Note –> All $ figures C$ unless stated otherwise (all metal prices in US$). Copper & Gold Equiv. calculations use spot prices of $5.12/lb. & $2,430/oz.

Wow! The Copper (“Cu”) price is up +34% in three months [2/19/24 = US$3.81/lb.] — the largest 3-month gain in 15 years. An all-time high was notched at $5.20/lb. on (5/19). On the morning of May 21st, the price was $5.12/lb. Naturally, most Cu stocks are at/near all-time highs, right? No! Fewer than 10% are within 5% of an ATH.

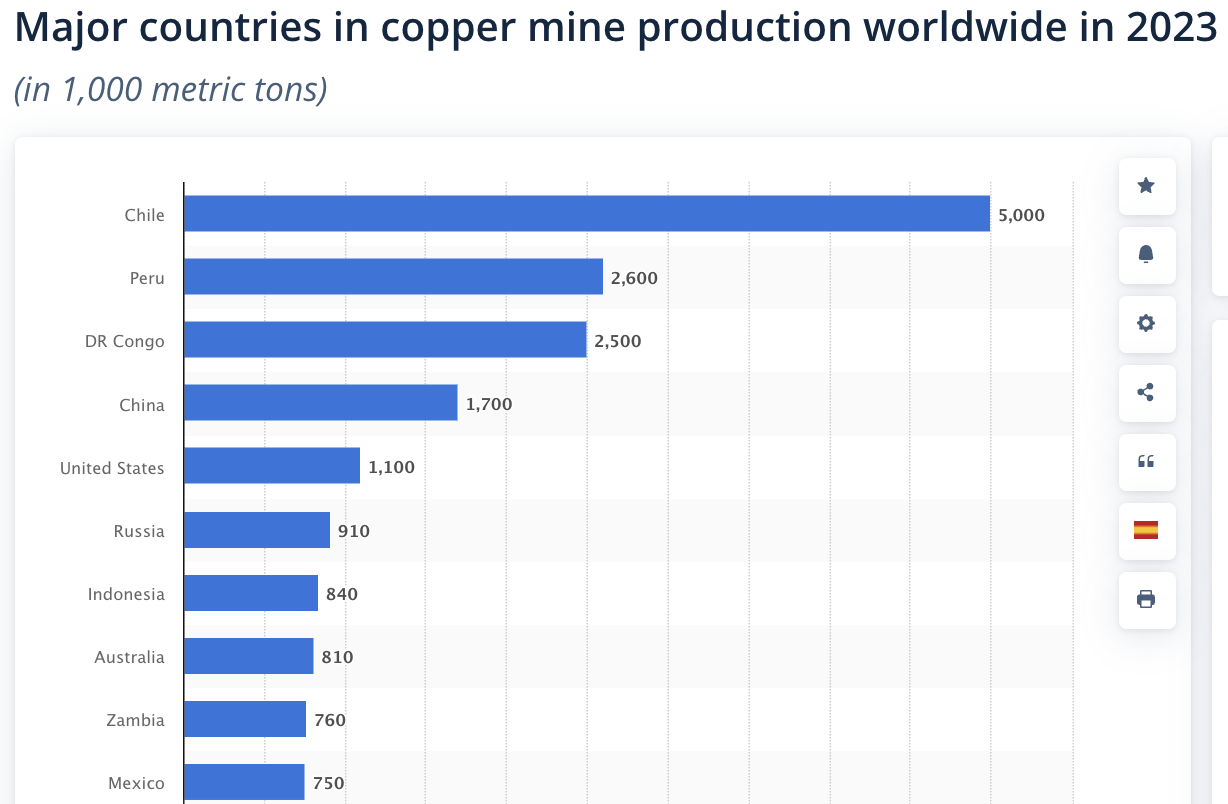

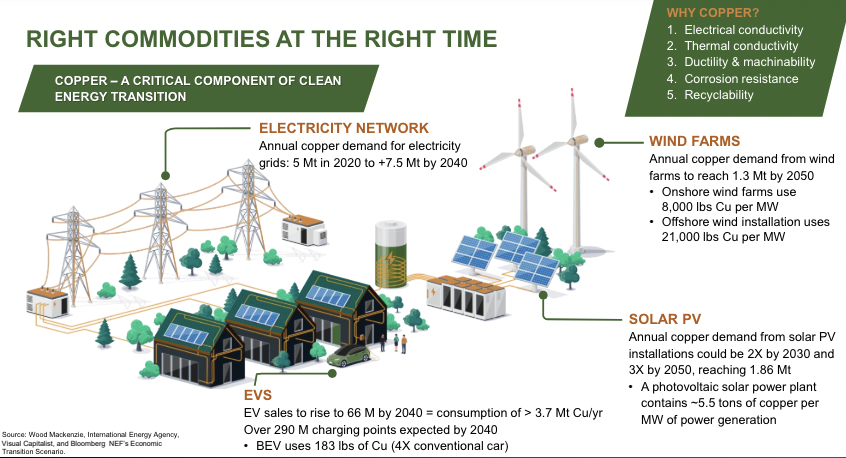

Copper demand has grown ~2%/yr. for decades. Going forward the average could be 2.5%-3.5%/yr. That doesn’t sound dire unless one considers supply. Two percent/yr. is transitioning to 3% due to;

1) renewable power plants are more Cu-intensive than their fossil fuel counterparts, 2) EVs use ~3x as much Cu, 3) power demand from AI/cloud/supercomputing/cryptocurrencies, robotics, smart cities, EVs/charging stations, 5G/6G wireless, etc., and 4) the expansion & upgrading of electrical grids.

Supply is already falling short, and it’s likely to get worse. PwC recently reported that 54% of the world’s Cu supply is in places at risk of severe drought by 2050. That’s why opposition to mining is rising in S. America. S&P Global opined that discoveries in 2020-23 will take an average of 18 years to commercialize.

Goldman Sachs is calling for an average of US$15,000/t in 2025, or $6.80/lb., vs. the current $5.12/lb. If that’s Goldman’s average — imagine what they think the high might be, $8.00/lb.?!?

Globally, there are dozens of low-grade, bulk-tonnage projects. Many have been in the pipeline for decades. Some will not make it. However, there are much higher-grade projects in Canada that are quite compelling.

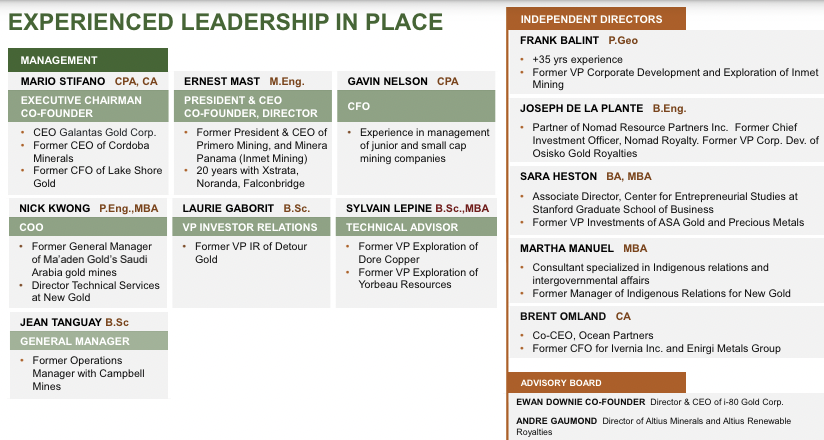

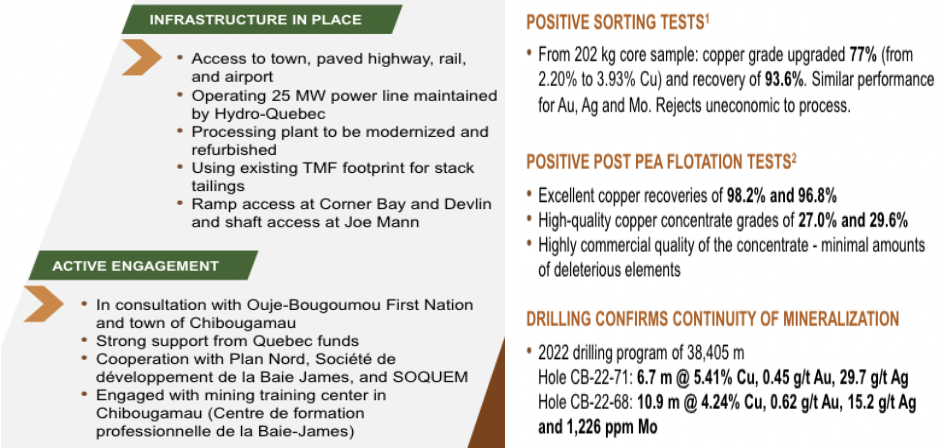

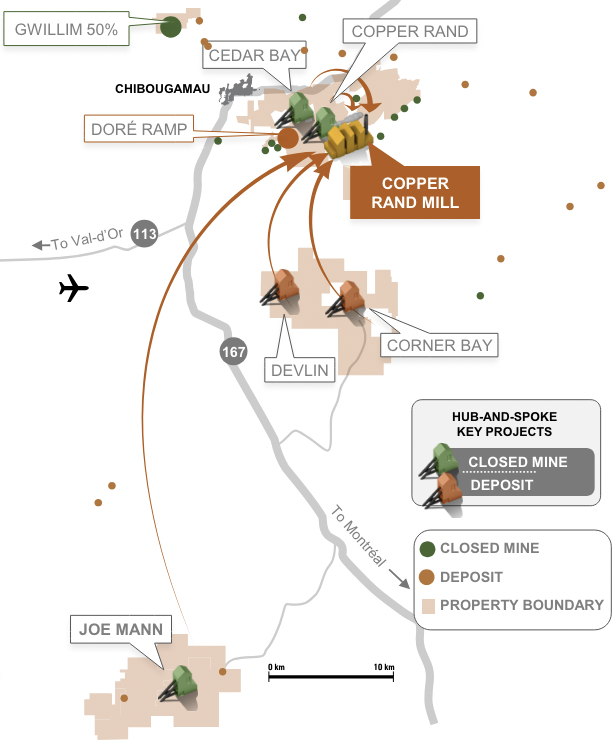

Doré Copper Mining (TSX-v: DCMC) / (OTC: DRCMF) has a very high-grade Cu/Au (brownfield) project in the prolific Chibougamau region of Quebec. It’s surrounded by crucial infrastructure including; roads, power, water, rail, an airport, labor, equipment & services.

Last week, Quebec’s ranking in the annual Fraser Institute Mining Survey improved from 8th best of 64 jurisdictions (top 13%) to #5 of 86 (top 6%). Quebec institutions own 9% of Doré Copper. Ocean Partners + Equinox Partners own an additional 54%.

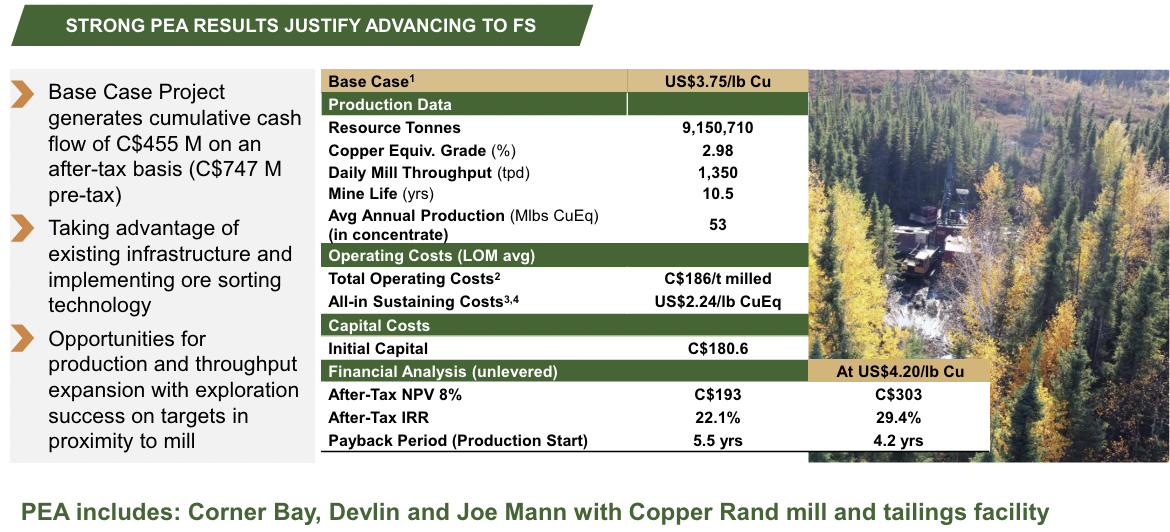

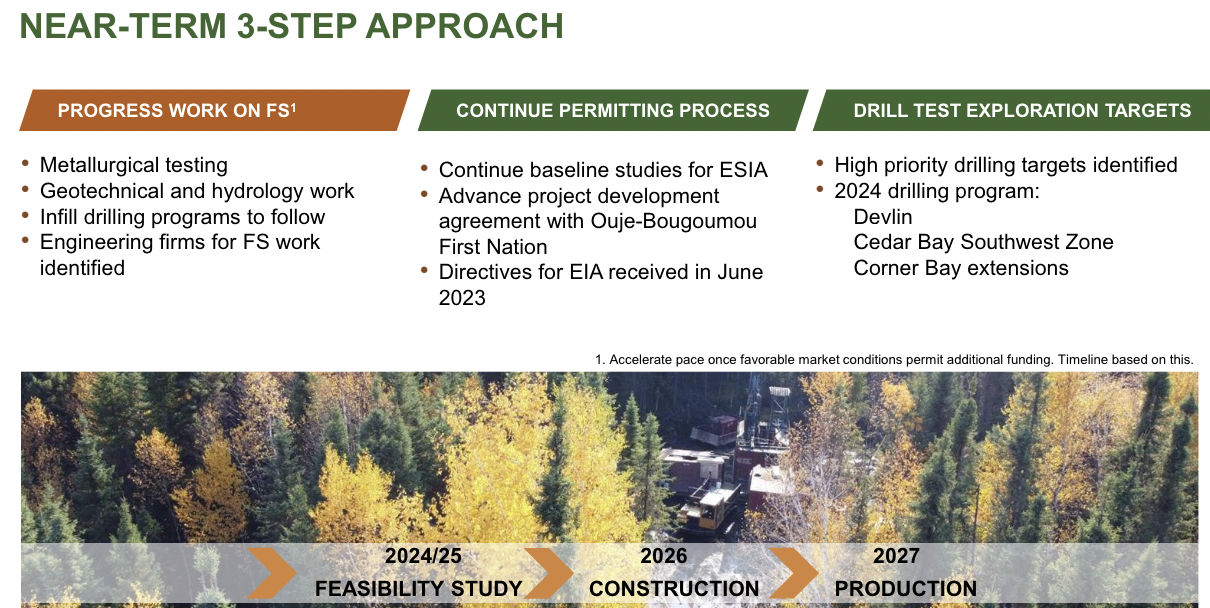

Doré has a tried & true hub-and-spoke development strategy upon which a Preliminary Economic Assessment (“PEA“) was done in May/June 2022. In my view, the PEA is the tip of the iceberg of what a well-funded development effort could deliver.

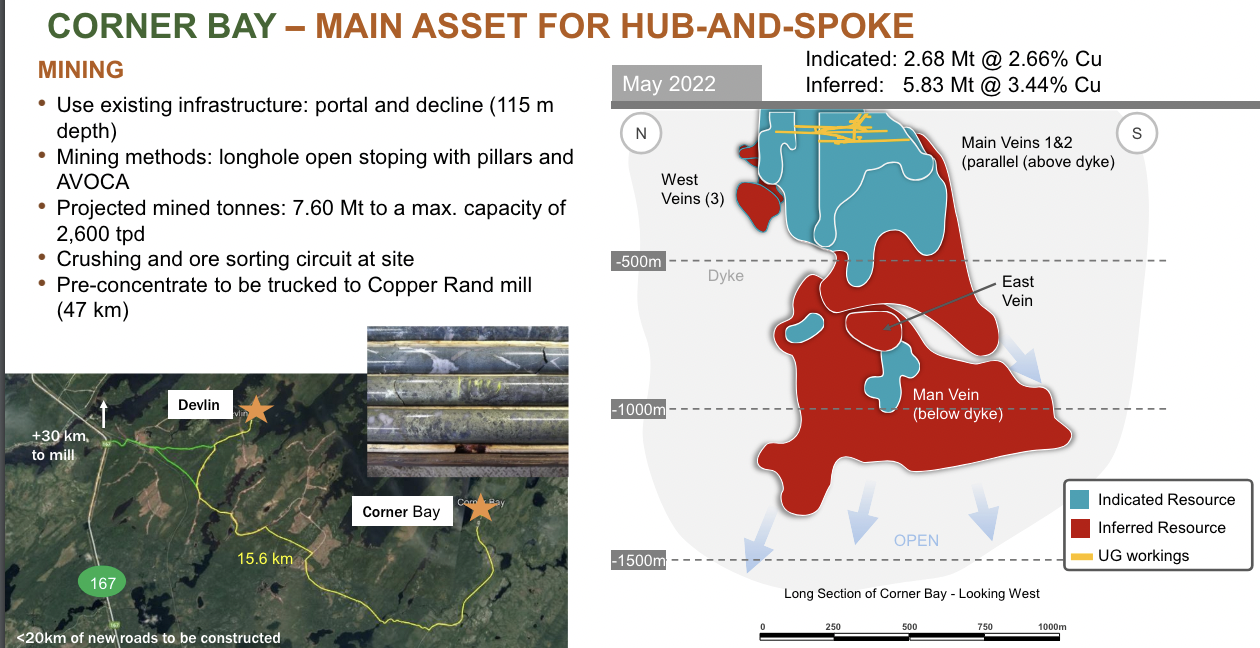

The Study was based on three project areas, 1) the Copper Rand Mill & tailings facility, [the hub], 2) the Corner Bay-Devlin property, and 3) the Joe Mann zone, the site of the former Joe Man Au mine.

Total mineralized material mined (as per the PEA) is 9.2M tonnes at 2.61% Cu + 0.59 g/t Au (diluted grades). Mine life is 10.5 years with peak annual production of 79M lbs. Cu + 51k oz. Au. All-in-Sustaining-Costs are US$2.24/Cu Eq. lb. Peak cash flow/yr. at spot pricing would be roughly C$400M!

From gov’t grants & loans, Quebec institutions, commercial lenders, equipment financing, partially pre-funded off-take agreements & royalty/streaming opportunities, Doré could potentially reach production without excessive equity dilution.

Or, management could sell a minority interest at the project level to cover its share of equity capital. Given the Cu price, a capital raise seems likely to fast-track infill & expansion drilling, permitting + other development imperatives.

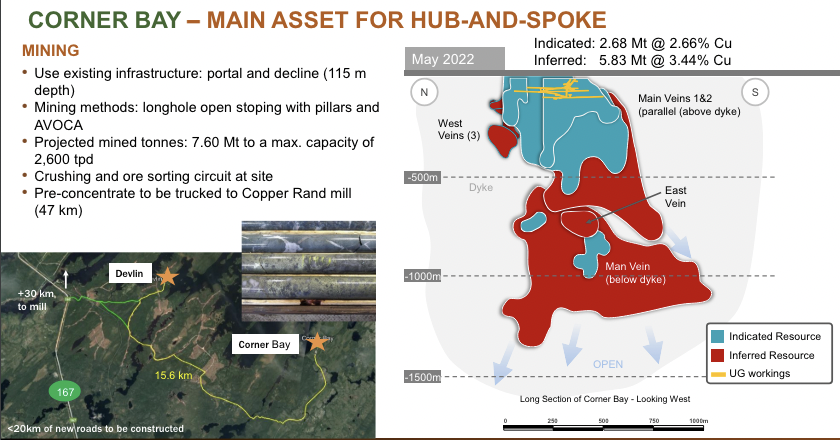

Corner Bay (82.5% of total resources) is 100% royalty-free, making it highly attractive to dozens of royalty/streaming companies competing for transactions.

It hosts a significant high-grade Cu-Au resource discovered in the early 1980s. There’s been no production, but an underground bulk sample of ~36,000 tonnes was processed through the 100%-owned, Rand Copper Mill in 2008. It returned 2.79% Cu Eq. or 4.0 g/t Au Eq. (without ore-sorting).

Recoveries were 94.4% Cu / 81.5% Au. Management believes there’s upside to recoveries as the Mill was not optimized to run Corner Bay ore. The deposit remains open at depth and to the north.

Corner Bay benefits from ramp access to a vertical depth of 115 m, with 2 km of development on three levels. At the Devlin deposit, there’s a 305 m decline + 364 m of drifts, serviced by several forestry roads.

At spot pricing, Doré has ~824M lbs. Cu Eq., with a meaningful upside to that figure as the footprint includes 13 past-producing mines, deposits & targets, spanning 17,232 hectares (net to the Company). Given numerous satellite deposits, and considerable discovery potential, that 824M lb. figure will grow.

S. American projects can have 10s of billions of Cu Eq. lbs., but are typically valued at ~$0.01 to $0.08/lb. Bulk tonnage valuations [per lb.] are so low because they include lbs. that won’t be mined for 50 years! Doré’s grade of ~3.16% is 6x the average bulk tonnage grade and it could be producing in 2027.

In addition to being in a top-ranked jurisdiction with ubiquitous, low-cost hydroelectric power, it has the 2,700 tpd Rand Mill. Management believes the Mill could be running in 2026, with mining operations 6-12 months later. The Company has already done some refurbishment.

The Mill is a hub for at least 10 named deposits/resources –> Corner Bay, Joe Mann, Devlin, [Cedar Bay] + [Ceder Bay SW zone], Jaculet, Doré Ramp, Gwillim — (a 50%/50% JV with Argonaut Gold) — Portage Island & Copper Rand.

Despite fabulous grades, and substantial exploration upside, in an excellent, low-cost, green jurisdiction, Doré is valued at just $16.5M, That’s $0.02/Cu Eq. lb. Converting 824M lbs. to Au Eq., results in ~1.73M troy ounces. Therefore, Doré is valued at $9.5/Au Eq. oz.

Compare that to nearby Northern Superior at $34/Au Eq. oz., Ontario’s Mayfair Gold at $55/oz., Quebec’s O3 Mining at $40/oz., Nevada’s West Vault at $54/oz., or B.C.’s Westhaven at $42/oz. None of those comps have as much infrastructure already in place.

Total upfront cap-ex is $181M vs. $billion(s) for bulk-tonnage behemoths. The replacement cost of still operable above & below-ground workings, infrastructure, equipment & buildings is > C$250M.

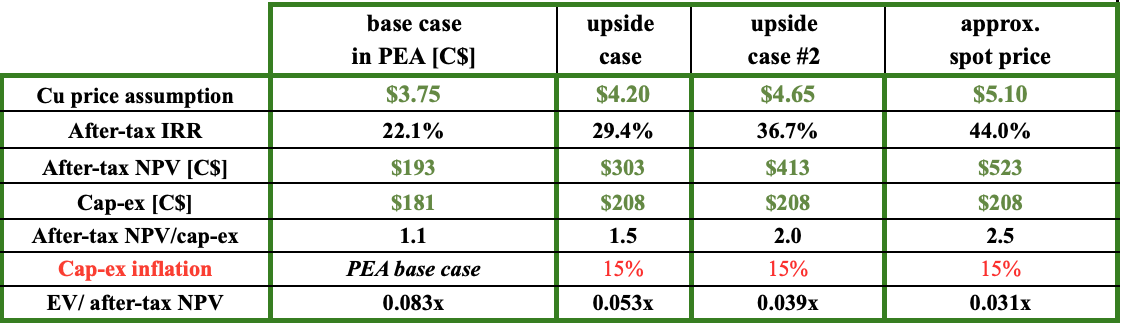

Replicating exploration studies, permitting & drilling dating back to the 1950s would cost a multiple of the Company’s $16.5M enterprise value. In the chart below are scenarios of after-tax NPVs & IRRs from the 2022 PEA at Cu prices ranging from $3.75 to $5.10/lb.

At a normalized $3.85/lb. Cu, the after-tax NPV of S. American projects ranges from ~15% to 30%. Doré’s IRR is ~24%. At spot pricing, the NPV increases to $523M and the IRR to 44%, with a ratio of NPV to cap-ex of 2.5x.

Peers have an average NPV/cap-ex ratio of ~1.3x. I increased cap-ex from Doré’s 2022 PEA by 15% to account for mining cost inflation. Notice the EV/after-tax NPV ratio of just 0.053x at $4.20/lb. Cu Eq. lb., That ratio should be a lot higher, especially after the delivery of a BFS.

Peers at BFS-stage trade at 0.20-0.40x EV/NPV, the better ones are valued at 0.40-0.60x if nearing production.

Doré could dramatically improve (already strong) project economics by extending the 10.5 yr. mine life while maintaining the same or higher annual production and/or increasing head grades. Peer project mine lives are 20-40 years.

A meaningful life extension will NOT be part of the upcoming Bank Feasibility Stidy (“BFS”), but strategic partners/acquirers & royalty/streaming companies can assess the prospects for longer mine life after reviewing next year’s BFS & ongoing drill results.

CEO Ernest Mast has several initiatives planned for the BFS (the Company’s skipping a PFS). In total, up to 10% of upfront cap-ex could be cut with design enhancements & reduced expenditures for the Mill refurbishment.

Also mitigating inflationary pressures are efforts to obtain more favorable tax treatment & improve concentrate grades. Silver will be included going forward, which could result in +900k oz. (payable).

Not included in the PEA/BFS is the possibility of toll-milling third-party ores. Mill capacity is 2,700 tpd, but the PEA contemplates operating at an average of 1,350 tpd.

Toll-milling could potentially start before the Company’s operations commence in 2027. The Mill can process Cu, Au, silver, zinc, lead & molybdenum and is the only large facility in the area. Importantly, there are opportunities to acquire nearby deposits. Far better than toll-milling is filling the Mill with Doré’s material.

From the PEA, “The exploration potential at Corner Bay remains substantial as veins remain open in one or more directions. In addition, there is potential for finding parallel zones of mineralization.”

Cedar Bay hosts a past-performing underground mine five km from the Mill that produced 3.86 Mt @ 1.63% Cu + 3.3 g/t Au. From 1958-1990 it was mined to a depth of 670.5 m.

A shaft goes down to the 1,036 m level. Cedar Bay has a resource of 130,000 tonnes Indicated @ 9.44 g/t Au + 1.55% Cu AND 230,000 tonnes Inferred @ 8.32 g/t Au + 2.13% Cu. Very high Au grades, but not a large deposit to date.

The Southwest (“SW“) Cedar Bay zone, 300 m SW of the Cedar Bay mine, is a known sheer zone, but due to multiple owners, ~800 m of strike was never tested. Management plans to drill the area this year for a potential SE extension.

Doré Ramp is just 2.5 km from the Mill. In 2022-23, the Company completed six holes / 7,020 m. The first hole intersected a mineralized zone ~350 m down-plunge from the deepest historical hole, returning 2.4 m of 4.37% Cu + 0.87 g/t Au.

In addition, a Cu/Au zone was discovered over a strike length of ~360 m, ~300 m south of Doré Ramp with the best intercept there being 2.35 m of 4.0% Cu + 3.6 g/t Au.

The past-producing Gwillim mine is 15 km NW of the Mill and consists of the KOD & Signal zones. Doré & Argonaut have a 50/50 JV on most of the project. KOD was discovered in 1986, accessed via a ramp in 1988, and drilled, but never mined.

From 2018-23, Doré/Argonaut completed six holes / 3,321 m. Highlights at Signal include; 3.33 g/t Au over 13.3 m at a depth of 28.7 m, and 4.4 / 9.8 m, incl. 16.5 / 2.3 m, and 9.67 g/t over 5.3 m at KOD. These are strong results for near-surface Au mineralization.

At Joe Mann, most of the former infrastructure has been maintained in good condition. There’s a shaft with a hoist in place, an office building, core facilities, a garage, and a connection to the hydroelectric grid. There is robust exploration potential at the Joe Mann main zone and known showings across the 6,300-ha land package.

Hopefully, I’ve conveyed a compelling Cu/Au opportunity, one where the value of the hard assets is well more than the market cap. Of course, if massive equity raises are coming, then the opportunity is not nearly as attractive.

I believe that management can navigate advancing the project, growing it, and funding it without major equity dilution. However, there will be equity raises along the way.

Readers should consider taking a few minutes to review Doré Copper’s (TSX-v: DCMC) / (OTC: DRCMF) new Corp. Presentation, one of the better ones in the Cu junior space.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Dore Copper Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Dore Copper Mining are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Dore Copper Mining was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply