The following Guest Post is by Alex Sekella of smartmoneygains.com. Peter Epstein of Epstein Research [ER] had nothing to with the writing, editing or choice of topics discussed. The reported facts, views, opinions, etc. are entirely, 100%, the responsibility of Alex Sekella & smartmoneygains. The featured company, Defense Metals Corp., is an advertiser on Epstein Research, and Peter Epstein owns shares in the Company.

Rare earth elements like scandium, neodymium & dysprosium are used in numerous products like smartphones, electric car motors, wind turbines, satellites and jet engines. These 17 prized metals are looking to be China’s biggest bargaining chip in winning the trade war with the U.S. and offer a great investment opportunity.

Our team has uncovered a company that is poised to benefit from the current situation and believe this stock could be set to surge. Demand for rare earths is forecast to increase, while a Chinese embargo could cut off much of the needed supply, creating an ideal situation for this company.

Big Threats and Big Consequences

China Supplies at least 95% of the world’s rare earths and the escalating trade war between the two superpowers presents an opportunity for investors. The key role these minerals play in many products means China could strike a heavy blow against the U.S.

On May 29th the official newspaper of the Chinese Communist Party made their third threat “The U.S. must not underestimate the ability of the Chinese side to hit back”

The U.S. is extremely dependant on critical mineral imports and many experts believe that China will move forward with an embargo. If China was to stop exports of rare earths to the U.S. for an extended period, it could cause a huge shock to the entire U.S. economy.

National Security concerns are enormous and the government is searching for solutions. With this mov,e China could effectively shoot-down the entire F-35 stealth fighter production program, missile systems and satellite development.

The US is looking elsewhere for supply

Increasing trade with allies and partners will help reduce the likelihood of disruption to critical mineral supply chains. The U.S. has a historical trade relationship and geographic proximity with Canada. Experts believe that supply chains will be shifted over the next 12 months.

Just this month, the U.S. laid out a federal strategy to ensure secure and reliable supplies of Critical Minerals that mentioned Canada as a key supply option.

Defence Metals Corp.

Defense Metals is a mineral exploration company focused on the acquisition of mineral deposits containing metals and elements commonly used in the electric power market, military, national security and the production of green energy technologies, such as high-strength alloys and rare earth magnets.

The company is able to capitalize on current marco events in the Rare Earth market through their Wicheeda Property in British Columbia. The Wicheeda Property consists of 6 mineral claims covering an area of 1,780 hectares, located approximately 80 km northwest of the city of Prince George, British Columbia.

The company recently received a 5-yr exploration permit (in May 2019) for the Wicheeda property which includes approval for up to 51 drill site locations. The company had $800k at the end of 2018 and is now well cashed up upon completion of a recent $1 million dollar Private Placement.

Drilling will commence this summer which means many potential catalysts that could drive the share price up.

Project Highlights

- 2 specific rare earth minerals Monazite & Bastnasite-Parisite with 60% of the REE contained in Monazite and 40% in Bastnasite-Parisite

- Results from a recent 30-tonne bulk sample include 1.77% lanthanum-oxide, 2.34% cerium-oxide, 0.52% neodymium-oxide, and 0.18% praseodymium-oxide which the Company considers potentially economically significant, for a total of 4.81% LREO (light rare-earth oxide)

- Extensive local infrastructure – Roads, Railway, Water, Power, Natural Gas and Labour

Share Structure

There are 30.2M shares outstanding and currently insiders and friendlies hold roughly 75% or ~22mm shares. The float of this stock is very small coming in at only 6 million meaning that this stock is susceptible to large gains.

Bottom Line

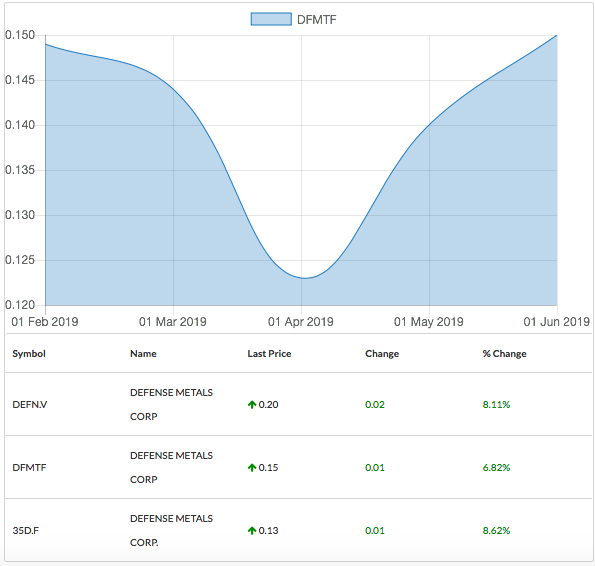

The growth potential in Rare Earths in North America can lead to profits for investors looking to take advantage of the Macro effects of the Trade War. DEFN has a proven asset base, sizable resource and a meaningful exploration program already underway. This stock’s small US$3.8 million dollar market capitalization has the potential to skyrocket.

Disclaimers: The Guest Post above is by Alex Sekella of smartmoneygains.com. Peter Epstein of Epstein Research [ER] had nothing to with the writing, editing or choice of topics discussed. The reported facts, views, opinions, etc. are entirely, 100%, the responsibility of Alex Sekella & smartmoneygains. The featured company, Defense Metals Corp., is an advertiser on Epstein Research & Peter Epstein owns shares in the Company.

![Epstein Research [ER]](http://EpsteinResearch.com/wp-content/uploads/2015/03/logo-ER.jpg)