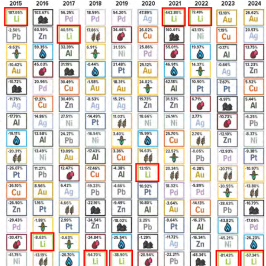

G-Silver… Sounds cool, right? Well, it was the only cool thing about the Company as silver (“Ag“) languished < US$24/oz. for much of 2023. Not only is G-Silver cool at $31+/oz., but at $40+/oz. it would be downright SEXY.

Yes, I’m excited about Ag, and gold (“Au“) as well. So are investment banks UBS, GS, JPM, BofA, RBC & ING all saying Au will hit $2,700-$3,000/oz, in 2025. By now, readers know my talking points for Ag fundamentals, 1) industrial demand, 2) Au: Ag ratio, 3) inflation adj. Ag price, and 4) long-term Ag supply.

All of these elements lean heavily toward a stronger for longer price paradigm. A fifth factor to watch is the demand for Ag in Electric Vehicles. Ag has very favorable properties in certain solid-state battery chemistries such as a new one by Samsung SDI slated for 2027.

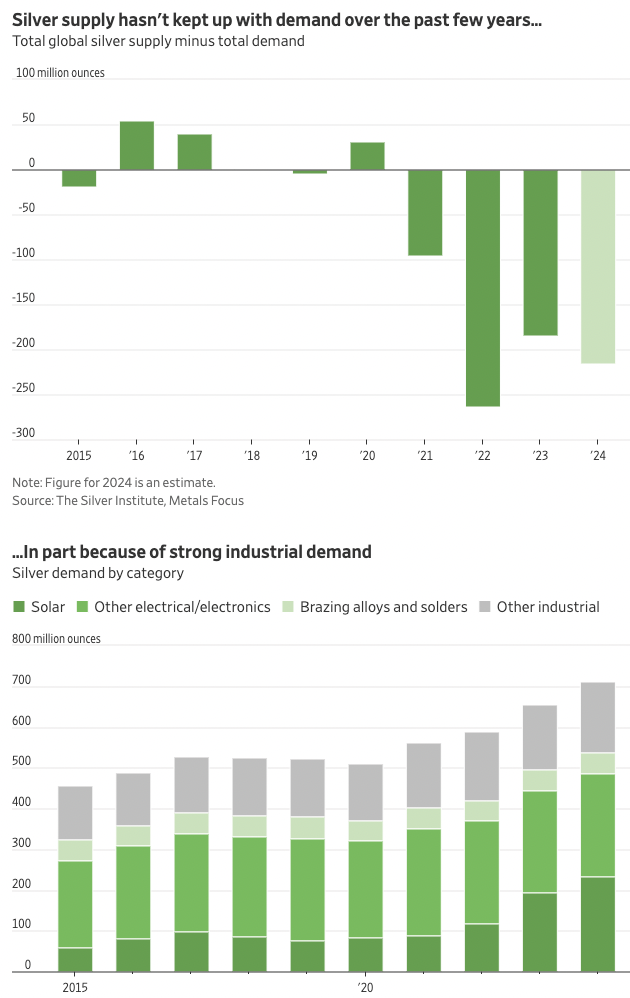

It’s not clear how much extra Ag is used, but even 10 grams per EV battery would increase annual demand by 5%-6% from the early 2030s on. Another new development is India’s ascendency is solar power.

Readers are reminded that solar panels use Ag and that China’s deployments have soared, up +152% in 2023 and expected to be +30% this year. India’s growth in 2024 is estimated at +75%, although new additions will be a quarter of China’s.

China & India are overproducing, leading to crashing panel prices, which increases demand. Surging Ag use in solar & EVs is quite resilient because the cost per panel or battery is very low.

The Au: Ag ratio is 83:1, yet over the past 35 years it averaged ~62.5:1. In 2011, it fell below 35:1 and in 1Q/21 65:1. When precious metal prices surge the ratio often falls. At the inflation-adj. highs of Ag & Au, (both in Jan-1980), the ratio was < 18:1.

All else equal, at 65:1 to Ag price would be $38.2/oz., if/when Au hits $3,000/oz., Ag could surpass $45/oz. Speaking of inflation-adj. highs, Ag’s is ~$200/oz.! Was that an outlier? Well, for the entire year of 1980 the infl.-adj. price was $85/oz., before EVs, massive solar power use, and wireless communications existed.

My final point on Ag fundamentals is the precarious supply situation. We are in year #4 of mined Ag deficits with no end in sight. The three largest Ag producing countries, Mexico, China & Peru accounted for 50% of supply in 2023. Yet, Mexico’s production growth in the 10 years to 2023 was just +1.0%/yr.

All of China’s production is consumed domestically, and Peru’s 10-yr. production CAGR through 2023 was negative -2.5%. Ok, Ag is going ballistic, got it, but why should I care about Guanajuato Silver? First, readers should want to own producers as well as developers, and among producers, very few are 90% exposed to Ag/Au.

Guanajuato has four mines + three operating mills in central Mexico, the El Cubo Mines complex, the Valenciana Mines complex, and San Ignacio Mine in Guanajuato State, and the Topia Mine + processing plant in Durango State.

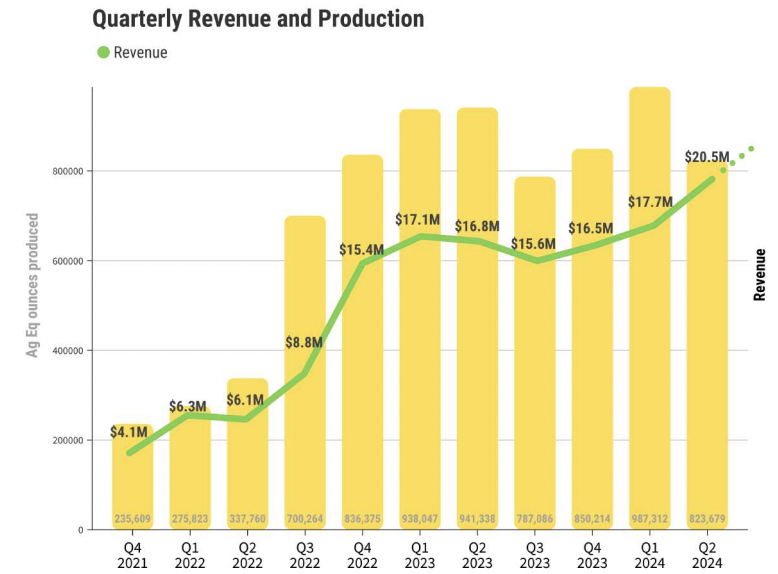

A combined mill capacity of 88,500 tonnes per month, plus 82.5M Measured, Indicated & Inferred Ag Eq. ounces, makes G-Silver a formidable player in central Mexico, producing over 3.5M Ag Eq. oz./yr.

Please watch these excellent videos of CEO James Anderson –> September 25th –> September 7th. He believes Q3 will be better than Q2 on costs & revenue. And, he’s excited about Q4 because several operating initiatives underway are coming to fruition. The Company has a strong mgmt. team, board & advisors.

Juan Martin Pena was just hired as VP of Operations. Mr. Pena is a 36-year veteran of the Mexican mining industry. From 2017 to 2024, Mr. Pena was the operations director for Grupo Mexico SAB de CV. Prior, he was GM at one of First Majestic Silver’s mines, and for 22 years Mr. Pena was employed by Industrias Penoles SA de CV.

COO Carlos Silva has 35 years’ experience in Mexico & Bolivia. He started and ran a mine and sold it to Santacruz Silver Mining. In 2017, he joined Santacruz as COO, and then CEO. Mr. Silva left in 2023, having helped it expand production from 815k Ag Eq. ounces in 2018 to 19.6M in 2022!

Readers should note the retirement of Ramon Davila and the departure of Hernan Dorado. While the Company has had impressive growth over the past three years, it has not been smooth sailing. Davila & Dorado were instrumental in working through difficult times.

The Company is moving forward with Silva & Pena and a reinvigorated focus on operating efficiencies & costs, across mining, procurement & logistics.

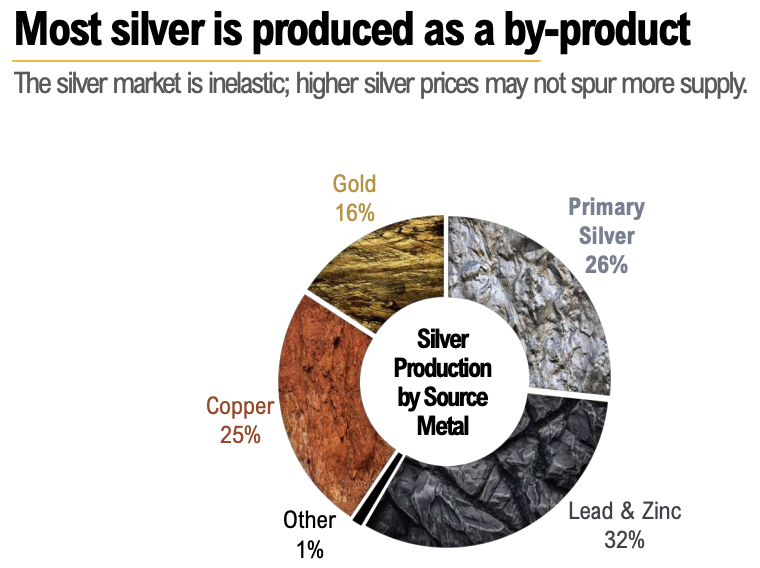

Ag supply is highly inelastic — even a much higher price won’t bring out substantial new production, as Ag is often a by-product of copper, lead, zinc, or Au mines.

Management believes the Company can grow production to ~4.25M Ag Eq. ounces in CY 2025. That production estimate is only from organic growth, it assumes no tuck-in acquisitions in the Guanajuato Ag/Au district.

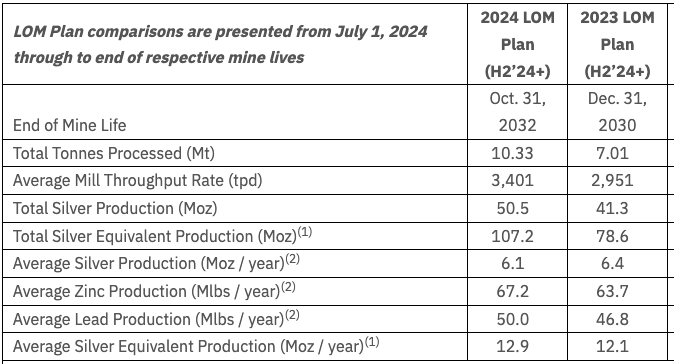

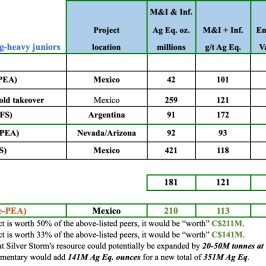

Gatos Silver operating metrics, Gatos being acquired by First Majestic…

Most notably, the team is installing new filter presses at Topia, de-watering El Cubo to access better ore, and switching on an ore-sorting circuit at the San Ignacio mine. These operating improvements will both lower AISC/oz. & increase production. The filter presses are expected to boost recoveries by 2%.

The ore sorter will, “provide significant monthly savings to operating costs, and generate an increase in Ag Eq. ounces per annum through improved grade, reduced energy consumption, reduced haulage charges, and increased concentration production capacity.”

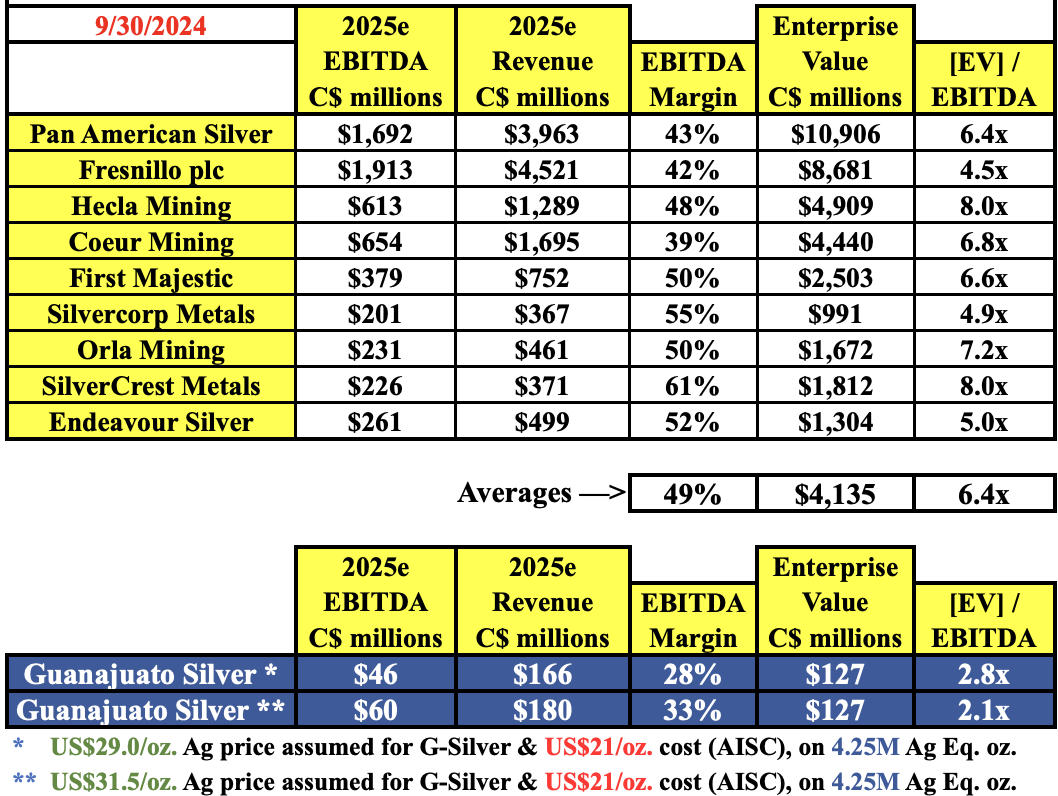

In the chart above are Gatos Silver’s life-of-mine production metrics. Notice that the average annual Ag Eq. production has been 12.9M ozs. G-Silver’s production is ~30% that of Gatos, a Company being acquired for C$1.32B.

Granted, it has higher margins, but G-Silver has a better metals mix [48% Ag, 42% Au, 9% lead/zinc] vs. [53% lead/zinc, 47% Ag].

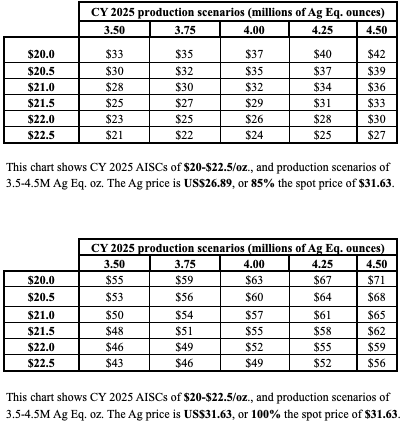

The image above shows operating scenarios, in millions of C$, for CY 2025. In the top chart are annual earnings scenarios at 85% of the Ag spot price, for 3.5M to 4.5M ounces, with costs of $20.0 to $22.5/oz. In the bottom chart the same metrics, but at 100% of spot.

With Ag over $31/oz., operations can finally deliver meaningful cash flow, and All-in-Sustaining-Cost (“AISC“) per ounce becomes less dangerous. G-Silver is valued at 2.8x 2025e EBITDA assuming $21/oz. costs & a $29/oz. Ag price on 4.25M Ag Eq. ounces.

With Ag in the low $30’s/oz., G-Silver could make additional acquisitions. Looking at the orange map above, it’s clear to me that one company should control all of the named mines/mills. G-Silver is by far the most logical to consolidate these assets, perhaps via a JV. By 2027-28, 8M Ag Eq. oz./yr. (net to G-Silver) could be at hand.

The district is simply too small for Fresnillo, and Endeavour already sold assets to G-Silver. I asked CEO Anderson how much production his team thinks could come from all the assets in the district, he thinks 12M Ag Eq. oz./yr. Readers should note that Fresnillo’s three mines & a large mill are not in operation, nor is Endeavour’s Cebada mine.

Eight million oz./yr. would generate tremendous cash flow, enough to comfortably pay a dividend. For example, assuming a robust US$10/oz. margin, cash flow could grow to C$108M/yr. on 8M ounces.

Taking half of that figure as free cash flow (FCF), [earnings after debt service/repayment, taxes & cap-ex] that would be C$54M. Management could pay 1/4th of that FCF as a dividend, yielding 13.5% (at C$0.23/shr.).

Dividends are just a thought experiment, management is not talking about dividends, they’re focused on operating efficiencies & cutting costs. The bottom line is that with Ag where it is today, G-Silver can deliver strong cash flow relative to its enterprise value {market cap + debt – cash} of ~C$127M.

Cash flows that management expects will grow in 2026-27-28 as tuck-in acquisitions of mines, mills, and stranded deposits are made. Readers are encouraged to review Guanajuato’s SEXY new corp. presentation.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Guanajuato Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Guanajuato Silver are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. Readers assume and agree that they will consult their own licensed or registered financial advisors before making any investment decisions.

When this article was posted, Peter Epstein owned stock in Guanajuato Silver. The Company is a paid sponsor of Epstein Research.

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will be (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

![Epstein Research [ER]](https://epsteinresearch.com/wp-content/uploads/2025/02/logo-ER.jpg)

Leave a Reply