Gold & silver are having an extraordinary year, up 25.5% & 31.0% year-to-date to $2,591/oz. & $31.23/oz. As expected, the stocks of many producers are up substantially. Newmont, Agnico Eagle, Kinross, Alamos Gold, Hecla Mining, Pan American Silver & Coeur Mining, are up an average of +115% from their 52-wk lows.

However, in most cases, gold (“Au”) & silver (“Ag”) junior miners have not rallied nearly as much. How could this be? It makes no sense. A few months ago, investors were concerned that robust metal price gains were unsustainable, but the Au price has been above $2,300/oz. for nearly six months.

No longer is it just gold bugs on Twitter & YouTube calling for much higher Au/Ag prices, now GS, UBS, Citi, JPM, RBC & BofA are calling for Au to hit $2,700-$3,000/oz. next year. $3,000/oz. is only +16% higher, so hardly a stretch.

In support of higher prices are interest rate cuts in the U.S., which started yesterday at 50 basis points! And, central bank buying continues to be a major driver, led this year by Turkey & India. Recession fears + an uptick in geo-political risk [NATO/Ukraine/Russia] / [the Middle East] & [China/the West] further highlight Au’s appeal.

Silver Storm Mining (TSX-v: SVRS) / (OTC: SVRSF) has an enterprise value {market cap + debt – cash} of ~C$49M at $0.11/shr., (down 39% from $0.18 on July 24th). Over the same 2-month period, the Ag price is up +12%.

This underperformance stems in part from delayed financials due to questions relating to last year’s acquisition of the La Parilla mine & mill complex. While there is added risk due to the delayed financials, no red flags have been raised and management hopes to have this issue resolved this month.

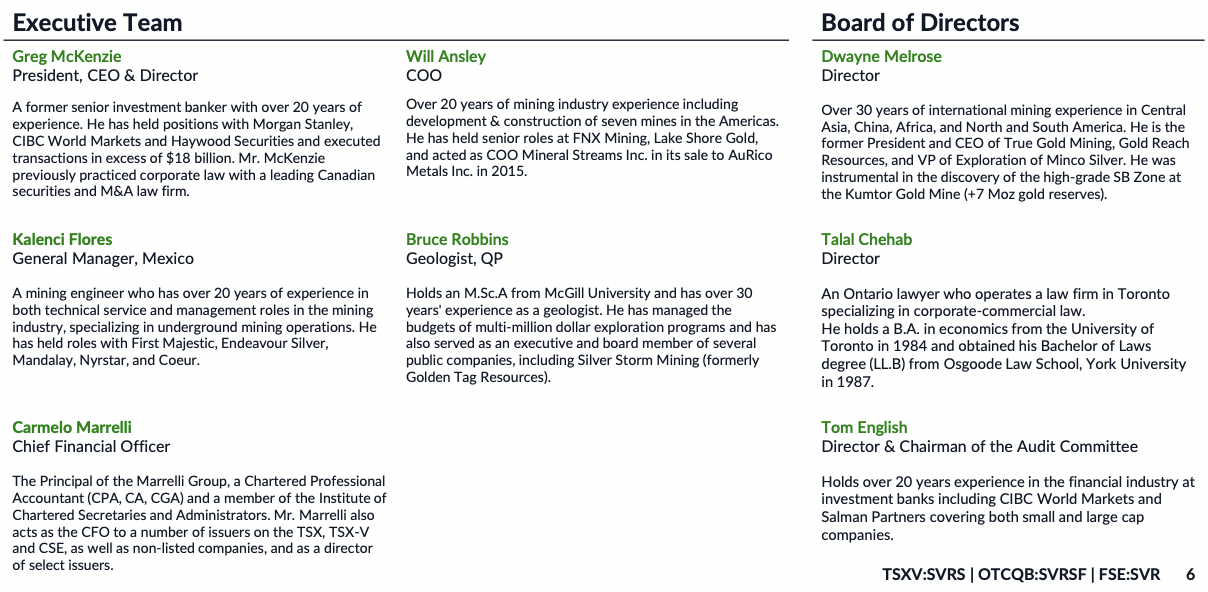

Interest in Ag juniors is rising. CEO Greg McKenzie had 30 meetings at last week’s Beaver Creek conference. So far I’ve focused on Au, but Silver Storm has both Au & Ag. The outlook for Ag could be even brighter than it is for Au.

Yet, Ag’s spot price today is 85% below its inflation-adjusted all-time high in 1980 (before EVs, ubiquitous solar, (wireless) electronics/telecom & urgent decarbonization efforts existed).

China’s killing it in solar, it’s overproducing panels driving prices down & global adoption up. Ag use in solar could be 30%-35% of total Ag demand in 2027. Two additional hot topics are India’s soaring needs, expected to double this year vs. 2023, and demand for another (upcoming) major end-use, solid-state EV batteries.

India will soon be consuming 20% of mined Ag, up from under 5% three years ago. Some solid-state EV batteries, like a new one from Samsung, require increased loadings of Ag.

How much incremental Ag is in a solid-state battery vs. a conventional EV battery seems to be a secret, but if 100 grams, that quickly adds up. By 2030, 40M solid-state batteries could be sold per year (and still growing), amounting to an additional 128M troy ounces/yr. in what will be a two-billion-ounce market.

How much is 128M ounces? It’s 2.4x larger than Fresnilo’s annual output, the world’s largest producer. These trends in solar & batteries are very resilient as the cost of the Ag content is very low, < 5% per panel & < 1% per battery, and the impact on performance is high.

Surging demand from China & India, and for solar panels & solid-state EV batteries globally, means Ag demand will grow nearly 10%/yr. for the next decade. The demand side is bulletproof, yet we’re in year #4 of a mined Ag deficit. Where will significant new supply come from?

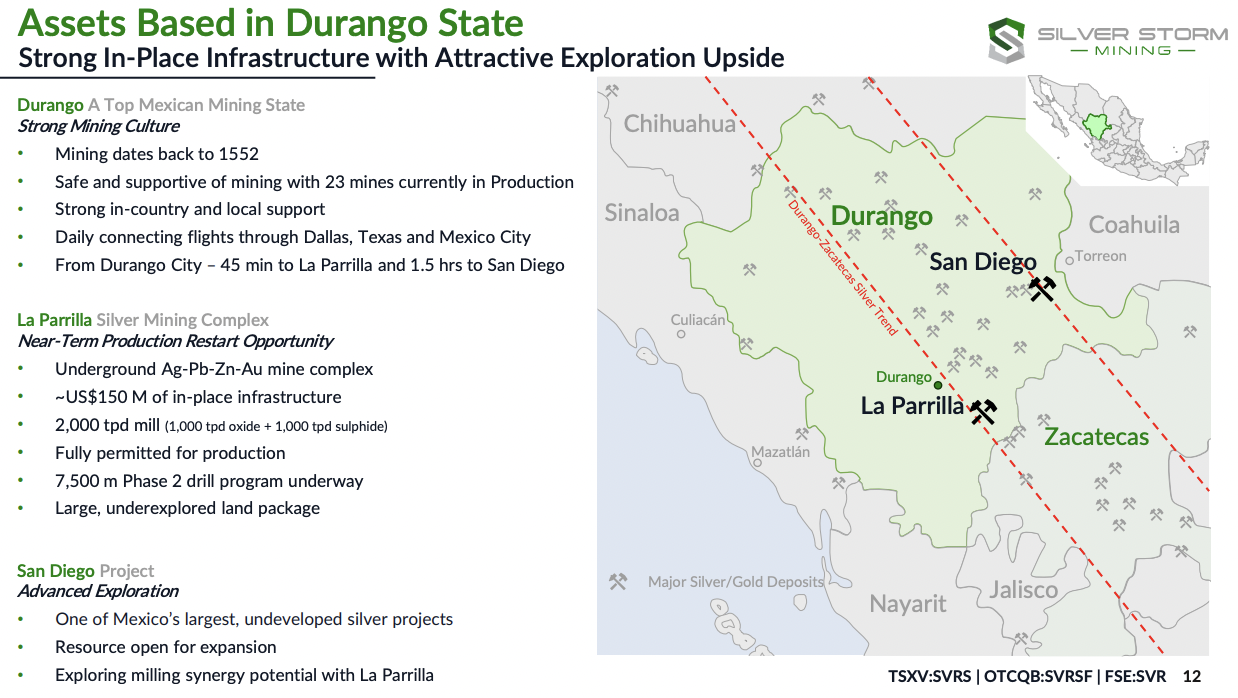

Silver Storm has the 100%-owned, past-producing, (100% underground) La Parrilla (“LP”) mine & mill complex in Durango state, Mexico. Durango hosts 23 operating mines, it’s known as a mining-friendly jurisdiction. LP was acquired last year from First Majestic (“FM”). FM remains Silver Storm’s largest shareholder at ~36%.

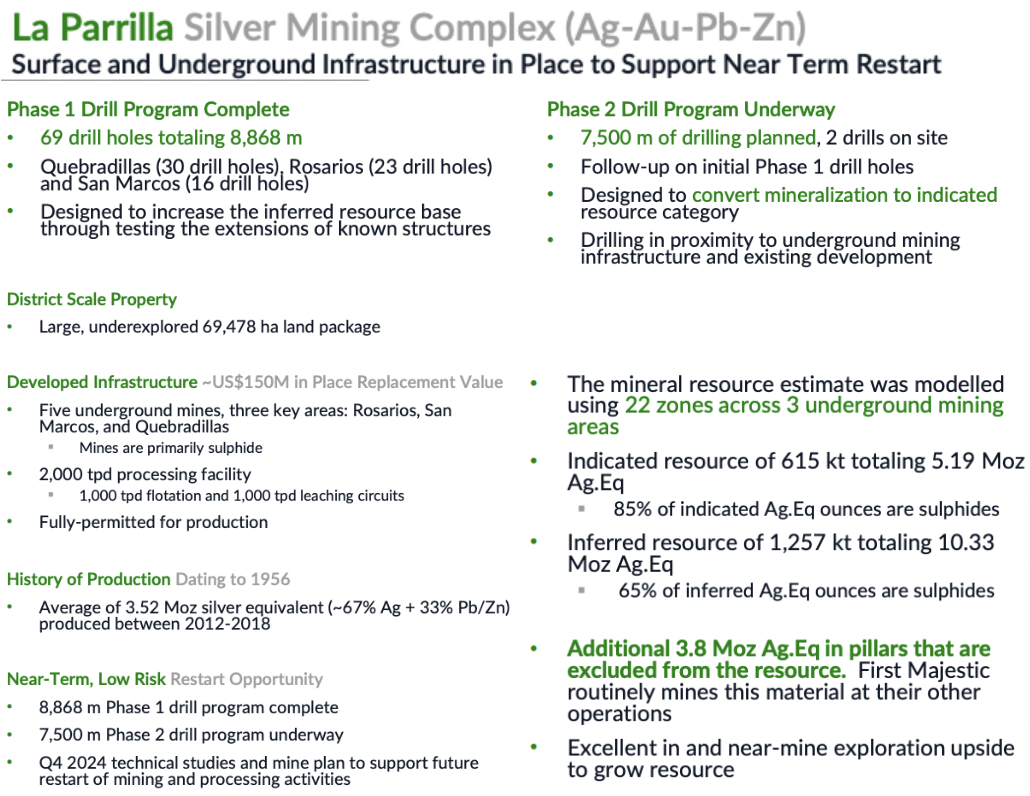

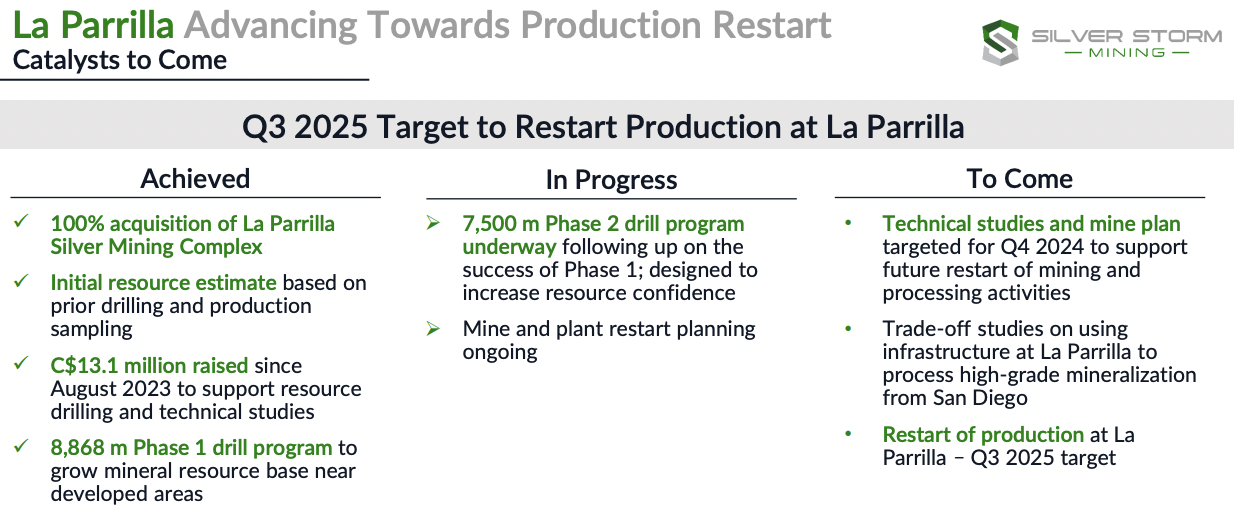

Two underground drill rigs are operating at LP. Phase 2 diamond drilling of ~7,500 meters will be completed in September/October with the main goal of upgrading Inferred mineralization to Indicated. Phase 1 consisted of 69 holes / 8,868 m.

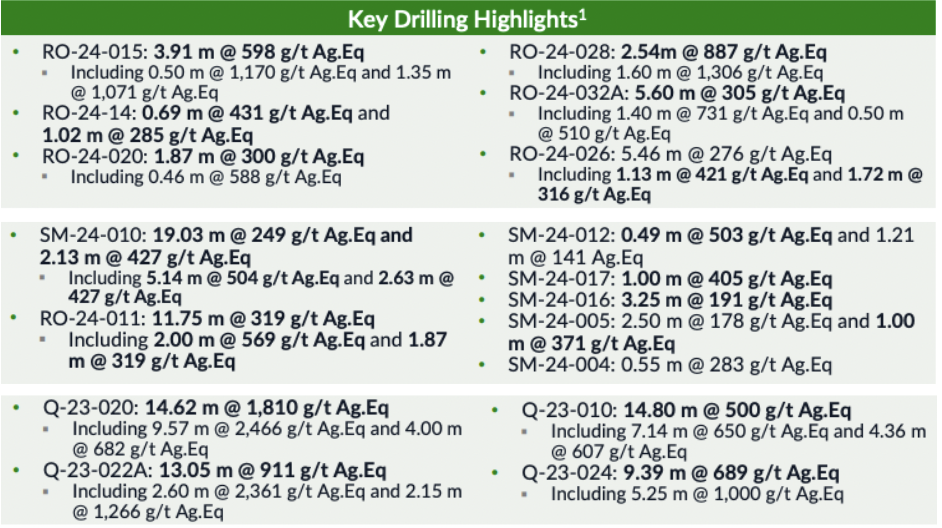

The best drilling intervals to date at LP are; [1,810 g/t Ag Eq. over 14.6 m], [911 g/t over 13.1 m] & [689 g/t over 9.4 m]. It would be impossible to overstate how important these bonanza grades are. 1,810 g/t Ag Eq. is a Top-5% drill result for intervals of at least 10 m, equating to ~22 g/t Au Eq.

If small pockets of new, ultra-high grade mineralization could be blended with existing 258 g/t Ag Eq. material, it could be a game-changer, but it’s too soon to know how much bonanza grade there is.

Although FM divested the LP Complex, it maintains considerable leverage to its success. It was in continuous operation from 2006 to 2019, producing over 34M Ag Eq. ounces, {67% Ag & 33% lead/zinc/Au}. Management expects to restart the mine in 2H 2025.

The replacement value of above & below-ground infrastructure at LP, including the fully-permitted 2,000 tpd mill and a “partial mining fleet” is estimated at US$150M = C$204M. Replicating this infrastructure would take 5+ years of studies, permitting, funding, construction & commissioning.

I estimate a cost of C$12M to reach production, but most of that could be obtained with a debt facility. LP hosts five underground mines and an open pit, surrounding a 2,000 tonne per day (“tpd”) fully-permitted mill consisting of parallel 1,000 tpd flotation & 1,000 tpd cyanidation leach circuits for oxide & sulfide ores.

Mineral resource estimates have been completed across 23 zones/veins in the Rosarios, San Marcos & Quebradillas areas. So far, LP has booked ~15.5M ounces grading ~258 g/t Ag Eq.

An additional estimated 3.8M ounces are contained inside of support pillars, most of which should be exploitable. A new resource at LP is expected in 1Q/25. Readers are reminded that 258 g/t is very attractive, it equates to 5 g/t Au Eq., a top-decile grade.

While owned by FM, the LP Complex produced up to 4.5M oz./yr., averaging ~3.5M/yr. from 2012-18. Management won’t commit to more than 3.0M oz./yr., but I think reaching a run-rate of 3.5 – 4.5M oz. is a reasonable goal in 2026, especially if Ag/Au prices remain strong.

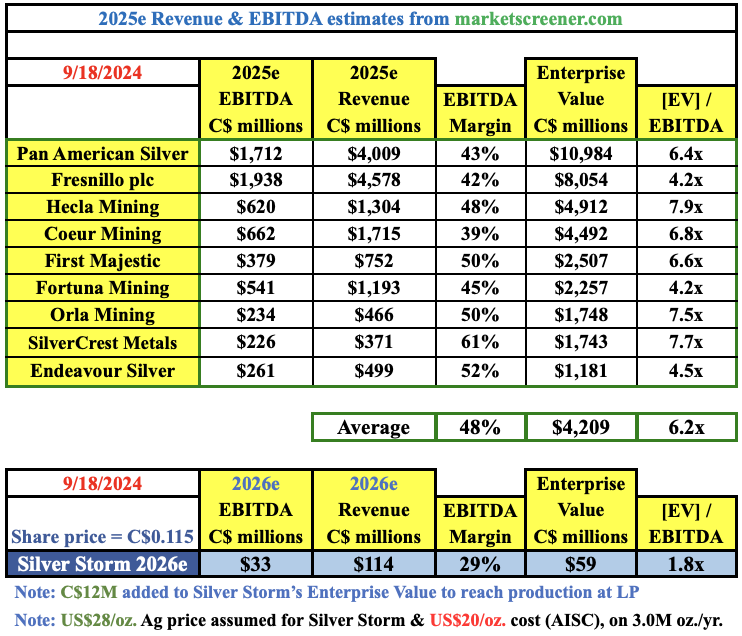

Assuming US$28/oz. Ag and an AISC of $20/oz., annual run-rate cash flow in 2026 could grow to C$33M on 3.0M Ag Eq. ounces. Some of that cash could be reinvested into the San Diego project. The Company is valued at just 1.8x 2026e EBITDA of C$33M, vs. peers at an average of 6.2x 2025e EBITDA.

To be clear, Silver Storm is riskier (pre-production) than the peer group, but I believe its cheap valuation makes up for the added risk. Investors at C$0.11/shr. get San Diego (“SD”) for free, an asset that was valued in the market at up to C$100M a few years ago.

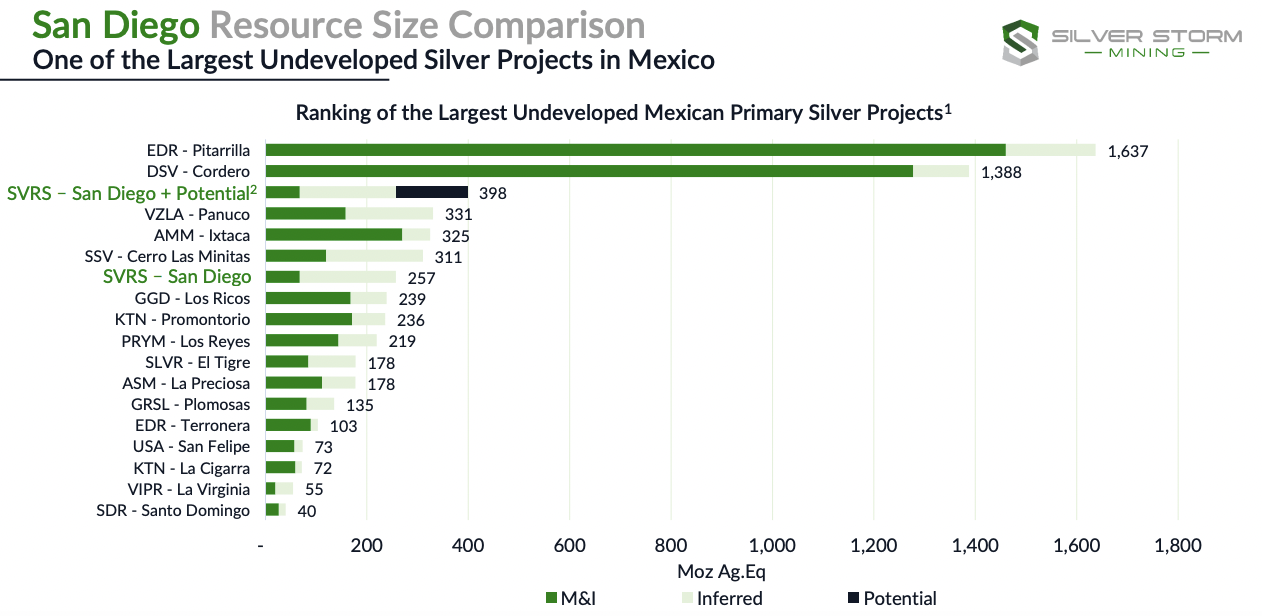

SD has ~257M Ag Eq. ounces, making it Mexico’s third-largest undeveloped primary Ag project. Unlike most companies, Silver Storm’s reported grades are adjusted for estimated recoveries [~80% Ag] & smelter deductions.

How large is 257M ounces? It equates to ~3M Au Eq. and is ~100M ounces more than B.C. Canada’s Dolly Varden. Yet pre-PEA stage Dolly is valued at > $300M. SD is valued at just ~C$0.24/oz. (incl. C$12M mentioned above). Compare that to C$1+/oz. for companies like; Dolly, Sierra Madre, Vizsla Silver, and Prime Mining.

According to SGS Canada, there could be nearly 400M Ag Eq. ounces at SD, making it the crown jewel of Silver Storm. SD is envisioned as a bulk tonnage operation of possibly 10M to 15M Ag Eq. oz./yr. {see pages 21-30 in this new corp. presentation}

With the Au price at an all-time high near $2,600/oz., Ag could see a meaningful move higher at any time. Yesterday, the Fed cut interest rates by 50 basis points. Ag is up 6%! from the low of yesterday. Near-term producers like Silver Storm Mining are ideally positioned to benefit in the coming years. See latest corp. presentation

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Silver Storm Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Silver Storm Mining are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Silver Storm Mining was an advertiser on [ER] and Peter Epstein owned shares in the company acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply