With gold (“Au“) up +37%!! in the past 12 months to $2,628/oz., earnings for producers are coming in hot. And, profits will be even stronger next year, as year-to-date Au has averaged $2,286/oz., ~13% below the current level. UBS, Citi, GS, JPM, RBC & BofA see Au hitting $2,700-$3,000/oz. in 2025, yet $3,000 is only +14% above today’s spot.

Given the strong Au price, what could go wrong for Au juniors? Lots of things! For example, in some countries the higher the price, the more likely are surprise increases in taxes and/or royalties. Many promising juniors are pre-discovery –> 5-10 years (if ever) from production.

Operating in mature markets like Canada & the U.S., juniors are not at risk of meaningful changes in taxes/royalties, expropriation of assets, bans on open pit mining, etc.

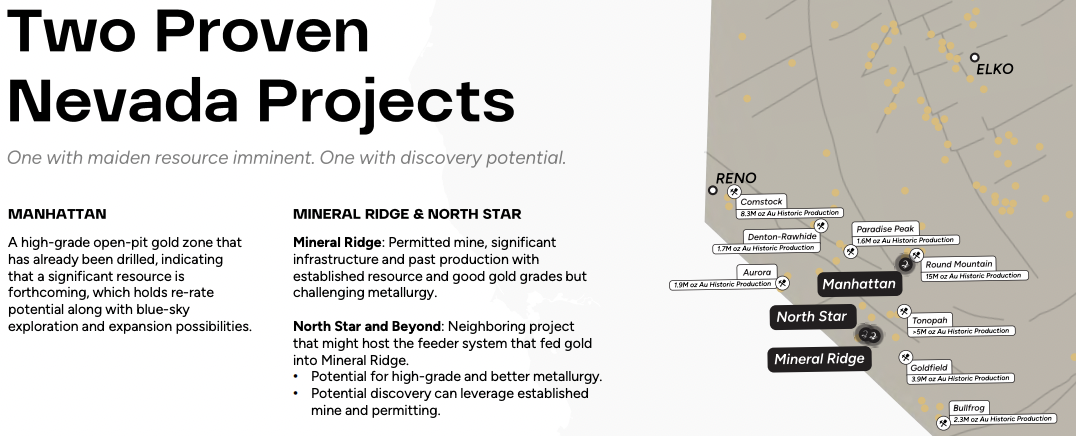

Take Nevada, it ranked [#1 / #2] [last year / this year] in the well-known Fraser Institute Mining Survey. In Nevada, it can take a long time to get greenfield projects started, but once discoveries are made, things move ahead slowly but surely.

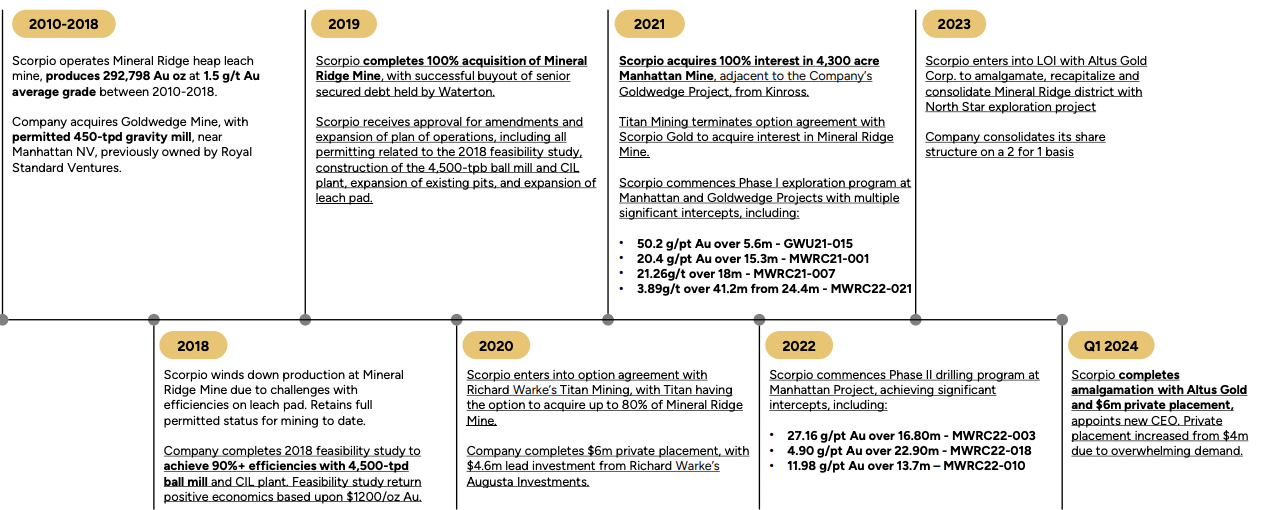

Scorpio Gold (TSX-v: SGN / OTCQB: SRCRF) holds 100% interests in the past-producing Manhattan & Mineral Ridge [“MR“] projects in Nevada’s world-famous Walker Lane Trend. MR could be back in production via conventional heap leach as soon as 2H 2025, but Manhattan is considered the crown jewel.

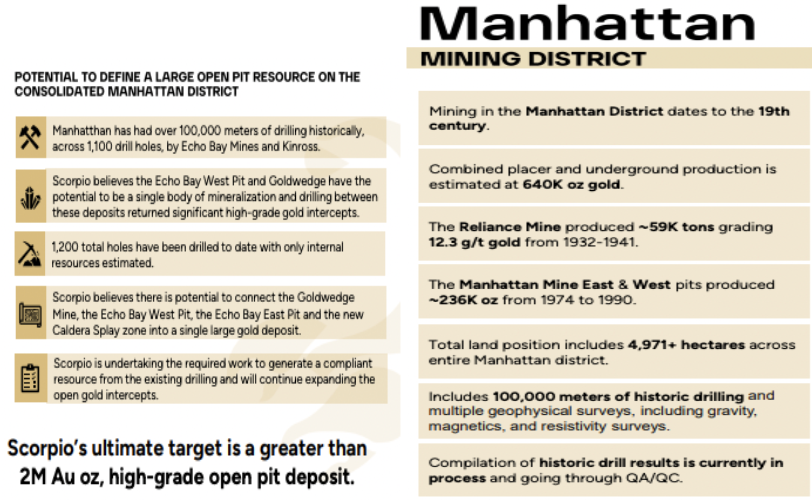

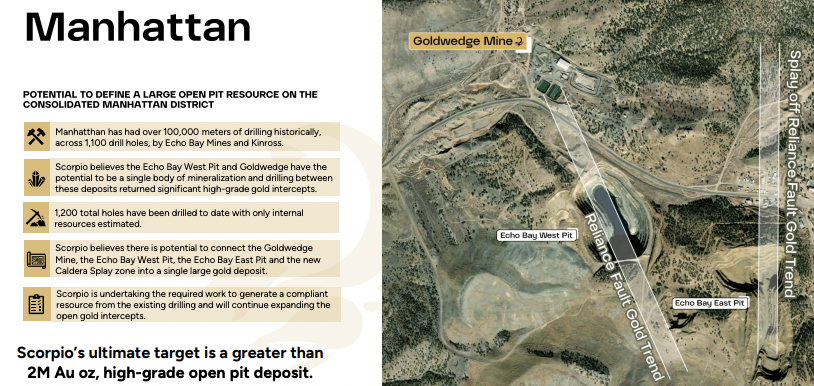

Scorpio’s consolidated Manhattan land package comprises the advanced exploration-stage Goldwedge, with a 400-ton-per-day gravity mill, and the adjacent Manhattan project centered on two past-producing pits, acquired from Kinross Gold in 2021.

Manhattan is a “low-sulphidation epithermal gold deposit containing a higher-grade coarse gold deposit” on the southern periphery of the Manhattan Caldera less than 20 km south of the Round Mountain Mine owned by Kinross. So far, over 16M ounces have been produced, making it one of the most prolific mines in U.S. history.

Combined historical placer & underground production on Scorpio’s footprint at Manhattan is estimated at 640,000 ounces of Au from both open pit & underground operations., including a reported 59,000 at 12.3 g/t Au from 1932-1941. Think about this for a moment… Since the acquisition from Kinross in March 2021, Au is up $900/oz.!

A high-grade, open-pit Au zone has already been drilled. Based on internal modeling and underpinned by over 100,000 meters of drilling + several geophysical studies done by Echo Bay & Kinross, and drilling by Scorpio in 2021, 2022 & this year, management hopes to one day book a multi-million-ounce deposit.

A new resource estimate on Manhattan is coming in January. Drilling 100k+ meters in Nevada today would take years and cost more than twice Scorpio’s current enterprise value {market cap + debt – cash} of ~$15M at C$0.135/shr. The combined replacement value of the decades of work done on [Manhattan/Goldwedge + the 400 tpd Mill] + MR is > $100M.

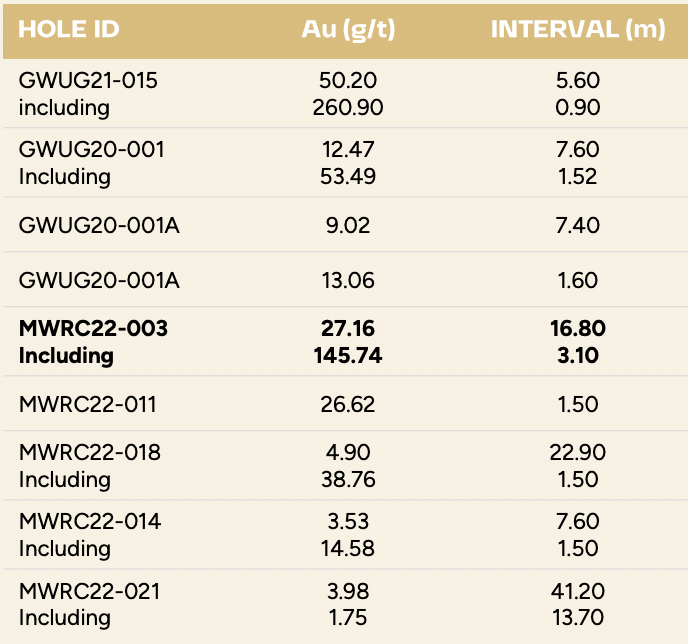

Drilling at Manhattan started in May. The first batch of results is expected in weeks. Phase 1 consisted of five holes totaling 1,178 meters, and Phase 2 is expected to include 3,109 m across 13 holes, all of which is diamond drilling. Scorpio completed successful RC programs in 2021-22, intercepting significant mineralization in multiple holes.

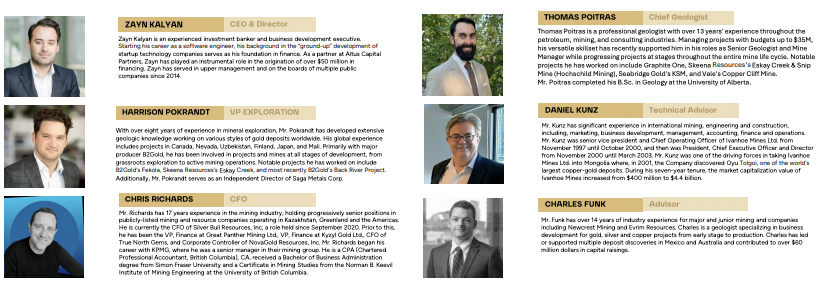

VP Exploration Harrison Pokrandt commented,

“Phase 1 & 2 holes were planned in close co-ordination with our advisory team Daniel Kunz & Associates, with the dual purpose of being follow-ups to historic drilling, alongside moderate step-outs of known structures to connect multiple zones of mineralization, particularly the Goldwedge underground & Manhattan West pit.”

In the drill results chart above, 16.8 m at 27.2 g/t Au, incl. 3.1 m at 145.7 g/t Au, is a Top-5% interval anywhere in the world. The fact that it’s in Nevada makes it even more impressive. Importantly, these holes were drilled recently (2021-2022) by Scorpio, not decades ago by another company.

The past-producing Goldwedge mine on the Manhattan footprint is a fully permitted underground mine with over 600 m of excavation and drilling that has outlined mineralization over a 335 m strike length, to a vertical depth of 150 m.

RC drilling from 2021-2022 delivered some spectacular intervals

In the image below it’s important to note that management believes that the Goldwedge, Echo Bay West, Echo Bay East & the Caldera Splay zones could be connected in what would be a large Au deposit.

This year’s drilling aims to extend known mineralization along strike into untested areas. Drilling will provide data for preliminary metallurgical testing, confirm previously drilled intervals, and expand the understanding of mineralized structures.

With Au so strong, Scorpio’s 400 tpd mill could be restarted to toll-mill nearby ore. Simple math suggests that at 8 g/t Au feedstock, the Mill could potentially generate ~C$1.5M in cash flow per month (net to Scorpio).

In addition to Majors Newmont, Barrick, Kinross, Franco-Nevada & Anglogold Ashanti, other mid-tier producers including; Hecla, McEwan Mining, SSR Mining, Alamos Gold & Coeur Mining have significant investments across Nevada and could be interested in Scorpio’s progress at Manhattan.

Mineral Ridge (“MR“) is a past-producing, [operated by Scorpio] that has significant infrastructure and a 250k-ounce resource with meaningful exploration potential (higher grades, better metallurgy).

The project is equidistant between Reno & Las Vegas, NV along the California border, and enjoys extensive permitting & water rights. Scorpio produced over 222,440 ounces at MR between 2010 & 2020. The recently acquired North Star target meaningfully bolsters the exploration opportunity.

Readers should note that other juniors in the region would kill for Scorpio’s water rights in Nevada! If a go-forward decision is made, MR could be back in production as a low-risk, conventional heap-leach mine within six months.

Looking back to the 4-yr. period 2014-2017 when annual revenue averaged ~C$74M (at the current C$/US$ exch. rate), the Company was not generating much, if any, positive cash flow. However, it’s no mystery why that was the case, Au averaged just US$1,234/oz. during that time.

While operating costs are up a lot since then, today’s price of $2,628/oz. is +113%. If in 2017 the AISC was around $1,175/oz., even if costs are up +40% to $1,645/oz., the operating margin would be $975/oz. Therefore, as long as MR can be reopened for a reasonable upfront cap-ex, it should be quite profitable.

For example, at 30,000 oz./yr., Au @ $2,628/oz., and all-in costs of $1,645/oz., operating income would be ~C$40M. CEO Zayn Kalyan’s team believes that funding the cap-ex at MR could be (mostly) done on a non-equity dilutive basis. Since the Project is fully permitted, it could be back in production by mid-2025.

A 2018 Feasibility Study on a 7.5-year mine life restart showed an after-tax NPV of ~C$49M, but that was based on US$1,250/oz. Au. At $2,400/oz., the NPV quadruples to ~C$200M before adjusting for +40% higher op-ex & cap-ex, knocking the pro forma NPV down to ~C$150M. Imagine what the post-tax NPV might be at $3,000/oz. Au.

C$150M is an excellent 100%-owned NPV vs. Scorpio’s current valuation of just C$15M. Note: earlier this month, management retired outstanding debt of ~C$4M by issuing shares at a deemed price of nearly C$0.22, almost double the share price at the time.

Au has been at $2,300+/oz. for six months. The price is currently > $2,600/oz. Scorpio Gold (TSX-v: SGN) / (OTC: SRCRF) could be in production in 2H 2025 in Nevada, generating $10s of millions per year to be reinvested into the crown jewel Manhattan project that could host 2M+ ounces. Execution risk is high, and so is the share price potential.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Scorpio Gold, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Scorpio Gold are highly speculative and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Scorpio Gold. was not an advertiser on [ER], and Peter Epstein owned shares in the company acquired in the open market. It’s hoped that Scorpio Gold will become a sponsor of [ER] in the future. Readers should consider Mr. Epstein biased in favor of Scorpio Gold.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors, including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply