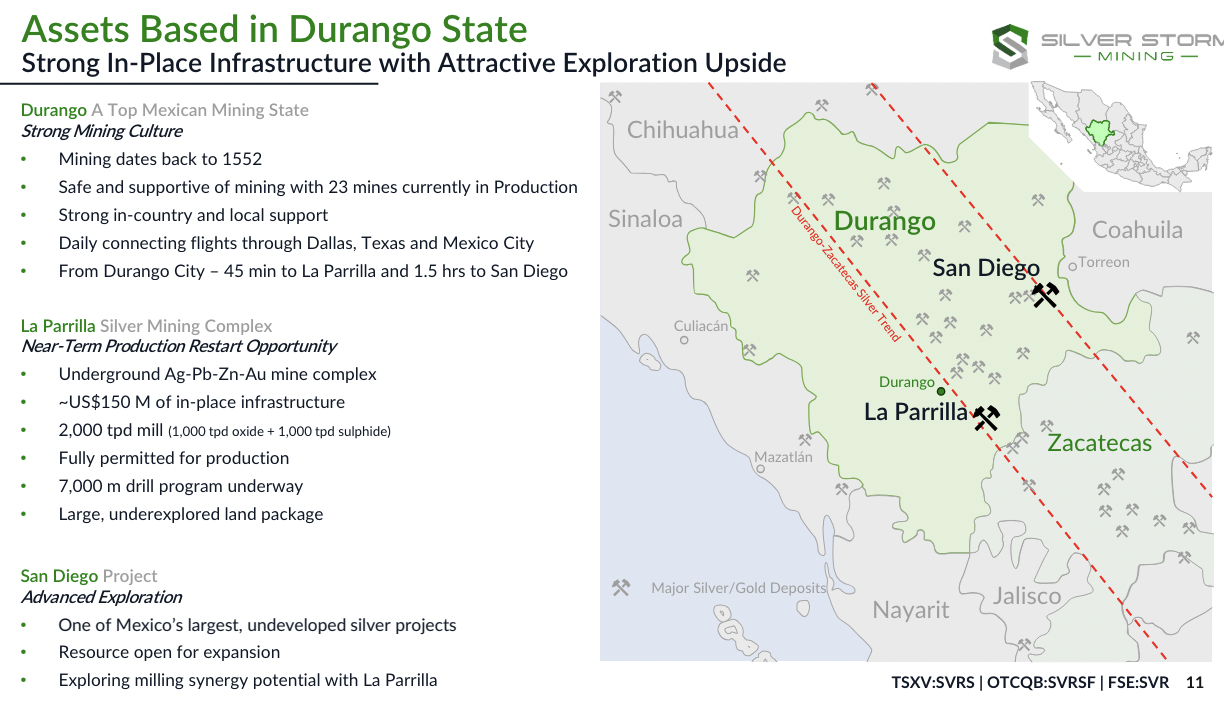

A high-quality primary Ag junior I like is Silver Storm Mining (TSX-v: SVRS) / (OTCQX: SVRSF), expected to reach commercial production in Durango State, Mexico in 2H 2025, ramping up to 3.0M Ag Eq. oz./yr.

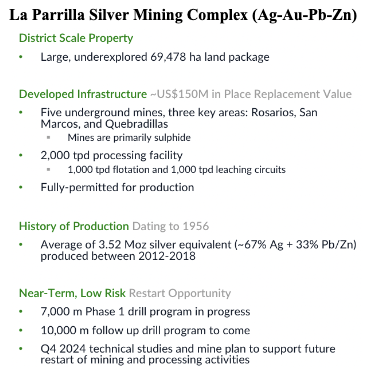

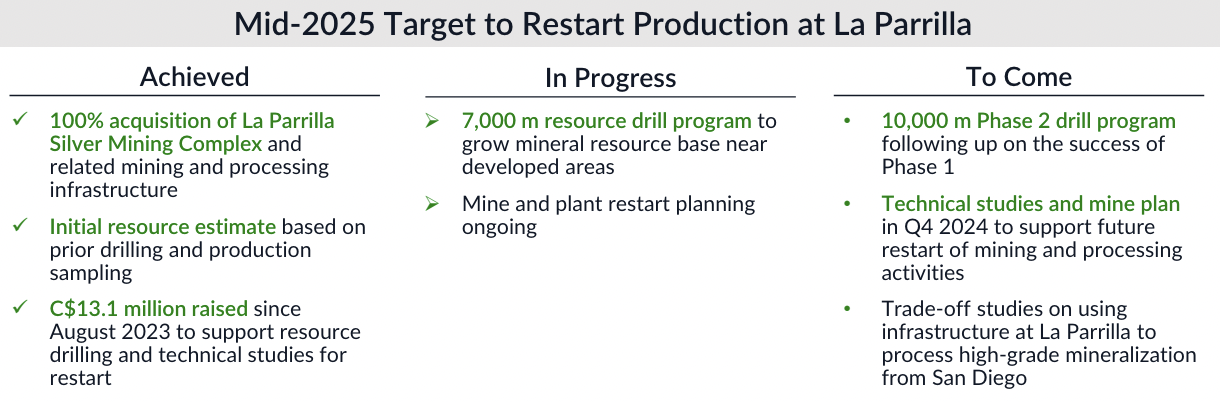

Silver Storm has the 100%-owned past-producing mine & mill complex La Parrilla (“LP”) acquired from First Majestic [“FM”], who remains the largest shareholder at 35.6%.

Transferring ownership of LP to Silver Storm was a win-win for both companies. FM maintained a significant upside to LP’s success and gained a free option on the 100%-owned crown jewel San Diego project. Silver Storm got a near-term producer in LP to help fund San Diego.

The LP complex was in continuous operation from 2005 to 2019, producing a total of 34.3M Ag Eq. ounces. This is a primary Ag operation — 67% of output is Ag — and 33% lead/zinc. Durango State has 23 operating mines, it’s a mining-friendly jurisdiction.

LP hosts five underground mines and one open pit, all surrounding a 2,000 tonne per day (“tpd”) fully-permitted mill consisting of parallel 1,000 tpd flotation & 1,000 tpd cyanidation leach circuits to treat both oxide & sulfide ores with a conventional flowsheet.

Mineral resource estimates have been completed on 22 veins in the Rosarios, San Marcos & Quebradillas zones, both oxide & sulfide. The estimate includes 2,025 core samples from 392 boreholes + 9,676 chip samples from 3,190 underground channels. So far, LP has booked ~15.5M Ag Eq. ounces grading ~258 g/t Ag Eq.

The LP operation was at times very profitable due to low costs. However, at 3.5M Ag Eq. ounces/yr., and Ag averaging ~US$16/oz. in 2019, it became too small to move the needle, (FM’s current enterprise value [market cap + debt – cash] is ~$3B). By contrast, Silver Storm is valued at $68M.

While owned by FM, the LP complex produced up to 4.5M Ag Eq. ounces, averaging 3.5M from 2012-18. Management won’t commit to more than 3.0M Ag Eq./yr., starting in 2H 2025, but I think 3.5 – 4.5M Ag Eq. oz. is reasonably possible from 2027 onwards.

The replacement value of above & below-ground infrastructure, including the fully permitted 2,000 tpd mill and a “partial mining fleet” is estimated at US$150M/C$205M. Replicating this infrastructure would take 5+ years of studies, permitting, funding, construction & commissioning.

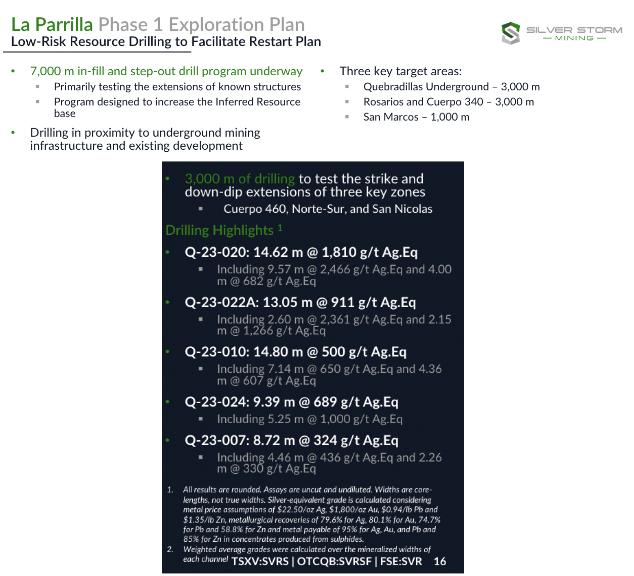

A 7,000-meter drill program is delivering strong results, including a few blockbusters. A 10,000-meter follow-up campaign is planned. The best interval to date is 1,810 g/t Ag Eq. over 14.6 meters. That’s 58.2 troy oz./tonne.

It would be nearly impossible to overstate how incredibly important these bonanza grades are. President & CEO Greg McKenzie has been saying for a year now that he expects 3M Ag Eq. ounces of production, but if ultra-high grade runs deeper and/or wider, all bets are off.

McKenzie recently commented,

“We are pleased with the strong returns from the La Estrella, San Rafael and C1940 Zones. High-grade mineralization can be traced at La Estrella over a strike length of 225 m, vertical extent of 135 m, and true thickness of up to 6 m. Limited mining was conducted by First Majestic within these zones, and they were not included in the August 2023 Resource Estimate.”

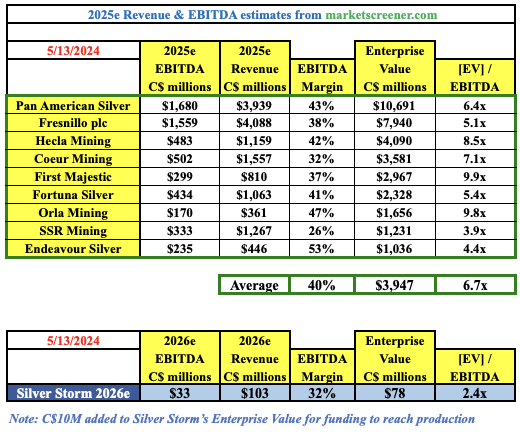

Assuming things go reasonably as planned, Silver Storm should be up & running at a run-rate of 3.0M Ag Eq. ounces by the end of next year. The chart below shows 10 Ag-heavy producers valued at an average 2025e EV/EBITDA multiple of 6.7x.

By contrast, Silver Storm is valued at 2.4x 2026e EBITDA. Note: {I added C$10M to Silver Storm’s EV for capital needed to reach production next year.}

McKenzie believes that annual cash flow could be ~C$33M/yr., assuming US$25/Ag Eq. oz. and an AISC of US$17/oz. Some of that cash flow could be reinvested into the even more exciting San Diego (“SD”) project.

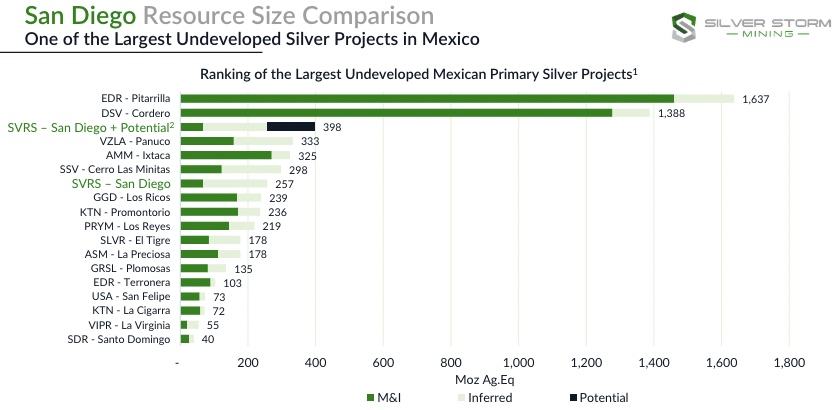

Using the same metal prices for SD used in the LP resource estimate, SD has ~257M Ag Eq. ounces, making it one of Mexico’s largest undeveloped Ag projects.

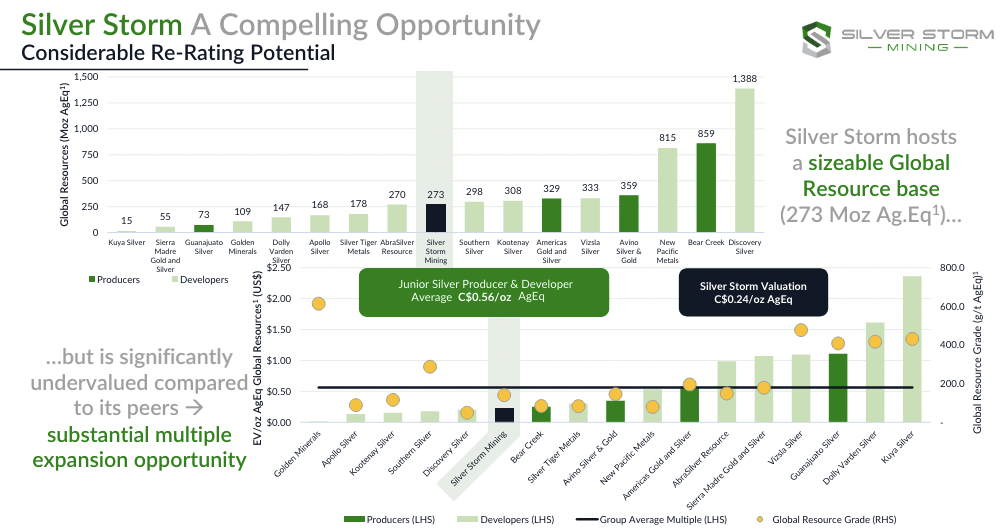

The combined Ag Eq. resource is ~273M oz. Silver Storm is valued at just ~C$0.30/Ag Eq. oz. (EV includes the C$10M addition mentioned above). By comparison, many Ag-heavy juniors are valued at C$1 to $2/oz. in the ground. For example, pre-PEA companies Vizsla Silver & Dolly Varden trade at $1.4 & $2.0/oz., respectively.

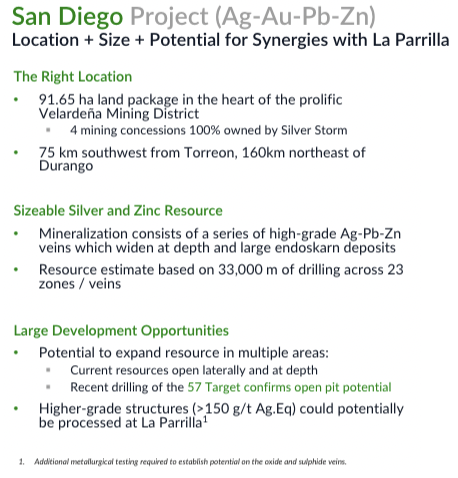

SD is envisioned as a bulk tonnage operation of possibly 10M to 15M Ag Eq. oz./yr. Management believes SD has serious potential as a low-cost, long-lived mine. Mineralization consists of a series of high-grade Ag-lead-zinc veins that widen at depth.

Higher-grade structures (>150 g/t Ag Eq.) could potentially be processed at La Parrilla. There are opportunities to expand SD in multiple areas as it’s open laterally and at depth. Readers should note that reported grades are adjusted for estimated recoveries [79.6% for Ag] & smelter deductions.

The replacement cost of the drilling & exploration work done at SD is estimated at ~$30M. Before LP was acquired last year, SD was the only major asset. In 2021, the Company (then named Golden Tag) was briefly valued at over $100M.

In the chart above, SD compares quite favorably to other Ag-heavy projects across Mexico. The peer projects have been normalized by using the same metal prices and accounting for each project’s unique metal recoveries.

According to SGS Canada, the resource could potentially be expanded by 20-50M tonnes at 100-150 g/t Ag Eq. from existing structures + lateral & depth extensions. The mid-point of those indicative figures (if obtained) would be an incremental ~141M Ag Eq. ounces (not adjusted for recoveries & smelter deductions).

Silver Storm Mining (TSX-v: SVRS) / (OTCQX: SVRSF) offers investors BOTH near-term production from a primary Ag complex in mining-friendly Durango State, Mexico, AND considerable blue-sky potential via one of Mexico’s largest undeveloped Ag resources, (also in Durango State).

Silver Storm is very attractively valued on BOTH an EV to expected EBITDA basis and EV/Ag Eq. ounce in the ground calculation. Mexico is the world’s largest Ag-producing country, and Durango is within easy trucking/rail distance to major auto markets in northern Mexico & southern U.S. states.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Silver Storm Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Silver Storm Mining are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Silver Storm Mining was an advertiser on [ER] and Peter Epstein owned no shares in the company.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply