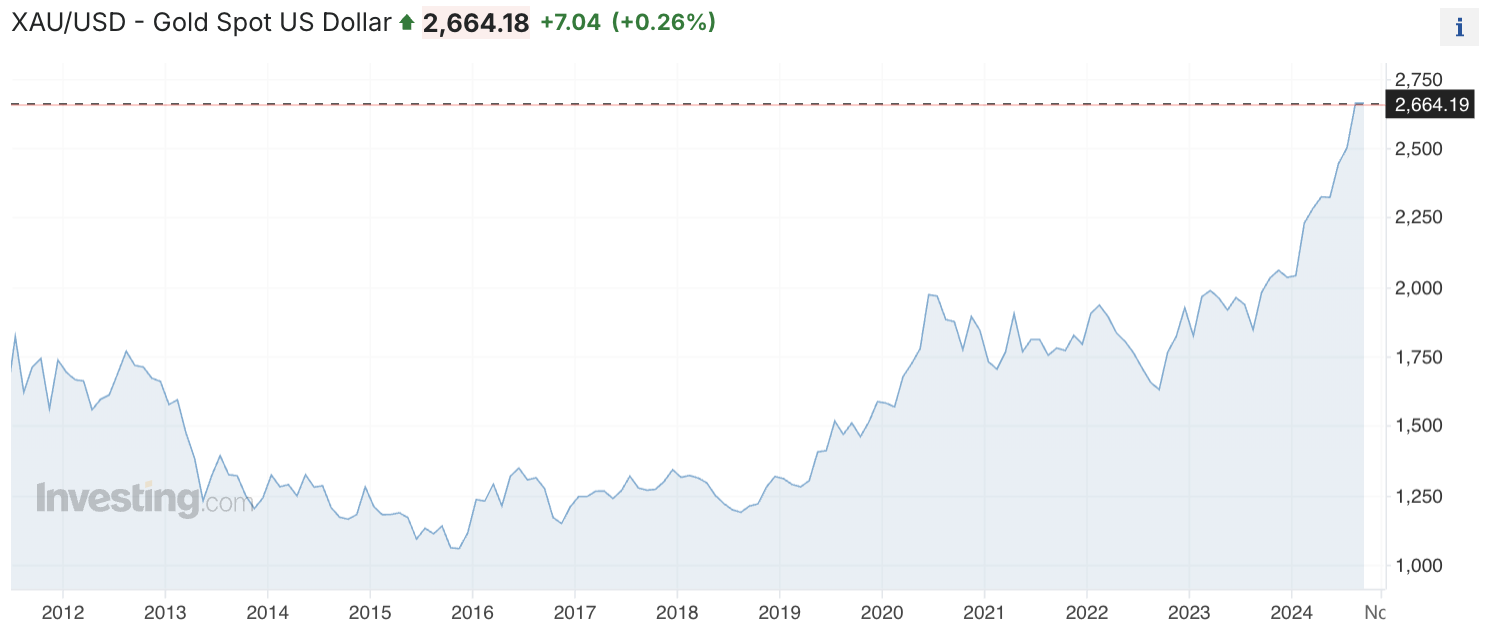

Six months ago I would have been laughed out of the room for talking about US$3,000/oz. gold (“Au“) in 2025… No one is laughing now! Au is up +39% in the past 12 months. If it were to rise another +39% by late-September 2025, it would sit at $3,702/oz.!

No, I’m not predicting that will happen. However, it wasn’t long ago that an EPIC bull market drove the Au price from $273 to $1,664/oz. The year-end closing price was higher every single year from 2000-2012! Interestingly, this past year’s spectacular move is not as rare as one might think. Since 2000, Au has soared 20%+ in 8 of 24 years.

Producers have been struggling with increasing mining costs. For example, Newmont’s AISC is up ~10%/yr. since 2019 to $1,562/oz. Yet, at today’s spot price of $2,664/oz., Newmont’s margin is $1,100/oz.! With margins so strong, Majors & mid-tiers greatly benefit from growing as fast as possible. That means a lot more M&A.

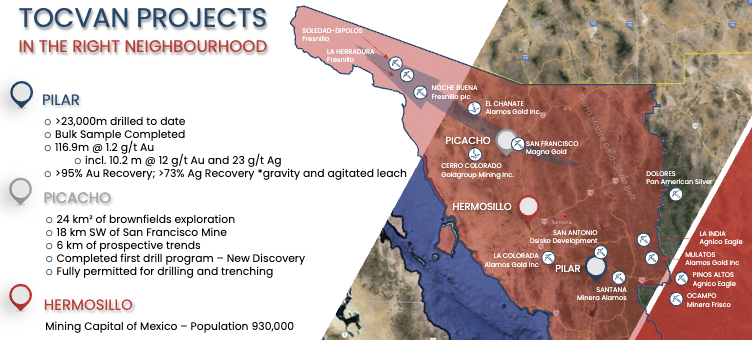

This year and next, buying growth will be far better than building, as speed to market is key. A company well positioned to thrive in this market as a prime takeover target is Tocvan Ventures (CSE: TOC) / (OTC: TCVNF) with two post-discovery, Au/Ag projects in Sonora, Mexico.

The Company has just 51.5M shares outstanding with no warrant or stock option overhang. The enterprise value {market cap + debt – cash} = C$24M. Tocvan has consolidated a highly prospective land position at its 100%-owned, 2,278-hectare, Pilar Au-Ag project covering 21 sq. km of prospective area + 51% of a 1 sq. km parcel.

It also holds a 100% interest in the El Picacho Au-Ag project in the Caborca Trend of northern Sonora, a region that hosts numerous major Au deposits. Of the two projects, the clear focus is on Pilar, 130 km SE of Hermosillo, the capital of Sonora, fully road-accessible via a 2-hour drive from Hermosillo.

Before digging deeper, some commentary on a proposed ban on open-pit mining in Mexico. According to the Mexican Mining Chamber, banning open-pit mining would generate an “economic contraction of 250 billion pesos,” and a million formal & informal mining-related jobs could disappear within a decade.

It would cause irreparable harm to a meaningful subset of the country’s labor force. A complete ban is unlikely as it would include aggregate mining (gravel, sand), negatively impacting the construction & cement industries. Therefore, a ban will probably be focused on the granting of new concessions. Tocvan has valid concessions and good community support.

The Company is being expertly managed by CEO Brodie Sutherland, a seasoned exploration geologist with > 16 years’ experience in > 20 countries and a focus on economic geology. Roles span grass roots exploration through to feasibility. As a founding member of Tocvan, he has built a strong local team of experts to breathe new life into Tocvan’s projects.

Director Calles-Montijo is an integral part of successful operations at Pilar, complimenting the Board & mgmt. team with expertise his experience in project development in Mexico. He has over 30 years of global exploration experience, working with Rio Tinto, Kennecott, SRK Consulting and as an independent consultant.

Director Arroyo, a professional Mine Engineer, has > 48 years in operations, planning, environmental health & safety, community development & exploration. He’s an expert in greenfield projects, and open pit mines. Throughout his career Mr. Arroyo worked with companies that include ArcelorMittal, Luismin, SICARTSA, Peña Colorada, Minera del Norte.

Management now refers to the consolidated area that includes the Pilar Main zone + the adjacent 22 sq. km area as Gran Pilar, signifying the broader scale project. Surface work continues with over 476 samples collected along northern & eastern extensions of the Main Zone, North Hill & 4-T trends.

The technical team is excited about new veins & artisanal underground workings being found. The sampling program covers 2.3 sq. km, slightly more than twice the area of the original Pilar footprint.

Producers including Grupo Mexico, Newmont, Industrias Penoles, BHP, Agnico Eagle, Fresnillo plc, Franco-Nevada, Alamos Gold, Equinox Gold, Fortuna Mining, Orla Mining, Minera Alamos & Minera Frisco have assets in Sonora or elsewhere in Mexico and could be interested in partnering with or acquiring Tocvan.

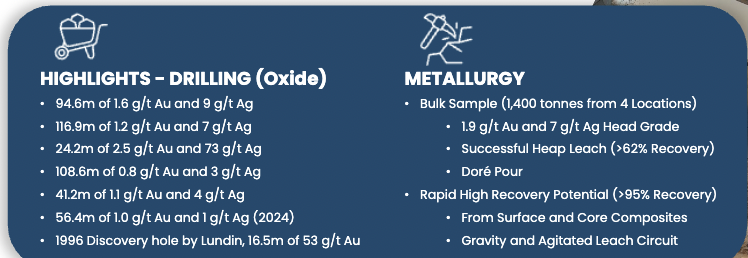

Gran Pilar has been the subject of two significant exploration programs. The first was from 1996-97, and the second was from 2008 to 2018. Both included significant surface exploration + RC drilling. Tocvan’s technical team is studying the potential for a heap leach mine ramping up to 50k ounces/yr.

Sonora has excellent mining infrastructure, (roads, power, water, skilled workforce, mining services & equipment). In the next 4-5 months the Company will deliver a mineral resource estimate (“MRE“) so prospective suitors can better evaluate the substantial potential.

While the MRE will be an important technical report providing critical insights on geology, geometry, continuity, structures, etc., it will be the tip of the iceberg, capturing < 3% of the total land package.

According to management, a“major regional producer” recently completed a detailed, district-scale review of Gran Pilar over six weeks of onsite due diligence. In my view, management wouldn’t mention the due diligence of this regional producer in interviews unless it was happy with what that producer uncovered.

The great thing about heap leach operations is that cap-ex is quite low. With Au at US$2,664/oz., an efficient, low-cost operation should be capable of delivering profits of > US$1,300/oz. Assuming a $1,300/oz. profit margin on 50k ounces/yr. later this decade, that would be C$88M/yr. in cash flow vs. Tocvan’s enterprise value of ~C$24M at $0.47/shr.

Given that a strategic partner is possibly already lined up, Gran Pilar could be in production within 3-4 years. There’s a good chance the unnamed interested party is listed above.

For a much larger company to be interested, Gran Pilar must have multi-million-ounce potential. Management is outlining a permitting & operations strategy for a pilot plant facility underpinning a robust test mine scenario processing up to 50,000 mineralized tonnes.

Timelines & budgets are being prepared with the aim of moving forward with a pilot plant early next year. Tocvan traded as high as C$0.79 in April 2023 when Au was ~$1,995/oz. Since then, Au is up a very strong 33%, yet the Company’s share price is down 41%. In mid-2021 the share price topped out at $1.67. In my view, a takeout would have to be north of $1.50.

CEO Sutherland commented,

“We are pleased with how quickly our area of interest is expanding and the added confidence we are gaining…Gran Pilar is largely untapped and the work being completed is strengthening our position as a leading explorer & developer in Sonora… we can already see the significance of these new areas and the positive impact they have for us… As discussions continue with potential strategic partners, our conviction to transform Gran Pilar into a top-tier asset has never been stronger.”

Preparations continue for the next phases of core & RC drilling focusing on resource definition. 1,200-2,000 meters of core drilling + 1,700-2,500 m of RC drilling is planned by year-end. Additional drilling across Gran Pilar will be considered next quarter. An MRE for the initial Main Zone + adjacent trends will provide an initial view of the blue-sky potential.

Regarding the on-site pilot plant, planning continues for a 50,000-tonne bulk sample run. Permitting is expected to be done in 4Q/24, with a start of pilot mining possible in Q1/25.

The Company will target surface material expected to average 1.3 g/t Au, and (from the 2023 bulk sample testing), a base case recovery of 62% is anticipated. Management is looking to optimize heap leach recoveries and test agitated leach + gravity methods.

Tocvan Ventures is well-positioned with a clear path forward of drilling and a pilot plant in the next six months. With Au above $2,660/oz., the Company’s C$24M valuation is way too low. A lot of companies will be closely watching the upcoming drill program. Readers are encouraged to review the latest corp. presentation.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Tocvan Ventures, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Tocvan Ventures are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Tocvan Ventures was an advertiser on [ER] and Peter Epstein owned shares in the company, purchased in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, or reported facts.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply